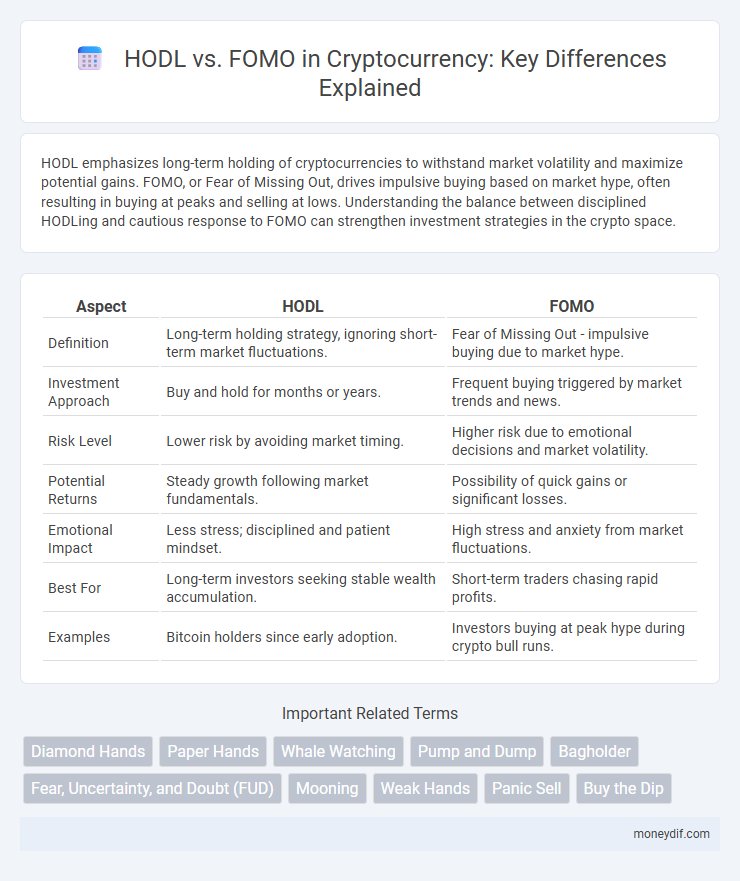

HODL emphasizes long-term holding of cryptocurrencies to withstand market volatility and maximize potential gains. FOMO, or Fear of Missing Out, drives impulsive buying based on market hype, often resulting in buying at peaks and selling at lows. Understanding the balance between disciplined HODLing and cautious response to FOMO can strengthen investment strategies in the crypto space.

Table of Comparison

| Aspect | HODL | FOMO |

|---|---|---|

| Definition | Long-term holding strategy, ignoring short-term market fluctuations. | Fear of Missing Out - impulsive buying due to market hype. |

| Investment Approach | Buy and hold for months or years. | Frequent buying triggered by market trends and news. |

| Risk Level | Lower risk by avoiding market timing. | Higher risk due to emotional decisions and market volatility. |

| Potential Returns | Steady growth following market fundamentals. | Possibility of quick gains or significant losses. |

| Emotional Impact | Less stress; disciplined and patient mindset. | High stress and anxiety from market fluctuations. |

| Best For | Long-term investors seeking stable wealth accumulation. | Short-term traders chasing rapid profits. |

| Examples | Bitcoin holders since early adoption. | Investors buying at peak hype during crypto bull runs. |

Understanding HODL: The Long-Term Mindset

HODL represents a long-term investment strategy where cryptocurrency holders resist the urge to sell during market volatility, focusing on potential future value rather than short-term gains. This mindset contrasts with FOMO (Fear Of Missing Out), which drives impulsive buying or selling based on market hype and price fluctuations. Embracing HODL requires discipline and confidence in the technology behind assets like Bitcoin or Ethereum, recognizing that patience can yield substantial returns amid the inherently volatile crypto market.

What Is FOMO and How Does It Affect Crypto Investors?

FOMO, or Fear of Missing Out, drives crypto investors to make impulsive decisions based on market hype rather than careful analysis. This emotional reaction often leads to buying at peak prices during bull runs and selling during market dips, increasing the risk of losses. Understanding FOMO is crucial for maintaining disciplined strategies like HODL, which emphasize long-term holding despite short-term volatility.

Historical Origins of HODL and FOMO in Crypto

The term HODL originated from a 2013 Bitcoin forum post where a user misspelled "hold," symbolizing a long-term investment strategy during market volatility. FOMO, short for "Fear of Missing Out," emerged as crypto prices surged, driving impulsive buying behavior fueled by social media hype and rapid price movements. Both concepts highlight contrasting investor psychology that has shaped cryptocurrency trading since its early days.

Psychological Drivers Behind HODL and FOMO

HODL behavior in cryptocurrency is driven by psychological factors such as loss aversion and long-term optimism, where investors resist selling during market dips to avoid realizing losses and anticipate future gains. FOMO (Fear of Missing Out) triggers impulsive buying as traders react to market hype and price surges, driven by social influence and fear of regret. Understanding these emotional drivers reveals how cognitive biases impact decision-making, often leading to suboptimal investment outcomes in volatile crypto markets.

HODL Strategy: Benefits and Risks

The HODL strategy in cryptocurrency emphasizes holding assets long-term despite market volatility, potentially maximizing profits through sustained value appreciation and avoiding impulsive selling driven by short-term market fluctuations. Benefits include reduced transaction fees, minimized stress from market noise, and the possibility of capitalizing on the overall bullish trend of digital assets like Bitcoin and Ethereum. Risks involve exposure to prolonged downturns, opportunity costs from missed trading gains, and vulnerabilities to regulatory changes affecting asset liquidity.

