Wrapped tokens represent assets from one blockchain on another network, enabling cross-chain compatibility and expanded use cases for cryptocurrencies originally confined to a single chain. Native tokens are the original assets of their respective blockchains, such as Bitcoin on the Bitcoin network or Ether on Ethereum, functioning as the primary medium of exchange and store of value within their ecosystems. Understanding the distinction between wrapped tokens and native tokens is crucial for investors navigating liquidity, interoperability, and smart contract interactions in the decentralized finance space.

Table of Comparison

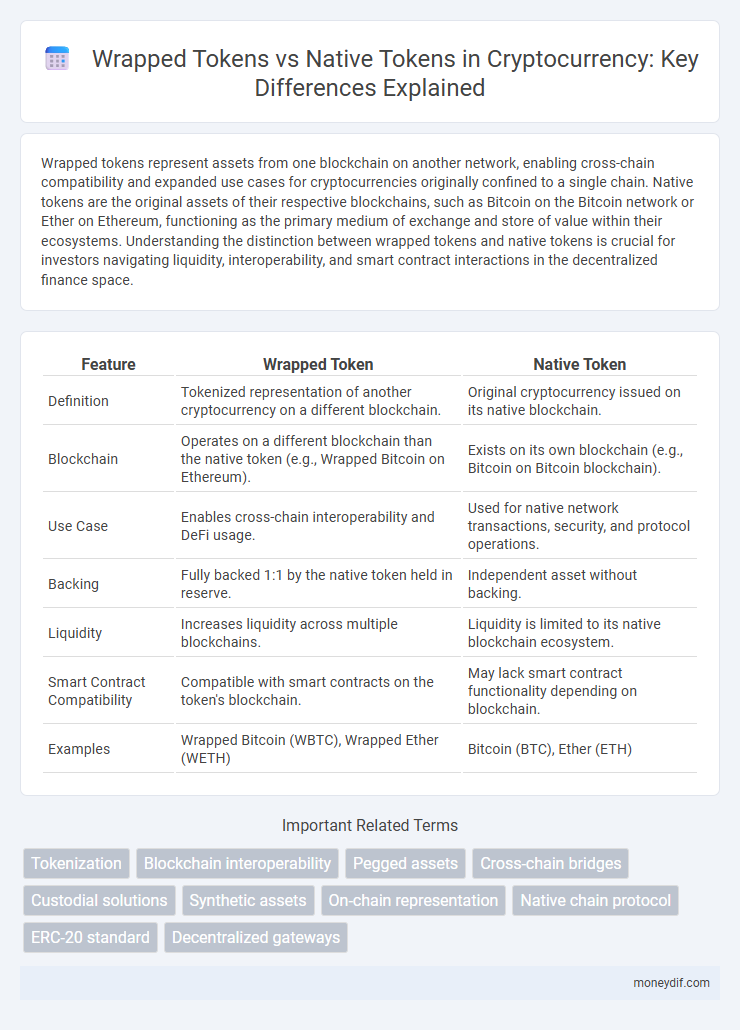

| Feature | Wrapped Token | Native Token |

|---|---|---|

| Definition | Tokenized representation of another cryptocurrency on a different blockchain. | Original cryptocurrency issued on its native blockchain. |

| Blockchain | Operates on a different blockchain than the native token (e.g., Wrapped Bitcoin on Ethereum). | Exists on its own blockchain (e.g., Bitcoin on Bitcoin blockchain). |

| Use Case | Enables cross-chain interoperability and DeFi usage. | Used for native network transactions, security, and protocol operations. |

| Backing | Fully backed 1:1 by the native token held in reserve. | Independent asset without backing. |

| Liquidity | Increases liquidity across multiple blockchains. | Liquidity is limited to its native blockchain ecosystem. |

| Smart Contract Compatibility | Compatible with smart contracts on the token's blockchain. | May lack smart contract functionality depending on blockchain. |

| Examples | Wrapped Bitcoin (WBTC), Wrapped Ether (WETH) | Bitcoin (BTC), Ether (ETH) |

Introduction to Native Tokens and Wrapped Tokens

Native tokens are the original digital assets that operate on their specific blockchain, such as Ether on the Ethereum network or Bitcoin on the Bitcoin network. Wrapped tokens represent these native assets on different blockchains by being pegged 1:1, enabling cross-chain compatibility and liquidity, like Wrapped Bitcoin (WBTC) on Ethereum. This mechanism allows users to leverage the value of native tokens within decentralized applications across multiple blockchain platforms without losing the asset's original value.

Key Differences Between Native and Wrapped Tokens

Native tokens are the original cryptocurrencies that operate directly on their own blockchain, such as Bitcoin on the Bitcoin network or Ether on the Ethereum network. Wrapped tokens are representations of these native tokens on different blockchains, enabling interoperability and cross-chain functionality by pegging their value one-to-one with the native asset. Key differences include native tokens having direct network consensus and security, while wrapped tokens rely on custodial or smart contract mechanisms to maintain their peg and liquidity.

How Native Tokens Work in Blockchain Ecosystems

Native tokens operate as the fundamental units of value and governance within their specific blockchain ecosystems, enabling secure peer-to-peer transactions, smart contract execution, and network incentivization. They are intrinsically tied to the blockchain's protocol, such as Ether on Ethereum, and their supply and issuance are governed by the blockchain's consensus mechanism. Native tokens facilitate decentralized applications by providing essential utility, including paying gas fees, participating in staking, and voting on protocol upgrades.

