Stablecoins maintain value through collateral backing with assets like fiat currency or commodities, ensuring stability and trust. Algorithmic stablecoins rely on algorithms and smart contracts to regulate supply and demand, aiming to keep prices stable without collateral. The primary difference lies in collateralization versus automated market mechanisms, impacting risk and volatility profiles.

Table of Comparison

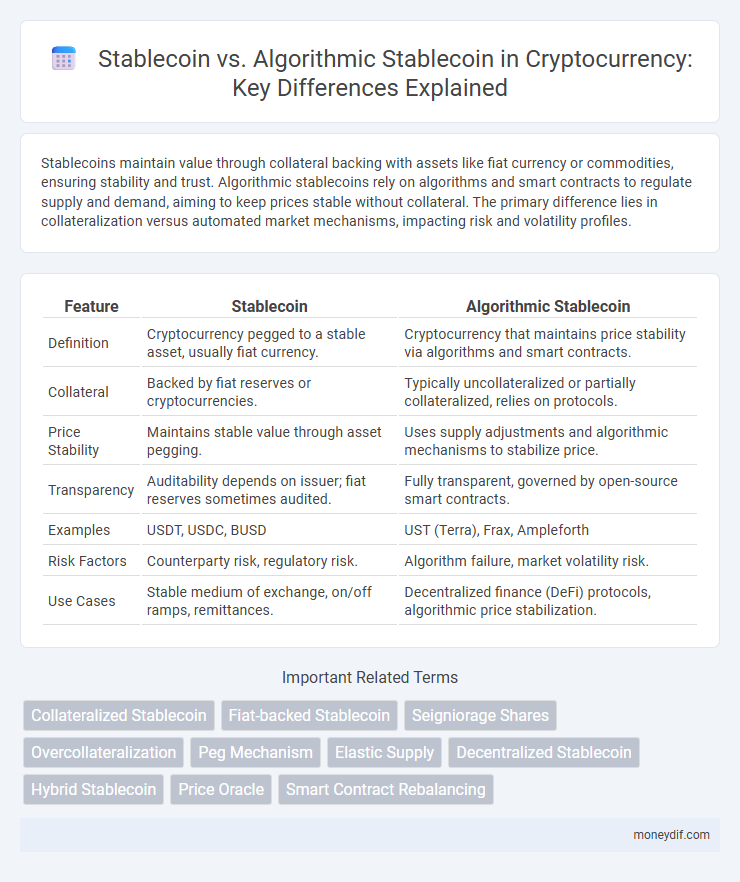

| Feature | Stablecoin | Algorithmic Stablecoin |

|---|---|---|

| Definition | Cryptocurrency pegged to a stable asset, usually fiat currency. | Cryptocurrency that maintains price stability via algorithms and smart contracts. |

| Collateral | Backed by fiat reserves or cryptocurrencies. | Typically uncollateralized or partially collateralized, relies on protocols. |

| Price Stability | Maintains stable value through asset pegging. | Uses supply adjustments and algorithmic mechanisms to stabilize price. |

| Transparency | Auditability depends on issuer; fiat reserves sometimes audited. | Fully transparent, governed by open-source smart contracts. |

| Examples | USDT, USDC, BUSD | UST (Terra), Frax, Ampleforth |

| Risk Factors | Counterparty risk, regulatory risk. | Algorithm failure, market volatility risk. |

| Use Cases | Stable medium of exchange, on/off ramps, remittances. | Decentralized finance (DeFi) protocols, algorithmic price stabilization. |

Understanding Stablecoins: An Overview

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging to assets like the US dollar or gold, providing a reliable medium of exchange and store of value. Algorithmic stablecoins achieve price stability through automated protocols that adjust supply based on demand rather than holding collateral. Understanding the differences between collateral-backed stablecoins and algorithmic variants is crucial for evaluating risk, transparency, and long-term viability in the crypto market.

What Are Algorithmic Stablecoins?

