Coins operate independently on their own blockchain, serving primarily as digital money or store of value. Tokens are built on existing blockchains and represent assets or utilities within specific ecosystems, often used for accessing services or voting rights. Understanding the distinction between coins and tokens is crucial for making informed investment and development decisions in the cryptocurrency space.

Table of Comparison

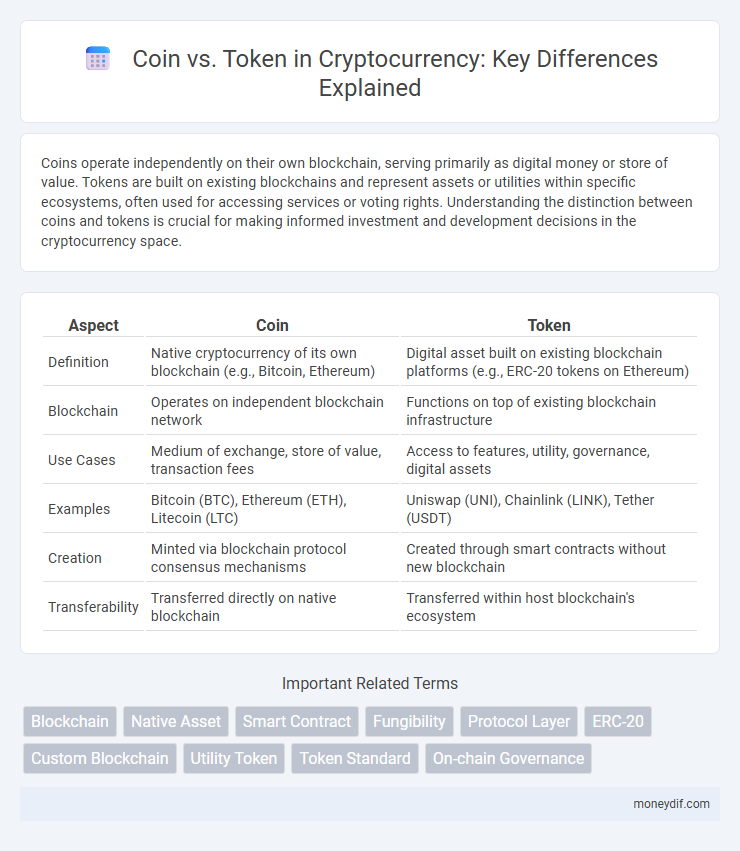

| Aspect | Coin | Token |

|---|---|---|

| Definition | Native cryptocurrency of its own blockchain (e.g., Bitcoin, Ethereum) | Digital asset built on existing blockchain platforms (e.g., ERC-20 tokens on Ethereum) |

| Blockchain | Operates on independent blockchain network | Functions on top of existing blockchain infrastructure |

| Use Cases | Medium of exchange, store of value, transaction fees | Access to features, utility, governance, digital assets |

| Examples | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) | Uniswap (UNI), Chainlink (LINK), Tether (USDT) |

| Creation | Minted via blockchain protocol consensus mechanisms | Created through smart contracts without new blockchain |

| Transferability | Transferred directly on native blockchain | Transferred within host blockchain's ecosystem |

Understanding the Basics: What Are Coins and Tokens?

Coins operate on their own blockchain and function primarily as digital money, like Bitcoin or Ethereum, facilitating transactions and store of value. Tokens are built on existing blockchains, most commonly Ethereum, and represent assets or utilities such as access rights, rewards, or digital collectibles. Distinguishing between coins and tokens is fundamental to navigating cryptocurrency markets, as their roles, functionalities, and underlying technologies differ significantly.

Key Differences Between Coins and Tokens

Coins operate on their own independent blockchain, serving primarily as digital currency for transactions and value storage, whereas tokens are built on existing blockchains and represent assets or utilities within specific platforms. Coins like Bitcoin and Ethereum function as native assets facilitating payments and security, while tokens such as ERC-20 or BEP-20 often grant access to services, voting rights, or represent digital collectibles. The critical distinction lies in blockchain independence and functional purpose, with coins often underpinning entire blockchain networks and tokens leveraging those networks to enable diverse applications.

The Role of Coins in Cryptocurrency Ecosystems

Coins serve as the fundamental digital currencies in cryptocurrency ecosystems, operating on their own independent blockchains such as Bitcoin or Ethereum. They facilitate peer-to-peer transactions, store value, and provide a basis for network security through consensus mechanisms like Proof of Work or Proof of Stake. Unlike tokens, coins function as native assets that underpin the economic infrastructure and incentivize network participation.

How Tokens Power Decentralized Applications

Tokens serve as programmable assets that power decentralized applications (dApps) by enabling functionalities such as governance, access control, and value exchange within blockchain ecosystems. Unlike coins, which primarily function as native currency on their respective blockchains, tokens operate on existing blockchain platforms like Ethereum through smart contracts, providing customizable utility and interoperability. These programmable tokens facilitate decentralized finance (DeFi), gaming, and digital identity applications, fostering innovation and user engagement across multiple sectors.

Blockchain Platforms: Where Coins and Tokens Operate

Coins operate on their own native blockchain platforms, such as Bitcoin on the Bitcoin blockchain or Ether on the Ethereum blockchain, providing fundamental network functions like transaction validation and security. Tokens, by contrast, exist on established blockchains like Ethereum, Binance Smart Chain, or Solana, leveraging these platforms' underlying protocols to create and manage digital assets, utilities, or securities. Understanding the distinction between native coins and platform-specific tokens is essential for navigating cryptocurrency ecosystems and their diverse use cases.

