Gas fees represent the cost required to execute a transaction or smart contract on blockchain platforms like Ethereum, calculated based on computational effort. Transaction fees encompass the total amount paid to process a transaction, which may include gas fees along with additional network charges depending on the blockchain. Understanding the distinction helps users optimize costs by selecting appropriate gas limits and fee strategies for timely confirmations.

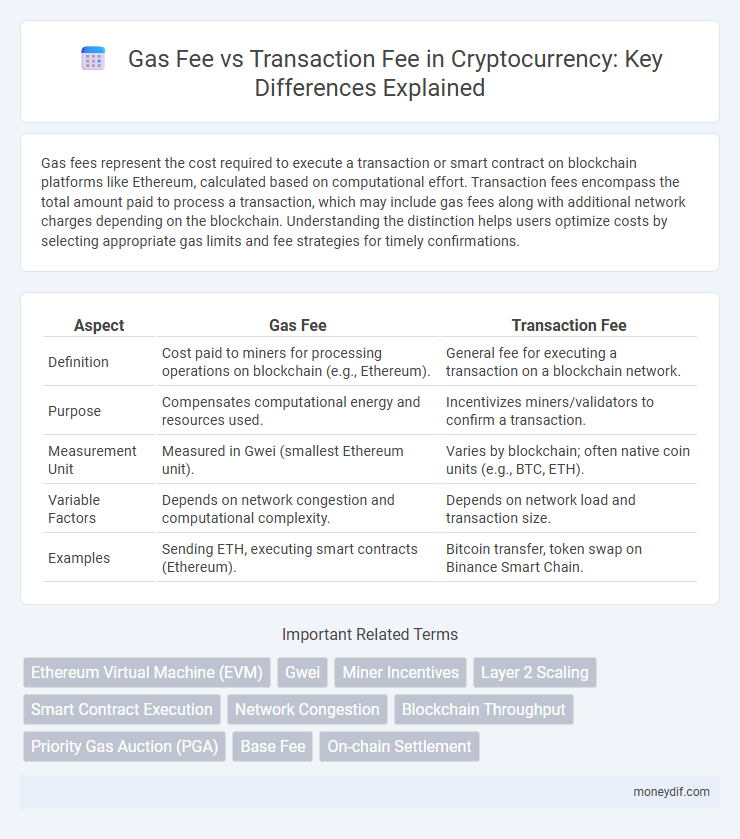

Table of Comparison

| Aspect | Gas Fee | Transaction Fee |

|---|---|---|

| Definition | Cost paid to miners for processing operations on blockchain (e.g., Ethereum). | General fee for executing a transaction on a blockchain network. |

| Purpose | Compensates computational energy and resources used. | Incentivizes miners/validators to confirm a transaction. |

| Measurement Unit | Measured in Gwei (smallest Ethereum unit). | Varies by blockchain; often native coin units (e.g., BTC, ETH). |

| Variable Factors | Depends on network congestion and computational complexity. | Depends on network load and transaction size. |

| Examples | Sending ETH, executing smart contracts (Ethereum). | Bitcoin transfer, token swap on Binance Smart Chain. |

Understanding Gas Fees and Transaction Fees in Cryptocurrency

Gas fees in cryptocurrency primarily refer to the cost required to perform a transaction or execute a contract on blockchain platforms like Ethereum, measured in gwei and determined by network demand and computational complexity. Transaction fees broadly cover the expenses paid to miners or validators for processing and confirming transactions across various blockchains, with amounts varying based on network congestion and transaction size. Distinguishing gas fees from general transaction fees highlights the unique role of gas in incentivizing computational work and maintaining blockchain security, especially in smart contract platforms.

Key Differences Between Gas Fees and Transaction Fees

Gas fees specifically refer to the computational charge required to execute operations on blockchain networks like Ethereum, while transaction fees encompass the overall cost paid to process and confirm transactions on various blockchains. Gas fees fluctuate based on network demand and the complexity of the transaction, whereas transaction fees vary according to the blockchain protocol and miner or validator incentives. Understanding these distinctions is crucial for optimizing transaction costs and ensuring efficient use of cryptocurrency networks.

How Gas Fees Work on Blockchain Networks

Gas fees on blockchain networks are payments made by users to compensate for the computational energy required to process and validate transactions or execute smart contracts on platforms like Ethereum. These fees are calculated based on the gas limit (the maximum amount of computational effort) and gas price (the cost per unit of gas in cryptocurrency), fluctuating with network demand and congestion. Unlike flat transaction fees on some blockchains, gas fees provide an incentive mechanism that maintains network security, regulates transaction prioritization, and prevents spam attacks.

