Liquidity pools enable decentralized trading by aggregating users' funds to provide continuous market liquidity without relying on traditional buyers and sellers. Order books display real-time buy and sell orders, matching counterparties directly to facilitate price discovery and trade execution. Both mechanisms influence market efficiency and asset pricing but serve different roles in cryptocurrency exchanges, with liquidity pools often supporting DeFi platforms and order books dominating centralized exchanges.

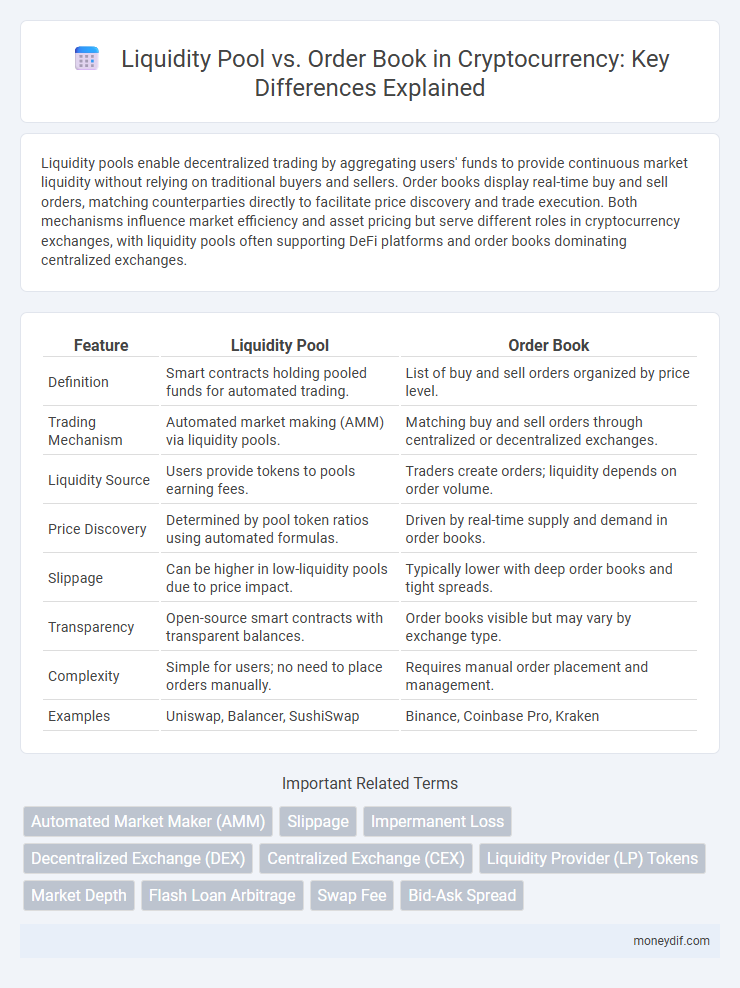

Table of Comparison

| Feature | Liquidity Pool | Order Book |

|---|---|---|

| Definition | Smart contracts holding pooled funds for automated trading. | List of buy and sell orders organized by price level. |

| Trading Mechanism | Automated market making (AMM) via liquidity pools. | Matching buy and sell orders through centralized or decentralized exchanges. |

| Liquidity Source | Users provide tokens to pools earning fees. | Traders create orders; liquidity depends on order volume. |

| Price Discovery | Determined by pool token ratios using automated formulas. | Driven by real-time supply and demand in order books. |

| Slippage | Can be higher in low-liquidity pools due to price impact. | Typically lower with deep order books and tight spreads. |

| Transparency | Open-source smart contracts with transparent balances. | Order books visible but may vary by exchange type. |

| Complexity | Simple for users; no need to place orders manually. | Requires manual order placement and management. |

| Examples | Uniswap, Balancer, SushiSwap | Binance, Coinbase Pro, Kraken |

Understanding Liquidity Pools: A Primer

Liquidity pools are decentralized collections of tokens locked in smart contracts that enable automated trading and liquidity provision without relying on traditional order books. These pools use algorithms like Automated Market Makers (AMMs) to determine token prices based on supply and demand, facilitating instant swaps between users. Understanding liquidity pools is crucial for engaging in decentralized finance (DeFi) platforms and earning trading fees through liquidity provision.

What Are Order Book Models?

Order book models represent a centralized system where buy and sell orders are listed and matched based on price and time priority, creating transparency and real-time market depth. Each order book contains bids and asks, allowing traders to execute precise trades at desired prices by matching counterparty orders. This contrasts with liquidity pools, which aggregate assets in smart contracts to facilitate decentralized trading without direct order matching.

Key Differences Between Liquidity Pools and Order Books

Liquidity pools utilize smart contracts to automate asset trading by pooling user funds, ensuring constant liquidity without relying on counterparties. Order books match buy and sell orders directly, depending on market participants' active engagement to set prices and complete trades. The primary difference lies in liquidity pools enabling decentralized, continuous trading with algorithmically determined prices, while order books rely on centralized or decentralized exchanges with price formation based on real-time order matching.

How Liquidity Pools Enhance Decentralized Trading

Liquidity pools enhance decentralized trading by providing continuous liquidity through pooled funds, enabling users to trade assets without relying on traditional order matching systems. These pools use automated market maker (AMM) algorithms to determine asset prices, reducing slippage and increasing trade efficiency. This system supports higher transaction speeds and lowers fees compared to order book exchanges, promoting seamless peer-to-peer trading in decentralized finance (DeFi) platforms.

The Role of Order Books in Traditional Exchanges

Order books in traditional exchanges serve as dynamic ledgers recording all buy and sell orders, facilitating transparent price discovery and market depth analysis. They enable traders to view real-time bid and ask prices, ensuring efficient matching of counterparty orders and optimal liquidity allocation. This system contrasts with liquidity pools by relying on direct buyer-seller interactions rather than algorithmic market-making models.

