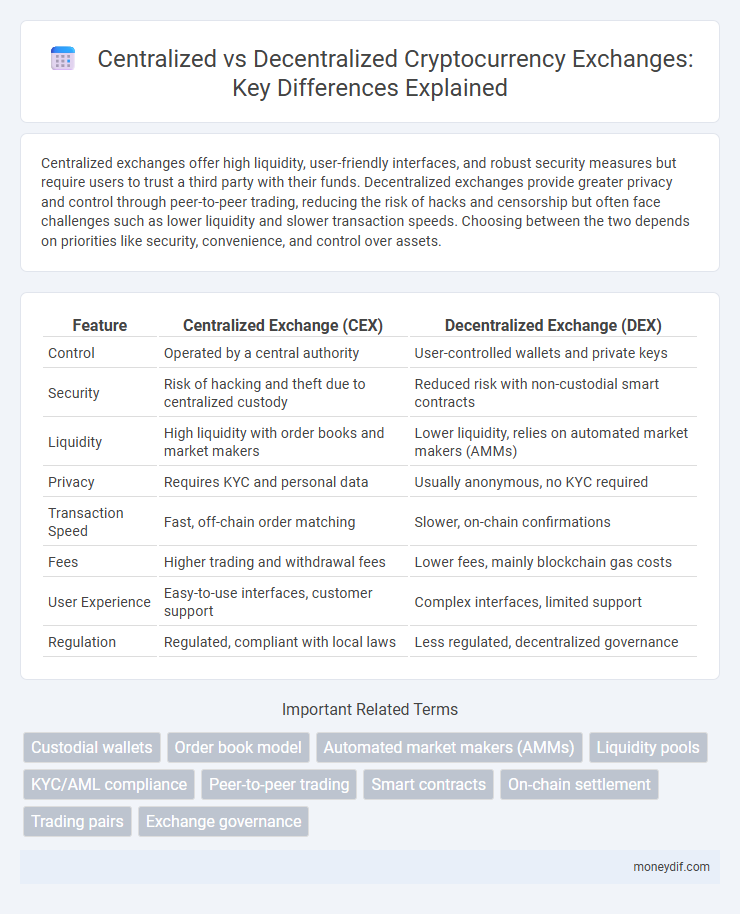

Centralized exchanges offer high liquidity, user-friendly interfaces, and robust security measures but require users to trust a third party with their funds. Decentralized exchanges provide greater privacy and control through peer-to-peer trading, reducing the risk of hacks and censorship but often face challenges such as lower liquidity and slower transaction speeds. Choosing between the two depends on priorities like security, convenience, and control over assets.

Table of Comparison

| Feature | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Control | Operated by a central authority | User-controlled wallets and private keys |

| Security | Risk of hacking and theft due to centralized custody | Reduced risk with non-custodial smart contracts |

| Liquidity | High liquidity with order books and market makers | Lower liquidity, relies on automated market makers (AMMs) |

| Privacy | Requires KYC and personal data | Usually anonymous, no KYC required |

| Transaction Speed | Fast, off-chain order matching | Slower, on-chain confirmations |

| Fees | Higher trading and withdrawal fees | Lower fees, mainly blockchain gas costs |

| User Experience | Easy-to-use interfaces, customer support | Complex interfaces, limited support |

| Regulation | Regulated, compliant with local laws | Less regulated, decentralized governance |

Understanding Centralized Exchanges: Key Features and Functions

Centralized exchanges (CEXs) act as intermediaries facilitating cryptocurrency trading by managing user funds and matching buy and sell orders on their platforms. Key features include high liquidity, user-friendly interfaces, and customer support, but they require users to trust the exchange with private keys and funds, which introduces counterparty risk. These exchanges also implement strict compliance with regulatory standards such as KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols to ensure secure and legal operations.

Decentralized Exchanges Explained: How They Work

Decentralized exchanges (DEXs) operate on blockchain technology, enabling peer-to-peer trading without intermediaries by using smart contracts to automate transactions. They enhance security and privacy since users retain control of their private keys and funds throughout the trading process. By eliminating central points of failure, DEXs offer resistance to censorship and lower risks of hacking compared to centralized exchanges.

Security Comparison: CEX vs DEX

Centralized exchanges (CEXs) store users' funds in custodial wallets, making them vulnerable to hacking and regulatory seizures, while decentralized exchanges (DEXs) use smart contracts and non-custodial wallets, enhancing security by eliminating single points of failure. CEXs require users to trust the platform's security measures and internal controls, whereas DEXs rely on blockchain protocols that offer transparency and user control over private keys. Security breaches in CEXs can lead to significant losses, but DEXs face risks like smart contract vulnerabilities and lower liquidity, impacting overall trading safety.

Liquidity and Trading Volume: A Comparative Analysis

Centralized exchanges (CEXs) typically offer higher liquidity and trading volumes due to their consolidated order books and large user bases, enabling faster trade execution and reduced slippage. Decentralized exchanges (DEXs) often face liquidity fragmentation because asset pools are distributed across multiple platforms, which can result in lower trade volumes and higher price volatility. Innovations like automated market makers (AMMs) and liquidity mining are helping DEXs improve liquidity, but CEXs still dominate in terms of overall trading volume and depth.

