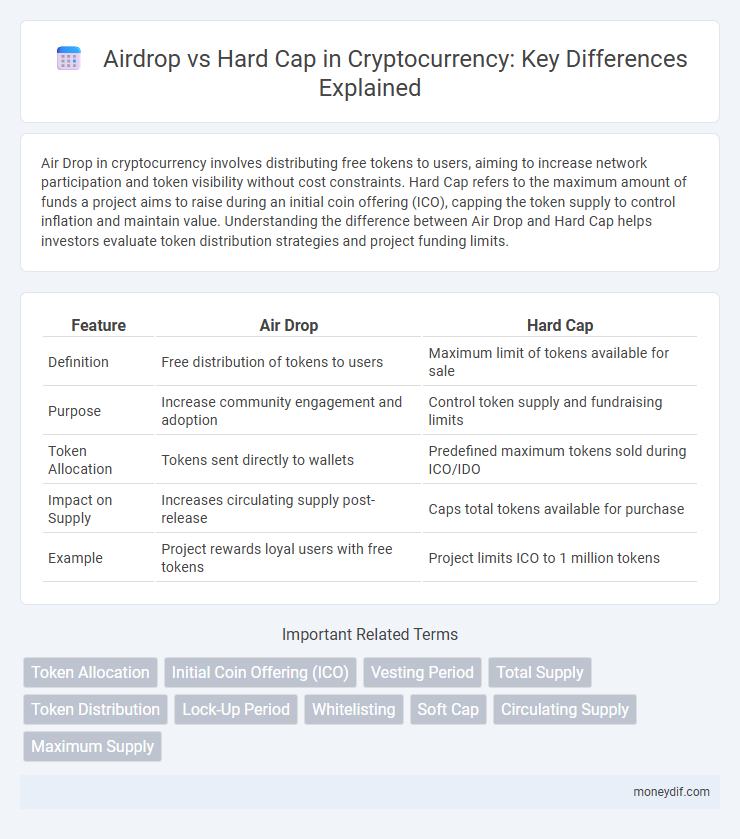

Air Drop in cryptocurrency involves distributing free tokens to users, aiming to increase network participation and token visibility without cost constraints. Hard Cap refers to the maximum amount of funds a project aims to raise during an initial coin offering (ICO), capping the token supply to control inflation and maintain value. Understanding the difference between Air Drop and Hard Cap helps investors evaluate token distribution strategies and project funding limits.

Table of Comparison

| Feature | Air Drop | Hard Cap |

|---|---|---|

| Definition | Free distribution of tokens to users | Maximum limit of tokens available for sale |

| Purpose | Increase community engagement and adoption | Control token supply and fundraising limits |

| Token Allocation | Tokens sent directly to wallets | Predefined maximum tokens sold during ICO/IDO |

| Impact on Supply | Increases circulating supply post-release | Caps total tokens available for purchase |

| Example | Project rewards loyal users with free tokens | Project limits ICO to 1 million tokens |

Understanding Airdrops in Cryptocurrency

Airdrops in cryptocurrency involve the free distribution of tokens to holders or community members, serving as a marketing strategy to increase user engagement and token adoption. Unlike a hard cap, which sets the maximum supply limit for a token, airdrops do not directly affect the token's supply ceiling but can influence market dynamics by expanding token circulation. Understanding airdrops is essential for investors to recognize opportunities for earning tokens and to analyze their impact on project growth and tokenomics.

What is a Hard Cap in Crypto Projects?

A Hard Cap in crypto projects refers to the maximum amount of capital a project aims to raise during its initial coin offering (ICO) or token sale, setting a strict limit on the total funds collected. This limit ensures scarcity and helps maintain the token's value by preventing excessive dilution from oversubscription. Understanding the Hard Cap is crucial to assessing a project's fundraising goals, market confidence, and token distribution strategy.

Key Differences Between Airdrop and Hard Cap

Airdrops involve distributing free cryptocurrency tokens to users as a marketing tool or to reward community members, enhancing coin adoption and user engagement. Hard caps refer to the maximum amount of funds a project aims to raise during an Initial Coin Offering (ICO) or token sale, ensuring limited token supply and controlling project funding. Key differences between airdrops and hard caps lie in their purpose: airdrops focus on token distribution for user incentivization, while hard caps regulate fundraising limits to maintain scarcity and project viability.

Benefits of Participating in Crypto Airdrops

Participating in crypto airdrops offers direct access to free tokens, enabling users to diversify their digital asset portfolio without initial investment. Airdrops promote community engagement and increase token liquidity by distributing coins broadly, enhancing market adoption. Unlike hard caps that limit fundraising, airdrops facilitate broader participation and help projects build user trust and awareness early in their development.

The Role of Hard Caps in Token Economics

Hard caps in token economics limit the maximum supply of tokens, preventing excessive inflation and preserving scarcity value essential for maintaining investor confidence. Unlike airdrops, which distribute tokens for promotional or community-building purposes, hard caps enforce a strict ceiling on token issuance, directly influencing market dynamics and long-term price stability. This supply constraint ensures that token scarcity is maintained, encouraging demand and supporting sustainable growth within the cryptocurrency ecosystem.

