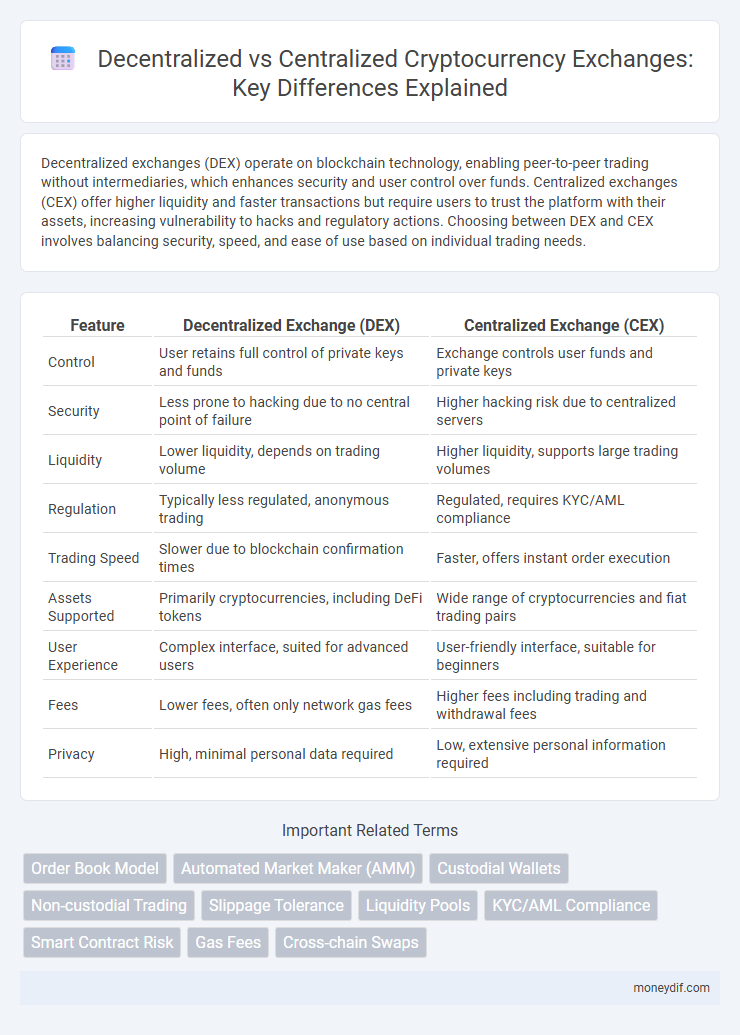

Decentralized exchanges (DEX) operate on blockchain technology, enabling peer-to-peer trading without intermediaries, which enhances security and user control over funds. Centralized exchanges (CEX) offer higher liquidity and faster transactions but require users to trust the platform with their assets, increasing vulnerability to hacks and regulatory actions. Choosing between DEX and CEX involves balancing security, speed, and ease of use based on individual trading needs.

Table of Comparison

| Feature | Decentralized Exchange (DEX) | Centralized Exchange (CEX) |

|---|---|---|

| Control | User retains full control of private keys and funds | Exchange controls user funds and private keys |

| Security | Less prone to hacking due to no central point of failure | Higher hacking risk due to centralized servers |

| Liquidity | Lower liquidity, depends on trading volume | Higher liquidity, supports large trading volumes |

| Regulation | Typically less regulated, anonymous trading | Regulated, requires KYC/AML compliance |

| Trading Speed | Slower due to blockchain confirmation times | Faster, offers instant order execution |

| Assets Supported | Primarily cryptocurrencies, including DeFi tokens | Wide range of cryptocurrencies and fiat trading pairs |

| User Experience | Complex interface, suited for advanced users | User-friendly interface, suitable for beginners |

| Fees | Lower fees, often only network gas fees | Higher fees including trading and withdrawal fees |

| Privacy | High, minimal personal data required | Low, extensive personal information required |

Introduction: Understanding DEX and CEX

Decentralized Exchanges (DEX) operate on blockchain technology, enabling peer-to-peer cryptocurrency trading without intermediaries, which enhances security and user control over assets. Centralized Exchanges (CEX) function through a centralized authority that manages transactions, offers higher liquidity, and provides user-friendly interfaces but requires users to trust the platform with their funds. Understanding the fundamental differences in custody, control, and transaction processes between DEX and CEX is essential for selecting the appropriate exchange for trading needs.

