Synthetic assets replicate the value and performance of real-world assets using blockchain technology without requiring ownership of the actual asset. Derivatives are financial contracts whose value is derived from the price movements of an underlying asset, often involving leverage and expiration dates. Synthetic assets offer direct exposure to the underlying asset's price, while derivatives provide more complex risk management and speculative opportunities in cryptocurrency markets.

Table of Comparison

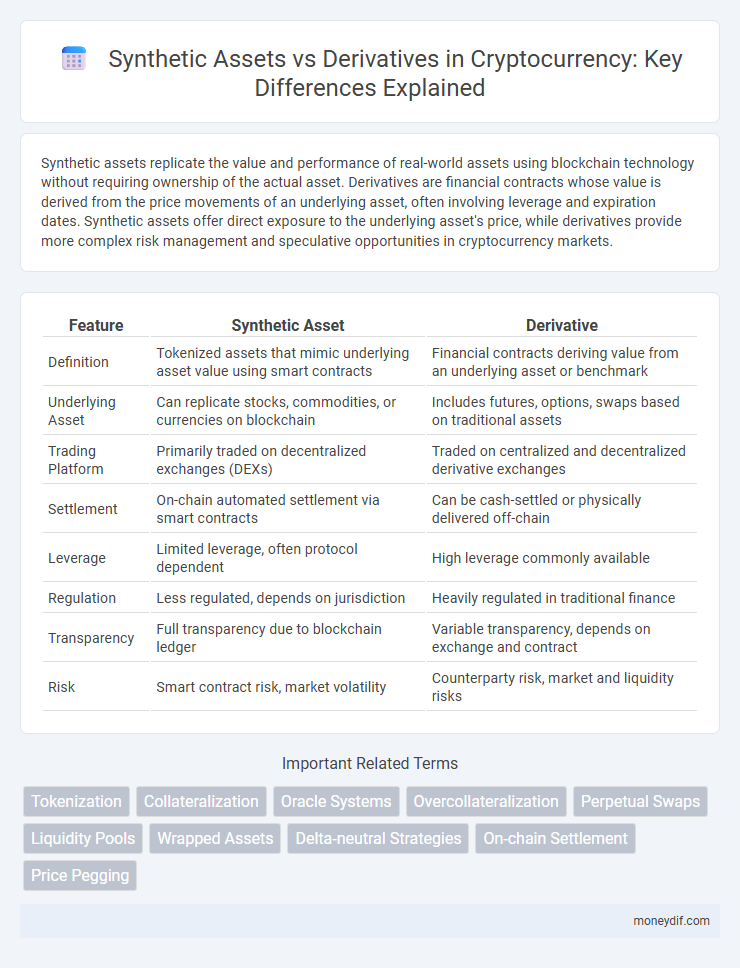

| Feature | Synthetic Asset | Derivative |

|---|---|---|

| Definition | Tokenized assets that mimic underlying asset value using smart contracts | Financial contracts deriving value from an underlying asset or benchmark |

| Underlying Asset | Can replicate stocks, commodities, or currencies on blockchain | Includes futures, options, swaps based on traditional assets |

| Trading Platform | Primarily traded on decentralized exchanges (DEXs) | Traded on centralized and decentralized derivative exchanges |

| Settlement | On-chain automated settlement via smart contracts | Can be cash-settled or physically delivered off-chain |

| Leverage | Limited leverage, often protocol dependent | High leverage commonly available |

| Regulation | Less regulated, depends on jurisdiction | Heavily regulated in traditional finance |

| Transparency | Full transparency due to blockchain ledger | Variable transparency, depends on exchange and contract |

| Risk | Smart contract risk, market volatility | Counterparty risk, market and liquidity risks |

Introduction to Synthetic Assets and Derivatives in Cryptocurrency

Synthetic assets in cryptocurrency replicate the value of underlying real-world assets using blockchain technology, enabling exposure without direct ownership. Derivatives are financial contracts whose value is derived from the performance of underlying crypto assets, allowing traders to speculate or hedge risk. Both synthetic assets and derivatives enhance liquidity and enable complex trading strategies within decentralized finance (DeFi) ecosystems.

