Rug pulls and pump and dump schemes are two common types of cryptocurrency scams that manipulate investors for quick profit. Rug pulls occur when developers abandon a project and withdraw all funds, leaving investors with worthless tokens. Pump and dump schemes involve artificially inflating a token's price through coordinated buying before selling off shares to unsuspecting investors, causing prices to crash.

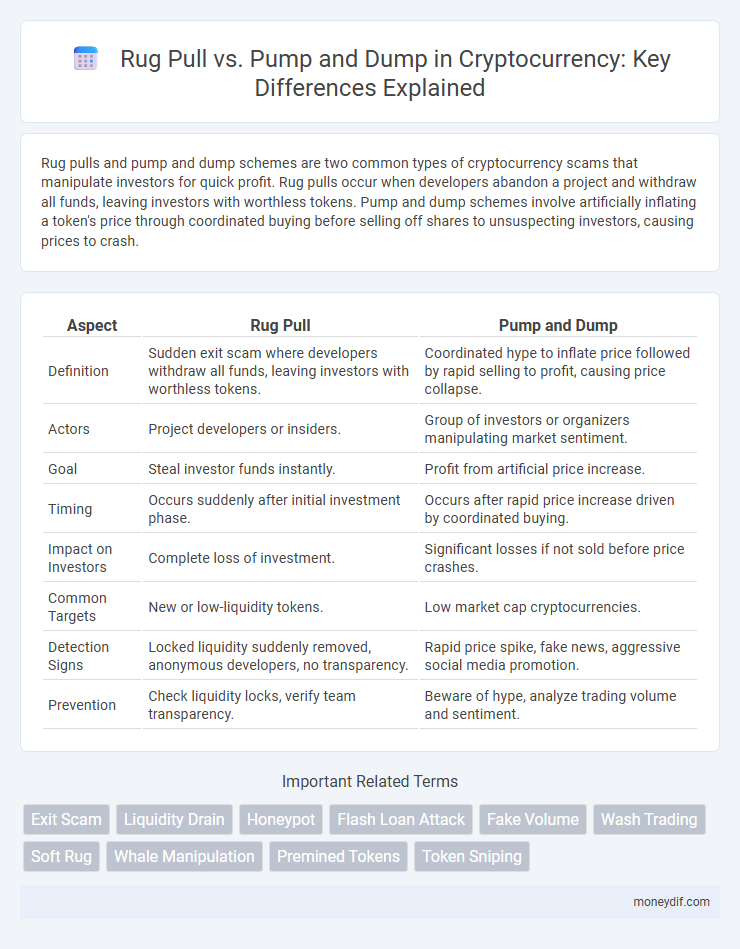

Table of Comparison

| Aspect | Rug Pull | Pump and Dump |

|---|---|---|

| Definition | Sudden exit scam where developers withdraw all funds, leaving investors with worthless tokens. | Coordinated hype to inflate price followed by rapid selling to profit, causing price collapse. |

| Actors | Project developers or insiders. | Group of investors or organizers manipulating market sentiment. |

| Goal | Steal investor funds instantly. | Profit from artificial price increase. |

| Timing | Occurs suddenly after initial investment phase. | Occurs after rapid price increase driven by coordinated buying. |

| Impact on Investors | Complete loss of investment. | Significant losses if not sold before price crashes. |

| Common Targets | New or low-liquidity tokens. | Low market cap cryptocurrencies. |

| Detection Signs | Locked liquidity suddenly removed, anonymous developers, no transparency. | Rapid price spike, fake news, aggressive social media promotion. |

| Prevention | Check liquidity locks, verify team transparency. | Beware of hype, analyze trading volume and sentiment. |

Introduction to Rug Pulls and Pump and Dumps

Rug pulls and pump and dump schemes are prevalent scams in the cryptocurrency market that manipulate investor trust and market prices. Rug pulls occur when developers abandon a project after collecting funds, causing token prices to collapse abruptly, while pump and dump schemes involve artificially inflating a cryptocurrency's price through misinformation to sell at a profit before the price crashes. Both tactics exploit market volatility and lack of regulation, posing significant risks to investors.

