Smart Contract Wallets offer programmable features, enabling automated transactions and enhanced security through multi-signature approvals, while Externally Owned Wallets (EOAs) rely solely on a private key for access and control. Unlike EOAs, Smart Contract Wallets can enforce custom rules and recovery options, reducing the risk of permanent asset loss. These programmable capabilities make Smart Contract Wallets more versatile for DeFi applications compared to the simpler, key-based EOAs.

Table of Comparison

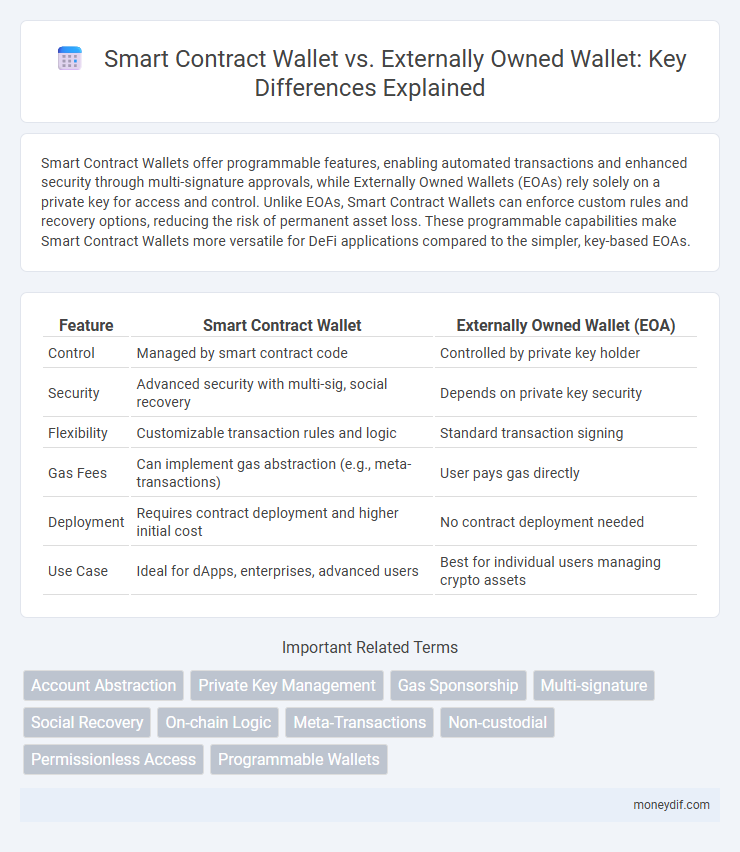

| Feature | Smart Contract Wallet | Externally Owned Wallet (EOA) |

|---|---|---|

| Control | Managed by smart contract code | Controlled by private key holder |

| Security | Advanced security with multi-sig, social recovery | Depends on private key security |

| Flexibility | Customizable transaction rules and logic | Standard transaction signing |

| Gas Fees | Can implement gas abstraction (e.g., meta-transactions) | User pays gas directly |

| Deployment | Requires contract deployment and higher initial cost | No contract deployment needed |

| Use Case | Ideal for dApps, enterprises, advanced users | Best for individual users managing crypto assets |

Introduction to Cryptocurrency Wallets

Smart contract wallets operate through programmable code on the blockchain, enabling automated transactions and enhanced security features compared to externally owned wallets (EOAs), which are controlled solely by private keys. EOAs provide straightforward access and direct control for users, making them the foundational type of cryptocurrency wallet for managing assets. Understanding the distinction between smart contract wallets and EOAs is crucial for selecting the appropriate security, functionality, and user experience in cryptocurrency management.

What is a Smart Contract Wallet?

A Smart Contract Wallet is a blockchain-based digital wallet that operates through programmable code, enabling automated transactions and enhanced security features beyond simple private key management. Unlike Externally Owned Wallets (EOAs), which rely solely on user-controlled private keys for transaction authorization, Smart Contract Wallets incorporate customizable logic such as multi-signature approvals, spending limits, and social recovery mechanisms. These programmable functionalities make Smart Contract Wallets ideal for users seeking advanced control, automation, and resilience in managing digital assets on platforms like Ethereum.

Understanding Externally Owned Wallets (EOAs)

Externally Owned Wallets (EOAs) are digital wallets controlled by private keys, enabling users to directly manage cryptocurrency assets and initiate transactions on blockchain networks without intermediate contracts. Unlike smart contract wallets, EOAs rely solely on cryptographic signatures for authentication and lack programmable logic to automate transaction processes or implement advanced security features. Understanding EOAs is essential for grasping fundamental blockchain interactions, as they represent the primary interface for users to access decentralized assets and participate in decentralized finance (DeFi) activities.

Key Differences Between Smart Contract Wallets and EOAs

Smart Contract Wallets operate through programmable logic allowing automated transactions, multisignature requirements, and enhanced security features, while Externally Owned Wallets (EOAs) rely solely on private keys for transaction authorization. EOAs provide simplicity and direct control but lack the flexibility and advanced functionalities embedded in Smart Contract Wallets. Security mechanisms in Smart Contract Wallets reduce risks of key loss and unauthorized access by enabling recovery options not available in EOAs.

Security Features: Smart Contract Wallets vs EOAs

Smart Contract Wallets enhance security by integrating programmable access controls, multi-signature approvals, and automated recovery options, reducing risks associated with lost keys or phishing attacks. Externally Owned Wallets (EOAs) rely solely on private key security, exposing users to higher vulnerability if keys are compromised or stolen. The advanced security protocols in Smart Contract Wallets provide more robust protection mechanisms compared to the simpler architecture of EOAs.

