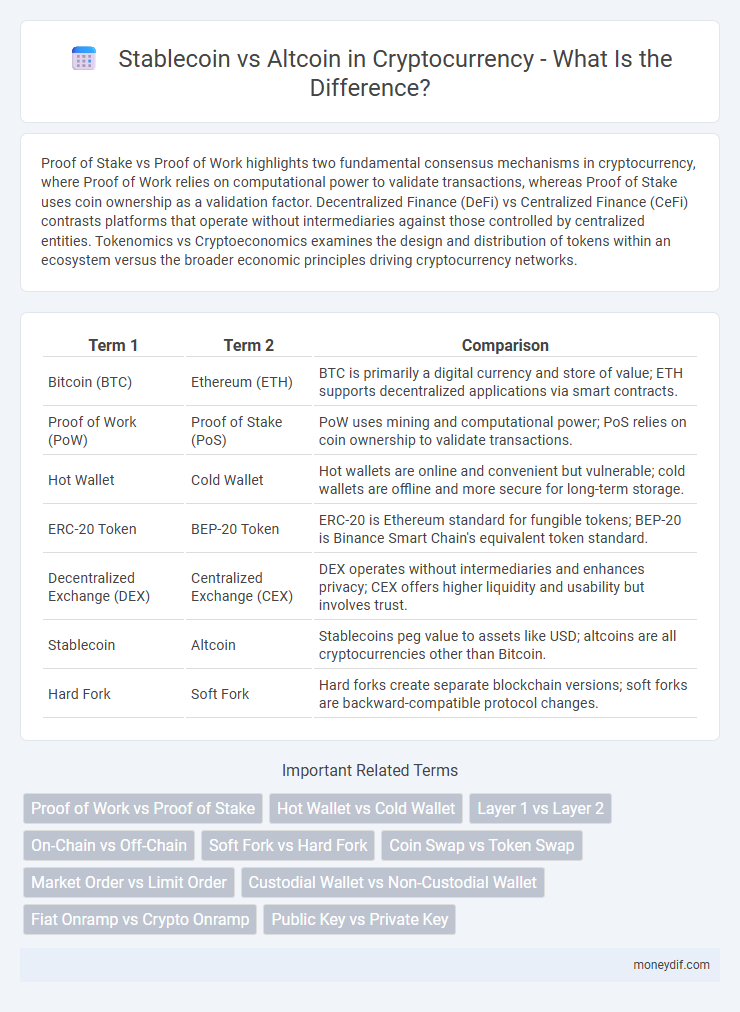

Proof of Stake vs Proof of Work highlights two fundamental consensus mechanisms in cryptocurrency, where Proof of Work relies on computational power to validate transactions, whereas Proof of Stake uses coin ownership as a validation factor. Decentralized Finance (DeFi) vs Centralized Finance (CeFi) contrasts platforms that operate without intermediaries against those controlled by centralized entities. Tokenomics vs Cryptoeconomics examines the design and distribution of tokens within an ecosystem versus the broader economic principles driving cryptocurrency networks.

Table of Comparison

| Term 1 | Term 2 | Comparison |

|---|---|---|

| Bitcoin (BTC) | Ethereum (ETH) | BTC is primarily a digital currency and store of value; ETH supports decentralized applications via smart contracts. |

| Proof of Work (PoW) | Proof of Stake (PoS) | PoW uses mining and computational power; PoS relies on coin ownership to validate transactions. |

| Hot Wallet | Cold Wallet | Hot wallets are online and convenient but vulnerable; cold wallets are offline and more secure for long-term storage. |

| ERC-20 Token | BEP-20 Token | ERC-20 is Ethereum standard for fungible tokens; BEP-20 is Binance Smart Chain's equivalent token standard. |

| Decentralized Exchange (DEX) | Centralized Exchange (CEX) | DEX operates without intermediaries and enhances privacy; CEX offers higher liquidity and usability but involves trust. |

| Stablecoin | Altcoin | Stablecoins peg value to assets like USD; altcoins are all cryptocurrencies other than Bitcoin. |

| Hard Fork | Soft Fork | Hard forks create separate blockchain versions; soft forks are backward-compatible protocol changes. |

Proof of Work vs Proof of Stake

Proof of Work (PoW) demands intensive computational power to solve complex cryptographic puzzles, ensuring network security but consuming significant energy. Proof of Stake (PoS) relies on validators holding and "staking" cryptocurrency tokens to validate transactions, offering greater energy efficiency and faster block creation. PoW is prominent in Bitcoin mining, while PoS is adopted by Ethereum 2.0 and other scalable blockchain platforms.