Algorithmic stablecoins maintain price stability through automated protocols that adjust supply based on market demand, rather than relying on collateral reserves like traditional stablecoins. These cryptocurrencies use algorithms and smart contracts to increase or decrease token supply, aiming to keep their value pegged to an asset such as the US dollar. The decentralized mechanism enhances scalability and reduces reliance on centralized collateral, though it introduces risks of price volatility during extreme market conditions.

Key Differences: Stablecoin vs Algorithmic Stablecoin

Stablecoins maintain price stability by being backed 1:1 with reserves such as fiat currency or assets, ensuring consistent value and reduced volatility. Algorithmic stablecoins use automated protocols and smart contracts to adjust supply based on demand, aiming to maintain a target price without collateral. The primary difference lies in collateralization: stablecoins have tangible asset backing, while algorithmic stablecoins rely on algorithm-driven supply mechanisms for stability.

Collateralization in Stablecoins Explained

Stablecoins maintain price stability through collateralization, typically backed by reserves such as fiat currency, cryptocurrencies, or commodities, ensuring users can redeem tokens at a fixed value. In contrast, algorithmic stablecoins use smart contracts and algorithms to adjust supply and demand without direct collateral backing, relying on market incentives to preserve price stability. Collateralized stablecoins offer more security and transparency, while algorithmic variants provide scalability but face higher volatility risks.

Price Stability Mechanisms Compared

Stablecoins maintain price stability by being directly pegged to fiat currencies or assets, ensuring predictable value through collateral reserves, while algorithmic stablecoins rely on smart contracts and algorithms to regulate supply and demand without collateral backing. Collateralized stablecoins use assets like USD or gold held in reserve to guarantee redemption at a fixed rate, providing robust price stability and lower volatility. Algorithmic stablecoins adjust circulating supply programmatically through minting and burning tokens, aiming for market equilibrium but often facing higher volatility and risk of de-peg events.

Risks and Vulnerabilities of Algorithmic Stablecoins

Algorithmic stablecoins rely on complex smart contracts and market incentives to maintain price stability, exposing them to significant systemic risks and vulnerabilities such as algorithmic failure, governance attacks, and liquidity crises. Unlike fiat-collateralized stablecoins backed by tangible assets, algorithmic stablecoins face heightened volatility during periods of market stress, which can trigger cascading failures and loss of peg stability. Historical collapses like TerraUSD illustrate the susceptibility of algorithmic stablecoins to rapid depegging, undermining user confidence and raising regulatory concerns.

Use Cases: When to Choose Each Type

Stablecoins backed by fiat currency or assets offer reliable value stability, making them ideal for everyday transactions, remittances, and as a safe haven during market volatility. Algorithmic stablecoins use smart contracts to maintain price stability without collateral, appealing to users seeking decentralized finance (DeFi) applications and high scalability. Choose fiat-collateralized stablecoins for security and trust, while algorithmic stablecoins suit experimental DeFi projects and users prioritizing decentralization.

Regulatory Challenges and Compliance

Stablecoins face stringent regulatory challenges due to their reliance on fiat reserves and potential risks to financial stability, prompting increased scrutiny from authorities like the SEC and FSOC. Algorithmic stablecoins, which maintain price stability through automated protocols without fiat backing, confront compliance hurdles related to transparency, operational risks, and investor protection. Both types encounter evolving frameworks aimed at enforcing AML, KYC, and capital requirements to mitigate systemic risks in the cryptocurrency ecosystem.

Real-World Examples of Both Stablecoin Types

Tether (USDT) and USD Coin (USDC) exemplify traditional stablecoins, maintaining value through reserves of fiat currency like the US dollar. Algorithmic stablecoins such as TerraUSD (UST) and Ampleforth (AMPL) rely on smart contracts and algorithms to regulate supply and stabilize price without backing by physical assets. Real-world performance highlights stability in fiat-collateralized coins, while algorithmic models face challenges in maintaining consistent value during market volatility.

