Staking involves locking up cryptocurrency in a blockchain network to support operations and earn rewards, typically offering lower risk and more predictable returns. Yield farming requires providing liquidity to decentralized finance protocols, often delivering higher yields but with increased risk due to market volatility and smart contract vulnerabilities. Choosing between staking and yield farming depends on an investor's risk tolerance and desired reward structure.

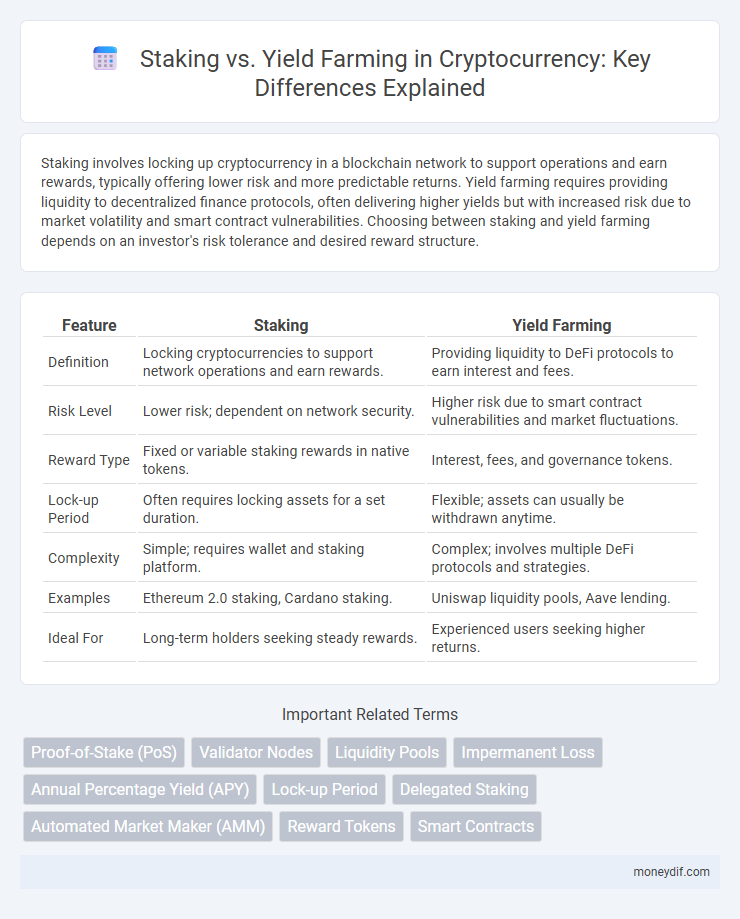

Table of Comparison

| Feature | Staking | Yield Farming |

|---|---|---|

| Definition | Locking cryptocurrencies to support network operations and earn rewards. | Providing liquidity to DeFi protocols to earn interest and fees. |

| Risk Level | Lower risk; dependent on network security. | Higher risk due to smart contract vulnerabilities and market fluctuations. |

| Reward Type | Fixed or variable staking rewards in native tokens. | Interest, fees, and governance tokens. |

| Lock-up Period | Often requires locking assets for a set duration. | Flexible; assets can usually be withdrawn anytime. |

| Complexity | Simple; requires wallet and staking platform. | Complex; involves multiple DeFi protocols and strategies. |

| Examples | Ethereum 2.0 staking, Cardano staking. | Uniswap liquidity pools, Aave lending. |

| Ideal For | Long-term holders seeking steady rewards. | Experienced users seeking higher returns. |

Introduction to Staking and Yield Farming

Staking involves locking up cryptocurrencies to support blockchain network operations, earning rewards in return, often through Proof-of-Stake (PoS) mechanisms. Yield farming, primarily in decentralized finance (DeFi), entails providing liquidity to protocols to generate interest or new tokens by utilizing smart contracts. Both strategies optimize crypto holdings for passive income but differ in risk, complexity, and reward structures.

How Staking Works in Cryptocurrency

Staking in cryptocurrency involves locking up digital assets in a blockchain network to support its operations, such as validating transactions and securing the network. Participants receive rewards, typically in the form of additional tokens, proportional to the amount staked and the staking duration. This process enhances network security through Proof of Stake (PoS) consensus mechanisms while providing passive income opportunities for investors.

Understanding Yield Farming Protocols

Yield farming protocols enable users to earn rewards by providing liquidity to decentralized finance (DeFi) platforms, often involving complex strategies that maximize returns through token incentives and interest accrual. These protocols utilize smart contracts to automate the distribution of rewards, requiring participants to lock their cryptocurrency assets in liquidity pools. Understanding yield farming involves analyzing protocol risks, reward mechanisms, and tokenomics to optimize profitability compared to simpler staking models.

Key Differences Between Staking and Yield Farming

Staking involves locking up a specific cryptocurrency to support network operations like validating transactions and securing the blockchain, earning rewards typically in the form of the staked coin. Yield farming, on the other hand, requires providing liquidity to decentralized finance (DeFi) protocols, often by depositing tokens into liquidity pools to earn interest, fees, or governance tokens. Key differences include staking's focus on network security and consensus mechanisms, while yield farming emphasizes maximizing returns through complex liquidity provision strategies and varying risk levels.

