Initial Coin Offerings (ICOs) allow projects to raise funds directly from investors by selling tokens independently, often with fewer regulations and higher risk. Initial Exchange Offerings (IEOs) are conducted through cryptocurrency exchanges, providing increased security and trust by leveraging the exchange's vetting process and established user base. Investors tend to prefer IEOs over ICOs due to enhanced transparency and reduced chances of fraud.

Table of Comparison

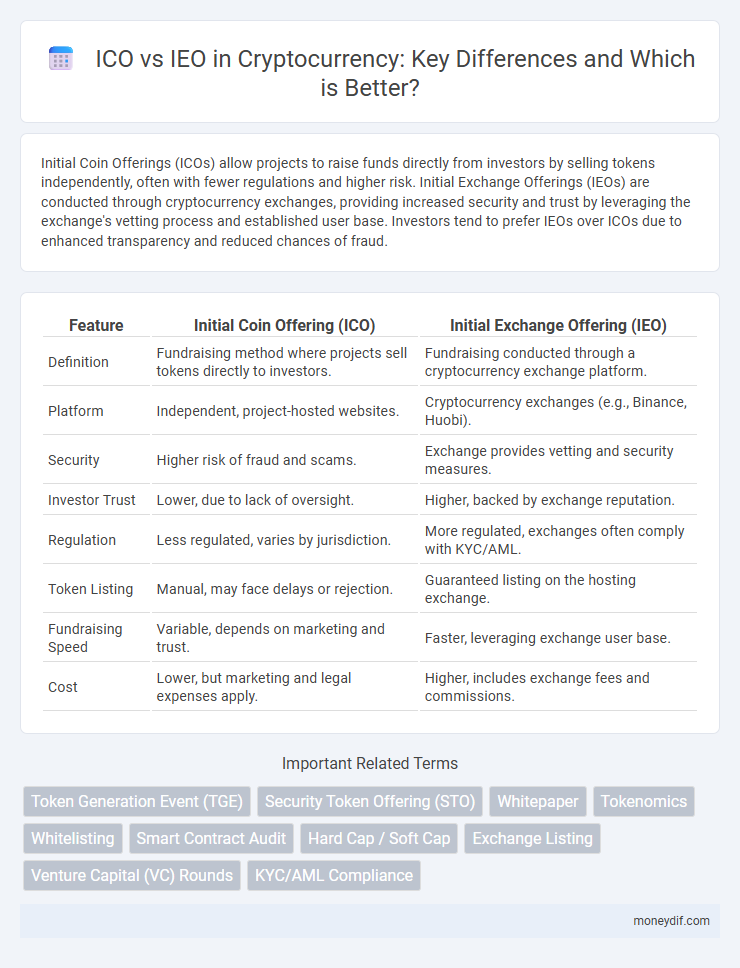

| Feature | Initial Coin Offering (ICO) | Initial Exchange Offering (IEO) |

|---|---|---|

| Definition | Fundraising method where projects sell tokens directly to investors. | Fundraising conducted through a cryptocurrency exchange platform. |

| Platform | Independent, project-hosted websites. | Cryptocurrency exchanges (e.g., Binance, Huobi). |

| Security | Higher risk of fraud and scams. | Exchange provides vetting and security measures. |

| Investor Trust | Lower, due to lack of oversight. | Higher, backed by exchange reputation. |

| Regulation | Less regulated, varies by jurisdiction. | More regulated, exchanges often comply with KYC/AML. |

| Token Listing | Manual, may face delays or rejection. | Guaranteed listing on the hosting exchange. |

| Fundraising Speed | Variable, depends on marketing and trust. | Faster, leveraging exchange user base. |

| Cost | Lower, but marketing and legal expenses apply. | Higher, includes exchange fees and commissions. |

Introduction to ICOs and IEOs

Initial Coin Offerings (ICOs) enable blockchain startups to raise capital by directly selling tokens to investors, bypassing traditional financial intermediaries. Initial Exchange Offerings (IEOs) differ by involving cryptocurrency exchanges as intermediaries that conduct the token sale on behalf of the project, providing increased security and credibility. Both ICOs and IEOs serve as fundraising mechanisms in the cryptocurrency ecosystem, with IEOs often considered more regulated and trustworthy due to the exchange's vetting process.

How ICOs Work

Initial Coin Offerings (ICOs) function as crowdfunding mechanisms where blockchain startups raise capital by issuing new cryptocurrency tokens directly to investors in exchange for established cryptocurrencies like Bitcoin or Ethereum. Smart contracts on platforms such as Ethereum automate token distribution and fund management, ensuring transparency and security throughout the investment process. Investors receive tokens that may grant access to a project's service or future profits, but ICOs carry regulatory risks due to their largely unregulated nature compared to Initial Exchange Offerings (IEOs).

How IEOs Work

Initial Exchange Offerings (IEOs) are fundraising events conducted on cryptocurrency exchanges, where the exchange acts as an intermediary between the project team and investors, enhancing security and trust. Investors participate by creating accounts on the hosting exchange and purchasing tokens directly through its platform, ensuring transactions are vetted and compliant with exchange standards. This streamlined process reduces fraud risks associated with Initial Coin Offerings (ICOs) by leveraging the exchange's existing infrastructure and user base.

Key Differences Between ICO and IEO

Initial Coin Offerings (ICO) allow projects to raise capital directly from investors by selling native tokens, whereas Initial Exchange Offerings (IEO) are conducted through cryptocurrency exchanges that act as intermediaries and carry out token sales on their platforms. ICOs often carry higher risks due to lack of regulatory oversight, while IEOs typically involve a vetting process by the exchange, enhancing trust and security for investors. The fundraising process in ICOs is decentralized and project-driven, whereas IEOs benefit from the established user base and marketing strength of crypto exchanges.

