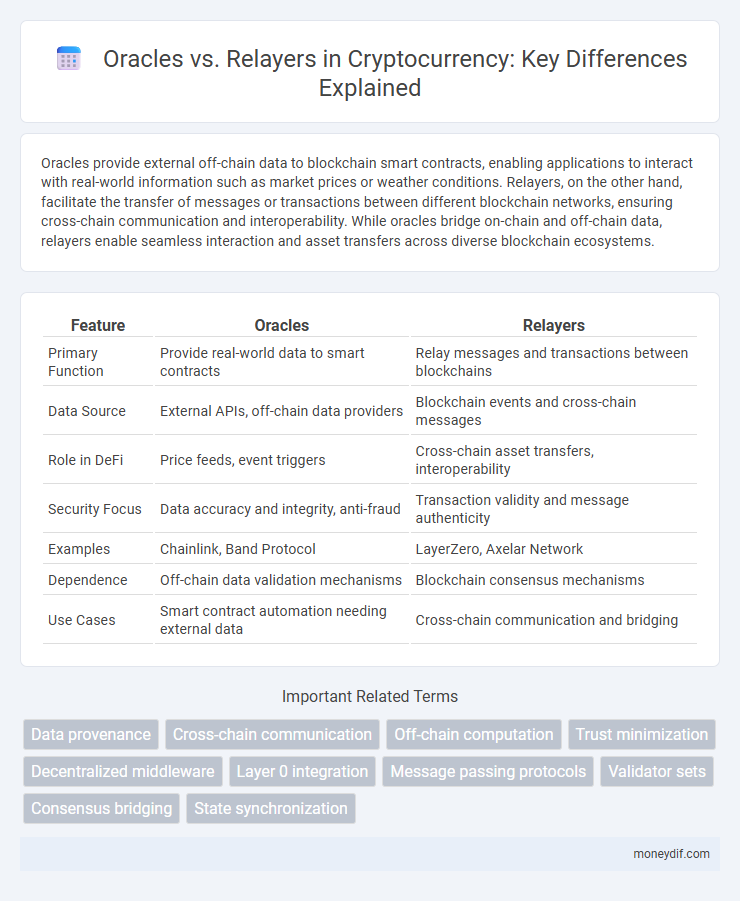

Oracles provide external off-chain data to blockchain smart contracts, enabling applications to interact with real-world information such as market prices or weather conditions. Relayers, on the other hand, facilitate the transfer of messages or transactions between different blockchain networks, ensuring cross-chain communication and interoperability. While oracles bridge on-chain and off-chain data, relayers enable seamless interaction and asset transfers across diverse blockchain ecosystems.

Table of Comparison

| Feature | Oracles | Relayers |

|---|---|---|

| Primary Function | Provide real-world data to smart contracts | Relay messages and transactions between blockchains |

| Data Source | External APIs, off-chain data providers | Blockchain events and cross-chain messages |

| Role in DeFi | Price feeds, event triggers | Cross-chain asset transfers, interoperability |

| Security Focus | Data accuracy and integrity, anti-fraud | Transaction validity and message authenticity |

| Examples | Chainlink, Band Protocol | LayerZero, Axelar Network |

| Dependence | Off-chain data validation mechanisms | Blockchain consensus mechanisms |

| Use Cases | Smart contract automation needing external data | Cross-chain communication and bridging |

Introduction to Oracles and Relayers in Cryptocurrency

Oracles serve as trusted data feeds that connect blockchain smart contracts with real-world information, enabling decentralized applications to interact with external data sources securely. Relayers facilitate off-chain transaction communication by transmitting signed messages or transactions between users and blockchain networks, optimizing scalability and privacy. Both oracles and relayers play crucial roles in enhancing blockchain functionality by bridging on-chain and off-chain environments.

Core Functions: Oracles vs Relayers

Oracles provide external data inputs to smart contracts by fetching and verifying real-world information, enabling blockchain applications to interact with off-chain events. Relayers facilitate transaction relay between different blockchain networks or layers, enhancing interoperability and scalability by enabling cross-chain communication and off-chain order execution. The core function of oracles centers on trusted data provision, while relayers focus on seamless transaction delivery across decentralized environments.

How Oracles Work in Blockchain Ecosystems

Oracles act as trusted data feeds that provide blockchain smart contracts with real-world information, enabling automated execution based on external events such as price changes, weather, or sports results. They source data from off-chain APIs, verify its authenticity, and deliver it on-chain in a tamper-proof manner, ensuring smart contracts interact with accurate and timely information. Unlike relayers, which primarily relay transaction data between networks, oracles focus on feeding external data into blockchain ecosystems to trigger contract conditions.

The Role of Relayers in Crypto Transactions

Relayers facilitate off-chain order matching and transaction forwarding in decentralized exchanges, reducing network congestion and gas fees by bundling multiple trades into a single on-chain transaction. Unlike oracles that provide external data feeds to smart contracts, relayers act as intermediaries ensuring efficient and secure communication between users and blockchain networks. Their role is crucial in enhancing scalability and user experience within decentralized finance ecosystems.