How Decentralized Exchanges Operate

Decentralized Exchanges (DEXs) operate on blockchain networks by enabling peer-to-peer cryptocurrency trading without intermediaries, utilizing smart contracts to facilitate direct asset swaps. Transactions occur on-chain, ensuring transparency, security, and user control over private keys, contrasting with Centralized Exchanges (CEXs) that hold custody of users' funds. Liquidity pools, automated market makers (AMMs), and non-custodial wallets are core components driving DEX functionality and enhancing decentralized finance (DeFi) ecosystems.

How Centralized Exchanges Function

Centralized exchanges (CEX) operate by acting as intermediaries that facilitate cryptocurrency trading through a centralized order book and custody of users' funds. They require users to create accounts, complete identity verification, and deposit assets into exchange-controlled wallets, enabling faster trade execution and liquidity. The centralized infrastructure allows for enhanced security measures, regulatory compliance, and customer support, but introduces counterparty risk due to control over private keys.

Security Comparison: DEX vs CEX

Decentralized Exchanges (DEX) enhance security by eliminating intermediaries, reducing risks of hacking and custody breaches commonly seen in Centralized Exchanges (CEX). In contrast, CEX platforms hold users' private keys, creating single points of failure susceptible to large-scale cyberattacks and regulatory shutdowns. DEXs offer users full control over their assets, leveraging smart contracts and blockchain transparency to ensure secure, trustless trading environments.

Liquidity Differences Between DEX and CEX

Liquidity on Centralized Exchanges (CEX) is generally higher due to aggregated order books, market makers, and institutional participants facilitating large volume trades with minimal slippage. Decentralized Exchanges (DEX) rely on Automated Market Makers (AMMs) and liquidity pools, which can suffer from lower liquidity and higher price impact in less popular trading pairs. The disparity in liquidity directly affects trade execution speed, pricing accuracy, and user experience between CEX and DEX platforms.

User Experience and Accessibility

Decentralized Exchanges (DEXs) offer enhanced user control and privacy by eliminating intermediaries, but often face challenges in intuitive interfaces and slower transaction speeds compared to Centralized Exchanges (CEXs). CEXs provide streamlined user experiences with high liquidity, fast transactions, and comprehensive customer support, making them more accessible to beginners. Despite these differences, advances in DEX protocols like automated market makers (AMMs) and layer-2 scaling solutions are gradually improving accessibility and usability.

Trading Fees and Cost Analysis

Decentralized Exchanges (DEXs) typically charge lower trading fees since they operate without intermediaries, reducing operational costs and enabling peer-to-peer transactions. Centralized Exchanges (CEXs) often impose higher fees, including deposit, withdrawal, and trading commissions, due to platform maintenance and regulatory compliance expenses. Comparing cost analysis, DEXs offer greater fee transparency but may incur higher network transaction costs (gas fees) depending on blockchain congestion.

Privacy and Anonymity: Which Offers More?

Decentralized Exchanges (DEXs) offer significantly enhanced privacy and anonymity by enabling peer-to-peer trading without requiring personal identification or custody of funds, minimizing data exposure and intermediary risks. Centralized Exchanges (CEXs) typically demand stringent KYC (Know Your Customer) procedures, compromising user anonymity to comply with regulatory standards and increasing data vulnerability. Consequently, users prioritizing privacy and anonymity generally prefer DEXs for their non-custodial nature and lower data collection.

Regulatory and Legal Considerations

Decentralized exchanges (DEXs) operate without a central authority, presenting unique regulatory challenges due to their pseudonymous nature and cross-jurisdictional transactions, often resulting in limited oversight. Centralized exchanges (CEXs) are subject to stringent regulatory frameworks, including KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance, ensuring greater legal accountability and consumer protection. Regulatory trends increasingly demand transparency and adherence to financial regulations, compelling CEXs to implement robust compliance measures while regulators grapple with frameworks for DEXs.

