Gas limit defines the maximum amount of computational work a user is willing to spend on a cryptocurrency transaction, ensuring the operation completes without running out of resources. Gas price represents the fee per unit of gas, directly influencing the transaction's priority and speed on the blockchain network. Balancing gas limit and gas price is essential for optimizing transaction costs and execution efficiency in blockchain interactions.

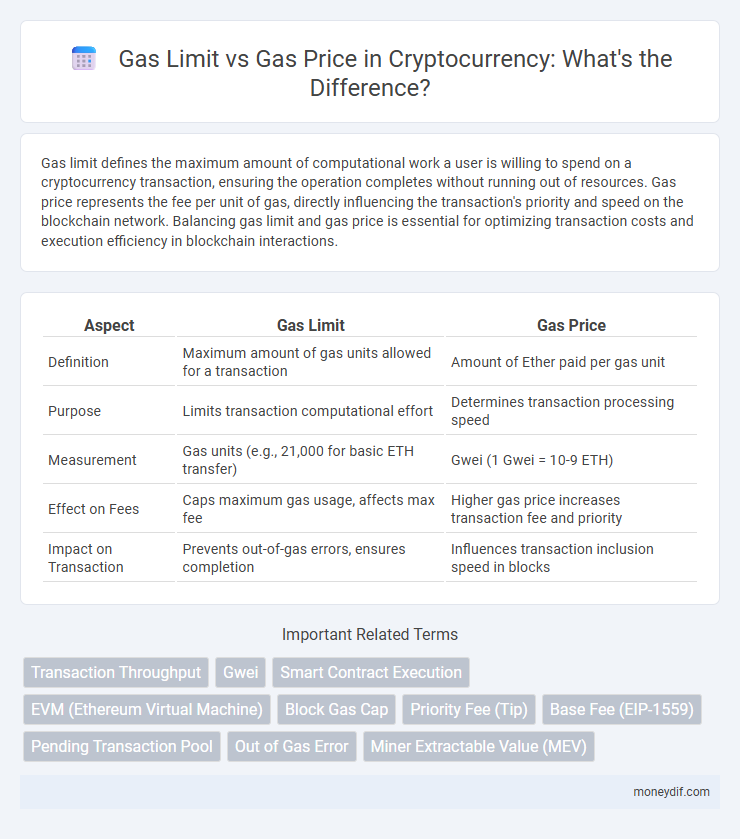

Table of Comparison

| Aspect | Gas Limit | Gas Price |

|---|---|---|

| Definition | Maximum amount of gas units allowed for a transaction | Amount of Ether paid per gas unit |

| Purpose | Limits transaction computational effort | Determines transaction processing speed |

| Measurement | Gas units (e.g., 21,000 for basic ETH transfer) | Gwei (1 Gwei = 10-9 ETH) |

| Effect on Fees | Caps maximum gas usage, affects max fee | Higher gas price increases transaction fee and priority |

| Impact on Transaction | Prevents out-of-gas errors, ensures completion | Influences transaction inclusion speed in blocks |

Understanding Gas in Cryptocurrency Transactions

Gas limit defines the maximum amount of computational work a cryptocurrency transaction can consume, ensuring it does not exceed network resource constraints. Gas price represents the fee per unit of gas, affecting transaction speed and miner prioritization within blockchain networks like Ethereum. Understanding both concepts is essential for optimizing transaction costs and avoiding failed or delayed confirmations.

Defining Gas Limit: What It Means

The gas limit in cryptocurrency transactions defines the maximum amount of computational work a user is willing to pay for when executing a contract or transferring tokens on blockchain networks like Ethereum. Setting an appropriate gas limit ensures that the transaction has enough resources to be processed without running out of gas, which leads to failure and loss of fees. Unlike gas price, which determines the cost per unit of gas, the gas limit controls the total units of gas allocated, directly impacting transaction success and cost efficiency.

What Is Gas Price? Key Concepts Explained

Gas price in cryptocurrency refers to the amount of Ether (ETH) a user is willing to pay per unit of gas to execute a transaction or contract on the Ethereum network. It is measured in Gwei, a denomination of Ether, and directly influences the transaction speed--higher gas prices incentivize miners to prioritize a transaction. Understanding gas price is crucial for optimizing transaction costs and ensuring timely confirmation on the blockchain.

How Gas Limit and Gas Price Work Together

Gas limit defines the maximum amount of computational work a transaction can consume on a blockchain, while gas price determines how much a user is willing to pay per unit of gas. The total transaction fee is calculated by multiplying the gas limit by the gas price, directly influencing transaction speed and miner priority. Efficiently balancing gas limit and gas price ensures successful execution without overpaying or risking transaction failure due to insufficient gas.

Setting the Right Gas Limit: Best Practices

Setting the right gas limit is crucial for efficient cryptocurrency transactions, ensuring they are processed without failure or excessive fees. A gas limit that is too low may cause transactions to run out of gas and fail, while an excessively high gas limit can lock up unnecessary funds temporarily. Best practices include estimating gas usage based on similar past transactions and using wallet or network tools that provide recommended gas limits for specific transaction types.

Impact of Gas Price on Transaction Speed

Gas price directly influences transaction speed on blockchain networks by incentivizing miners to prioritize higher-fee transactions, resulting in faster confirmation times. Increasing the gas price accelerates processing by making transactions more attractive to validators, especially during network congestion. Conversely, low gas prices can lead to delays, as miners prioritize transactions offering higher rewards in the form of gas fees.

