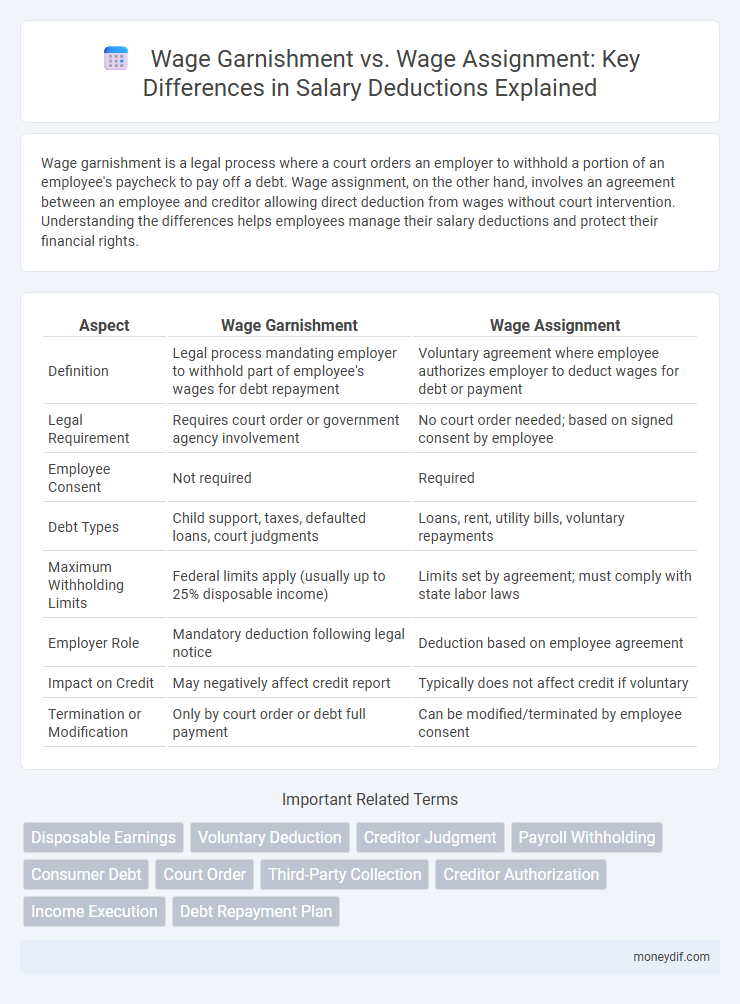

Wage garnishment is a legal process where a court orders an employer to withhold a portion of an employee's paycheck to pay off a debt. Wage assignment, on the other hand, involves an agreement between an employee and creditor allowing direct deduction from wages without court intervention. Understanding the differences helps employees manage their salary deductions and protect their financial rights.

Table of Comparison

| Aspect | Wage Garnishment | Wage Assignment |

|---|---|---|

| Definition | Legal process mandating employer to withhold part of employee's wages for debt repayment | Voluntary agreement where employee authorizes employer to deduct wages for debt or payment |

| Legal Requirement | Requires court order or government agency involvement | No court order needed; based on signed consent by employee |

| Employee Consent | Not required | Required |

| Debt Types | Child support, taxes, defaulted loans, court judgments | Loans, rent, utility bills, voluntary repayments |

| Maximum Withholding Limits | Federal limits apply (usually up to 25% disposable income) | Limits set by agreement; must comply with state labor laws |

| Employer Role | Mandatory deduction following legal notice | Deduction based on employee agreement |

| Impact on Credit | May negatively affect credit report | Typically does not affect credit if voluntary |

| Termination or Modification | Only by court order or debt full payment | Can be modified/terminated by employee consent |

Understanding Wage Garnishment

Wage garnishment is a legal process where a portion of an employee's earnings is withheld by the employer for debt repayment based on a court order, commonly arising from unpaid taxes, child support, or creditor judgments. It involves direct deductions from wages and is strictly regulated by federal and state laws, including limits on the percentage of income that can be garnished to protect the employee's financial stability. Understanding wage garnishment is essential for employees to know their rights, the legal basis for deductions, and how it impacts take-home pay.

What Is a Wage Assignment?

A wage assignment is a voluntary agreement where an employee authorizes their employer to deduct a specified amount from their paycheck to repay a debt. Unlike wage garnishment, which is court-ordered and mandatory, wage assignments are typically negotiated directly between the debtor and creditor. Wage assignments are often used for debt repayment plans, such as loans or credit card debts, providing a structured way to manage salary deductions without legal intervention.

Key Differences Between Wage Garnishment and Wage Assignment

Wage garnishment is a court-ordered deduction from an employee's paycheck to repay debts, whereas wage assignment is a voluntary agreement where the employee consents to regular deductions. Garnishments typically prioritize federal and state tax liabilities and have legal limits on deduction amounts, while assignments depend on the terms set between the employer and employee. Employers must comply with garnishment orders by law, but wage assignments rely on employee authorization, which can be revoked at any time.

Legal Processes Involved in Wage Garnishment

Wage garnishment is a legal process where a court orders an employer to withhold a portion of an employee's wages to pay a debt, ensuring creditor repayment through a formal judicial procedure. This process typically requires a court judgment or government agency order, following strict legal guidelines and employee rights protections outlined in federal and state laws. Wage assignments, in contrast, involve a voluntary agreement between employee and creditor without court intervention, lacking the formal legal safeguards present in wage garnishment.