Use Cases: When to Choose Coins vs. Tokens

Coins function as native assets on independent blockchains, primarily used for value transfer, network fees, and as store-of-value mediums. Tokens operate on existing blockchain platforms, enabling diverse use cases such as representing assets, access rights, or participation in decentralized applications (dApps). Choose coins for fundamental blockchain transactions and tokens for specialized functions like utility, governance, or asset representation.

Creation Process: How Coins and Tokens Are Minted

Coins are created through a process called mining or staking on their native blockchain, involving consensus algorithms like Proof of Work or Proof of Stake to validate transactions and secure the network. Tokens are minted on existing blockchains, such as Ethereum, by deploying smart contracts that generate and manage token supply without the need for mining. The creation of coins requires dedicated blockchain infrastructure, while tokens leverage programmable protocols on established platforms for issuance and distribution.

Security and Regulation: Comparing Coins and Tokens

Coins operate on their own independent blockchains, offering enhanced security through dedicated consensus mechanisms and cryptographic protocols. Tokens, built on existing blockchain platforms like Ethereum, inherit the security features of their underlying blockchains but may face increased regulatory scrutiny due to their diverse functionalities, such as utility or security tokens. Regulatory bodies often distinguish between coins as currencies and tokens as investment instruments, impacting compliance requirements and legal frameworks in the cryptocurrency market.

Investing in Coins vs. Tokens: Risks and Rewards

Investing in coins, which operate on their own blockchain like Bitcoin or Ethereum, typically offers greater security and liquidity due to wider adoption and robust underlying technology. Tokens, created on existing blockchains like Ethereum's ERC-20 standard, often present higher volatility and risk but potential for significant returns through innovative use cases such as decentralized finance (DeFi) and non-fungible tokens (NFTs). Understanding the technological foundation and market behavior of both coins and tokens is critical for balancing risk and reward in cryptocurrency investments.

The Future of Coins and Tokens in the Crypto Market

Coins like Bitcoin and Ethereum operate on their own independent blockchains, offering foundational digital currencies, while tokens are built on existing blockchain platforms, representing assets or utilities within specific ecosystems. The future of coins is likely to involve increased adoption as stores of value and mediums of exchange, whereas tokens will continue to drive innovation in decentralized finance (DeFi), non-fungible tokens (NFTs), and governance models. Emerging trends indicate greater interoperability and regulatory clarity will shape the evolving landscape of both coins and tokens in the crypto market.

Important Terms

Blockchain

Blockchain technology enables the creation of both coins and tokens, where coins like Bitcoin operate on their own independent blockchain and serve as a digital currency, while tokens are built on existing blockchains such as Ethereum and represent assets or utilities within a specific project or ecosystem. Coins typically function as a medium of exchange or store of value, whereas tokens can embody a wide range of functions including governance rights, access to services, or representation of physical assets.

Native Asset

Native assets are cryptocurrencies built directly on a blockchain's protocol, such as Bitcoin on the Bitcoin network or Ether on Ethereum, serving as the fundamental currency for transaction fees and network security. In contrast, tokens are digital assets created on existing blockchains using smart contracts, often representing assets or utilities within decentralized applications without native blockchain status.

Smart Contract

Smart contracts automate transactions and enforce rules on blockchain networks, enabling the creation and management of both coins and tokens with distinct functionalities. Coins represent native cryptocurrencies like Bitcoin or Ethereum, while tokens are built on existing blockchains, often serving specific utilities or assets within decentralized applications.

Fungibility

Fungibility refers to the ability of an asset to be interchangeable with another unit of the same kind, which is a key characteristic of cryptocurrencies like Bitcoin (a coin) that operate on their own blockchain. Tokens, often issued on existing blockchains such as Ethereum, can be fungible like ERC-20 tokens or non-fungible (NFTs), impacting their interchangeability and use cases in digital transactions.

Protocol Layer

The protocol layer defines the foundational blockchain infrastructure where coins like Bitcoin and Ether operate as native assets essential for network security and transaction validation. Tokens, however, are built atop this protocol layer using smart contracts, representing assets or utilities without owning the underlying blockchain's consensus rules.

ERC-20

ERC-20 defines a technical standard used for creating tokens on the Ethereum blockchain, enabling interoperability and seamless transactions within the Ethereum ecosystem. Unlike coins such as Ether (ETH), which operate on their native blockchain, ERC-20 tokens exist as digital assets on the Ethereum network, representing various types of value or utility.

Custom Blockchain

Custom blockchains offer the ability to create native coins that operate as the primary currency within their ecosystem, while tokens are typically built on existing blockchains like Ethereum through smart contracts. Choosing between coins and tokens depends on the level of blockchain customization required, with coins providing greater autonomy and control over consensus mechanisms and network protocols.

Utility Token

Utility tokens function as digital assets that provide users access to a product or service within a blockchain ecosystem, differing from coins which primarily serve as a medium of exchange or store of value on their native blockchain. Unlike coins such as Bitcoin or Ethereum, utility tokens are often issued through Initial Coin Offerings (ICOs) on existing platforms and do not operate independently as standalone cryptocurrencies.

Token Standard

Token standards like ERC-20 on Ethereum define a set of rules for creating fungible tokens, enabling interoperability and standardized transactions across platforms. Unlike coins, which operate independently on their own blockchain, tokens exist on existing blockchains and represent assets or utilities tied to smart contracts.

On-chain Governance

On-chain governance enables transparent decision-making directly on the blockchain, allowing token holders to vote on protocol upgrades or changes, contrasting with coins like Bitcoin that often rely on off-chain governance mechanisms. Tokens issued on blockchain platforms typically integrate governance features granting holders influence over project development, protocol rules, and ecosystem funding.

Coin vs Token Infographic

moneydif.com

moneydif.com