Automated Market Makers (AMMs) utilize liquidity pools and algorithmic pricing to enable seamless, decentralized trading without requiring a counterpart, making trades faster and more accessible. In contrast, order book systems rely on matching buy and sell orders from individual traders, offering more precise price discovery but often with lower liquidity and slower execution. Understanding the trade-offs between AMMs and order books is crucial for selecting the appropriate trading mechanism based on liquidity needs and market transparency.

Table of Comparison

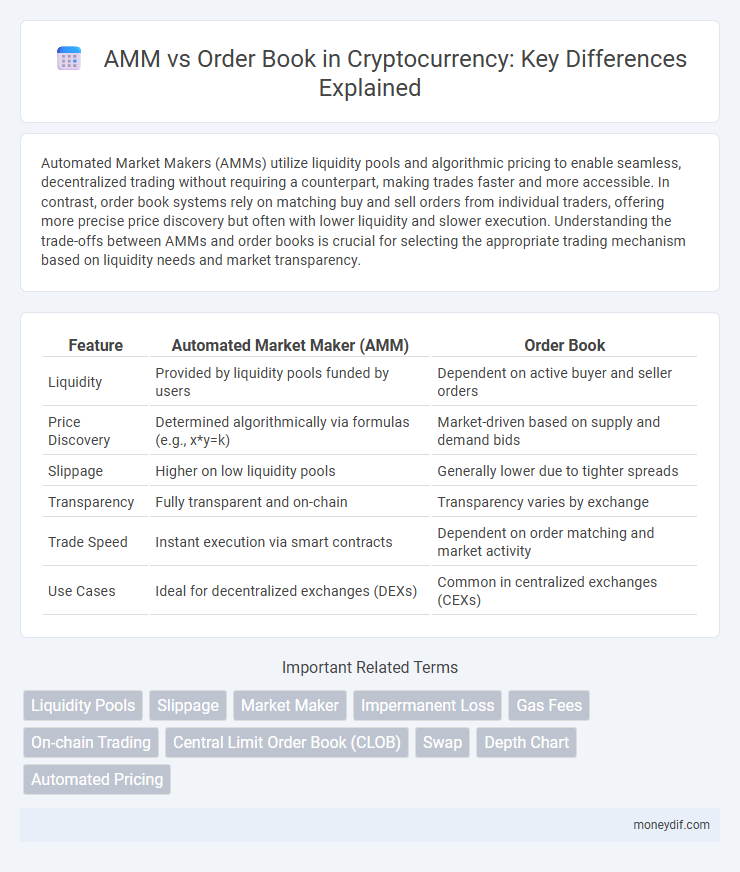

| Feature | Automated Market Maker (AMM) | Order Book |

|---|---|---|

| Liquidity | Provided by liquidity pools funded by users | Dependent on active buyer and seller orders |

| Price Discovery | Determined algorithmically via formulas (e.g., x*y=k) | Market-driven based on supply and demand bids |

| Slippage | Higher on low liquidity pools | Generally lower due to tighter spreads |

| Transparency | Fully transparent and on-chain | Transparency varies by exchange |

| Trade Speed | Instant execution via smart contracts | Dependent on order matching and market activity |

| Use Cases | Ideal for decentralized exchanges (DEXs) | Common in centralized exchanges (CEXs) |

Understanding AMMs and Order Books: Key Differences

Automated Market Makers (AMMs) use liquidity pools and smart contracts to enable decentralized trading without relying on traditional buy and sell orders, allowing continuous asset swaps based on predefined algorithms like constant product formulas. Order books display real-time bid and ask prices from individual traders, facilitating centralized exchange mechanisms where users place limit or market orders that execute based on matching price levels. Understanding the key differences, AMMs offer automated liquidity provision and price discovery on decentralized platforms, while order book models provide direct price competition and transparency in centralized trading environments.

How Automated Market Makers (AMMs) Work

Automated Market Makers (AMMs) operate using smart contracts that algorithmically determine asset prices based on liquidity pool ratios rather than traditional buy and sell orders. Liquidity providers deposit token pairs into pools, enabling continuous, permissionless trading without intermediaries. Price slippage and impermanent loss are key considerations for users interacting with AMM protocols such as Uniswap, SushiSwap, and Balancer.

Traditional Order Book Mechanisms Explained

Traditional order book mechanisms in cryptocurrency exchanges organize buy and sell orders by price level, enabling real-time matching through a centralized ledger that records bids and asks. This system prioritizes price-time priority, ensuring orders at better prices and earlier timestamps are executed first, providing transparency and liquidity depth. Unlike Automated Market Makers (AMMs) that rely on liquidity pools and algorithms to price assets, order books offer direct control to traders over order types and execution speeds.

Liquidity Provision: AMM vs Order Book

Automated Market Makers (AMMs) rely on liquidity pools funded by users who earn fees in exchange for providing continuous liquidity, making price discovery algorithmic rather than based on matching buy and sell orders. In contrast, order book exchanges depend on individual limit and market orders, where liquidity is supplied through discrete bids and asks, often resulting in higher order fragmentation but more precise price levels. AMMs offer more consistent liquidity without requiring counterparties for trades, while order books can provide greater depth and price accuracy in highly liquid markets.

Trading Fees and Costs: A Comparative Analysis

Automated Market Makers (AMMs) typically charge a fixed percentage fee on each trade, which is shared among liquidity providers, while traditional order book exchanges often impose variable fees based on trade volume and market maker or taker status. AMMs incur costs related to impermanent loss for liquidity providers, indirectly affecting overall trading costs, whereas order books may have lower fees for high-volume traders but can experience higher slippage in low-liquidity markets. Understanding the fee structures and hidden costs in both models is crucial for traders aiming to optimize profitability and minimize expenses in cryptocurrency trading.

