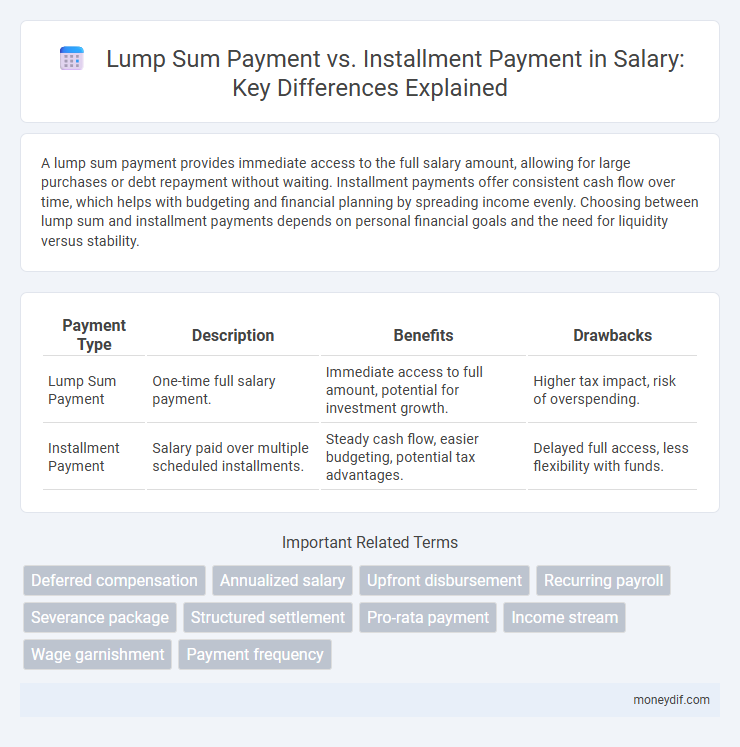

A lump sum payment provides immediate access to the full salary amount, allowing for large purchases or debt repayment without waiting. Installment payments offer consistent cash flow over time, which helps with budgeting and financial planning by spreading income evenly. Choosing between lump sum and installment payments depends on personal financial goals and the need for liquidity versus stability.

Table of Comparison

| Payment Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| Lump Sum Payment | One-time full salary payment. | Immediate access to full amount, potential for investment growth. | Higher tax impact, risk of overspending. |

| Installment Payment | Salary paid over multiple scheduled installments. | Steady cash flow, easier budgeting, potential tax advantages. | Delayed full access, less flexibility with funds. |

Understanding Lump Sum vs Installment Salary Payments

Lump sum salary payments provide employees with a full, one-time payment, often including bonuses or settlements, which can offer immediate financial flexibility and potential tax planning opportunities. Installment salary payments distribute income over a set period, promoting consistent cash flow and easier budget management for both employees and employers. Understanding the differences helps in choosing the optimal payment structure based on personal financial goals and organizational policies.

Key Differences Between Lump Sum and Installment Payments

Lump sum payments involve a single, full disbursement of salary, offering immediate access to the entire amount, which can be beneficial for large expenses or investments. Installment payments spread the salary over multiple periods, providing consistent cash flow and reducing the risk of overspending. The key differences include cash flow timing, financial planning flexibility, and potential tax implications based on the payment structure.

Pros and Cons of Lump Sum Salary Payments

Lump sum salary payments provide employees with immediate access to the full amount, enhancing financial flexibility and enabling large investments or debt repayment. However, this payment method can lead to cash flow management challenges, increasing the risk of rapid depletion and potential financial instability. Employers benefit from simplified payroll processing, but must consider potential tax implications and reduced employee satisfaction if funds are mismanaged.

Benefits and Drawbacks of Salary Installment Payments

Salary installment payments provide employees with a steady and predictable cash flow, enhancing budgeting and financial planning. However, installments may reduce immediate liquidity compared to lump sum payments, potentially limiting large one-time expenditures or investments. Employers benefit from improved cash management but must manage ongoing administrative costs associated with regular salary disbursements.