Hot Wallet vs Cold Wallet

Hot Wallets store cryptocurrency online, providing instant access for quick transactions but are more vulnerable to hacking. Cold Wallets keep digital assets offline, enhancing security by isolating private keys from internet exposure. Choosing between Hot Wallet and Cold Wallet depends on the balance between accessibility and security needs for cryptocurrency management.

Stablecoin vs Altcoin

Stablecoins maintain price stability by being pegged to assets like the US dollar, providing low volatility and reliable value for transactions and savings. Altcoins represent all cryptocurrencies other than Bitcoin, offering diverse features, technologies, and use cases such as smart contracts, privacy, and scalability improvements. Investors and users often choose stablecoins for security and predictability, while altcoins attract those seeking innovation and higher risk-reward opportunities.

Public Key vs Private Key

Public key and private key are fundamental components of cryptocurrency cryptography, where the public key serves as an address for receiving funds, while the private key authorizes transactions by signing them. The security of a cryptocurrency wallet relies on safeguarding the private key, as its exposure can lead to unauthorized access and theft of assets. Public keys can be shared openly without risking the wallet's integrity, making them essential for transparent and secure blockchain transactions.

Centralized Exchange vs Decentralized Exchange

Centralized Exchange (CEX) operates through a central authority managing user funds and transactions, offering high liquidity and faster trade execution. Decentralized Exchange (DEX) enables peer-to-peer trading without intermediaries, enhancing privacy and reducing counterparty risk. Security vulnerabilities in CEX include hacking risks, whereas DEX faces challenges in scalability and user experience.

Token vs Coin

Tokens represent digital assets issued on existing blockchains, often used for specific applications or utilities within decentralized platforms. Coins operate on their native blockchain networks and primarily function as digital currency or store of value, such as Bitcoin or Ethereum. Understanding the distinction between tokens and coins is crucial for navigating cryptocurrency investments and blockchain technology applications.

Hard Fork vs Soft Fork

Hard fork vs soft fork distinguishes two types of blockchain protocol upgrades; a hard fork creates a permanent divergence requiring all nodes to upgrade, while a soft fork is backward-compatible, allowing non-upgraded nodes to continue operating. Hard forks often result in chain splits and new cryptocurrencies, exemplified by Bitcoin Cash from Bitcoin. Soft forks enhance consensus rules without splitting the chain, improving scalability or security through more restrictive protocol changes.

Layer 1 vs Layer 2

Layer 1 refers to the base blockchain architecture, such as Bitcoin or Ethereum, responsible for transaction validation and network security through consensus mechanisms like Proof of Work or Proof of Stake. Layer 2 solutions operate on top of Layer 1 to enhance scalability and throughput by processing transactions off-chain or through sidechains, examples include the Lightning Network for Bitcoin and Optimistic Rollups for Ethereum. Understanding the balance between Layer 1 decentralization and Layer 2 scalability is crucial for optimizing blockchain performance and user experience.

Custodial Wallet vs Non-Custodial Wallet

Custodial wallets store private keys on behalf of users, providing ease of access but relying on third-party security measures. Non-custodial wallets grant users full control over their private keys, enhancing security and privacy but requiring personal management and responsibility. The choice between custodial and non-custodial wallets impacts asset ownership, risk exposure, and user autonomy in cryptocurrency management.