Risk Factors: Staking vs Yield Farming

Staking generally involves lower risk as it requires locking tokens in a blockchain network to support operations, with rewards tied to network stability and inflation rates. Yield farming carries higher risk because it often involves complex DeFi protocols, impermanent loss, liquidity pool vulnerabilities, and smart contract exploits. Assessing factors like market volatility, protocol security audits, and token lock-up periods is crucial when comparing staking and yield farming risk profiles.

Potential Rewards and Returns Comparison

Staking typically offers more predictable and stable rewards by locking up a cryptocurrency to support network security, often yielding annual percentage rates (APRs) ranging from 4% to 20%. Yield farming involves providing liquidity to decentralized finance (DeFi) protocols, with returns that can fluctuate wildly but potentially reach upwards of 100% APY or more depending on market conditions and token incentives. Risk levels differ as staking rewards are generally steadier due to network consensus mechanisms, while yield farming returns can be higher but are subject to impermanent loss and smart contract vulnerabilities.

Popular Platforms for Staking and Yield Farming

Popular platforms for staking include Coinbase, Binance, and Kraken, which offer user-friendly interfaces and support a wide range of cryptocurrencies such as Ethereum, Cardano, and Polkadot. Yield farming is prominently featured on decentralized finance (DeFi) platforms like Uniswap, PancakeSwap, and Aave, where users provide liquidity to earn rewards in diverse token pairs. Both staking and yield farming platforms emphasize security, competitive APYs, and ease of access to attract individual and institutional investors.

Security Considerations for Investors

Staking involves locking cryptocurrencies to support network security, offering relatively lower risks due to its connection with established blockchain protocols and reduced exposure to smart contract vulnerabilities. Yield farming, while potentially more profitable, exposes investors to higher security risks through complex DeFi platforms, including impermanent loss and smart contract exploits. Evaluating platform audits, asset volatility, and withdrawal restrictions is crucial for investors prioritizing security in these decentralized finance strategies.

Tax Implications of Staking and Yield Farming

Staking cryptocurrency generates taxable income typically classified as ordinary income based on the fair market value of the rewards at the time they are received, triggering tax events upon reward distribution. Yield farming involves more complex tax implications, as users may incur taxable events during the swapping, lending, or liquidity provision processes, with gains or losses reported as capital gains or losses upon disposal of tokens. Understanding local tax regulations is crucial, as both staking and yield farming can result in multiple taxable events throughout the holding period, affecting the overall tax liability.

Choosing the Right Crypto Earning Strategy

Staking involves locking up cryptocurrencies to support blockchain operations and earn rewards, offering lower risk with steady returns. Yield farming leverages decentralized finance (DeFi) protocols to maximize profits through liquidity provision, but carries higher risk due to market volatility and smart contract vulnerabilities. Choosing the right crypto earning strategy depends on risk tolerance, reward expectations, and understanding of underlying mechanisms in staking versus yield farming.

Important Terms

Proof-of-Stake (PoS)

Proof-of-Stake (PoS) secures blockchain networks by requiring validators to lock cryptocurrency in staking, which differs from yield farming where users provide liquidity to earn variable returns.

Validator Nodes

Validator nodes secure blockchain networks by validating transactions and earning staking rewards, whereas yield farming involves providing liquidity on DeFi platforms to generate interest and token incentives.

Liquidity Pools

Liquidity pools enable users to stake assets and provide liquidity in decentralized finance protocols, earning yield farming rewards through transaction fees and incentive tokens.

Impermanent Loss

Impermanent loss occurs when the value of tokens in a liquidity pool changes compared to simply staking, making yield farming potentially riskier but often more profitable due to trading fee rewards and token incentives.

Annual Percentage Yield (APY)

Annual Percentage Yield (APY) in staking typically offers fixed, predictable returns by locking assets, whereas yield farming presents variable, often higher APYs by providing liquidity across DeFi platforms with increased risk and complexity.

Lock-up Period

Lock-up periods in staking lock tokens for a fixed duration to earn predictable rewards, whereas yield farming often involves shorter or flexible lock-ups to maximize liquidity and variable returns.

Delegated Staking

Delegated staking allows users to earn rewards by entrusting their cryptocurrency to validators, providing a lower-risk, passive income alternative compared to the higher-risk, liquidity-focused strategies in yield farming.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) enable decentralized trading by using liquidity pools where users can stake tokens to earn transaction fees, contrasting yield farming which involves actively moving assets across protocols to maximize token rewards. Staking in AMMs offers a relatively stable income through fee-sharing, while yield farming typically provides higher but variable returns by exploiting incentive programs and liquidity mining opportunities.

Reward Tokens

Reward tokens earned through staking typically provide consistent passive income and network security, whereas yield farming rewards often offer higher returns by optimizing liquidity provision across multiple DeFi protocols.

Smart Contracts

Smart contracts automate staking processes by locking tokens securely on a blockchain to earn rewards, minimizing risks through predefined rules and transparency. In yield farming, these contracts facilitate complex liquidity provision strategies across decentralized finance (DeFi) protocols, optimizing returns by dynamically allocating assets based on real-time market conditions.

Staking vs yield farming Infographic

moneydif.com

moneydif.com