Halving events in cryptocurrency reduce the block reward by half, directly impacting miner revenue and the supply rate of new coins. Difficulty adjustment recalibrates the mining difficulty to maintain a consistent block time despite changes in network hash power. Understanding the interplay between halving and difficulty adjustment is crucial for predicting mining profitability and network security trends.

Table of Comparison

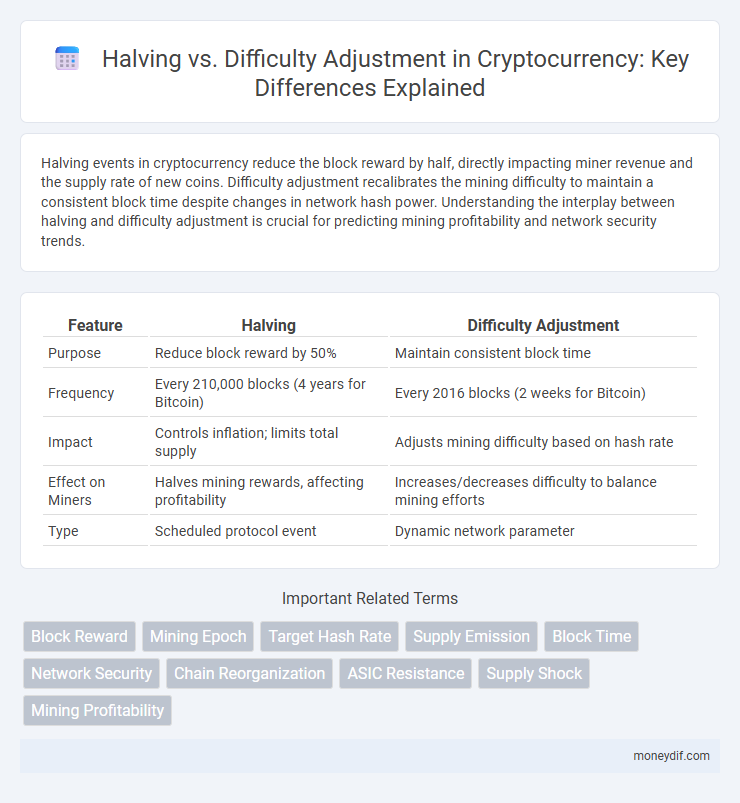

| Feature | Halving | Difficulty Adjustment |

|---|---|---|

| Purpose | Reduce block reward by 50% | Maintain consistent block time |

| Frequency | Every 210,000 blocks (4 years for Bitcoin) | Every 2016 blocks (2 weeks for Bitcoin) |

| Impact | Controls inflation; limits total supply | Adjusts mining difficulty based on hash rate |

| Effect on Miners | Halves mining rewards, affecting profitability | Increases/decreases difficulty to balance mining efforts |

| Type | Scheduled protocol event | Dynamic network parameter |

Understanding Cryptocurrency Halving

Cryptocurrency halving is a pre-programmed event that reduces the block reward miners receive by 50%, directly impacting the supply rate of new coins and often influencing market prices. Difficulty adjustment, by contrast, automatically recalibrates the mining difficulty based on network hash rate to maintain consistent block times, ensuring network security and stability. Understanding the interplay between halving and difficulty adjustment is crucial for anticipating mining profitability and blockchain performance dynamics.

What Is Difficulty Adjustment in Blockchain?

Difficulty adjustment in blockchain is a mechanism that regulates the mining difficulty to maintain a consistent block time despite fluctuations in network hash rate. This process ensures the blockchain remains secure and stable by automatically increasing or decreasing the complexity of solving cryptographic puzzles. Unlike halving events that reduce block rewards, difficulty adjustment focuses solely on balancing mining efforts to sustain predictable transaction processing speed.

Key Differences: Halving vs Difficulty Adjustment

Halving in cryptocurrency is a pre-scheduled event that reduces the block reward miners receive by 50%, occurring roughly every four years to control inflation and supply. Difficulty adjustment, on the other hand, dynamically modifies the mining difficulty approximately every two weeks based on the network's hash rate to ensure consistent block times of about 10 minutes. While halving directly impacts miner revenue by cutting rewards, difficulty adjustment affects mining competition and energy consumption without changing the reward size.

How Halving Impacts Coin Supply

Halving in cryptocurrencies reduces the block reward miners receive by half, directly limiting the rate at which new coins enter circulation and thereby controlling inflation. This predetermined event enhances scarcity, often leading to increased demand and price appreciation over time. In contrast, difficulty adjustment modifies mining complexity to stabilize block production speed without affecting the actual coin supply.

Difficulty Adjustment: Ensuring Network Stability

Difficulty adjustment in cryptocurrency mining plays a crucial role in maintaining network stability by dynamically altering the mining difficulty based on the rate of block production. This mechanism ensures that blocks are mined at consistent intervals, despite fluctuations in the total hash rate of the mining network. By automatically recalibrating difficulty, the network prevents rapid inflation or stagnation of block generation, safeguarding blockchain security and transaction integrity.

Effects on Miners: Halving and Difficulty Shifts

Halving events reduce the block reward miners receive by 50%, directly impacting their revenue and potentially causing less efficient miners to exit the market. Difficulty adjustments recalibrate the mining complexity based on network hash rate, aiming to stabilize block times despite changes in mining power. Together, these mechanisms influence miners' profitability and network security by balancing incentives and computational competition.

