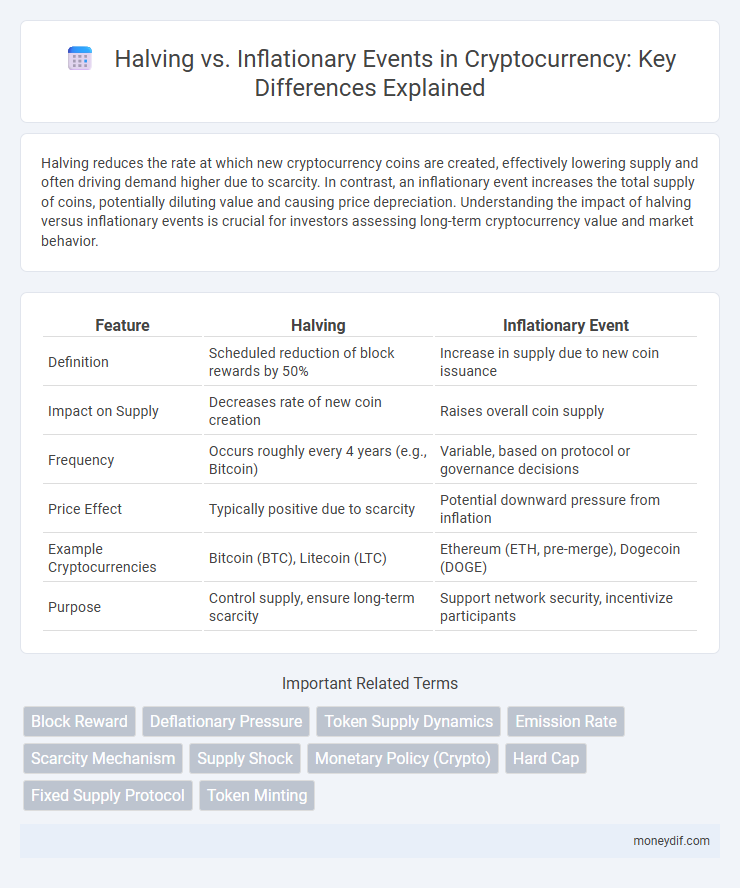

Halving reduces the rate at which new cryptocurrency coins are created, effectively lowering supply and often driving demand higher due to scarcity. In contrast, an inflationary event increases the total supply of coins, potentially diluting value and causing price depreciation. Understanding the impact of halving versus inflationary events is crucial for investors assessing long-term cryptocurrency value and market behavior.

Table of Comparison

| Feature | Halving | Inflationary Event |

|---|---|---|

| Definition | Scheduled reduction of block rewards by 50% | Increase in supply due to new coin issuance |

| Impact on Supply | Decreases rate of new coin creation | Raises overall coin supply |

| Frequency | Occurs roughly every 4 years (e.g., Bitcoin) | Variable, based on protocol or governance decisions |

| Price Effect | Typically positive due to scarcity | Potential downward pressure from inflation |

| Example Cryptocurrencies | Bitcoin (BTC), Litecoin (LTC) | Ethereum (ETH, pre-merge), Dogecoin (DOGE) |

| Purpose | Control supply, ensure long-term scarcity | Support network security, incentivize participants |

Understanding Halving in Cryptocurrency

Halving in cryptocurrency refers to the programmed reduction of block rewards by 50%, occurring at specific intervals to control supply and create scarcity. This mechanism contrasts with inflationary events, where new tokens are continuously minted, increasing supply and potentially diluting value. Understanding halving is crucial for investors as it directly impacts cryptocurrency scarcity, miner incentives, and market price dynamics.

What Are Inflationary Events in Crypto?

Inflationary events in cryptocurrency occur when new coins are continuously created and added to the circulating supply, increasing the total number of tokens over time. This process can reduce the value of existing coins due to dilution, as seen in coins with no fixed supply cap or ongoing mining rewards. Unlike halving events, which reduce the rate of new coin issuance, inflationary events maintain or increase token supply growth, impacting price stability and investor returns.

Key Differences: Halving vs Inflationary Events

Halving events in cryptocurrency reduce the block reward by 50%, directly limiting the supply growth and creating scarcity that can drive price appreciation. Inflationary events increase the total coin supply through mechanisms like new token issuance or block rewards, which can dilute value if demand doesn't keep pace. Key differences lie in their impact on supply dynamics: halving enforces scarcity, while inflationary events expand supply, influencing market behavior and investment strategies differently.

Impact of Halving on Supply and Price

Halving events in cryptocurrency reduce the block reward by 50%, effectively decreasing the rate of new coin supply entering the market, which contrasts with inflationary events that increase supply and can dilute value. This controlled reduction in supply often creates upward price pressure due to scarcity, as demand remains steady or grows. Historical data from Bitcoin halvings show significant price appreciation following the supply contraction, reinforcing the scarcity-driven value proposition intrinsic to halving mechanisms.

Inflationary Events: How They Affect Crypto Value

Inflationary events in cryptocurrency increase the supply of coins through mechanisms such as block rewards, diluting scarcity and potentially lowering value if demand remains constant. These events can encourage spending and network activity by providing continuous incentives to miners and validators, impacting market dynamics and token valuation. Understanding inflation rates and supply schedules is crucial for investors to assess the long-term value and inflation risk of digital assets.

