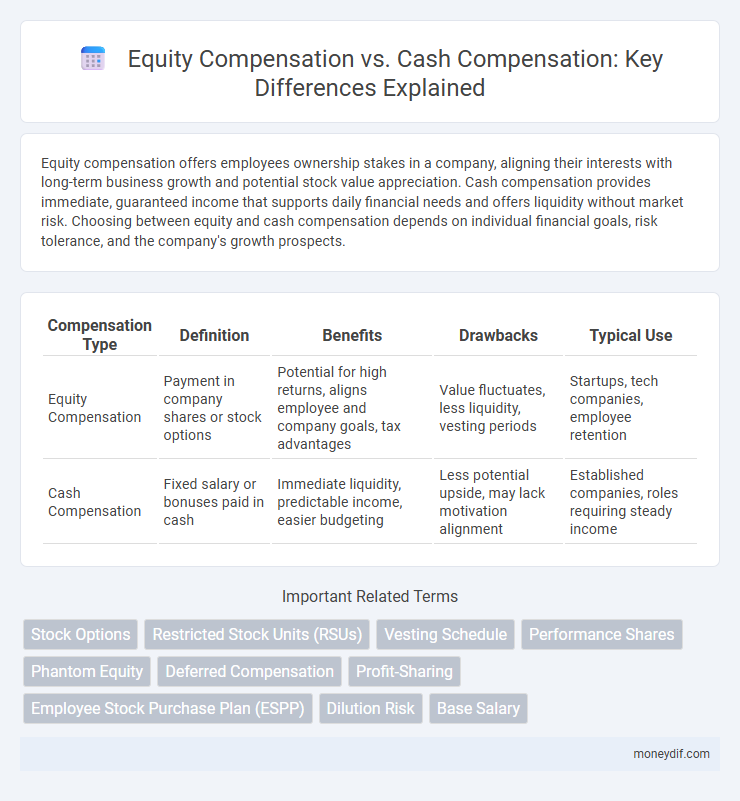

Equity compensation offers employees ownership stakes in a company, aligning their interests with long-term business growth and potential stock value appreciation. Cash compensation provides immediate, guaranteed income that supports daily financial needs and offers liquidity without market risk. Choosing between equity and cash compensation depends on individual financial goals, risk tolerance, and the company's growth prospects.

Table of Comparison

| Compensation Type | Definition | Benefits | Drawbacks | Typical Use |

|---|---|---|---|---|

| Equity Compensation | Payment in company shares or stock options | Potential for high returns, aligns employee and company goals, tax advantages | Value fluctuates, less liquidity, vesting periods | Startups, tech companies, employee retention |

| Cash Compensation | Fixed salary or bonuses paid in cash | Immediate liquidity, predictable income, easier budgeting | Less potential upside, may lack motivation alignment | Established companies, roles requiring steady income |

Understanding Equity Compensation vs Cash Compensation

Equity compensation grants employees ownership stakes through stock options or shares, aligning their interests with company growth and long-term value creation. Cash compensation provides immediate, guaranteed income through salaries and bonuses, offering financial stability and liquidity. Understanding the trade-offs between potential long-term gains from equity and the certainty of cash compensation is essential for making informed career and financial decisions.

Key Differences Between Equity and Cash Compensation

Equity compensation offers employees partial ownership in a company through stock options or shares, aligning their interests with long-term company performance and potential capital gains. Cash compensation provides immediate, guaranteed income via salary or bonuses, supporting short-term financial stability and liquidity. Key differences include risk exposure, vesting schedules, and tax implications, with equity carrying potential growth rewards but uncertain value, while cash delivers consistent and predictable earnings.

Pros and Cons of Equity Compensation

Equity compensation offers employees potential for significant financial growth through company stock value appreciation, aligning their interests with long-term corporate success. However, it carries risks such as stock price volatility and lack of liquidity, which can limit immediate financial benefits compared to cash compensation. Equity also often involves vesting periods, delaying full ownership and access, making cash compensation more reliable for short-term financial needs.

Pros and Cons of Cash Compensation

Cash compensation offers immediate financial liquidity and predictable income, allowing employees to cover living expenses and plan short-term needs effectively. However, it lacks the potential for wealth accumulation tied to company performance, which equity compensation provides through stock options or shares. Relying solely on cash compensation may limit long-term financial growth and employee investment in the company's success.

Tax Implications: Equity vs Cash Salary

Equity compensation is often taxed as capital gains, which can result in lower tax rates compared to ordinary income tax applied to cash salary. Cash compensation is subject to immediate income tax withholding and payroll taxes, increasing the overall tax burden upon receipt. Understanding the timing and type of tax events associated with equity versus cash compensation is crucial for effective financial planning.