Price Movements: Halving Events vs Difficulty Changes

Halving events in cryptocurrency reduce the block reward by 50%, leading to a sudden supply shock that often triggers significant price rallies due to increased scarcity. Difficulty adjustments, however, recalibrate mining complexity based on network hash rate and typically induce more gradual and less pronounced price changes since they reflect mining activity rather than direct supply constraints. Historical data from Bitcoin's halvings in 2012, 2016, and 2020 show sharp upward price trends post-halving, whereas difficulty adjustments correlate with smaller price corrections or stabilization phases.

Security Implications for the Blockchain

Halving events reduce the block reward, directly impacting miner incentives and potentially decreasing network hash power, which can lower blockchain security by making it more vulnerable to attacks. Difficulty adjustments recalibrate the mining challenge based on recent hash rate fluctuations, ensuring block times remain stable and preserving consistent security levels. Together, these mechanisms balance miner motivation and network resilience, crucial for maintaining the integrity of the blockchain.

Investor Strategies: Responding to Halving and Adjustments

Investors often recalibrate portfolios ahead of cryptocurrency halving events to capitalize on anticipated supply shocks and price appreciation. Strategic responses to difficulty adjustments include monitoring mining hash rates and network stability to gauge potential volatility and adjust holding periods. Diversifying assets while leveraging on-chain metrics enhances resilience against market fluctuations triggered by both halvings and mining difficulty changes.

Future Outlook: Halving Cycles and Network Difficulty

Halving cycles reduce Bitcoin's block rewards approximately every four years, systematically shrinking supply and influencing price dynamics by increasing scarcity. Network difficulty adjusts approximately every two weeks to maintain consistent block times despite fluctuating mining power, ensuring network security and stability. Future outlooks emphasize how these mechanisms interplay, with halving events often triggering increased mining competition, prompting significant difficulty recalibrations that impact miner profitability and network resilience.

Important Terms

Block Reward

Block reward decreases approximately every 210,000 blocks during halving events, reducing miners' earnings by 50% to control Bitcoin's supply issuance. Difficulty adjustment occurs every 2,016 blocks to maintain a 10-minute average block time, balancing mining difficulty with changing network hash power despite reward reductions.

Mining Epoch

Mining Epoch in blockchain refers to a fixed interval after which difficulty adjustment occurs to maintain a consistent block time despite network hash rate changes, differing from halving which reduces block rewards every set number of blocks to control inflation. While halving directly impacts miner revenue by cutting rewards, difficulty adjustment dynamically alters mining difficulty to balance network security and performance.

Target Hash Rate

Target hash rate represents the optimal computational power required for mining a new block within a blockchain's expected time frame. It influences the difficulty adjustment, which recalibrates mining difficulty post-halving events to maintain block production consistency despite changes in miner incentives and network hash power.

Supply Emission

Supply emission in blockchain networks directly influences monetary inflation through block rewards, which are systematically reduced by the halving event approximately every four years, cutting the issuance rate in half. Difficulty adjustment ensures consistent block times by recalibrating mining complexity based on network hash power, indirectly interacting with supply emission by stabilizing issuance intervals despite fluctuating mining participation.

Block Time

Block time typically averages around 10 minutes on the Bitcoin network, balancing the halving event's impact on miner rewards and the difficulty adjustment algorithm. Difficulty adjusts approximately every 2016 blocks to maintain consistent block times despite fluctuations in hash rate post-halving, ensuring network stability and security.

Network Security

Network security in blockchain systems relies heavily on difficulty adjustment algorithms to maintain a consistent block time despite the network's hash power fluctuations, ensuring that security parameters remain robust. Halving events reduce miner rewards systematically, impacting miner incentives and potentially affecting network hash rate and security until the difficulty adjusts accordingly to stabilize block production.

Chain Reorganization

Chain reorganization occurs when a blockchain replaces a portion of its chain with a longer, valid chain, often triggered by shifts in mining power after halving events that reduce block rewards. Difficulty adjustment algorithms stabilize block times by recalibrating mining difficulty post-halving, influencing the likelihood and extent of chain reorganizations during periods of network hash rate volatility.

ASIC Resistance

ASIC resistance enhances blockchain decentralization by preventing specialized hardware dominance, maintaining fair mining opportunities, especially during halving events that reduce block rewards. Difficulty adjustment algorithms respond to hash rate fluctuations post-halving to stabilize block times, ensuring network security despite reduced mining incentives.

Supply Shock

Supply shock in cryptocurrency arises when halving events halve block rewards, reducing new coin issuance and tightening supply, which often triggers price volatility. Difficulty adjustment algorithms respond by modifying mining difficulty to maintain block times despite fluctuating hash power caused by the reduced rewards.

Mining Profitability

Mining profitability is directly influenced by Bitcoin's halving events, which reduce block rewards by 50%, decreasing miner revenue while difficulty adjustment recalibrates mining complexity approximately every two weeks based on network hash rate to maintain a 10-minute block interval. As halving lowers income, difficulty adjustments can either mitigate or exacerbate profitability changes depending on the collective mining power, making efficient hardware and low electricity costs critical for sustained mining operations.

halving vs difficulty adjustment Infographic

moneydif.com

moneydif.com