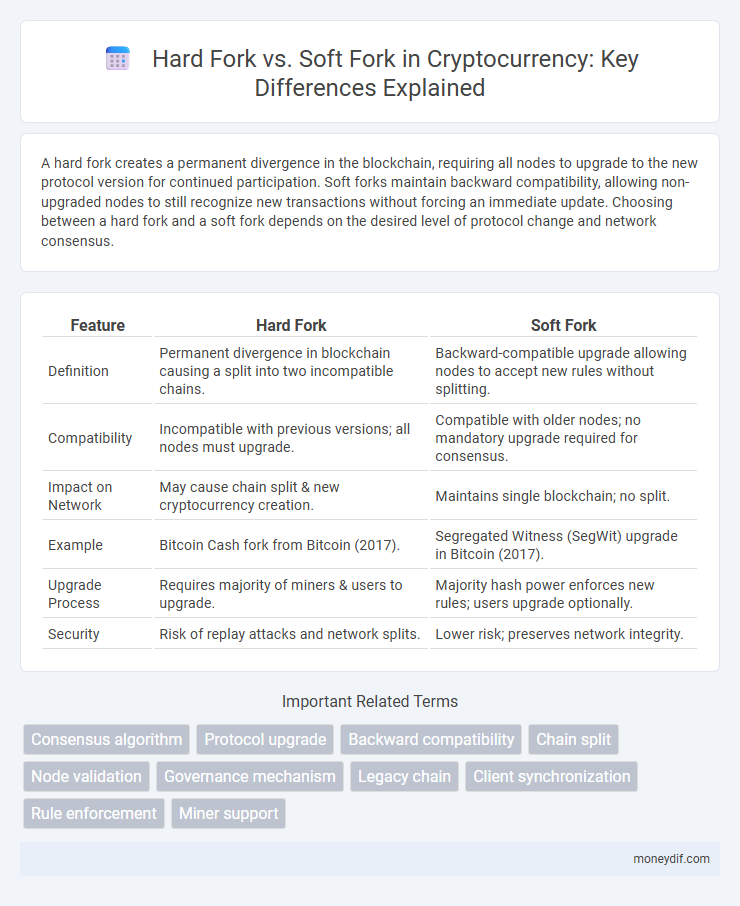

A hard fork creates a permanent divergence in the blockchain, requiring all nodes to upgrade to the new protocol version for continued participation. Soft forks maintain backward compatibility, allowing non-upgraded nodes to still recognize new transactions without forcing an immediate update. Choosing between a hard fork and a soft fork depends on the desired level of protocol change and network consensus.

Table of Comparison

| Feature | Hard Fork | Soft Fork |

|---|---|---|

| Definition | Permanent divergence in blockchain causing a split into two incompatible chains. | Backward-compatible upgrade allowing nodes to accept new rules without splitting. |

| Compatibility | Incompatible with previous versions; all nodes must upgrade. | Compatible with older nodes; no mandatory upgrade required for consensus. |

| Impact on Network | May cause chain split & new cryptocurrency creation. | Maintains single blockchain; no split. |

| Example | Bitcoin Cash fork from Bitcoin (2017). | Segregated Witness (SegWit) upgrade in Bitcoin (2017). |

| Upgrade Process | Requires majority of miners & users to upgrade. | Majority hash power enforces new rules; users upgrade optionally. |

| Security | Risk of replay attacks and network splits. | Lower risk; preserves network integrity. |

Understanding Blockchain Forks: Hard Forks vs Soft Forks

Blockchain forks occur when a blockchain's protocol diverges into different paths, creating updated rulesets known as hard forks or soft forks. Hard forks introduce incompatible changes that require all nodes to upgrade, resulting in a permanent split and two separate blockchains, as seen in Ethereum's shift to Ethereum Classic. Soft forks, however, are backward-compatible upgrades where only a majority of miners enforce the new rules, maintaining a single chain and enabling smoother upgrades without network disruption.

Key Differences Between Hard Forks and Soft Forks

Hard forks in cryptocurrency create a permanent divergence from the previous blockchain version, requiring all nodes to upgrade to remain compatible, while soft forks maintain backward compatibility, allowing non-upgraded nodes to continue validating transactions. Key differences include the potential for hard forks to split the network into two separate blockchains, whereas soft forks introduce backward-compatible changes that tighten existing rules without network splits. Security considerations differ as hard forks may lead to replay attacks if not properly managed, whereas soft forks rely on majority hash power to enforce updated protocols.

How Hard Forks Impact Cryptocurrency Networks

Hard forks create divergent blockchain paths resulting in two separate cryptocurrencies, often causing network splits and requiring users to upgrade to new protocol versions. This split can lead to temporary transaction disruptions, reduced network security, and fragmentation of community consensus within cryptocurrency networks like Ethereum and Bitcoin. Hard forks sometimes increase innovation opportunities but also pose risks of confusion among users and potential loss of funds if wallets or exchanges do not promptly support the forked chain.

The Role of Soft Forks in Blockchain Upgrades

Soft forks play a crucial role in blockchain upgrades by enabling backward-compatible changes that enhance network security and efficiency without requiring all nodes to update. These upgrades tighten existing protocol rules, allowing non-upgraded nodes to still recognize new blocks as valid, minimizing network disruption. Soft forks facilitate smoother consensus transitions and broader adoption of protocol improvements compared to hard forks, which require all nodes to upgrade and can lead to chain splits.