Pros and Cons of Liquidity Pools

Liquidity pools offer continuous liquidity and lower slippage by allowing users to trade directly against pooled assets, unlike traditional order books that rely on matching buy and sell orders. They enable decentralized trading without the need for intermediaries, enhancing accessibility and reducing fees, but can expose users to impermanent loss when asset prices fluctuate. While liquidity pools facilitate automated market making and 24/7 trading, they generally suffer from lower price discovery efficiency compared to order book systems.

Pros and Cons of Order Book Systems

Order book systems provide precise control over trade prices and enable transparent market depth visibility, making them ideal for assets with high trading volumes. However, they often suffer from lower liquidity in less popular markets, leading to slippage and slower trade execution. Complex order types and maintenance overhead can also present challenges for smaller exchanges and novice traders alike.

Impact on Trading Fees and Slippage

Liquidity pools in decentralized exchanges use automated market makers, resulting in more consistent trading fees and reduced slippage, especially for small to medium trades. Order books in centralized exchanges can offer tighter spreads but often lead to higher slippage during low liquidity periods and variable trading fees based on order size and market depth. Traders must weigh the predictability of fees and slippage in liquidity pools against the potential cost savings and risks inherent in order book trading.

Security Risks: Liquidity Pools vs Order Books

Liquidity pools expose users to smart contract vulnerabilities and impermanent loss risks, potentially leading to direct financial losses in decentralized exchanges (DEXs). Order books, typically used in centralized exchanges (CEXs), face risks related to hacking, data manipulation, and insider trading, which can compromise user funds and market integrity. Both systems require robust security measures, but liquidity pools demand heightened vigilance due to the immutable nature of blockchain transactions and the reliance on automated protocols.

Choosing the Best Model for Your Crypto Strategy

Liquidity pools offer decentralized trading with continuous liquidity by aggregating funds from multiple users, ideal for users seeking automated, permissionless transactions without relying on a counterparty. Order books provide real-time buy and sell orders with transparent price discovery, favoring traders who prioritize market depth and direct negotiation of prices. Selecting the best model depends on your strategy's need for speed, transparency, and control over trade execution within decentralized finance (DeFi) or centralized exchange environments.

Important Terms

Automated Market Maker (AMM)

Automated Market Makers (AMMs) operate using liquidity pools, where traders trade against a shared pool of assets rather than matching buy and sell orders in an order book system. This decentralized approach allows for continuous liquidity and price discovery through smart contract algorithms, contrasting with traditional order book exchanges that rely on limit and market orders from individual participants.

Slippage

Slippage refers to the difference between the expected price of a trade and the actual execution price, often caused by low liquidity or high volatility. In Liquidity Pools, slippage occurs due to the constant product formula affecting token reserves, while in Order Books, it results from insufficient order depth or large market orders surpassing available bids or asks.

Impermanent Loss

Impermanent loss occurs when providing liquidity to a liquidity pool causes a divergence in token prices compared to holding assets in an order book, leading to potential value loss during price volatility. Unlike traditional order book trading, liquidity pools rely on automated market makers (AMMs) that continuously adjust asset ratios, increasing exposure to impermanent loss as prices fluctuate.

Decentralized Exchange (DEX)

Decentralized Exchanges (DEX) primarily utilize liquidity pools to facilitate automated market-making, enabling users to trade assets directly from smart contracts without intermediaries. Unlike traditional order book systems that match buy and sell orders, liquidity pools rely on pooled tokens and pricing algorithms to provide continuous liquidity and reduce slippage in trading.

Centralized Exchange (CEX)

Centralized Exchanges (CEX) primarily use order books to match buy and sell orders, providing structured trading with transparent price discovery and depth through limit orders. Unlike decentralized liquidity pools that aggregate funds for automated market making, CEX order books rely on user-generated orders, leading to potentially higher liquidity and more efficient execution for high-frequency and large-volume trading.

Liquidity Provider (LP) Tokens

Liquidity Provider (LP) tokens represent a user's share in a decentralized liquidity pool, enabling automated market making without the need for traditional order books. These tokens facilitate seamless trading by allowing participants to earn fees proportionate to their contributed assets in the pool rather than relying on matching buy and sell orders.

Market Depth

Market depth represents the volume of buy and sell orders at various price levels, reflecting liquidity and price stability in trading. Liquidity pools aggregate assets in decentralized finance to enable instant swaps without traditional order matching, while order books list discrete buy and sell orders in centralized exchanges, directly displaying market depth and real-time price discovery.

Flash Loan Arbitrage

Flash loan arbitrage exploits temporary price discrepancies between decentralized liquidity pools and traditional order book exchanges by borrowing uncollateralized funds within a single transaction. This strategy leverages the instant capital access of flash loans to capitalize on arbitrage opportunities with minimal risk and no upfront capital, primarily within decentralized finance ecosystems.

Swap Fee

Swap fees in liquidity pools are typically fixed percentages charged on each trade to incentivize liquidity providers, fostering continuous asset availability and reducing slippage. In contrast, order book systems often involve variable fees based on maker or taker roles, influencing trading behavior and market depth differently.

Bid-Ask Spread

The bid-ask spread in liquidity pools is often narrower due to automated market making mechanisms that provide continuous pricing, while order books rely on discrete buy and sell orders which can create larger spreads during low liquidity periods. In decentralized finance (DeFi), liquidity pools aggregate capital from multiple users, enhancing market depth and reducing slippage compared to traditional order book exchanges where depth depends on individual order placements.

Liquidity Pool vs Order Book Infographic

moneydif.com

moneydif.com