Defining Rug Pulls in Cryptocurrency

A rug pull in cryptocurrency is a type of scam where developers suddenly withdraw liquidity from a project, causing token prices to crash and investors to lose funds. Unlike pump and dump schemes, which rely on artificially inflating prices before selling off, rug pulls often involve malicious project creators abandoning the platform. Identifying rug pulls requires analyzing project transparency, developer activity, and liquidity lock status to minimize the risk of financial loss.

What is a Pump and Dump Scheme?

A pump and dump scheme in cryptocurrency involves artificially inflating the price of a token through misleading or false positive statements, creating a buying frenzy among investors. Once the price peaks due to increased demand, the perpetrators sell off their holdings at a profit, causing the token's value to crash and leaving other investors with significant losses. This fraudulent practice contrasts with a rug pull, where developers abruptly withdraw all funds from a project, but both result in substantial financial damage to unsuspecting participants.

Key Differences: Rug Pull vs Pump and Dump

Rug pull scams involve developers abruptly withdrawing liquidity or funds from a cryptocurrency project, leaving investors with worthless tokens. Pump and dump schemes manipulate a token's price by artificially inflating it through coordinated buying before rapidly selling off to profit, causing the price to crash. Key differences lie in execution: rug pulls exploit trust and access to project funds, while pump and dumps rely on market manipulation and coordinated trading activity.

How Rug Pulls Operate: Step-by-Step

Rug pulls in cryptocurrency typically begin with creators launching a new token or project, often accompanied by aggressive marketing and social media hype to attract investors. Once a significant amount of capital is locked into the project's liquidity pool, the developers abruptly withdraw all funds, causing the token's value to plummet and leaving investors with worthless assets. This malicious tactic contrasts with pump and dump schemes, as rug pulls involve exploiting decentralized finance (DeFi) mechanisms and smart contracts to drain liquidity instantly.

The Anatomy of a Pump and Dump

A pump and dump scheme in cryptocurrency involves artificially inflating the price of a coin through coordinated buying and hype, often via social media and private groups. Once the price peaks, insiders sell off their holdings, causing the value to plummet and leaving unsuspecting investors with significant losses. This manipulation relies on high volatility, low liquidity assets, and crowd psychology to quickly drive demand before exploiting the market downturn.

Warning Signs and Red Flags in Crypto Scams

Rug pulls often involve sudden withdrawal of liquidity by developers, indicated by invisible or locked liquidity pools and anonymous teams. Pump and dump schemes show rapid, unnatural price spikes with aggressive social media hype and coordinated buy-ins from small investor groups. Lack of transparent project updates, unverifiable token metrics, and dubious partnership claims are key red flags signaling potential crypto scams.

Real-World Examples: Notorious Cases

The notorious rug pull of the DeFi project Squid Game in 2021 resulted in investors losing more than $3.38 million as developers vanished post-launch, creating a stark contrast to the infamous pump and dump scheme orchestrated by the Dogecoin community in 2021, which temporarily inflated the coin's value before a rapid crash. Another real-world example is the BitConnect collapse in 2018, often cited as a classic pump and dump scam that defrauded investors of over $2.6 billion. These cases highlight distinct manipulative tactics where rug pulls rely on deceitful project abandonment, whereas pump and dump schemes involve coordinated hype and sell-offs to manipulate market prices.

Protecting Yourself from Crypto Fraud

Identifying key differences between rug pulls and pump and dump schemes enables investors to protect themselves from crypto fraud effectively. Rug pulls involve developers abruptly withdrawing liquidity, leaving investors with worthless tokens, while pump and dump schemes manipulate price through coordinated selling after artificially inflating value. Implementing rigorous due diligence, such as verifying developer legitimacy and monitoring token liquidity, significantly reduces the risk of falling victim to these scams.