Key Differences Between Oracles and Relayers

Oracles provide external real-world data to smart contracts, enabling decentralized applications to interact with off-chain information such as price feeds, weather updates, or event outcomes. Relayers facilitate the off-chain aggregation and forwarding of transactions between users and blockchain networks, commonly improving scalability and transaction efficiency in layer-2 solutions or cross-chain communication. The key difference lies in their roles: oracles connect blockchains to external data sources, whereas relayers manage the secure transfer and ordering of on-chain transactions without directly providing external data.

Use Cases: Practical Applications of Oracles

Oracles enable smart contracts to interact with real-world data, essential for decentralized finance (DeFi) platforms that require price feeds, weather data, or event outcomes to automate transactions. They are crucial in insurance, supply chain management, and gaming industries, providing trusted external information to trigger contract execution. Unlike relayers that facilitate transaction relay across blockchain networks, oracles deliver verified off-chain information, making them indispensable for use cases reliant on accurate and timely data inputs.

Real-World Examples: Relayers in Action

Relayers play a crucial role in decentralized exchanges like Uniswap and Loopring by facilitating off-chain order matching to optimize transaction speed and reduce gas fees. In contrast to oracles that provide external data feeds, relayers handle the communication between users and smart contracts, ensuring seamless trade execution and order routing. Real-world applications demonstrate relayers' ability to enhance scalability and improve user experience in decentralized finance ecosystems.

Security Considerations: Oracles vs Relayers

Oracles and relayers play crucial roles in blockchain ecosystems, with distinct security considerations. Oracles face risks related to data integrity and trustworthiness, as they provide external information that can be manipulated or corrupted, leading to potentially flawed smart contract executions. Relayers, on the other hand, concentrate on the secure and timely transmission of messages between chains or layers, where attacks such as transaction censorship or message withholding can compromise cross-chain functionality.

Advantages and Limitations of Each Solution

Oracles provide real-world data to smart contracts, ensuring reliability and decentralization but face challenges in data authenticity and latency. Relayers facilitate off-chain transaction processing with faster execution and lower costs but often sacrifice decentralization and transparency. Understanding these trade-offs is crucial for selecting the right solution in decentralized finance and blockchain applications.

Future Trends: Oracles and Relayers in Decentralized Finance

Oracles and relayers are poised to play pivotal roles in the future of decentralized finance (DeFi) by enhancing data accuracy and transaction efficiency. Advanced oracle networks will improve real-time data integration from off-chain sources, while relayers will optimize trade execution and liquidity aggregation across decentralized exchanges. Emerging trends highlight increased interoperability between oracles and relayers, driving more secure and seamless DeFi ecosystems.

Important Terms

Data provenance

Data provenance in blockchain relies on oracles for secure off-chain data verification, while relayers primarily facilitate transaction relay without ensuring data authenticity.

Cross-chain communication

Cross-chain communication relies on oracles to securely transmit real-world data to blockchain networks, while relayers facilitate consensus and message transfer between different chains. Oracles focus on data accuracy and verification, whereas relayers ensure reliable cross-chain transaction execution and interoperability.

Off-chain computation

Off-chain computation enhances blockchain scalability by utilizing oracles to securely fetch external data and relayers to efficiently submit transaction proofs without on-chain execution.

Trust minimization

Trust minimization in blockchain systems relies on oracles to securely provide verified external data without intermediaries, whereas relayers often introduce additional trust assumptions by acting as data conveyors between networks.

Decentralized middleware

Decentralized middleware leverages oracles to securely fetch off-chain data while relayers facilitate efficient transaction propagation and consensus within blockchain networks.

Layer 0 integration

Layer 0 integration enhances blockchain interoperability by facilitating seamless data exchange across different chains, where oracles provide trusted external data inputs to smart contracts while relayers enable cross-chain transaction forwarding and consensus messaging. Oracles ensure accuracy and security in off-chain data verification, whereas relayers focus on bridging communication layers to maintain decentralized and efficient transaction execution across multiple blockchain networks.

Message passing protocols

Oracles provide external data to blockchain smart contracts, while relayers facilitate off-chain message passing and transaction forwarding between different blockchain networks.

Validator sets

Validator sets ensure blockchain security by verifying oracle data, while relayers focus on transmitting information between chains without validating its authenticity.

Consensus bridging

Consensus bridging utilizes decentralized oracles to securely verify external data, contrasting with relayers that depend on trusted intermediaries for data transmission across blockchains.

State synchronization

State synchronization ensures accurate data transfer between blockchains, where oracles supply external verified data crucial for smart contracts execution, while relayers facilitate efficient transaction relay within or across chains. Oracles focus on data integrity from off-chain sources, whereas relayers prioritize communication speed and protocol interoperability.

Oracles vs relayers Infographic

moneydif.com

moneydif.com