Choosing the Right Exchange for Your Needs

Decentralized exchanges (DEXs) offer enhanced privacy, lower risk of hacking, and direct peer-to-peer transactions, making them ideal for users prioritizing control over their assets. Centralized exchanges (CEXs) provide higher liquidity, faster transaction speeds, and extensive customer support, suitable for beginners and high-volume traders. Evaluating factors like security preferences, trading volume, asset variety, and user experience is essential when choosing between DEX and CEX platforms.

Important Terms

Order Book Model

The Order Book Model is fundamental to both Centralized Exchanges (CEX) and some Decentralized Exchanges (DEX), facilitating buy and sell orders with transparent price levels and liquidity. While CEXs maintain a centralized order book enabling faster execution and higher liquidity, DEXs rely on decentralized order book implementations or Automated Market Makers (AMMs), often facing challenges with scalability and order matching efficiency.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) power liquidity pools in Decentralized Exchanges (DEXs), enabling peer-to-peer token swaps without order books, contrasting with Centralized Exchanges (CEXs) that rely on traditional order book matching and custodial wallets. AMMs enhance decentralized liquidity and reduce reliance on intermediaries, while CEXs offer higher transaction speed and customer support through centralized control.

Custodial Wallets

Custodial wallets in Centralized Exchanges (CEX) store private keys on behalf of users, enabling seamless access and trading but sacrificing full user control over assets. In contrast, Decentralized Exchanges (DEX) require non-custodial wallets, empowering users with complete ownership of their private keys and funds while enhancing security and privacy.

Non-custodial Trading

Non-custodial trading on Decentralized Exchanges (DEXs) enables users to retain full control over their private keys and funds, reducing the risk of hacking and custody-related failures common in Centralized Exchanges (CEXs). While CEXs offer higher liquidity and faster transaction speeds, DEXs prioritize user sovereignty, transparency, and permissionless access through smart contract-based order execution.

Slippage Tolerance

Slippage tolerance in decentralized exchanges (DEXs) allows traders to set a maximum acceptable price change during a transaction, mitigating risks from volatile liquidity pools and front-running attacks common in automated market makers. Centralized exchanges (CEXs) typically offer lower slippage due to deeper order books and faster execution but lack the customizable slippage settings that protect users in the more dynamic and less liquid DEX environment.

Liquidity Pools

Liquidity pools in Decentralized Exchanges (DEXs) enable automated market making by allowing users to provide asset pairs, facilitating seamless peer-to-peer trading without intermediaries, whereas Centralized Exchanges (CEXs) rely on order books managed by the platform to match buyers and sellers. DEX liquidity pools offer enhanced transparency and reduced counterparty risk but can face issues like impermanent loss, while CEXs typically provide higher liquidity and faster execution times due to centralized control.

KYC/AML Compliance

KYC/AML compliance in centralized exchanges (CEX) involves strict identity verification and transaction monitoring to prevent fraud and money laundering, adhering to regulatory standards. Decentralized exchanges (DEX) typically lack formal KYC/AML processes due to their peer-to-peer structure, presenting challenges for regulatory compliance and increased risks of illicit activities.

Smart Contract Risk

Smart contract risks in Decentralized Exchanges (DEX) include vulnerabilities such as coding errors, exploits in liquidity pools, and flash loan attacks, which can lead to significant financial losses without a central authority to reverse transactions. In contrast, Centralized Exchanges (CEX) mitigate these risks by relying on internal controls, audits, and insurance mechanisms but face user custody and insider threat risks.

Gas Fees

Gas fees on decentralized exchanges (DEXs) are transaction costs paid to blockchain validators for processing trades, often fluctuating with network congestion and leading to potentially higher or unpredictable fees compared to centralized exchanges (CEXs). Centralized exchanges typically charge fixed or lower trading fees since they handle transactions off-chain, eliminating the need for blockchain gas fees and providing faster, cost-effective trading experiences.

Cross-chain Swaps

Cross-chain swaps enable seamless token exchanges across different blockchain networks without intermediary custody, enhancing decentralization and reducing counterparty risk compared to centralized exchanges (CEX). Decentralized exchanges (DEX) leverage smart contracts for trustless, peer-to-peer transactions, whereas CEX platforms handle asset custody and order matching centrally, often limiting cross-chain interoperability and increasing regulatory exposure.

Decentralized Exchange (DEX) vs Centralized Exchange (CEX) Infographic

moneydif.com

moneydif.com