The Process of Creating Wrapped Tokens

Wrapped tokens are created through a process called token wrapping, where native tokens are locked in a smart contract on their original blockchain, and an equivalent amount of wrapped tokens are minted on a different blockchain. This process requires a trusted custodian or a decentralized protocol to manage the lock-and-mint mechanism, ensuring that each wrapped token is fully backed by the native asset. Wrapped tokens facilitate cross-chain interoperability, allowing native tokens from blockchains like Bitcoin or Ethereum to be used seamlessly on other networks such as Binance Smart Chain or Polygon.

Advantages of Using Native Tokens

Native tokens offer enhanced security through their direct integration with the underlying blockchain protocol, reducing reliance on external smart contracts and minimizing attack vectors. These tokens benefit from increased liquidity and seamless compatibility with native blockchain features, facilitating faster transaction processing and lower fees. Users leveraging native tokens also experience improved decentralization and network consensus participation, which strengthens overall blockchain integrity.

Benefits and Use Cases of Wrapped Tokens

Wrapped tokens provide enhanced interoperability by allowing assets native to one blockchain to be utilized on another, expanding liquidity and access to decentralized finance (DeFi) platforms. They enable seamless cross-chain transactions without the need to convert or trade for native tokens on the host blockchain. Use cases include participating in yield farming, lending protocols, and decentralized exchanges where native tokens are unsupported, thereby increasing asset utility and market reach.

Cross-Chain Interoperability: Wrapped vs Native

Wrapped tokens enable cross-chain interoperability by representing native tokens on different blockchains through smart contracts, facilitating seamless asset transfers without losing value. Native tokens operate solely within their original blockchain, limiting their functionality across multiple networks. Wrapped tokens expand usability across ecosystems like Ethereum and Binance Smart Chain, enhancing liquidity and decentralized finance opportunities.

Security Considerations: Native vs Wrapped Tokens

Native tokens operate directly on their original blockchain, offering robust security through inherent consensus mechanisms and reducing risks linked to third-party custodian vulnerabilities. Wrapped tokens represent native assets on alternative blockchains by locking the original tokens in custody, introducing potential counterparty risks and smart contract vulnerabilities within the wrapping protocol. Careful evaluation of the wrapping smart contract's security audits and the custodial entity's trustworthiness is crucial to mitigate risks when using wrapped tokens.

Popular Examples of Wrapped and Native Tokens

Wrapped tokens like Wrapped Bitcoin (WBTC) and Wrapped Ether (WETH) represent native assets such as Bitcoin (BTC) and Ether (ETH) on alternative blockchains, enabling interoperability and decentralized finance activities. Native tokens, including Bitcoin (BTC), Ether (ETH), and Binance Coin (BNB), function on their original blockchains with inherent security and consensus mechanisms. Popular wrapped tokens facilitate liquidity and cross-chain transactions, while native tokens serve as primary units of value and governance within their native ecosystems.

Future Trends: The Evolving Role of Wrapped and Native Tokens

Wrapped tokens enable seamless interoperability across different blockchain networks, paving the way for more integrated decentralized finance (DeFi) ecosystems. Native tokens, maintaining intrinsic blockchain security and governance, continue to play a critical role in network consensus and value storage. Future trends indicate a growing synergy where wrapped tokens enhance liquidity and accessibility while native tokens underpin core network functionality and institutional adoption.

Important Terms

Tokenization

Wrapped tokens represent native tokens locked on their original blockchain and issued on another chain to enable cross-chain compatibility and liquidity.

Blockchain interoperability

Wrapped tokens enable blockchain interoperability by representing native tokens from one chain on another, facilitating cross-chain transactions without sacrificing the original token's value or security.

Pegged assets

Pegged assets like Wrapped tokens represent native tokens on different blockchains by maintaining a 1:1 value ratio through collateralization and smart contracts, enabling cross-chain interoperability.

Cross-chain bridges

Cross-chain bridges enable the transfer of wrapped tokens--representations of native tokens from one blockchain on another network--allowing users to utilize assets across multiple ecosystems while maintaining liquidity and interoperability. Wrapped tokens often incur additional smart contract risks and may lack the same security guarantees as native tokens, which circulate directly on their original blockchain.

Custodial solutions

Custodial solutions for wrapped tokens provide secure asset management by holding native tokens and issuing equivalent wrapped tokens on alternative blockchains, ensuring liquidity and interoperability while maintaining trust through centralized custody.

Synthetic assets

Synthetic assets enable exposure to wrapped tokens without directly holding the native token, enhancing liquidity and cross-chain interoperability.

On-chain representation

On-chain representation of wrapped tokens enables cross-chain interoperability by encoding native tokens from one blockchain into ERC-20 compatible assets on another blockchain, preserving liquidity and value while facilitating decentralized trading.

Native chain protocol

Native Chain Protocol enables seamless interoperability by allowing native tokens to be securely wrapped into wrapped tokens, facilitating cross-chain transactions without losing the original asset's value. Wrapped tokens act as pegged representations of native tokens on other blockchains, maintaining liquidity and usability while leveraging the security and trust of the original chain.

ERC-20 standard

ERC-20 standard defines a common interface for Ethereum tokens, enabling wrapped tokens to represent native assets like Ether as interoperable ERC-20 tokens on decentralized platforms.

Decentralized gateways

Decentralized gateways enable seamless interoperability by facilitating the conversion of wrapped tokens, which represent assets on different blockchains, into native tokens that maintain original blockchain utility and value.

Wrapped token vs native token Infographic

moneydif.com

moneydif.com