Risk Factors in Equity and Cash Compensation

Equity compensation carries risk due to market volatility, potential dilution, and lack of liquidity compared to cash compensation, which provides immediate, guaranteed income without market exposure. Equity value fluctuates with company performance and stock market conditions, creating uncertainty and potential loss of value, while cash compensation ensures predictable earnings that support short-term financial stability. Risk tolerance and financial goals should guide the choice, as equity rewards long-term growth at the expense of short-term security inherent in cash salaries.

Impact on Employee Retention and Motivation

Equity compensation, such as stock options or restricted shares, aligns employees' financial interests with the company's long-term success, enhancing retention by fostering a sense of ownership and motivation to drive performance. Cash compensation provides immediate financial rewards, satisfying short-term needs but often lacks incentives for sustained commitment or company growth engagement. Companies leveraging equity compensation often see higher employee loyalty and motivation, as future financial gains are directly tied to company performance and tenure.

Equity Compensation in Startups vs Established Companies

Equity compensation in startups often offers significant upside potential through stock options or restricted shares, aligning employee incentives with company growth and future valuation. Established companies tend to provide equity as part of a more balanced compensation package, with restricted stock units (RSUs) offering stability and predictable value. The risk-reward profile of equity in startups contrasts sharply with established firms, where equity may be less volatile but also less likely to yield dramatic financial returns.

Negotiating Equity vs Cash Offers: Tips and Strategies

Negotiating equity versus cash offers requires a clear understanding of company valuation, vesting schedules, and liquidity timelines to accurately assess the total compensation value. Prioritize requests for detailed stock option agreements and explore opportunities for accelerated vesting or cash bonuses to mitigate risks associated with equity volatility. Research market equity benchmarks and leverage competitive cash compensation data to strengthen your negotiation position and align with your financial goals.

Making the Right Choice: Equity, Cash, or a Balanced Mix

Choosing between equity compensation and cash compensation hinges on individual financial goals, risk tolerance, and time horizon for potential growth. Equity can offer significant upside through stock price appreciation and alignment with company success, while cash provides immediate liquidity and financial stability. A balanced mix often maximizes benefits by combining steady income with long-term wealth-building opportunities and tax advantages.

Important Terms

Stock Options

Stock options provide employees with the right to purchase company shares at a fixed price, aligning their interests with shareholder value and offering potential long-term financial gain through equity appreciation. Equity compensation, such as stock options, often incentivizes performance and loyalty more effectively than cash compensation, which offers immediate but less growth-aligned reward.

Restricted Stock Units (RSUs)

Restricted Stock Units (RSUs) provide employees with company equity that vests over time, aligning long-term incentives, while cash compensation offers immediate, guaranteed income without equity ownership or potential stock value appreciation.

Vesting Schedule

A vesting schedule outlines the timeline over which employees earn ownership of equity compensation, typically stock options or shares, incentivizing long-term commitment and aligning interests with company growth. In contrast, cash compensation is usually paid immediately without vesting, providing instant liquidity but lacking the retention benefits inherent to equity vesting structures.

Performance Shares

Performance shares in equity compensation align employee incentives with company growth by granting stock-based awards contingent on performance metrics, offering potential long-term value beyond the immediate liquidity of cash compensation.

Phantom Equity

Phantom equity provides employees with benefits similar to actual equity compensation by granting value tied to company stock performance without transferring ownership, offering a cash equivalent payout upon vesting or triggering events. This structure aligns employee incentives with company success while avoiding dilution of equity, contrasting with direct cash compensation which lacks long-term investment ties and potential upside linked to company growth.

Deferred Compensation

Deferred compensation plans allow employees to postpone taxable income by receiving equity compensation such as stock options or restricted shares instead of immediate cash compensation, aligning long-term incentives with company performance.

Profit-Sharing

Profit-sharing plans enhance employee incentives by distributing company earnings, often integrated with equity compensation to align long-term shareholder value more effectively than cash compensation alone.

Employee Stock Purchase Plan (ESPP)

Employee Stock Purchase Plans (ESPP) offer equity compensation by allowing employees to purchase company shares at a discounted price, providing ownership incentives and potential capital gains compared to immediate cash compensation.

Dilution Risk

Dilution risk occurs when issuing new equity compensation such as stock options or shares reduces existing shareholders' ownership percentage, potentially decreasing the value of their holdings. In contrast, cash compensation avoids dilution but can impact company cash flow and profitability, making equity compensation a strategic tool to align employee incentives without immediate cash outlay.

Base Salary

Base salary forms the fixed cash compensation component, while equity compensation grants ownership stakes that align employee incentives with long-term company performance.

Equity Compensation vs Cash Compensation Infographic

moneydif.com

moneydif.com