User Experience: Ease of Use on CEX and DEX

Centralized exchanges (CEX) offer intuitive interfaces, faster transaction speeds, and integrated customer support, enhancing ease of use for beginners. Decentralized exchanges (DEX) provide greater control and privacy but typically require users to manage private keys and navigate more complex interfaces. CEX platforms streamline onboarding and trading processes, while DEXs prioritize security at the cost of a steeper learning curve.

Regulatory Compliance: CEX vs DEX Approaches

Centralized exchanges (CEX) typically adhere to strict regulatory compliance by implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to meet government standards and reduce illicit activities. Decentralized exchanges (DEX) operate without intermediaries, often lacking formal KYC processes, which challenges traditional regulatory frameworks but preserves user privacy and autonomy. Regulatory bodies increasingly scrutinize both models, pushing for innovative compliance solutions that balance security, transparency, and decentralization.

Fees and Costs: Which Exchange Model is Cheaper?

Centralized exchanges (CEXs) typically charge higher fees, including trading commissions, withdrawal fees, and deposit charges, due to intermediaries and operational costs. Decentralized exchanges (DEXs) often incur lower or no platform fees but can be subject to network gas fees, particularly on Ethereum, which fluctuate with blockchain congestion. For cost-conscious traders, DEXs generally provide cheaper transaction expenses, though CEXs may offer better fee discounts through loyalty programs and higher liquidity benefits.

Control and Ownership: Custodial vs Non-Custodial Platforms

Centralized exchanges (CEX) operate as custodial platforms where users relinquish control of their crypto assets to the exchange, introducing counterparty risk but offering enhanced user experience and liquidity. Decentralized exchanges (DEX) function as non-custodial platforms, allowing users full ownership and control of private keys, significantly reducing the risk of hacks and regulatory interventions. The trade-off between custodial and non-custodial models directly impacts users' security, privacy, and autonomy in managing their cryptocurrency holdings.

Risks and Vulnerabilities: Centralized and Decentralized Challenges

Centralized exchanges face significant risks such as hacking, insider theft, and regulatory crackdowns due to their single points of control and custody over user funds. Decentralized exchanges, while reducing custody risks, introduce vulnerabilities including smart contract bugs, lower liquidity, and susceptibility to front-running attacks. Both models present inherent challenges in security and trust, requiring users to balance convenience against potential technical and operational risks.

Future of Crypto Trading: Hybrid and Emerging Exchange Models

Centralized exchanges (CEXs) prioritize liquidity and user-friendly interfaces, while decentralized exchanges (DEXs) emphasize security and user control through smart contracts. Emerging hybrid exchange models combine the strengths of both, offering seamless liquidity, enhanced security, and improved privacy features. These innovations are shaping the future of crypto trading by balancing scalability, regulatory compliance, and decentralized finance (DeFi) integration.

Important Terms

Custodial wallets

Custodial wallets managed by centralized exchanges store user private keys, offering ease of access and faster transactions, whereas decentralized exchanges rely on non-custodial wallets, enabling users to retain control of their private keys and enhancing security and privacy.

Order book model

The order book model in centralized exchanges relies on a centralized ledger for matching buy and sell orders, while decentralized exchanges utilize distributed order books to enable peer-to-peer trading without intermediaries.

Automated market makers (AMMs)

Automated market makers (AMMs) enable decentralized exchanges to provide continuous liquidity through algorithmic pricing models, contrasting with centralized exchanges that rely on order books and human market makers.

Liquidity pools

Liquidity pools on decentralized exchanges (DEXs) consist of user-funded token reserves that enable automated trading via smart contracts, contrasting with centralized exchanges (CEXs) that rely on order books and market makers to maintain liquidity. Decentralized liquidity pools reduce reliance on intermediaries, offering continuous availability and decentralized asset custody, while centralized exchanges provide higher liquidity depth and faster trade execution due to centralized infrastructure.

KYC/AML compliance

KYC/AML compliance in centralized exchanges involves stringent identity verification and transaction monitoring, whereas decentralized exchanges operate with minimal or no KYC/AML measures due to their peer-to-peer architecture.

Peer-to-peer trading

Peer-to-peer trading enables direct asset exchange between users, contrasting with centralized exchanges that rely on intermediaries and decentralized exchanges that operate on blockchain-based protocols for trustless transactions.

Smart contracts

Smart contracts automate trustless transactions on decentralized exchanges, eliminating intermediaries and enhancing transparency compared to centralized exchanges that rely on proprietary control and custodial management.

On-chain settlement

On-chain settlement in decentralized exchanges (DEXs) ensures transparent, trustless trade execution by recording every transaction directly on the blockchain, eliminating counterparty risk common in centralized exchanges (CEXs). Centralized exchanges rely on off-chain order books and internal ledgers for faster transaction speeds but introduce risks such as custodian vulnerability and reduced transparency compared to the immutable on-chain settlement of DEXs.

Trading pairs

Trading pairs on centralized exchanges provide higher liquidity and faster execution, while decentralized exchanges offer greater security and user control by enabling peer-to-peer trading without intermediaries.

Exchange governance

Exchange governance structures differ significantly between centralized exchanges, which rely on hierarchical control and regulatory compliance, and decentralized exchanges, which operate on blockchain-based protocols enabling peer-to-peer trading without central authority.

Centralized exchange vs decentralized exchange Infographic

moneydif.com

moneydif.com