Maker orders add liquidity to the cryptocurrency market by placing limit orders that are not immediately matched, while taker orders remove liquidity by executing against existing orders on the order book. Makers often benefit from lower trading fees since they help maintain market depth and stability, whereas takers typically pay higher fees for instant execution. Understanding the distinction between maker and taker roles is crucial for traders looking to optimize costs and trading strategies in volatile crypto markets.

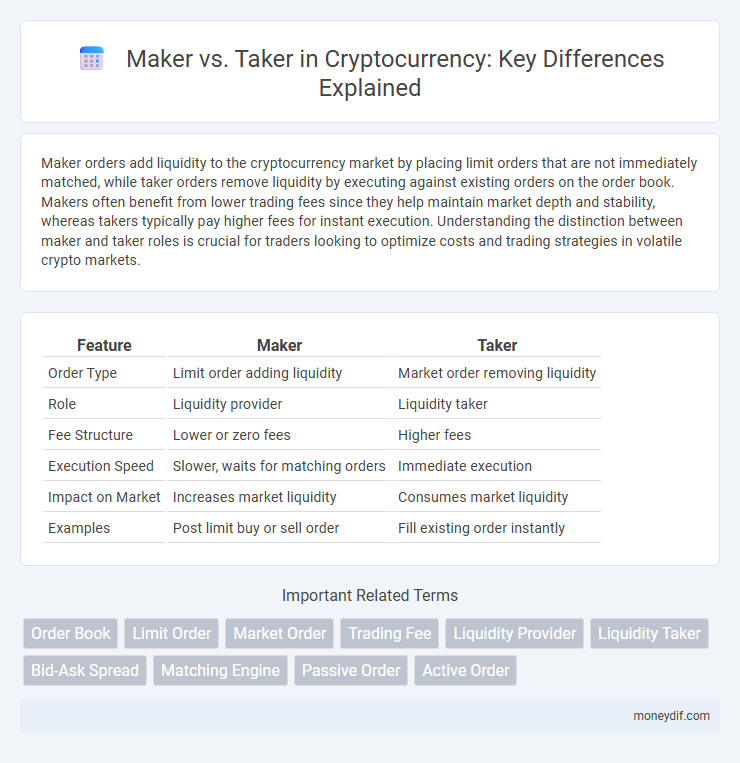

Table of Comparison

| Feature | Maker | Taker |

|---|---|---|

| Order Type | Limit order adding liquidity | Market order removing liquidity |

| Role | Liquidity provider | Liquidity taker |

| Fee Structure | Lower or zero fees | Higher fees |

| Execution Speed | Slower, waits for matching orders | Immediate execution |

| Impact on Market | Increases market liquidity | Consumes market liquidity |

| Examples | Post limit buy or sell order | Fill existing order instantly |

Maker vs Taker: Key Definitions

Makers are market participants who provide liquidity by placing limit orders that add to the order book, helping stabilize prices and reduce spreads on cryptocurrency exchanges. Takers remove liquidity by executing market orders that match existing limit orders, facilitating immediate trade execution but often incurring higher fees. This distinction between maker and taker roles is fundamental for understanding fee structures, market depth, and trading strategies in cryptocurrency markets.

How Maker and Taker Fees Work

Maker fees apply when placing limit orders that add liquidity to the order book, typically resulting in lower charges to incentivize market depth; taker fees are charged when executing market orders that remove liquidity by matching existing orders, usually at a higher rate. These fees are calculated as a percentage of the total trade value and vary across cryptocurrency exchanges, influencing traders' strategies to minimize costs. Understanding the distinction between maker and taker fees is essential for optimizing trading expenses and enhancing overall portfolio performance in volatile crypto markets.

Impact on Liquidity: Makers vs Takers

Makers improve market liquidity by placing limit orders that add depth to the order book, enabling smoother trading and reducing price volatility. Takers execute market orders that consume liquidity, often causing immediate price shifts and increasing short-term volatility. The balance between makers and takers is essential for maintaining efficient price discovery and a stable trading environment in cryptocurrency markets.

Pros and Cons of Being a Maker

Being a maker in cryptocurrency trading offers advantages such as lower trading fees and improved market liquidity, enhancing overall trading efficiency. Makers provide valuable limit orders that help stabilize price fluctuations but face the risk of orders not being filled if market conditions shift rapidly. This approach suits traders seeking cost savings and willing to accept potentially slower trade execution compared to takers.

Pros and Cons of Being a Taker

Being a taker in cryptocurrency trading allows for immediate order execution by matching existing orders, providing quick market access during volatile price movements. However, takers often face higher fees compared to makers because taker fees compensate for the liquidity consumed from the order book. The rapid execution advantage can lead to less favorable price fills during high volatility, increasing the risk of slippage and impacting overall trade profitability.