Key Definitions: Synthetic Assets vs Derivatives

Synthetic assets are blockchain-based financial instruments that replicate the value of real-world assets using smart contracts, enabling decentralized exposure without owning the underlying asset. Derivatives are financial contracts deriving value from an underlying asset, often centralized and regulated, including futures, options, and swaps. Synthetic assets offer increased accessibility and transparency through decentralized finance (DeFi) platforms compared to traditional derivative markets.

How Synthetic Assets Work on Blockchain

Synthetic assets on blockchain function by tokenizing real-world assets through smart contracts, enabling users to gain exposure without owning the underlying asset. These assets mirror the price movements of commodities, stocks, or cryptocurrencies by using collateralized debt positions and decentralized oracles for accurate data feeds. Unlike traditional derivatives, synthetic assets are fully collateralized and operate on decentralized networks, reducing counterparty risk and enhancing transparency in crypto markets.

How Derivatives Function in Crypto Markets

Derivatives in crypto markets function as financial contracts whose value derives from underlying digital assets like Bitcoin or Ethereum, enabling traders to speculate on price movements without owning the actual cryptocurrencies. These instruments include futures, options, and swaps, providing leverage and hedging opportunities while mitigating direct exposure to market volatility. Unlike synthetic assets that mimic real asset value through a combination of tokens, derivatives settle based on predefined conditions tied to the performance or price of the underlying crypto.

Core Differences Between Synthetic Assets and Derivatives

Synthetic assets replicate the value of real-world assets using blockchain technology without requiring direct ownership, offering exposure to asset price movements through tokenized representations. Derivatives are financial contracts whose value is based on an underlying asset but do not involve ownership of the asset itself, typically including options, futures, and swaps. The core difference lies in synthetic assets being tokenized digital contracts that simulate asset behavior on decentralized platforms, whereas derivatives are traditional or digital contracts primarily used for hedging or speculation purposes.

Use Cases: When to Choose Synthetic Assets or Derivatives

Synthetic assets enable exposure to underlying assets without ownership, ideal for decentralized finance users seeking liquidity and composability on blockchain platforms. Derivatives, such as futures and options, suit institutional traders aiming for hedging, speculation, or risk management in regulated markets. Choose synthetic assets to gain tokenized, programmable representations of assets with borderless access; opt for derivatives to leverage standardized contracts with established legal frameworks and margin requirements.

Risk Assessment: Synthetic Assets vs Derivatives

Synthetic assets replicate the value of underlying assets using blockchain technology, offering exposure without direct ownership, which reduces counterparty risk but introduces smart contract vulnerabilities. Derivatives, such as futures and options, depend on third-party exchanges and clearinghouses, exposing traders to counterparty risk and market manipulation. Effective risk assessment reveals synthetic assets carry code execution and platform risk, while derivatives are subject to liquidity risk and regulatory factors impacting traditional financial markets.

Regulatory Considerations for Crypto Synthetics and Derivatives

Regulatory considerations for crypto synthetics and derivatives differ significantly due to their structural complexities and underlying asset representations. Synthetic assets often face scrutiny under securities laws, requiring compliance with frameworks that govern tokenized asset classes, while derivatives are primarily regulated under commodity trading and financial derivatives regulations such as the Commodity Futures Trading Commission (CFTC) in the United States. Global regulatory approaches vary, with jurisdictions like the European Union implementing the Markets in Crypto-Assets (MiCA) regulation, influencing the legal treatment and transparency requirements for both synthetic tokens and derivatives in decentralized finance (DeFi) ecosystems.

Major Platforms Offering Synthetic Assets and Derivative Products

Major platforms such as Synthetix and dYdX lead in offering synthetic assets and derivative products within the cryptocurrency space. Synthetix specializes in minting synthetic assets that track real-world assets like commodities, stocks, and cryptocurrencies, enabling decentralized exposure without owning the underlying asset. dYdX, a prominent decentralized exchange, focuses on derivatives like perpetual contracts and options, providing advanced trading capabilities with leverage for crypto traders.