The Future of Stablecoins: Trends and Predictions

Stablecoins continue to evolve with increasing demand for transparency, scalability, and regulatory compliance driving innovation in both fiat-backed and algorithmic models. Algorithmic stablecoins are gaining traction by leveraging decentralized protocols and smart contracts to maintain price stability without collateral, promising enhanced efficiency and lower costs. Future trends indicate wider adoption in DeFi, integration with CBDCs, and improved governance mechanisms, positioning stablecoins as key infrastructure in the expanding digital economy.

Important Terms

Collateralized Stablecoin

Collateralized stablecoins maintain value by backing each token with reserves such as fiat currency or cryptocurrencies, ensuring price stability through tangible assets. Unlike algorithmic stablecoins that rely on smart contracts and market incentives to regulate supply and demand, collateralized stablecoins offer more predictable stability due to their asset-backed nature.

Fiat-backed Stablecoin

Fiat-backed stablecoins maintain value stability by collateralizing each token with a reserve of fiat currency such as the US dollar, ensuring a one-to-one peg managed by centralized entities. Algorithmic stablecoins, in contrast, use decentralized supply adjustment mechanisms and smart contracts to stabilize price without direct fiat backing, but often face higher volatility and risk of depegging.

Seigniorage Shares

Seigniorage Shares operate as a mechanism in algorithmic stablecoins to maintain price stability by expanding or contracting token supply based on market demand, unlike traditional stablecoins that rely on collateral reserves like fiat or crypto assets. This model incentivizes holders through share issuance during contraction phases, aligning supply adjustments with decentralized governance to stabilize the algorithmic stablecoin's peg.

Overcollateralization

Overcollateralization in stablecoins involves backing each token with collateral exceeding its market value, ensuring stability and reducing default risk, commonly seen in asset-backed stablecoins like USDC and DAI. Algorithmic stablecoins rely on supply-demand mechanisms without heavy collateral, using smart contracts and incentivized protocols to maintain price stability but often face higher volatility and failure risks due to lack of sufficient collateral buffers.

Peg Mechanism

The peg mechanism in stablecoins maintains a fixed value, often $1 USD$, through collateral backing or algorithmic supply adjustments to ensure price stability. Algorithmic stablecoins adjust their circulating supply via code-based protocols without collateral, relying on market incentives and automated rebalancing to preserve their peg.

Elastic Supply

Elastic supply mechanisms adjust the circulating supply of stablecoins to maintain price stability, contrasting with algorithmic stablecoins that rely on smart contract protocols to expand or contract supply without collateral backing. Elastic supply stablecoins often incorporate rebase functions to directly modulate token quantities, offering a flexible alternative to traditional collateral-backed models in achieving stable value.

Decentralized Stablecoin

Decentralized stablecoins maintain value stability through collateralization or algorithms without relying on a central authority, contrasting with traditional stablecoins like USDC that are backed by fiat reserves. Algorithmic stablecoins use smart contracts to automatically adjust supply based on demand, aiming for stability but often facing higher volatility risks compared to collateral-backed decentralized stablecoins.

Hybrid Stablecoin

Hybrid stablecoins combine fiat-collateralized and algorithmic mechanisms to maintain price stability, leveraging both reserve assets and smart contract algorithms. Unlike purely stablecoins backed by physical assets or fully algorithmic stablecoins reliant solely on supply adjustments, hybrid models offer enhanced resilience against market volatility and reduced centralization risks.

Price Oracle

Price oracles provide real-time market data essential for maintaining the peg of both stablecoins and algorithmic stablecoins, ensuring accurate price feeds for minting and redemption processes. Algorithmic stablecoins rely heavily on oracles to trigger supply adjustments based on price fluctuations, whereas traditional stablecoins use oracles primarily to monitor collateral value and maintain stability.

Smart Contract Rebalancing

Smart Contract Rebalancing enhances liquidity management by automating asset allocation between Stablecoins, which maintain value through collateral, and Algorithmic Stablecoins that rely on algorithms to adjust supply. This mechanism reduces volatility risks and ensures stability by dynamically recalibrating balances based on market conditions and demand fluctuations.

Stablecoin vs Algorithmic Stablecoin Infographic

moneydif.com

moneydif.com