ERC-20 tokens are fungible digital assets widely used for creating cryptocurrencies and facilitating transactions within the Ethereum ecosystem. ERC-721 tokens represent unique, non-fungible assets, making them ideal for digital collectibles and NFTs with distinct attributes and ownership. Understanding the differences between ERC-20 and ERC-721 standards is essential for developers when choosing the appropriate token type for their blockchain projects.

Table of Comparison

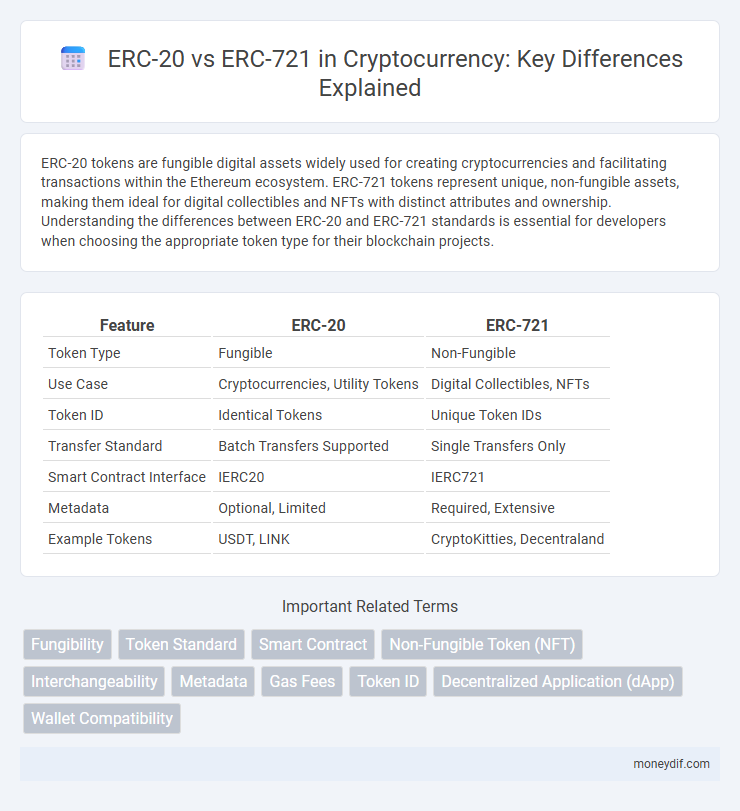

| Feature | ERC-20 | ERC-721 |

|---|---|---|

| Token Type | Fungible | Non-Fungible |

| Use Case | Cryptocurrencies, Utility Tokens | Digital Collectibles, NFTs |

| Token ID | Identical Tokens | Unique Token IDs |

| Transfer Standard | Batch Transfers Supported | Single Transfers Only |

| Smart Contract Interface | IERC20 | IERC721 |

| Metadata | Optional, Limited | Required, Extensive |

| Example Tokens | USDT, LINK | CryptoKitties, Decentraland |

ERC-20 vs ERC-721: Key Differences Explained

ERC-20 tokens represent fungible assets, meaning each token is identical and interchangeable, commonly used for cryptocurrencies and utility tokens. ERC-721 defines non-fungible tokens (NFTs), each unique and indivisible, ideal for digital art, collectibles, and unique assets. The key differences lie in fungibility, transferability, and metadata structure, with ERC-20 supporting uniform token quantities and ERC-721 enabling distinct, individually verifiable digital ownership.

Understanding the ERC-20 Token Standard

ERC-20 is a widely adopted token standard on the Ethereum blockchain that defines a set of rules for creating fungible tokens, ensuring seamless interoperability across wallets and exchanges. Unlike ERC-721 tokens, which represent unique, non-fungible assets often used for digital collectibles, ERC-20 tokens are identical and divisible, making them ideal for cryptocurrencies and utility tokens. The standardized functions of ERC-20, such as balance tracking and transfer approvals, enable efficient asset management and widespread compatibility.