Future Trends: The Evolution of Synthetics and Derivatives in Crypto

Synthetic assets in cryptocurrency replicate the value of real-world assets through blockchain-based smart contracts, enabling fractional ownership and seamless cross-asset exposure. Derivatives, including futures and options, provide leveraged trading opportunities and risk management but often require centralized exchanges with higher counterparty risks. Future trends indicate a convergence where decentralized synthetic assets leverage on-chain derivatives to offer enhanced liquidity, transparency, and programmable financial products, driving the evolution of more sophisticated DeFi ecosystems.

Important Terms

Tokenization

Tokenization enables synthetic assets by creating blockchain-based representations of underlying assets, enhancing liquidity and transparency compared to traditional derivatives. Unlike derivatives that derive value from an external asset, synthetic assets are fully collateralized tokens that replicate asset performance through smart contracts.

Collateralization

Collateralization in synthetic assets involves locking up underlying assets to back the value of the synthetic exposure, enhancing security and reducing counterparty risk. Unlike traditional derivatives, synthetic assets rely on over-collateralization mechanisms within decentralized finance (DeFi) protocols to maintain price stability and liquidity.

Oracle Systems

Oracle systems provide reliable external data feeds essential for synthetic asset platforms, enabling accurate price discovery and settlement in decentralized finance (DeFi) markets. Unlike traditional derivatives that depend on centralized intermediaries, synthetic assets utilize oracles to mirror underlying asset values, enhancing transparency and reducing counterparty risk.

Overcollateralization

Overcollateralization ensures that synthetic assets maintain a higher collateral value than the asset they represent, reducing counterparty risk compared to traditional derivatives which may not require excess collateral. This mechanism enhances liquidity and stability in decentralized finance (DeFi) platforms by mitigating the risk of under-collateralized positions common in derivative trading.

Perpetual Swaps

Perpetual swaps are a type of derivative instrument that allows traders to speculate on the price of an underlying synthetic asset without owning it directly, offering continuous exposure without expiration. Unlike traditional derivatives, perpetual swaps rely on funding rates to anchor prices to the underlying synthetic asset, enabling efficient leverage and hedging in decentralized finance (DeFi) markets.

Liquidity Pools

Liquidity pools provide decentralized capital essential for synthetic assets, enabling users to mint and trade tokens that track underlying assets without direct ownership. Unlike traditional derivatives, synthetic assets rely on pooled collateral within smart contracts to maintain price stability and reduce counterparty risk in decentralized finance ecosystems.

Wrapped Assets

Wrapped assets enable the representation of cryptocurrencies on different blockchains, providing synthetic exposure without requiring direct ownership of the underlying asset. Unlike traditional derivatives, which derive value from underlying assets through contracts, synthetic assets replicate asset price movements on-chain, offering composability and cross-chain liquidity in decentralized finance (DeFi).

Delta-neutral Strategies

Delta-neutral strategies aim to hedge portfolio risk by balancing positive and negative delta positions, often utilizing synthetic assets created through combinations of options and underlying securities to replicate derivative exposure without direct ownership. These synthetic assets offer flexible risk management and cost advantages compared to traditional derivatives, enabling precise control over delta exposure while minimizing hedging costs.

On-chain Settlement

On-chain settlement enables immediate, transparent, and trustless execution of synthetic asset contracts by leveraging blockchain technology, contrasting with traditional derivatives that typically involve off-chain clearance and counterparty risk. This decentralized settlement mechanism reduces latency and fraud potential while enhancing liquidity and real-time asset price tracking within synthetic asset platforms.

Price Pegging

Price pegging in synthetic assets involves maintaining the asset's value closely aligned with an underlying index or asset through algorithmic adjustments, contrasting with derivatives that derive value from the underlying asset's price movements without necessarily enforcing a fixed peg. Synthetic assets use decentralized protocols and smart contracts to replicate the price behavior of real-world assets, while derivatives provide leveraged exposure or hedging opportunities based on contract terms.

Synthetic Asset vs Derivative Infographic

moneydif.com

moneydif.com