Smart Contracts vs Traditional Contracts

Smart contracts execute automatically on blockchain networks without intermediaries, ensuring transparency and immutability, while traditional contracts require manual enforcement and reliance on legal systems. The decentralized nature of smart contracts reduces counterparty risk and accelerates transaction speed compared to the slower, paper-based processes of traditional contracts. Smart contracts are programmable code with predefined rules, enabling complex conditional transactions beyond the static terms of conventional agreements.

Important Terms

Proof of Work vs Proof of Stake

Proof of Work (PoW) consumes substantial computational power to validate transactions and secure blockchain networks, prioritizing security and decentralization. Proof of Stake (PoS) reduces energy usage by selecting validators based on their cryptocurrency holdings, enhancing scalability while maintaining network integrity.

Hot Wallet vs Cold Wallet

Hot wallets provide instant access to cryptocurrencies through internet-connected devices, facilitating quick transactions but posing higher security risks. Cold wallets store crypto assets offline on hardware or paper, significantly reducing vulnerability to hacks and unauthorized access.

Layer 1 vs Layer 2

Layer 1 refers to the base blockchain architecture, such as Bitcoin or Ethereum, responsible for core consensus and security, while Layer 2 solutions like Lightning Network or Polygon operate atop Layer 1 to enhance scalability and transaction speed by processing off-chain transactions. Layer 1's inherent decentralization contrasts with Layer 2's focus on throughput optimization, making them complementary components in the cryptocurrency ecosystem.

On-Chain vs Off-Chain

On-chain transactions occur directly on the blockchain, ensuring decentralization, transparency, and immutability, whereas off-chain transactions happen outside the blockchain, offering faster speeds and lower costs but relying on trust in third parties. Understanding the trade-offs between on-chain and off-chain mechanisms is crucial for optimizing scalability, security, and transaction efficiency in cryptocurrency networks.

Soft Fork vs Hard Fork

Soft fork versus hard fork represents two types of blockchain protocol upgrades: a soft fork is backward-compatible, allowing non-upgraded nodes to still validate transactions, while a hard fork is a permanent divergence creating two separate blockchains requiring all nodes to upgrade for consensus. This difference directly impacts network consensus, security, and user adoption within cryptocurrency ecosystems.

Coin Swap vs Token Swap

Coin swap involves exchanging one cryptocurrency for another at the blockchain level, often requiring network consensus or a hard fork, while token swap refers to exchanging tokens within a specific blockchain, usually during platform migrations or upgrades. Coin swaps impact the underlying asset's blockchain, whereas token swaps typically occur within smart contracts or wallet platforms without altering the base blockchain.

Market Order vs Limit Order

Market order executes cryptocurrency trades instantly at the current best available price, ensuring immediate transaction completion but potentially varying execution prices due to market volatility. Limit order sets a specific price for buying or selling cryptocurrencies, allowing traders to control entry or exit points but without guaranteed immediate execution if the market price does not reach the limit.

Custodial Wallet vs Non-Custodial Wallet

Custodial wallets store private keys on behalf of users, offering convenience and recovery options but requiring trust in a third party, while non-custodial wallets give users full control over their private keys, enhancing security and privacy at the cost of personal responsibility for key management. Choosing between custodial and non-custodial wallets involves balancing ease of access with autonomy and security in cryptocurrency asset management.

Fiat Onramp vs Crypto Onramp

Fiat Onramp enables direct conversion of traditional currencies like USD or EUR into cryptocurrencies, providing a seamless entry point for new users, while Crypto Onramp facilitates transactions between different cryptocurrencies without involving fiat, optimizing for speed and lower fees. Understanding the distinctions between Fiat Onramp and Crypto Onramp is crucial for investors aiming to efficiently navigate liquidity and transaction costs in the crypto market.

Public Key vs Private Key

Public Key vs Private Key: Public Key is a cryptographic code that allows users to receive cryptocurrency transactions securely, while Private Key is a secret code enabling access and control over the associated crypto assets. Public Key can be shared openly to facilitate transactions, whereas Private Key must remain confidential to prevent unauthorized access and potential theft.

Sure! Here’s a list of niche cryptocurrency terms in the "term1 vs term2" format: Infographic

moneydif.com

moneydif.com