FOMO Investing: Pitfalls and Consequences

FOMO investing in cryptocurrency often leads to impulsive decisions driven by fear of missing out on rapid market gains, resulting in buying at peak prices and significant financial losses. Emotional trading increases vulnerability to market volatility, causing investors to sell during downturns, crystallizing losses. Awareness of these pitfalls is crucial for developing disciplined strategies that mitigate risk and protect long-term portfolio growth.

Case Studies: Success and Failure Stories of HODL vs FOMO

Case studies of cryptocurrency investors reveal that HODL strategies often lead to long-term wealth accumulation, exemplified by early Bitcoin adopters who retained their assets through market volatility. Conversely, FOMO-driven decisions frequently result in substantial losses, as seen in speculative buying during price spikes like the 2017 ICO boom or the 2021 NFT craze. Analyzing these outcomes highlights the importance of disciplined investment approaches in volatile crypto markets.

How Market Volatility Amplifies HODL and FOMO Behaviors

Market volatility intensifies HODL behavior as investors cling to long-term gains amid fluctuating prices, seeking to avoid panic selling during sudden dips. Conversely, price surges trigger FOMO, compelling traders to buy hastily, driven by fear of missing short-term profit opportunities. This cyclical interaction between volatility, HODL steadfastness, and FOMO-driven impulsiveness shapes cryptocurrency market dynamics and trading volumes.

Tips for Balancing Emotions and Making Rational Crypto Decisions

Managing emotions in cryptocurrency trading involves setting clear investment goals and sticking to a predetermined strategy like HODL to avoid impulsive decisions driven by FOMO (Fear of Missing Out). Utilizing tools such as stop-loss orders and regularly reviewing portfolio performance helps maintain discipline and minimize losses during market volatility. Developing a balanced mindset through education on market trends and risk management techniques enhances rational decision-making and long-term success.

Building a Winning Strategy: Choosing Between HODL and FOMO

Building a winning cryptocurrency strategy requires understanding the key differences between HODL and FOMO approaches. HODL emphasizes long-term holding to capitalize on market growth and minimize losses from short-term volatility, while FOMO drives impulsive buying based on fear of missing out, often resulting in higher risk exposure. Prioritizing disciplined investment and leveraging market data for timing decisions enhances portfolio resilience and maximizes returns over time.

Important Terms

Diamond Hands

Diamond Hands signifies unwavering commitment to holding assets despite market volatility, prioritizing long-term value over impulsive selling driven by FOMO (Fear Of Missing Out). This strategy contrasts sharply with HODL, which simply means holding assets but may not emphasize the emotional resilience and conviction embodied by Diamond Hands.

Paper Hands

Paper Hands refers to investors who quickly sell their assets at the first sign of market volatility, contrasting with HODLers who hold their investments long-term despite fluctuations; this behavior often stems from FOMO, driving impulsive decisions that undermine potential gains. Understanding the psychology behind Paper Hands versus HODL strategies is crucial for maximizing returns and avoiding market panic selling.

Whale Watching

Whale watching in cryptocurrency refers to tracking large holders who HODL significant amounts of digital assets, influencing market stability through steady accumulation, while FOMO (Fear of Missing Out) often triggers rapid buying frenzies among small investors, amplifying volatility. Understanding whale behavior provides critical insights into market trends, helping traders differentiate between calculated holding strategies and impulsive FOMO-driven price spikes.

Pump and Dump

Pump and Dump schemes exploit FOMO-driven investors by artificially inflating cryptocurrency prices before rapidly selling off to realize profits, leaving HODLers vulnerable to significant losses. Understanding the distinction between strategic HODLing and impulsive FOMO buying is crucial to avoiding these market manipulations.

Bagholder

A bagholder is an investor left holding a depreciated asset after succumbing to FOMO (Fear of Missing Out) rather than practicing HODL (Hold On for Dear Life), which emphasizes long-term holding despite market volatility. Understanding the distinction between HODL and FOMO is crucial to avoid becoming a bagholder, as impulsive buying during hype often leads to significant losses.

Fear, Uncertainty, and Doubt (FUD)

Fear, Uncertainty, and Doubt (FUD) often drives investors to abandon HODL strategies in favor of impulsive FOMO-induced trades, causing market volatility and inconsistent portfolio growth. Recognizing FUD patterns enables disciplined investors to maintain long-term HODL positions, minimizing panic selling and capitalizing on sustained cryptocurrency appreciation.

Mooning

Mooning in cryptocurrency refers to a rapid and substantial increase in an asset's price, often prompting investors to decide between HODL--holding onto their assets long-term to maximize gains--and FOMO, the fear of missing out that drives impulsive buying during price surges. Understanding the dynamics of mooning helps traders weigh the benefits of patient HODLing against the risks of FOMO-fueled market entries, optimizing investment strategies in volatile crypto markets.

Weak Hands

Weak Hands refers to investors who sell their assets quickly under market pressure, contrasting with HODL, a strategy emphasizing holding assets long-term despite volatility. Unlike FOMO-driven traders who buy impulsively during price surges, Weak Hands lack the conviction to withstand market downturns, often leading to premature losses.

Panic Sell

Panic selling occurs when investors rapidly sell assets due to fear, often triggered by market downturns, contrasting with HODL strategies that emphasize holding through volatility to maximize long-term gains. Unlike FOMO-driven buying fueled by fear of missing out, panic selling typically results in losses as sellers exit positions at low prices.

Buy the Dip

Buying the dip involves purchasing assets during temporary price declines, capitalizing on market volatility while HODL (hold on for dear life) focuses on long-term asset retention regardless of short-term fluctuations. Unlike FOMO (fear of missing out), which drives impulsive buying during price surges, buying the dip uses strategic patience to maximize returns by entering positions at lower prices.

HODL vs FOMO Infographic

moneydif.com

moneydif.com