Consensus Mechanisms: Hard Forks vs Soft Forks

Hard forks and soft forks represent distinct approaches to blockchain consensus mechanisms, with hard forks creating a permanent divergence requiring all nodes to upgrade, while soft forks maintain backward compatibility and only require majority miner consensus for changes. Hard forks lead to split chains, fostering decentralized decision-making but risking network fragmentation, whereas soft forks enhance security and efficiency by enforcing stricter protocol rules without disrupting non-upgraded nodes. These mechanisms play crucial roles in cryptocurrency governance, influencing protocol upgrades, network consensus, and long-term scalability.

Notable Examples of Hard and Soft Forks in Crypto History

Bitcoin Cash is a notable hard fork from Bitcoin that occurred in 2017 to increase block size and improve transaction speed. Ethereum's Constantinople upgrade in 2019 exemplifies a soft fork, introducing optimizations without splitting the chain. Another significant hard fork is Bitcoin SV in 2018, which aimed to restore the original Bitcoin protocol and increase block size beyond Bitcoin Cash.

Security Implications of Forking: Hard vs Soft

Hard forks create permanent divergences in blockchain protocols, potentially increasing attack surfaces and security risks due to chain splits and replay attacks. Soft forks maintain backward compatibility, reducing security vulnerabilities by allowing non-upgraded nodes to continue validating transactions. Proper implementation of consensus rules in soft forks strengthens network security, while hard forks require coordinated upgrades to prevent double-spending and chain reorganization attacks.

Community Governance in Hard Fork and Soft Fork Scenarios

Hard forks represent a significant split in blockchain protocols, often requiring extensive community governance and consensus to implement changes that create incompatibility with previous versions. Soft forks maintain backward compatibility and generally require less rigorous coordination among stakeholders, enabling incremental updates without fracturing the community. Effective governance in hard forks hinges on inclusive decision-making and managing divergent interests, while soft forks rely on majority miner signaling to enforce protocol upgrades.

Forking and Token Economics: What Investors Should Know

Hard forks create a permanent divergence in blockchain protocols, often resulting in new tokens that can significantly impact token supply and valuation. Soft forks, being backward-compatible upgrades, typically maintain token continuity but may influence network consensus and future token economics. Investors must evaluate the potential for token inflation, network security, and community support when assessing the implications of both hard and soft forks on their portfolio.

The Future of Blockchain Upgrades: Hard Forks, Soft Forks, and Beyond

Hard forks and soft forks represent critical mechanisms for implementing blockchain upgrades, each impacting network consensus and compatibility differently. Hard forks create permanent splits requiring all nodes to upgrade, potentially leading to new, independent blockchains, while soft forks maintain backward compatibility with updated protocols enforced by upgraded nodes. Emerging solutions like layer-two scaling and protocol-agnostic upgrades signify the future of blockchain evolution, aiming to enhance scalability, security, and interoperability beyond traditional fork models.

Important Terms

Consensus algorithm

Consensus algorithms govern the validation process in blockchain networks, determining the acceptance of changes such as hard forks or soft forks in the protocol. Hard forks create permanent divergences by implementing incompatible changes that require all nodes to upgrade, whereas soft forks enforce backward-compatible updates allowing non-upgraded nodes to continue participating under the new rules.

Protocol upgrade

A protocol upgrade involves a hard fork, which creates a permanent divergence in the blockchain requiring all nodes to upgrade, or a soft fork, which is backward-compatible and allows non-upgraded nodes to continue validating transactions.

Backward compatibility

Backward compatibility ensures that soft forks maintain network functionality with older nodes, while hard forks break compatibility by requiring all nodes to upgrade.

Chain split

A chain split occurs when a blockchain undergoes a hard fork, creating two incompatible versions of the ledger that invalidate each other's blocks and transactions, resulting in entirely separate networks. In contrast, a soft fork maintains backward compatibility, allowing non-upgraded nodes to recognize new rules while consensus is preserved within a single chain.

Node validation

Node validation ensures consensus integrity by requiring nodes to strictly follow protocol rules in a hard fork, while soft forks allow backward-compatible rule changes validated by upgraded nodes.

Governance mechanism

Governance mechanisms in blockchain determine consensus rules, where hard forks create permanent protocol splits requiring unanimous upgrade, while soft forks allow backward-compatible updates enabling network continuity without full node consensus.

Legacy chain

A legacy chain results from a hard fork that permanently splits the blockchain, while a soft fork maintains backward compatibility by enforcing stricter rules within the existing chain.

Client synchronization

Client synchronization during a hard fork requires downloading and validating an entirely new blockchain, while a soft fork allows clients to synchronize by updating within the existing blockchain protocol.

Rule enforcement

Hard forks enforce rules by creating incompatible protocol changes requiring all nodes to upgrade, while soft forks enforce rules through backward-compatible updates allowing non-upgraded nodes to remain valid.

Miner support

Miner support determines the success of a hard fork by requiring majority acceptance for protocol changes, while a soft fork maintains backward compatibility and can be enforced with minority miner consensus.

Hard fork vs soft fork Infographic

moneydif.com

moneydif.com