User Experience and Accessibility Comparison

Smart Contract Wallets enhance user experience by enabling programmable transactions, multi-signature approvals, and seamless integration with decentralized applications, offering greater flexibility compared to Externally Owned Wallets (EOAs). EOAs rely on private keys for direct ownership and simpler transaction execution but may lack advanced security features and usability enhancements found in Smart Contract Wallets. Accessibility improves with Smart Contract Wallets through built-in recovery options and social key management, reducing the risk of lost access common in EOAs.

Cost and Transaction Fee Considerations

Smart Contract Wallets typically incur higher deployment and execution costs due to complex on-chain logic, affecting overall transaction fees. Externally Owned Wallets (EOWs) benefit from minimal costs as they rely on simple cryptographic signatures without additional contract interactions. Users prioritizing cost efficiency often prefer EOWs for routine transactions, while Smart Contract Wallets justify higher fees through enhanced security and programmable features.

Recovery and Backup Mechanisms

Smart Contract Wallets offer advanced recovery mechanisms by enabling customizable multi-signature approvals and social recovery options, significantly enhancing backup security compared to Externally Owned Wallets (EOWs), which rely solely on private key storage. EOWs pose higher risks in case of key loss or theft, as their non-recoverable private keys cannot be regenerated or reset without access to backups. The programmable nature of Smart Contract Wallets allows seamless integration of recovery policies, reducing user dependency on traditional seed phrases and minimizing the risk of permanent asset loss.

Use Cases: Choosing the Right Wallet for Your Needs

Smart Contract Wallets enable programmable transactions and multi-signature security, making them ideal for decentralized applications and automated payment systems. Externally Owned Wallets, controlled by private keys, are favored for straightforward asset management and direct interactions with blockchain networks. Selecting the right wallet depends on use cases: Smart Contract Wallets excel in complex, conditional transactions, while Externally Owned Wallets suit users seeking simplicity and direct control.

Future Trends in Crypto Wallet Technology

Smart Contract Wallets are evolving to offer enhanced security and automation by integrating programmable logic that allows for multi-signature approvals, recovery mechanisms, and interaction with decentralized finance (DeFi) protocols, setting a new standard for user control and flexibility. Externally Owned Wallets (EOAs), relying on private keys for direct transactions, face limitations in upgrading functionality without smart contract layers, which drives innovation towards hybrid models combining EOAs with smart contract features. The future trends in crypto wallet technology emphasize seamless interoperability, gasless transactions via meta-transactions, and broader adoption of account abstraction to simplify user experience and expand decentralized application accessibility.

Important Terms

Account Abstraction

Account Abstraction enables smart contract wallets to execute programmable transactions and custom authorization logic, providing enhanced flexibility and security compared to externally owned wallets controlled solely by private key signatures.

Private Key Management

Private Key Management in Smart Contract Wallets involves programmable security features and multi-signature capabilities, enhancing protection against theft and unauthorized access compared to Externally Owned Wallets, which rely solely on a single private key for transaction authorization. This distinction makes Smart Contract Wallets more resilient to private key compromise, offering automated recovery options and customizable access controls that Externally Owned Wallets lack.

Gas Sponsorship

Gas sponsorship enables Smart Contract Wallets to cover transaction fees on behalf of users, unlike Externally Owned Wallets which require users to pay gas costs directly.

Multi-signature

Multi-signature in Smart Contract Wallets enables programmable, multi-party transaction approvals, enhancing security through customizable access controls, whereas Externally Owned Wallets rely solely on a single private key signature lacking inherent multi-signature capabilities. Smart Contract Wallets integrate multi-signature schemes directly into their code, facilitating complex authorization logic, unlike Externally Owned Wallets which require external multi-sig contract interaction for similar functionality.

Social Recovery

Social recovery enhances security for smart contract wallets by allowing trusted contacts to help regain access if keys are lost, unlike externally owned wallets that rely solely on private key possession. This mechanism reduces the risk of permanent loss and improves usability while maintaining decentralized control.

On-chain Logic

On-chain logic governs the execution of smart contract wallets, enabling programmable transactions and enhanced security features beyond basic key control found in externally owned wallets (EOAs). Smart contract wallets utilize decentralized code to automate functions such as multi-signature approval and spend limits, while EOAs rely solely on private key signatures for transaction authorization.

Meta-Transactions

Meta-transactions enable users to interact with blockchain applications without directly paying gas fees by allowing relayers to submit transactions on their behalf, significantly enhancing user experience for smart contract wallets. Unlike externally owned wallets that require users to hold cryptocurrency for gas, smart contract wallets leverage meta-transactions to abstract gas payments and implement advanced features like gasless transactions and multi-signature security.

Non-custodial

Non-custodial smart contract wallets enhance security and functionality by enabling programmable transactions and multisignature authorization, unlike externally owned wallets that rely solely on single private key control.

Permissionless Access

Permissionless access enables smart contract wallets to execute programmable transactions autonomously, unlike externally owned wallets which require direct private key control for authorization.

Programmable Wallets

Programmable wallets leverage smart contract wallets to enable automated transactions and customizable permissions, in contrast to externally owned wallets that rely solely on private keys for control. Smart contract wallets enhance security and flexibility by allowing multisignature authorization and built-in recovery options, whereas externally owned wallets offer simpler but less adaptable management of digital assets.

Smart Contract Wallet vs Externally Owned Wallet Infographic

moneydif.com

moneydif.com