What Makes ERC-721 Unique?

ERC-721 tokens are unique because they represent non-fungible assets, unlike ERC-20 tokens which are fungible and interchangeable. Each ERC-721 token has a distinct identifier and metadata, enabling the creation of digital collectibles, art, and unique in-game items. This non-fungibility allows ERC-721 to support complex ownership and provenance tracking on the Ethereum blockchain.

Use Cases: ERC-20 for Fungible Tokens

ERC-20 tokens are designed for fungible assets, meaning each token holds the same value and can be exchanged interchangeably, making them ideal for cryptocurrencies, utility tokens, and stablecoins. Use cases include payment systems, governance tokens in decentralized finance (DeFi), and reward points due to their divisibility and uniformity. The ERC-20 standard ensures compatibility across wallets, exchanges, and smart contracts, facilitating seamless token transfers and liquidity management.

Use Cases: ERC-721 for Non-Fungible Tokens (NFTs)

ERC-721 tokens represent unique digital assets, making them ideal for Non-Fungible Tokens (NFTs) used in digital art, collectibles, and gaming. Unlike ERC-20 tokens, which are fungible and interchangeable, ERC-721 ensures each token has distinct attributes and ownership records on the Ethereum blockchain. This uniqueness supports exclusive ownership, provenance tracking, and transferability for various digital assets.

Token Structure and Interoperability

ERC-20 tokens represent fungible assets with identical value and interchangeable units, enabling seamless transactions and broad compatibility across decentralized applications and wallets. ERC-721 tokens are non-fungible and uniquely identifiable, designed to represent distinct digital assets such as collectibles, ensuring provenance and uniqueness within blockchain ecosystems. Both standards leverage Ethereum's smart contract functionality but differ fundamentally in token structure, impacting their interoperability and use cases in decentralized finance and NFT markets.

Security Considerations: ERC-20 vs ERC-721

ERC-20 tokens, widely used for fungible assets, require rigorous security audits to prevent common vulnerabilities like integer overflow and unauthorized token transfers, which can lead to significant financial losses. ERC-721, designed for unique non-fungible tokens (NFTs), demands stringent identity verification and ownership protection mechanisms to secure distinct digital assets from theft or duplication. Implementing secure smart contract practices such as input validation, access control, and adherence to the latest Ethereum Improvement Proposals (EIPs) is critical for mitigating risks in both ERC-20 and ERC-721 standards.

Popular Projects Using ERC-20 and ERC-721

Popular projects utilizing ERC-20 tokens include Ethereum-based platforms like Uniswap, Chainlink, and Tether, which leverage the standard for fungible asset representation and seamless token swaps. In contrast, prominent ERC-721 projects such as CryptoKitties, Axie Infinity, and Decentraland highlight the use of non-fungible tokens (NFTs) to establish unique digital collectibles and virtual land ownership. These distinctions emphasize ERC-20's role in broad financial ecosystems while ERC-721 drives innovation in digital art and gaming collectibles.

Smart Contract Deployment: ERC-20 vs ERC-721

ERC-20 tokens utilize smart contracts designed for fungible assets, enabling seamless transferability and standardized interactions across decentralized applications, promoting liquidity and widespread adoption. ERC-721 smart contracts represent non-fungible tokens (NFTs) with unique identifiers for each asset, requiring more complex logic to handle ownership, provenance, and metadata management. Deployment of ERC-20 contracts typically involves simpler, more gas-efficient code compared to ERC-721, which demands additional functions to ensure the uniqueness and singular ownership of each token.

Future Trends in Token Standards

ERC-20 tokens continue to dominate as the standard for fungible digital assets, enabling seamless exchanges and widespread adoption across DeFi platforms. ERC-721 tokens, representing unique non-fungible assets, are driving innovation in digital collectibles, gaming, and metaverse projects. Future trends indicate hybrid token standards like ERC-1155 may unify fungible and non-fungible properties, enhancing scalability and flexibility in blockchain ecosystems.