Advantages of ICOs

Initial Coin Offerings (ICOs) provide cryptocurrency projects with direct access to global investors, enabling faster capital raising without intermediaries. ICOs offer greater regulatory flexibility compared to Initial Exchange Offerings (IEOs), allowing for innovative tokenomics and project structures. Lower entry barriers and increased decentralization make ICOs attractive for startups seeking to launch their blockchain tokens independently.

Advantages of IEOs

Initial Exchange Offerings (IEOs) provide enhanced security and trust for investors by utilizing the reputation and regulatory compliance of established cryptocurrency exchanges. IEOs streamline the fundraising process with immediate access to a broad user base and integrated exchange services, reducing the risks associated with fraudulent projects often seen in Initial Coin Offerings (ICOs). The increased liquidity and faster trading availability on reputable platforms make IEOs a preferred choice for both startups and investors in the crypto market.

Risks and Challenges in ICOs and IEOs

Initial Coin Offerings (ICOs) pose significant risks including lack of regulatory oversight, potential for fraud, and project failure, leading to substantial investor losses. Initial Exchange Offerings (IEOs) mitigate some risks by involving cryptocurrencies exchanges that perform due diligence and provide a layer of security, yet they still face challenges such as exchange solvency risk and limited transparency. Both ICOs and IEOs encounter market volatility and uncertainty, demanding thorough research and cautious investment strategies to minimize potential financial damage.

Regulatory Perspectives on ICOs vs IEOs

Regulatory perspectives on Initial Coin Offerings (ICOs) often highlight concerns about fraud and lack of investor protection due to minimal oversight, leading to increased scrutiny from agencies like the SEC. Initial Exchange Offerings (IEOs) benefit from regulatory advantages as token sales are conducted through reputable cryptocurrency exchanges, which perform due diligence and comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. This shift results in enhanced transparency and security for investors, making IEOs a more compliant alternative under evolving global cryptocurrency regulations.

Factors to Consider Before Participating

Evaluating the credibility and regulatory compliance of the project team is crucial before participating in an ICO or IEO, as these factors directly impact investment security. Assessing the platform's transparency, tokenomics, and liquidity can influence potential returns and exit strategies. Understanding market demand, historical performance of the exchange (for IEOs), and the project's roadmap helps mitigate risks associated with market volatility and fraudulent schemes.

Future Trends: ICOs and IEOs

Future trends in cryptocurrency show a shift from Initial Coin Offerings (ICOs) towards Initial Exchange Offerings (IEOs) due to increased regulatory scrutiny and enhanced investor protection. IEOs leverage the reputation and security of cryptocurrency exchanges, leading to higher trust and broader market access compared to ICOs. Blockchain innovation and evolving compliance standards continue to shape the dynamics, making IEOs a preferred fundraising method in upcoming digital asset markets.

Important Terms

Token Generation Event (TGE)

Token Generation Event (TGE) marks the creation of cryptocurrency tokens, serving as a foundational phase for Initial Coin Offering (ICO) where tokens are sold directly to investors, while Initial Exchange Offering (IEO) involves selling tokens through a cryptocurrency exchange platform for enhanced security and trust.

Security Token Offering (STO)

Security Token Offering (STO) represents a regulated fundraising method offering tokenized securities, contrasting with the less regulated Initial Coin Offering (ICO) and the exchange-managed Initial Exchange Offering (IEO) that focuses on project listings within crypto exchanges.

Whitepaper

A whitepaper comparing ICO and IEO highlights that ICOs rely on direct token sales to investors, while IEOs involve regulated token offerings conducted through cryptocurrency exchanges, enhancing investor trust and compliance.

Tokenomics

Tokenomics in Initial Coin Offerings (ICO) versus Initial Exchange Offerings (IEO) differs significantly, with ICOs allowing direct community fundraising and greater token distribution control, while IEOs rely on exchange-led token sales, enhancing security and investor trust but limiting token control for project teams.

Whitelisting

Whitelisting in Initial Coin Offerings (ICOs) involves user registration and KYC verification directly by the project team, whereas in Initial Exchange Offerings (IEOs), the exchange conducts the whitelisting process, ensuring regulatory compliance and participant vetting.

Smart Contract Audit

Smart contract audits are crucial for Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) to ensure code security, reduce vulnerabilities, and build investor confidence. While ICOs require comprehensive audits by third-party firms, IEOs often benefit from exchange-led audits combined with platform due diligence, enhancing trust and regulatory compliance.

Hard Cap / Soft Cap

Hard cap in ICOs limits total token sales to control supply, whereas soft cap sets minimum funding targets for project viability; IEOs often have preset hard caps managed by exchanges to ensure regulatory compliance and investor protection.

Exchange Listing

Initial Exchange Offering (IEO) leverages exchange listing for immediate token liquidity and security, whereas Initial Coin Offering (ICO) relies on direct investor participation without guaranteed exchange support.

Venture Capital (VC) Rounds

Venture Capital rounds fund startups by exchanging equity, whereas Initial Coin Offerings (ICOs) and Initial Exchange Offerings (IEOs) raise capital through token sales with ICOs conducted directly by projects and IEOs facilitated by cryptocurrency exchanges.

KYC/AML Compliance

KYC/AML compliance for Initial Coin Offerings (ICOs) often faces regulatory scrutiny due to direct issuer-investor interactions, whereas Initial Exchange Offerings (IEOs) benefit from exchange-led KYC/AML procedures that enhance transparency and reduce fraud risks.

Initial Coin Offering (ICO) vs Initial Exchange Offering (IEO) Infographic

moneydif.com

moneydif.com