Gas fees are the transaction costs required to process and validate operations on a blockchain, while slippage refers to the difference between the expected price of a cryptocurrency trade and the actual executed price. High gas fees can increase the overall cost of transactions, especially during network congestion, whereas significant slippage can result in less favorable trade outcomes. Understanding the balance between gas costs and slippage is crucial for optimizing trading strategies and reducing losses in volatile markets.

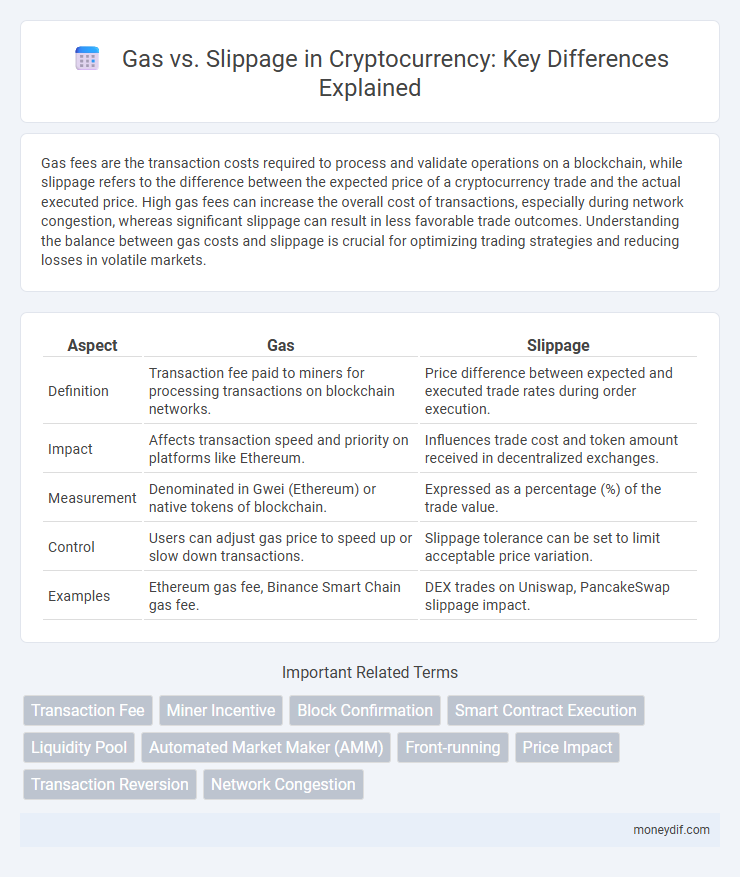

Table of Comparison

| Aspect | Gas | Slippage |

|---|---|---|

| Definition | Transaction fee paid to miners for processing transactions on blockchain networks. | Price difference between expected and executed trade rates during order execution. |

| Impact | Affects transaction speed and priority on platforms like Ethereum. | Influences trade cost and token amount received in decentralized exchanges. |

| Measurement | Denominated in Gwei (Ethereum) or native tokens of blockchain. | Expressed as a percentage (%) of the trade value. |

| Control | Users can adjust gas price to speed up or slow down transactions. | Slippage tolerance can be set to limit acceptable price variation. |

| Examples | Ethereum gas fee, Binance Smart Chain gas fee. | DEX trades on Uniswap, PancakeSwap slippage impact. |

Understanding Gas Fees in Cryptocurrency Transactions

Gas fees in cryptocurrency transactions represent the cost required to execute operations on a blockchain, primarily in networks like Ethereum. These fees compensate miners or validators for processing and validating the transaction, calculated based on computational complexity and network congestion. Understanding gas fees is crucial for optimizing transaction costs and avoiding delays during periods of high demand.

What is Slippage and Why Does It Matter?

Slippage refers to the difference between the expected price of a cryptocurrency trade and the actual price at which the trade is executed. It matters because high slippage can significantly increase transaction costs, especially in volatile markets or low liquidity pools, impacting the overall profitability of trades. Understanding slippage helps traders optimize their order timing and choice of trading platforms to minimize unexpected losses.

Key Differences Between Gas Fees and Slippage

Gas fees represent the transaction costs paid to miners or validators to process and confirm blockchain transactions, directly impacting the speed and priority of execution. Slippage refers to the difference between the expected price of a cryptocurrency trade and the actual execution price, often caused by market volatility or low liquidity. Unlike gas fees, which are fixed network charges, slippage is an economic impact on trade value influenced by market conditions and order size.

How Blockchain Networks Determine Gas Costs

Blockchain networks determine gas costs based on network demand, computational complexity, and transaction type to ensure efficient resource allocation and prevent spam. Ethereum, for example, uses a dynamic fee model that adjusts gas prices according to current network congestion and base fee calculations. Miners prioritize transactions offering higher gas fees, influencing users to strategically set gas limits and fees to balance speed and cost.

Factors Influencing Slippage in Crypto Trading

Slippage in crypto trading is primarily influenced by market volatility, trading volume, and order size relative to the liquidity pool. Rapid price fluctuations cause execution prices to deviate from expected values, while low liquidity amplifies price impact for large orders. Understanding how these factors interact helps traders minimize unexpected costs beyond gas fees.