Historical Examples of Halving Events

Bitcoin's halving events, occurring approximately every four years, historically reduce the block reward by 50%, significantly impacting supply issuance and market sentiment. The 2012, 2016, and 2020 halvings corresponded with notable price surges, demonstrating a correlation between reduced inflation rate and increased scarcity. These halving events differ from inflationary events, where new tokens continuously enter circulation, often diluting value instead of enhancing scarcity-driven appreciation.

Notable Inflationary Events in Crypto Markets

Notable inflationary events in crypto markets, such as the Ethereum London hard fork and token minting increases in DeFi projects, significantly impact token supply dynamics and market valuations. Unlike Bitcoin halving events that reduce block rewards and induce scarcity, inflationary events introduce new tokens, often leading to diluted value and altered investor expectations. Understanding these divergent mechanisms is crucial for evaluating long-term crypto asset performance and inflation risk management.

Investor Strategies: Halving vs Inflationary Coins

Investor strategies differ significantly between halving events and inflationary cryptocurrency models. Halving events reduce the supply issuance rate, often driving scarcity-driven price appreciation and encouraging long-term holding or accumulation ahead of supply shocks. Conversely, inflationary coins increase supply over time, prompting investors to focus on utility, staking rewards, or yield generation rather than capital gains from scarcity.

Long-term Economic Effects of Halving and Inflation

Halving events in cryptocurrencies, such as Bitcoin, reduce the rate of new coin issuance, leading to decreased supply growth and potential price appreciation over time as scarcity increases. In contrast, inflationary events expand the coin supply, which can dilute value and increase circulating tokens, potentially causing price depreciation or reduced purchasing power. Long-term economic effects of halving often include increased investor confidence and network security, while inflationary mechanisms may support liquidity and incentivize spending but risk undermining value stability.

Future Outlook: Managing Halving and Inflationary Risks

Halving events in cryptocurrency reduce the reward for mining new blocks, leading to a decreased supply rate and potential price appreciation due to scarcity. Inflationary events increase token supply, posing risks of devaluation and necessitating strategies to maintain purchasing power. Effective management involves balancing halving-driven scarcity with inflation control measures to ensure long-term network stability and investor confidence.

Important Terms

Block Reward

Block reward, the cryptocurrency incentive miners receive for validating transactions, undergoes a halving event that reduces the reward by 50%, effectively controlling inflation by limiting the supply of new coins. This halving contrasts with inflationary events where increased supply dilutes coin value, making halving a crucial mechanism to maintain scarcity and long-term value growth.

Deflationary Pressure

Deflationary pressure intensifies after a halving event as the cryptocurrency's supply growth rate is cut in half, reducing new coin issuance and creating scarcity against steady or increasing demand. In contrast, inflationary events increase coin supply, diluting value and weakening deflationary trends by flooding the market with additional tokens.

Token Supply Dynamics

Token supply dynamics are heavily influenced by halving events, which reduce the block reward and slow the creation of new tokens, creating deflationary pressure. In contrast, inflationary events increase token issuance, expanding the circulating supply and potentially diluting value.

Emission Rate

The emission rate during a Bitcoin halving event is reduced by 50%, effectively decreasing the inflation rate of new coins entering circulation and enforcing scarcity. This deflationary mechanism contrasts with typical inflationary events where new tokens are continuously minted, impacting supply dynamics and market valuation.

Scarcity Mechanism

The scarcity mechanism in cryptocurrency, particularly seen in Bitcoin's halving events, reduces block rewards by 50% approximately every four years, effectively decreasing new supply and driving deflationary pressure. This contrasts with inflationary events in traditional fiat systems where continuous currency issuance expands supply, potentially diluting value over time.

Supply Shock

A supply shock occurs when the availability of a key asset, such as Bitcoin, is suddenly reduced, often due to halving events that cut block rewards in half, tightening supply against steady or increasing demand. This scarcity contrasts with inflationary events where asset supply expands, diluting value and influencing market dynamics by altering asset price behavior and investor expectations.

Monetary Policy (Crypto)

Monetary policy in cryptocurrency, particularly Bitcoin, is significantly influenced by halving events, which reduce the block reward by half approximately every four years, leading to decreased supply issuance and potential deflationary pressure. In contrast, inflationary events increase token supply, diluting value, thus halving acts as a built-in deflationary mechanism that counters inflation commonly seen in fiat monetary systems.

Hard Cap

Hard Cap in cryptocurrency limits the total coin supply, preventing inflationary events by capping token issuance, whereas halving reduces block rewards to control inflation rate gradually over time. This distinction impacts monetary policy, with hard caps enforcing strict scarcity and halving events moderating inflation without fixed supply limits.

Fixed Supply Protocol

Fixed Supply Protocols maintain a predetermined maximum token supply, ensuring scarcity by limiting total circulation and preventing inflationary dilution common in inflationary events. Halving events reduce the block reward by half at regular intervals, reinforcing supply constraints and enhancing value stability within fixed supply ecosystems.

Token Minting

Token minting impacts cryptocurrency supply through mechanisms like halving and inflationary events; halving reduces block rewards by 50% periodically, slowing new token issuance and controlling inflation, while inflationary events increase token supply continuously to incentivize network participation and maintain liquidity. Understanding the balance between halving-induced scarcity and inflationary minting is crucial for predicting token value and supply dynamics.

Halving vs Inflationary Event Infographic

moneydif.com

moneydif.com