Tax Implications: Lump Sum vs Installments

Lump sum payments often trigger higher immediate tax liabilities due to the entire amount being taxed as income in a single fiscal year, potentially pushing earners into a higher tax bracket. In contrast, installment payments spread taxable income across multiple years, enabling better tax planning and possibly reducing overall tax burdens through lower annual taxable income. Employers and employees must evaluate tax regulations carefully to optimize after-tax income based on payment structure.

Impact on Employee Financial Planning

Lump sum payments provide employees with immediate access to a large sum, enabling significant financial decisions such as debt repayment or investment opportunities. Installment payments offer consistent cash flow, supporting steady budgeting and expense management over time. The choice between these payment methods significantly influences employees' ability to plan savings, manage taxes, and meet long-term financial goals.

Employer Considerations in Choosing Payment Methods

Employers weigh the financial stability and cash flow impact when choosing between lump sum and installment salary payments, as lump sum payments require a significant upfront expense while installments distribute costs over time. Tax implications and employee retention strategies also influence payment method decisions, with lump sums potentially serving as incentives or bonuses. Compliance with labor laws and payroll systems further determines the feasibility and administrative burden of each payment option.

Legal Aspects of Salary Payment Structures

Lump sum salary payments are often subject to specific legal requirements, including timely reporting and tax withholding obligations mandated by labor laws. Installment payments must comply with wage payment regulations that ensure consistent and periodic compensation to employees, preventing delays that could violate labor standards. Both payment structures require clear contractual agreements to avoid disputes and ensure compliance with employment laws governing salary disbursements.

Industry Trends: Lump Sum and Installment Preferences

Industry trends reveal a growing preference for lump sum payments in sectors with high employee turnover and contract-based roles, providing immediate financial benefits and simplifying payroll processes. Conversely, installment payments remain dominant in traditional industries like manufacturing and public service, supporting regular cash flow management for employees and employers alike. Data from recent surveys indicate 65% of tech companies favor lump sum disbursements, while 70% of government agencies adhere to monthly salary installments.

Choosing the Right Salary Payment Method

Choosing the right salary payment method depends on employee preferences and company cash flow management. Lump sum payments provide immediate full compensation, beneficial for budgeting large expenses, while installment payments offer consistent cash flow and regular financial stability. Employers must evaluate factors like tax implications, legal requirements, and financial planning to optimize salary disbursement for both parties.

Important Terms

Deferred compensation

Deferred compensation plans allow employees to receive earned income at a later date, often choosing between lump sum payments or installment payments, each impacting tax liabilities and cash flow differently. Lump sum payments provide immediate access to funds but may result in higher tax brackets, while installment payments spread income over time, potentially reducing tax burdens and offering steady financial support.

Annualized salary

Annualized salary calculations differ significantly when comparing lump sum payments, which provide immediate full compensation, to installment payments that distribute earnings over a specified period, impacting cash flow and tax liabilities.

Upfront disbursement

Upfront disbursement involves providing the entire lump sum payment at once, ensuring immediate access to full funds without incremental delays typical of installment payments. This method maximizes cash flow efficiency and reduces administrative costs compared to disbursed installments spread over time.

Recurring payroll

Recurring payroll management optimizes cash flow by comparing lump sum payments, which require immediate full disbursement, to installment payments that distribute salary expenses over multiple periods.

Severance package

Severance packages often include a choice between lump sum payment and installment payment, where a lump sum offers immediate full compensation but may have higher tax implications, while installment payments provide steady income over time with potential tax benefits and financial planning advantages. Evaluating the total payout, tax impact, and personal financial needs is crucial to determining the optimal severance payment method.

Structured settlement

Structured settlements provide periodic installment payments offering long-term financial security compared to a lump sum payment that delivers immediate access to total funds but carries higher risks of rapid depletion.

Pro-rata payment

Pro-rata payment allocates the total lump sum amount proportionally over the installment periods to ensure equitable distribution based on usage or time.

Income stream

Choosing a lump sum payment generates immediate capital for investment while installment payments provide a consistent income stream over time.

Wage garnishment

Wage garnishment impacts lump sum payments by requiring immediate full deductions, whereas installment payments allow for spread-out, manageable deductions over time.

Payment frequency

Payment frequency significantly impacts cash flow management when choosing between lump sum payments upfront and installment payments spread over time.

lump sum payment vs installment payment Infographic

moneydif.com

moneydif.com