Regulatory Responses and Future Prevention

Regulatory responses to rug pulls and pump and dump schemes in cryptocurrency increasingly involve stricter enforcement of anti-fraud laws and enhanced transparency requirements for token issuers. Governments and financial authorities are implementing mandatory disclosures, real-time transaction monitoring, and robust identity verification to deter malicious actors. Future prevention relies on advanced blockchain analytics, investor education, and collaboration between global regulators to create standardized frameworks that mitigate these scams effectively.

Important Terms

Exit Scam

Exit scam involves fraudsters suddenly abandoning a project after collecting substantial investor funds, often seen in crypto markets. Unlike rug pull, which rapidly drains liquidity from a decentralized exchange pool, and pump and dump, which manipulates asset prices to sell at a profit before collapse, exit scams leave investors with worthless tokens and no recourse.

Liquidity Drain

Liquidity drain occurs when assets are rapidly removed from a liquidity pool, often signaling malicious activity such as a rug pull, where developers withdraw all funds, leaving investors with worthless tokens. In contrast, pump and dump schemes involve artificially inflating a token's price through coordinated buying before selling off holdings, but do not always lead to immediate liquidity pool depletion.

Honeypot

Honeypots in cryptocurrency are deceptive traps designed to attract and trap users by mimicking legitimate tokens, often exposing Rug Pull schemes where developers suddenly withdraw liquidity, causing massive investor losses. Unlike Pump and Dump scams that artificially inflate token prices before dumping assets, Honeypots prevent selling entirely, effectively locking investors' funds and highlighting risks in decentralized finance ecosystems.

Flash Loan Attack

A flash loan attack exploits unsecured DeFi protocols by borrowing large amounts of capital without collateral, enabling attackers to manipulate prices and execute rug pulls or pump-and-dump schemes. These attacks often disrupt markets by artificially inflating or deflating token values, causing severe financial losses for unsuspecting investors.

Fake Volume

Fake volume manipulates perceived market activity through artificial trade orders, often used in pump and dump schemes to inflate prices and attract unsuspecting investors before massive sell-offs occur. In contrast, rug pulls involve developers abruptly withdrawing liquidity or funds, instantly collapsing the asset's value and leaving investors with worthless tokens.

Wash Trading

Wash trading manipulates market prices by repeatedly buying and selling the same asset to create artificial volume, often preceding rug pulls where developers abruptly abandon projects and drain liquidity. This tactic contrasts with pump and dump schemes, which rely on hype to inflate asset prices before orchestrating a sharp sell-off to defraud investors.

Soft Rug

Soft rug refers to a subtle form of rug pull in cryptocurrency, where developers gradually withdraw funds to avoid immediate detection, contrasting with the abrupt exit of a traditional rug pull. This deceptive tactic can mislead investors during pumps and dumps by creating a false sense of security before the eventual collapse of token value.

Whale Manipulation

Whale manipulation in cryptocurrency involves large holders, or "whales," strategically influencing token prices through coordinated buy or sell actions, often causing sharp market swings. This practice contributes to rug pulls where developers abandon projects after inflating value, and pump and dump schemes where whales artificially inflate prices before rapidly selling to profit, leaving smaller investors at a loss.

Premined Tokens

Premined tokens are cryptocurrency assets created and allocated to developers or insiders before public release, often raising concerns about potential rug pulls where creators abandon the project after extracting funds. Unlike pump and dump schemes driven by market hype and rapid price manipulation, rug pulls involve deliberate protocol-level deception tied to premined token control and ownership concentration.

Token Sniping

Token sniping exploits rapid market movements by purchasing newly listed tokens before price surges caused by pump and dump schemes or rug pulls. This strategy relies on detecting token launches and unusual transaction patterns to capitalize before the inevitable price collapse or liquidity withdrawal.

Rug Pull vs Pump and Dump Infographic

moneydif.com

moneydif.com