Important Terms

Fungibility

ERC-20 tokens are fungible, meaning each unit is identical and interchangeable, enabling seamless trading and liquidity within decentralized finance ecosystems. In contrast, ERC-721 tokens represent non-fungible assets with unique identifiers, ensuring indivisibility and distinct ownership of digital collectibles and NFTs.

Token Standard

ERC-20 token standard defines fungible tokens with uniform value and interchangeable units, widely used for cryptocurrencies and utility tokens on the Ethereum blockchain. ERC-721 specifies non-fungible tokens (NFTs) with unique identifiers and distinct properties, enabling ownership of digital collectibles, art, and assets with provable scarcity.

Smart Contract

Smart contracts facilitate automated execution on blockchain platforms, with ERC-20 tokens representing fungible assets standardized for seamless transactions, while ERC-721 tokens enable unique, non-fungible asset management critical for digital collectibles and NFTs. Both standards define specific protocols for token transfer, ownership, and interoperability within the Ethereum ecosystem, optimizing decentralized finance and digital asset exchange.

Non-Fungible Token (NFT)

Non-Fungible Tokens (NFTs) are unique digital assets typically implemented using the ERC-721 standard, which allows each token to have distinct characteristics, unlike ERC-20 tokens that are fungible and interchangeable. ERC-721 enables the creation of one-of-a-kind collectibles, art, and digital assets on the Ethereum blockchain, while ERC-20 focuses on uniform digital currencies or tokens with identical value.

Interchangeability

ERC-20 tokens are interchangeable fungible assets, allowing each unit to be identical and mutually replaceable, ideal for currencies and utility tokens. In contrast, ERC-721 tokens are non-fungible and unique, representing distinct assets like digital art or collectibles, where each token has unique attributes and cannot be exchanged on a one-to-one basis with another.

Metadata

Metadata in ERC-20 tokens primarily includes basic information such as token name, symbol, and decimals to define fungible assets, while ERC-721 metadata provides detailed, unique attributes like token ID, owner, and URI pointing to off-chain resources, enabling the representation of distinct, non-fungible tokens. The structured metadata standards in ERC-721 facilitate tracking and displaying individual token characteristics, unlike the uniform metadata used in ERC-20 for interchangeable tokens.

Gas Fees

Gas fees for ERC-20 tokens are generally lower because transactions involve simple transfers between accounts, while ERC-721 tokens, representing unique assets in non-fungible tokens (NFTs), require higher gas fees due to the complexity of managing distinct token metadata and ownership verification. The average gas cost for an ERC-20 transfer can be around 21,000 gas units, whereas ERC-721 transfers often exceed 50,000 gas units depending on contract complexity and network congestion.

Token ID

Token ID uniquely identifies each token within the ERC-721 standard, enabling distinct, non-fungible assets on the blockchain, whereas ERC-20 tokens lack individual Token IDs, representing fungible tokens with identical value and properties. The presence of Token ID in ERC-721 facilitates ownership tracking and transfer of unique digital items, contrasting ERC-20's uniform token structure designed for interchangeable assets.

Decentralized Application (dApp)

Decentralized applications (dApps) leverage blockchain standards such as ERC-20 and ERC-721 to enable varying functionalities; ERC-20 tokens represent fungible assets, ideal for currencies or utility tokens, while ERC-721 tokens are used for non-fungible tokens (NFTs), allowing unique digital ownership and asset representation. This distinction affects dApp development by defining asset interchangeability, smart contract interactions, and use cases in gaming, digital art, and decentralized finance (DeFi).

Wallet Compatibility

ERC-20 tokens are widely supported across most cryptocurrency wallets due to their standardized fungible token structure, ensuring seamless integration for trading and transfers. In contrast, ERC-721 tokens, representing unique non-fungible assets, require specialized wallet support capable of handling individual token metadata and provenance, often found in NFT-focused platforms.

ERC-20 vs ERC-721 Infographic

moneydif.com

moneydif.com