Risks Associated With Crypto Airdrops

Crypto airdrops often carry risks such as exposure to phishing scams and the distribution of worthless or malicious tokens, which can compromise wallet security. Compared to hard caps that limit the total token supply, airdrops lack stringent controls on token distribution, increasing vulnerability to market manipulation and dilution of token value. Users should exercise caution by verifying sources and avoiding interactions with unsolicited airdrops to minimize potential financial losses.

How Hard Caps Influence Investor Confidence

Hard caps in cryptocurrency fundraising create a clear maximum limit on token supply, preventing excessive dilution and ensuring scarcity, which boosts investor confidence. By setting a hard cap, projects demonstrate fiscal discipline and commitment to long-term value, attracting investors who seek predictable returns and reduced risk. This finite cap contrasts with unlimited airdrops, which can lead to inflation and undermine token value stability.

Impact on Token Distribution: Airdrop vs Hard Cap

Airdrops influence token distribution by directly allocating free tokens to users, increasing decentralization and community engagement through broad ownership. Hard caps restrict the total supply of tokens, ensuring scarcity and potential value appreciation but limiting distribution to early investors and participants. The balance between airdrops and hard caps affects market liquidity, token accessibility, and long-term ecosystem growth.

Regulatory Considerations for Airdrops and Hard Caps

Regulatory considerations for cryptocurrency airdrops often center on securities laws, with jurisdictions like the SEC scrutinizing whether airdropped tokens qualify as unregistered securities, potentially triggering compliance requirements. Hard caps in token sales impose strict fundraising limits that help projects demonstrate adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, reducing regulatory risk. Both mechanisms require careful legal structuring to ensure alignment with country-specific regulatory frameworks to avoid penalties and ensure investor protection.

Choosing the Right Strategy: Airdrop or Hard Cap

Choosing the right strategy between an airdrop and a hard cap depends on the project's fundraising goals and community engagement objectives. Airdrops distribute free tokens to boost user adoption and increase token circulation, ideal for growing an active user base. Hard caps set a maximum fundraising limit during token sales to control token supply and protect against market dilution, best suited for projects aiming to maintain scarcity and value stability.

Important Terms

Token Allocation

Token allocation strategies significantly impact the success of Air Drops and Hard Cap fundraising approaches, with Air Drops often distributing tokens freely to engage early users and Hard Caps imposing maximum limits on token sales to control supply and demand. Efficient token allocation balances community incentives from Air Drops with financial discipline enforced by Hard Cap constraints, optimizing network growth and investor confidence.

Initial Coin Offering (ICO)

Initial Coin Offering (ICO) involves fundraising through token sales, where Air Drop distributes free tokens to users for promotional purposes, increasing token visibility and community engagement. Hard Cap defines the maximum amount a project aims to raise during an ICO, limiting token supply to maintain value and investor confidence.

Vesting Period

The vesting period in token airdrops ensures gradual distribution of tokens over a specified timeframe, preventing immediate sell-offs and promoting long-term engagement, while a hard cap limits the maximum supply or allocation of tokens available in the airdrop to maintain scarcity and value. Implementing both mechanisms balances token liquidity and market stability by controlling release schedules and total token circulation.

Total Supply

Total supply represents the maximum number of tokens that will ever be created, often capped by a hard cap to ensure scarcity and value retention. Air drops distribute a portion of this total supply directly to users as free tokens, impacting circulation but not exceeding the predetermined hard cap limit.

Token Distribution

Token distribution strategies in blockchain projects often balance between airdrops, which enable wide, cost-effective token dissemination to incentivize user engagement, and hard caps that limit the total token supply to maintain scarcity and value stability. Optimizing the mix of airdrops and hard caps ensures fair access while preserving the token's long-term market value and controlling inflation.

Lock-Up Period

The lock-up period restricts the immediate transfer or sale of tokens received through an airdrop, helping to prevent price volatility and market manipulation before a project's hard cap is reached. This mechanism stabilizes token distribution by ensuring holders retain their tokens for a set duration, aligning with fundraising limits set by the hard cap to maintain project sustainability.

Whitelisting

Whitelisting in AirDrop campaigns ensures only pre-approved participants can receive tokens, enhancing security and targeting, whereas a Hard Cap limits the total token distribution to control supply and preserve value. Combining whitelisting with a Hard Cap optimizes token allocation efficiency, prevents oversubscription, and maintains project integrity during fundraising or token distribution events.

Soft Cap

Soft Cap represents the minimum funding goal in a token sale or Air Drop, ensuring project viability before releasing tokens, whereas Hard Cap defines the maximum fundraising limit, preventing oversaturation and maintaining token value. Air Drops distributed before reaching the Soft Cap may risk token undervaluation, while hitting the Hard Cap solidifies token scarcity and market confidence.

Circulating Supply

Circulating supply represents the number of cryptocurrency tokens currently available for trading, directly influenced by factors like airdrops which increase token distribution without surpassing the project's predetermined hard cap limit. The hard cap defines the maximum total token issuance, ensuring that airdrop distributions and other allocations do not inflate supply beyond this immutable ceiling, maintaining scarcity and value integrity.

Maximum Supply

Maximum supply defines the total number of tokens that can ever exist, setting a fixed limit known as the hard cap, which cannot be exceeded during token minting. Air drops distribute a portion of the existing maximum supply directly to users without increasing the hard cap, ensuring token scarcity remains controlled.

Air Drop vs Hard Cap Infographic

moneydif.com

moneydif.com