Transaction Fees Explained: Purpose and Calculation

Transaction fees in cryptocurrency networks compensate miners or validators for processing and confirming transactions on the blockchain, ensuring security and network integrity. These fees vary based on network congestion, transaction size, and priority level, often measured in cryptocurrency units like satoshis for Bitcoin or gwei for Ethereum. Calculating transaction fees involves multiplying the gas used or transaction weight by the fee rate, influencing how quickly a transaction is confirmed on the network.

Factors Influencing Gas Fees vs Transaction Fees

Gas fees in cryptocurrency primarily depend on network congestion, gas limit, and gas price set by users, affecting how quickly a transaction is processed on blockchains like Ethereum. Transaction fees vary across different blockchain platforms, influenced by factors such as consensus mechanisms, block size, and transaction complexity. Market demand and technological upgrades also play critical roles in dynamically adjusting both gas fees and transaction fees in decentralized networks.

Gas Fees in Ethereum: What You Need to Know

Gas fees in Ethereum represent the cost required to perform transactions and execute smart contracts on the network, measured in Gwei, a derivative of Ether (ETH). These fees fluctuate based on network demand, transaction complexity, and gas price set by users, directly influencing transaction speed and priority. Understanding gas fees is essential for optimizing costs, as they differ from flat transaction fees found in other cryptocurrencies by dynamically adjusting to network congestion and computational effort.

Transaction Fees in Bitcoin and Other Cryptocurrencies

Transaction fees in Bitcoin and other cryptocurrencies compensate miners or validators for processing and securing transactions on the blockchain network. These fees vary based on network congestion, transaction size, and urgency, influencing the speed of confirmation. Unlike Ethereum's gas fees, which measure computational work, Bitcoin transaction fees are typically calculated in satoshis per byte, reflecting the data size of the transaction.

Impact of Network Congestion on Fees

Network congestion in cryptocurrency significantly increases gas fees, as miners prioritize transactions with higher fees to process blocks efficiently. During peak activity, gas prices can surge dramatically, causing transaction fees to escalate and delay confirmation times. This congestion-driven fee volatility directly influences user costs and transaction speeds across blockchain networks like Ethereum.

Strategies to Minimize Gas and Transaction Fees

Optimizing gas fees in cryptocurrency transactions involves timing trades during network off-peak hours and utilizing Layer 2 scaling solutions like Polygon or Optimism. Setting gas price limits through wallets or platforms that support EIP-1559 can further prevent overpayment and reduce transaction costs. Aggregating multiple actions into a single transaction or using fee tokens also strategically minimizes overall fees.

Future Trends: Evolving Fee Structures in Cryptocurrency

Future trends in cryptocurrency emphasize the evolution of gas fees and transaction fees through scalable Layer 2 solutions and sharding protocols, which aim to significantly reduce costs and increase network efficiency. Emerging fee models incorporate dynamic pricing based on real-time network congestion, enhancing user experience and transaction throughput on platforms like Ethereum 2.0. Innovations such as EIP-1559 and alternative consensus mechanisms like Proof of Stake further drive the transformation of fee structures, making cryptocurrency transactions more predictable and economical.

Important Terms

Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) processes smart contract executions where gas fees measure computational effort, directly influencing the total transaction fee paid to miners.

Gwei

Gwei is a denomination of Ether used to calculate gas fees, which directly determine the transaction fee required to process and validate Ethereum blockchain transactions.

Miner Incentives

Miner incentives primarily derive from transaction fees paid in gas, which reward miners for processing and validating blockchain transactions.

Layer 2 Scaling

Layer 2 scaling solutions significantly reduce Ethereum's gas fees by processing transactions off-chain, thereby lowering transaction costs and increasing network throughput.

Smart Contract Execution

Gas fees determine the computational cost required for smart contract execution, directly influencing the overall transaction fee on blockchain networks.

Network Congestion

Network congestion significantly increases gas fees, causing higher transaction fees and slower processing times on blockchain platforms.

Blockchain Throughput

Blockchain throughput directly impacts gas fees, as networks with higher throughput can process more transactions per second, reducing congestion and lowering gas costs. Transaction fees, often denominated in gas units, fluctuate based on network demand and throughput capacity, making efficient throughput critical for optimizing transaction costs.

Priority Gas Auction (PGA)

Priority Gas Auction (PGA) optimizes blockchain transactions by dynamically adjusting gas fees to prioritize higher-value transactions over standard transaction fees, enhancing network efficiency.

Base Fee

Base Fee is the minimum gas price burned per transaction on Ethereum, directly influencing the overall gas fee and differentiating it from additional transaction fees like priority tips.

On-chain Settlement

On-chain settlement involves executing transactions directly on the blockchain, where gas fees represent the computational cost needed to process and validate each transaction, while transaction fees include gas fees plus additional charges set by network participants or platforms.

Gas fee vs transaction fee Infographic

moneydif.com

moneydif.com