Gas Limit vs Gas Price: Main Differences

Gas limit refers to the maximum amount of computational work a user is willing to spend on a transaction, while gas price represents the amount of Ether a user is willing to pay per unit of gas. Gas limit controls the complexity and resource consumption of the transaction, whereas gas price influences the transaction's priority and speed on the Ethereum network. Understanding the main differences between gas limit and gas price helps users optimize transaction costs and confirmation times.

How to Optimize Gas Fees in Crypto Transactions

Optimizing gas fees in crypto transactions involves managing the gas limit and gas price effectively to reduce costs while ensuring transaction success. The gas limit sets the maximum computational effort allowed, so estimating it accurately avoids overpaying or failed transactions, while adjusting the gas price according to network congestion impacts the fee speed and amount. Utilizing tools like gas fee prediction platforms and scheduling transactions during low network activity can significantly minimize overall transaction costs on Ethereum and similar blockchain networks.

Risks of Incorrect Gas Limit and Gas Price Settings

Incorrect gas limit settings can lead to transaction failure or excessive ETH consumption if set too low or too high, respectively, causing financial losses and network congestion. Similarly, setting an inappropriate gas price risks delayed transaction processing during peak network demand or overpayment during low activity periods, impacting cost efficiency. Understanding and accurately configuring these parameters is critical for optimizing transaction success and minimizing unnecessary expenses on Ethereum and similar blockchain platforms.

Future Trends in Gas Fees and Blockchain Scalability

Future trends in gas fees emphasize decreasing gas prices through innovative Layer 2 scaling solutions like rollups and sharding, which significantly enhance blockchain throughput while maintaining security. Adjustments in gas limits enable more transactions per block, directly impacting network scalability and user experience by reducing congestion. Emerging protocols integrating dynamic gas fee models aim to optimize transaction costs, fostering broader adoption and efficiency in decentralized finance ecosystems.

Important Terms

Transaction Throughput

Transaction throughput in blockchain networks depends significantly on the gas limit and gas price, where the gas limit dictates the maximum amount of computational work per block and the gas price influences the priority of transaction inclusion by miners. Optimizing throughput requires balancing a higher gas limit to enable more complex or numerous transactions per block against setting competitive gas prices to ensure timely processing without escalating network congestion or transaction costs.

Gwei

Gwei is a denomination of Ethereum used to measure gas price, where 1 Gwei equals 0.000000001 ETH, and it directly influences transaction fees based on the gas limit, which defines the maximum computational effort allowed. Higher gas prices in Gwei incentivize miners to prioritize transactions within the set gas limit, balancing cost and processing speed on the Ethereum network.

Smart Contract Execution

Smart contract execution requires careful consideration of gas limits and gas prices to optimize transaction efficiency and cost. A higher gas limit ensures sufficient computational resource allocation, while adjusting the gas price influences the transaction's priority and speed on the Ethereum network.

EVM (Ethereum Virtual Machine)

EVM processes transactions within the gas limit, defining the maximum computational effort allowed, while the gas price determines the cost per unit of gas paid by users to prioritize transaction execution. Higher gas prices can lead to faster transaction confirmation, but the gas limit ensures that computation does not exceed network constraints, optimizing Ethereum's resource allocation and security.

Block Gas Cap

Block gas cap defines the maximum cumulative gas allowed per block, effectively setting a gas limit that controls the total computational effort for processing transactions. Gas price determines the fee per unit of gas miners collect, influencing transaction prioritization within the block gas cap constraints.

Priority Fee (Tip)

The Priority Fee, also known as the Tip, incentivizes miners to include transactions faster by supplementing the base gas price with an additional amount paid per unit of gas. This fee directly affects the transaction's total cost, calculated by multiplying the sum of the base gas price and Priority Fee by the gas limit, which represents the maximum gas units needed to execute the transaction.

Base Fee (EIP-1559)

The base fee in Ethereum's EIP-1559 is a dynamic minimum gas price burned per transaction, automatically adjusted according to network congestion by targeting a 50% gas limit utilization per block. Gas limits represent the maximum gas allowed per block, while the base fee fluctuates inversely to block demand, ensuring predictable and stable transaction pricing without bidders overpaying.

Pending Transaction Pool

The Pending Transaction Pool stores unconfirmed transactions competing for inclusion in the next block, where miners prioritize based on gas price to maximize rewards within the block's gas limit. High gas prices increase the likelihood of faster processing, but the total gas consumed by selected transactions cannot exceed the block's gas limit, creating a balance between transaction fee incentives and block capacity.

Out of Gas Error

An Out of Gas Error occurs when a transaction exceeds the specified gas limit, preventing its execution despite the gas price paid. Optimizing the gas limit ensures sufficient computational resources, while adjusting the gas price influences transaction prioritization on the Ethereum network.

Miner Extractable Value (MEV)

Miner Extractable Value (MEV) significantly influences the gas price as miners strategically prioritize transactions with higher fees within the constraints of the gas limit per block to maximize profits. The interplay between gas limit and gas price impacts MEV opportunities by determining the number of transactions a miner can include, thereby affecting the potential revenue from transaction reordering or inclusion.

gas limit vs gas price Infographic

moneydif.com

moneydif.com