Voluntary vs Involuntary Deductions

Wage garnishment is an involuntary deduction mandated by a court order, typically used to satisfy debts such as child support, taxes, or unpaid loans, where a portion of an employee's earnings is withheld directly by the employer. Wage assignment, on the other hand, is a voluntary deduction authorized by the employee, allowing creditors to collect payments like loan repayments or union dues directly from wages. Understanding the distinction between these involuntary garnishments and voluntary assignments is essential for employees to manage their paycheck deductions effectively.

Employee Rights Under Wage Garnishment and Assignment

Employees facing wage garnishment have legal protections that limit the amount an employer can withhold from their paycheck, ensuring a portion of their earnings remains for essential living expenses. Wage assignment, often based on voluntary agreements, typically lacks the statutory protections of garnishment, potentially exposing employees to full withholding of agreed-upon wages. Understanding the distinction between these processes is crucial for employees to safeguard their financial stability and assert their rights under federal and state laws.

Employer Responsibilities and Compliance

Employers must carefully differentiate between wage garnishment and wage assignment to ensure compliance with legal requirements and avoid penalties. In wage garnishment, employers are legally obligated to withhold a specified portion of an employee's wages based on a court order and remit it to the creditor, while wage assignments require employee consent and typically involve a voluntary deduction authorization. Adhering to federal and state laws, including the Consumer Credit Protection Act (CCPA), is essential for employers to maintain accurate records, notify employees properly, and protect against liability in wage withholding processes.

Impact on Credit and Financial Health

Wage garnishment directly impacts credit by appearing on credit reports and signaling financial distress to lenders, potentially lowering credit scores. Wage assignment, being a voluntary agreement, typically does not affect credit reports or credit scores, preserving financial reputation. Understanding the differences helps individuals manage their financial health and maintain better credit standing.

How to Avoid Wage Garnishment or Assignment

To avoid wage garnishment or wage assignment, prioritize proactive communication with creditors to negotiate payment plans or settlements before legal actions occur. Maintaining an emergency fund and monitoring credit reports regularly can help detect financial risks early, preventing enforceable deductions from your paycheck. Consulting with a financial advisor or credit counselor provides personalized strategies to manage debt and protect your income from garnishment or assignment.

Frequently Asked Questions About Wage Deductions

Wage garnishment is a legal process where a portion of an employee's earnings is withheld by the employer to pay off a debt after a court order, while wage assignment is a voluntary agreement between the employee and creditor to deduct funds directly from wages. Common questions about wage deductions include how much can be garnished, which debts qualify for garnishment, and employee rights regarding notice and dispute procedures. Understanding the differences is crucial for employees to protect their income and ensure compliance with state and federal wage laws.

Important Terms

Disposable Earnings

Disposable earnings refer to the income left after legally required deductions such as taxes and Social Security, which are critical in determining the amount subject to wage garnishment or wage assignment. Wage garnishment involuntarily withholds a percentage of disposable earnings to satisfy a debt, while wage assignment involves a voluntary agreement to allocate funds from disposable earnings toward a creditor.

Voluntary Deduction

Voluntary deduction involves an employee's explicit consent for a portion of wages to be withheld, contrasting with wage garnishment which is a court-ordered deduction for debt repayment. Wage assignment, unlike garnishment, is a private agreement between employer and employee without court intervention, allowing specified amounts to be deducted directly from wages.

Creditor Judgment

Creditor judgment enforces debt repayment through wage garnishment, a court-ordered deduction from wages, whereas wage assignment involves a voluntary agreement allowing creditors to collect directly from an employee's paycheck.

Payroll Withholding

Payroll withholding legally deducts wages for tax or debt obligations, while wage garnishment is a court-ordered deduction for creditor claims, and wage assignment is a voluntary wage deduction agreement.

Consumer Debt

Consumer debt repayment through wage garnishment legally compels employers to withhold a portion of an employee's wages, while wage assignment involves a voluntary agreement where the debtor directs their employer to deduct payments, impacting the management of outstanding consumer debts.

Court Order

A court order for wage garnishment legally mandates withholding a portion of an employee's earnings to satisfy a debt, unlike a wage assignment, which is a voluntary agreement between employer and employee for wage deduction.

Third-Party Collection

Third-party collection involves a creditor hiring an external agency to recover debts, whereas wage garnishment is a legal process allowing creditors to directly deduct funds from an employee's wages, and wage assignment is a voluntary agreement where the employee authorizes the employer to withhold wages for debt repayment.

Creditor Authorization

Creditor authorization determines whether a wage garnishment, a court-ordered deduction, or a wage assignment, a voluntary employee consent, is applicable for debt repayment.

Income Execution

Income execution is a legal process used to enforce court-ordered debt payments by directly deducting funds from a debtor's wages, with wage garnishment being the most common method authorized under federal law, requiring employers to withhold a portion of earnings to satisfy debts. Wage assignment differs as it involves the debtor voluntarily assigning a portion of their wages to a creditor, typically through a signed agreement, and is often subject to different regulations and limitations compared to involuntary wage garnishment.

Debt Repayment Plan

A Debt Repayment Plan structured through wage garnishment legally requires an employer to withhold a portion of an employee's wages to repay creditors, often involving court orders and federal limits on garnishment amounts. In contrast, a wage assignment is a voluntary agreement between the debtor and creditor allowing direct deductions from wages without court intervention, typically providing more flexible repayment terms but less legal protection.

Wage Garnishment vs Wage Assignment Infographic

moneydif.com

moneydif.com