Fee Structures Across Top Crypto Exchanges

Maker and taker fees vary significantly across top cryptocurrency exchanges, with makers typically enjoying lower or even zero fees to incentivize market liquidity. For example, Binance charges makers 0.1% and takers 0.1%, while Coinbase Pro offers maker fees as low as 0.00% and taker fees starting at 0.30%. Understanding these fee structures can optimize trading strategies by reducing costs and increasing profitability for both liquidity providers and order executors.

Strategies for Optimizing Maker and Taker Roles

Optimizing maker and taker roles in cryptocurrency trading involves leveraging liquidity provision and order execution strategies to minimize fees and maximize profitability. Makers benefit from placing limit orders that add liquidity to the market and often receive lower fees or rebates, while takers execute market orders that remove liquidity but enable faster trades, suitable for volatile conditions or quick entry and exit. Employing algorithmic trading tools can dynamically switch between maker and taker roles based on market depth, volume, and fee structures to enhance overall trading efficiency.

Maker-Taker Dynamics in Spot vs Derivatives Trading

Maker-taker dynamics in cryptocurrency trading differ significantly between spot and derivatives markets, impacting liquidity and fee structures. In spot trading, makers add liquidity by placing limit orders that are not immediately filled, often benefiting from lower or rebated fees, while takers remove liquidity through market orders and face higher fees. Conversely, derivatives trading platforms frequently implement more complex maker-taker fee models to incentivize market stability and hedging strategies, reflecting heightened volatility and leverage considerations inherent in futures and perpetual contracts.

How to Reduce Your Trading Fees

Reducing trading fees as a Maker involves placing limit orders that add liquidity to the order book, often qualifying for lower fees or even rebates on many cryptocurrency exchanges. Takers pay higher fees since they execute orders instantly, removing liquidity, but minimizing frequent market orders can reduce total fee costs. Using exchanges with tiered fee structures and increasing your monthly trading volume can further decrease both Maker and Taker fees effectively.

Maker vs Taker: Which is Right for You?

Makers provide liquidity by placing limit orders, earning lower fees, making them ideal for traders seeking cost efficiency and market control. Takers execute trades immediately using market orders, paying higher fees but benefiting from faster execution, suitable for those prioritizing speed over cost. Choosing between maker and taker roles depends on your trading strategy, fee sensitivity, and need for order execution speed.

Important Terms

Order Book

An order book displays real-time buy and sell orders for a specific asset, categorizing participants as makers who add liquidity by placing limit orders, and takers who remove liquidity by matching existing orders through market orders. Makers typically benefit from lower fees or rebates for providing market depth, while takers pay higher fees for immediate execution.

Limit Order

Limit orders act as makers by adding liquidity to the order book, setting buy or sell conditions at specific prices, while market orders act as takers by immediately matching and removing existing limit orders from the book. Makers receive lower fees or rebates for providing liquidity, whereas takers incur higher fees for consuming liquidity instantly.

Market Order

Market orders execute immediately at the best available price, acting as takers by consuming existing liquidity on the order book. Makers provide liquidity by placing limit orders that remain unfilled and await execution from takers' market orders.

Trading Fee

Trading fees vary significantly between makers and takers, with makers typically incurring lower fees or even rebates for providing liquidity, while takers pay higher fees for removing liquidity from the order book. This fee structure incentivizes market makers to add depth and stability, enhancing overall market efficiency and reducing spreads.

Liquidity Provider

Liquidity providers enhance market depth by placing limit orders that add liquidity, contrasting with takers who remove liquidity through market orders. Makers benefit from lower fees or rebates as incentives to supply liquidity, while takers pay higher fees for immediate execution.

Liquidity Taker

Liquidity takers execute market orders, consuming existing liquidity by matching instantly with liquidity makers who provide limit orders on order books. The maker versus taker model influences trading fees, where makers often receive rebates for adding liquidity, while takers pay fees for removing it, balancing market efficiency and order flow.

Bid-Ask Spread

The bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask), directly impacting market liquidity. Makers, who add liquidity by placing limit orders, often experience tighter spreads and receive rebates, while takers, who remove liquidity by executing market orders, typically pay wider spreads and incur fees.

Matching Engine

A matching engine efficiently pairs buy and sell orders in financial markets by prioritizing maker orders, which provide liquidity to the order book, over taker orders that consume liquidity by executing immediately against existing orders. This mechanism optimizes market depth and price discovery while enabling fee structures that incentivize makers through rebates and charge takers with fees.

Passive Order

Passive orders are limit orders placed by makers who provide liquidity by waiting for takers to accept their bids or offers, benefiting from narrower spreads and reduced trading fees. Takers remove liquidity by executing market orders against these passive orders, often paying higher fees due to immediate order fulfillment.

Active Order

Active orders in trading refer to live buy or sell requests awaiting execution on an exchange, directly impacting liquidity dynamics between makers and takers. Makers provide liquidity by placing limit orders that add to the order book, while takers remove liquidity by executing market orders against these active orders.

Maker vs Taker Infographic

moneydif.com

moneydif.com