User Experience and Accessibility

Automated Market Makers (AMMs) offer seamless liquidity and instant trades without the need for order matching, significantly enhancing user experience by simplifying the trading process. Order book systems require users to manually place buy or sell orders, which can be complex and less accessible for beginners. AMMs provide broader accessibility through decentralized platforms, allowing continuous trading even with low liquidity, making them more user-friendly compared to traditional order book exchanges.

Risks and Security Considerations

Automated Market Makers (AMMs) expose users to impermanent loss and smart contract vulnerabilities, posing significant financial risks without centralized oversight. Order book exchanges offer enhanced security through regulated custodial practices and transaction transparency but remain susceptible to front-running and liquidity manipulation. Evaluating these risks is crucial for investors seeking a balance between decentralized accessibility and robust security in cryptocurrency trading.

Market Efficiency and Price Discovery

Automated Market Makers (AMMs) enhance market efficiency by enabling continuous liquidity through algorithmic pricing formulas, reducing reliance on traditional order book depth. In contrast, order book models rely on matching discrete buy and sell orders which can lead to price slippage and slower price discovery during low liquidity periods. AMMs offer more consistent price updates and enable seamless trading, driving more efficient and transparent price discovery in decentralized finance ecosystems.

Popular AMM and Order Book Platforms

Uniswap and PancakeSwap dominate as popular AMM platforms, leveraging liquidity pools for seamless decentralized trading with minimal slippage. On the other hand, Binance and Coinbase Pro lead order book platforms, offering deep liquidity and precise price discovery through real-time bid and ask matching. Each system caters to different trading needs, with AMMs excelling in accessibility for retail traders and order books favored by professional traders for advanced order types.

Which Model Is Best for Your Trading Needs?

Automated Market Makers (AMMs) provide continuous liquidity through algorithmic pricing, ideal for traders seeking quick and decentralized transactions with minimal slippage. In contrast, Order Book exchanges offer precise control over trade execution and price discovery, benefiting those who prefer transparent bid-ask dynamics and limit orders. Choosing between AMM and Order Book models depends on your priorities regarding decentralization, liquidity depth, and control over trade execution.

Important Terms

Liquidity Pools

Liquidity pools in automated market makers (AMMs) enable seamless token swaps by aggregating user funds, contrasting with traditional order books where buyers and sellers place limit orders to match trades. AMMs rely on algorithms like constant product formulas to maintain market liquidity, while order book systems depend on active order matching and depth for price discovery and execution efficiency.

Slippage

Slippage in Automated Market Makers (AMMs) occurs when large trades impact the liquidity pool, causing the execution price to deviate from the expected price due to constant product formulas like x*y=k. In contrast, order book systems experience slippage when market orders consume multiple price levels, reflecting the depth and spread of available limit orders.

Market Maker

Market makers provide liquidity in both AMM (Automated Market Maker) systems and traditional order book exchanges, but AMMs rely on algorithmic pricing formulas and liquidity pools, while order books match buyers and sellers through limit orders. The efficiency of AMMs in decentralized finance contrasts with the precise price discovery and depth of order book models typically used in centralized exchanges.

Impermanent Loss

Impermanent Loss occurs in Automated Market Makers (AMMs) when the price of deposited assets diverges from their initial ratio, causing liquidity providers to experience reduced value compared to holding the assets in a traditional order book exchange. Unlike AMMs, order book exchanges maintain fixed prices for assets with direct buy and sell orders, preventing impermanent loss but requiring active trading and liquidity management.

Gas Fees

Gas fees for Automated Market Makers (AMMs) tend to be higher due to multiple on-chain interactions per trade, in contrast to order book models that batch transactions off-chain before settling, reducing on-chain gas costs. The real-time liquidity provision in AMMs increases gas consumption, whereas order books optimize gas fees by minimizing the frequency of direct blockchain transactions.

On-chain Trading

On-chain trading leverages decentralized automated market makers (AMMs) to provide continuous liquidity through algorithmic pricing, contrasting with traditional order book models that rely on matching buy and sell orders. AMMs enable seamless token swaps on decentralized exchanges (DEXs) like Uniswap by using liquidity pools, while order book systems, prevalent in centralized exchanges, depend on real-time bid-ask order matching to establish market prices.

Central Limit Order Book (CLOB)

Central Limit Order Book (CLOB) systems aggregate buy and sell orders to provide transparent price discovery and depth, contrasting automated market makers (AMMs) that rely on liquidity pools and pricing curves without order matching. CLOBs offer precise control over trade execution and allow for limit orders, whereas AMMs prioritize liquidity provision and continuous pricing through algorithms.

Swap

Automated Market Makers (AMMs) facilitate swaps by using liquidity pools and algorithm-driven price adjustments, enabling seamless token exchanges without relying on traditional order books. In contrast, order book systems match buy and sell orders directly, often resulting in higher price transparency but requiring sufficient market depth to ensure efficient swaps.

Depth Chart

Depth charts visualize liquidity distribution in Automated Market Makers (AMMs) by showing price impact curves, whereas order book depth charts display discrete buy and sell orders with specific volumes at various price levels. AMM depth charts highlight slippage risks in liquidity pools, and order book charts emphasize real-time market supply and demand transparency.

Automated Pricing

Automated Pricing utilizes Automated Market Makers (AMMs) by leveraging liquidity pools to set prices algorithmically based on supply and demand, contrasting with Order Book systems that rely on matching buy and sell orders to determine market prices dynamically. AMMs offer continuous liquidity and price discovery without the need for counterparties, while Order Books provide price transparency and depth through visible bids and asks.

AMM vs Order book Infographic

moneydif.com

moneydif.com