Strategies to Minimize Gas Fees

Minimizing gas fees in cryptocurrency transactions involves timing trades during network off-peak hours when gas prices are lower and adjusting gas limits manually to avoid overpayment. Using layer 2 solutions such as Polygon or Optimism significantly reduces gas costs by processing transactions off the main Ethereum chain. Implementing these strategies helps traders optimize transaction costs and improve profitability in decentralized finance interactions.

Tips to Reduce Slippage Risks

To reduce slippage risks in cryptocurrency trading, set a slippage tolerance that balances execution speed and price stability, typically between 0.1% and 1%. Use limit orders instead of market orders to control the exact price at which trades are executed, minimizing unexpected price changes. Monitor gas fees closely, as higher gas prices can speed transaction processing, decreasing the chance of slippage during volatile market conditions.

Impact of Network Congestion on Gas and Slippage

Network congestion significantly increases gas fees as more users compete to have their transactions processed quickly, driving up the price per unit of gas. High congestion also exacerbates slippage, causing the executed trade price to deviate further from the expected price due to delayed transaction confirmation. Understanding the correlation between network congestion, gas costs, and slippage is crucial for optimizing transaction timing and minimizing unexpected trading expenses on blockchain platforms.

Comparing Gas and Slippage Across Major Exchanges

Gas fees on major cryptocurrency exchanges like Binance and Coinbase typically fluctuate based on network congestion and transaction complexity, with Ethereum gas fees often reaching high levels during peak usage. Slippage, experienced during trade execution on platforms such as Uniswap and PancakeSwap, varies depending on liquidity and market volatility, frequently increasing for large orders or less liquid tokens. Comparing gas and slippage reveals that while gas fees are fixed transaction costs paid to miners, slippage represents the price impact within order books, both significantly affecting trading costs and execution quality.

Optimizing Transactions: Balancing Gas and Slippage

Optimizing cryptocurrency transactions requires a careful balance between gas fees and slippage to maximize efficiency and cost-effectiveness. Users should set gas prices that ensure timely transaction confirmation without overpayment, while adjusting slippage tolerance to avoid failed trades or excessive price impact. Advanced tools and real-time market data can help traders dynamically manage these parameters, enhancing overall trading performance and minimizing losses.

Important Terms

Transaction Fee

Transaction fees in blockchain networks are primarily influenced by gas prices, which represent the computational cost required to execute operations, while slippage refers to the price difference caused by market volatility during transaction processing. Higher gas fees can expedite transaction confirmation, reducing slippage risk, whereas lower gas fees may delay processing and increase exposure to unfavorable price changes.

Miner Incentive

Miner incentive strongly depends on maximizing gas fees while minimizing slippage risks during transaction execution, as higher gas fees directly increase miner rewards and excessive slippage can reduce transaction profitability. Efficiently balancing gas price selection with slippage tolerance ensures optimal miner revenue and smoother transaction confirmations on blockchain networks.

Block Confirmation

Block confirmation ensures transaction finality on the blockchain by validating that a block has been added to the chain, directly impacting gas fees and slippage. Higher gas fees accelerate block confirmation times, reducing slippage risk by minimizing price fluctuations during transaction processing.

Smart Contract Execution

Smart contract execution efficiency directly impacts gas consumption, where optimizing transaction logic reduces gas fees and prevents excessive expenditure. High slippage in decentralized exchanges can inflate gas costs by causing repeated contract interactions, emphasizing the need for precise gas estimation and slippage tolerance settings.

Liquidity Pool

Liquidity pools provide the essential token reserves enabling decentralized trading, where gas fees cover transaction execution on the blockchain and slippage measures price variations between order placement and fulfillment. High gas costs can limit transaction frequency, while low liquidity increases slippage, impacting trade efficiency and user cost.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) optimize trade execution by balancing gas fees and slippage, where higher gas fees can reduce slippage through faster transactions in decentralized exchanges. Efficient AMM algorithms dynamically adjust liquidity pool prices to minimize slippage while managing transaction costs on blockchain networks like Ethereum.

Front-running

Front-running exploits gas price manipulation to prioritize transactions, resulting in higher transaction fees and increased slippage for other users. Elevated gas bids accelerate execution but cause significant price impact, deteriorating token swap efficiency.

Price Impact

Price impact refers to the change in an asset's price caused by a trade, often influenced by gas fees in blockchain transactions and slippage during order execution. High gas fees can increase transaction costs, while slippage represents the difference between expected and actual trade prices, both affecting overall price impact in decentralized finance (DeFi) trading.

Transaction Reversion

Transaction reversion occurs when a blockchain transaction fails due to insufficient gas or unfavorable slippage conditions, causing the entire operation to be rolled back. Optimizing gas limits and setting appropriate slippage tolerance is crucial to prevent reversion and ensure successful transaction execution in decentralized finance protocols.

Network Congestion

Network congestion occurs when transaction demand exceeds blockchain capacity, causing increased gas fees and delays. Higher gas prices can reduce slippage by incentivizing faster confirmations, while low gas fees during congestion lead to greater slippage due to delayed or failed transactions.

Gas vs Slippage Infographic

moneydif.com

moneydif.com