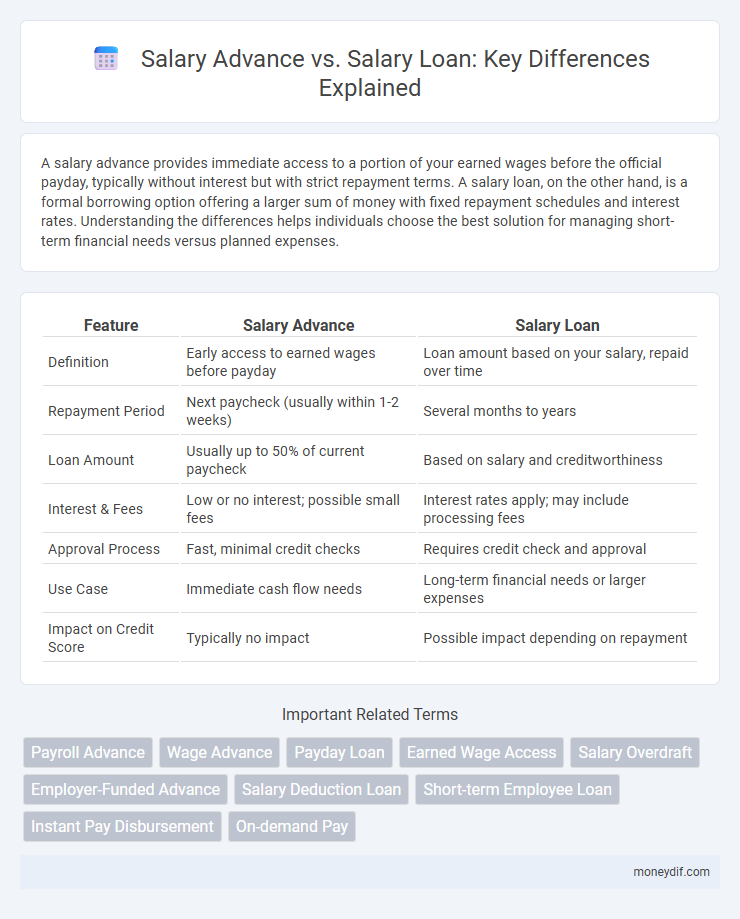

A salary advance provides immediate access to a portion of your earned wages before the official payday, typically without interest but with strict repayment terms. A salary loan, on the other hand, is a formal borrowing option offering a larger sum of money with fixed repayment schedules and interest rates. Understanding the differences helps individuals choose the best solution for managing short-term financial needs versus planned expenses.

Table of Comparison

| Feature | Salary Advance | Salary Loan |

|---|---|---|

| Definition | Early access to earned wages before payday | Loan amount based on your salary, repaid over time |

| Repayment Period | Next paycheck (usually within 1-2 weeks) | Several months to years |

| Loan Amount | Usually up to 50% of current paycheck | Based on salary and creditworthiness |

| Interest & Fees | Low or no interest; possible small fees | Interest rates apply; may include processing fees |

| Approval Process | Fast, minimal credit checks | Requires credit check and approval |

| Use Case | Immediate cash flow needs | Long-term financial needs or larger expenses |

| Impact on Credit Score | Typically no impact | Possible impact depending on repayment |

Understanding Salary Advance and Salary Loan

A salary advance is a short-term payment option allowing employees to access a portion of their upcoming paycheck before the official payday, typically with little or no interest. In contrast, a salary loan is a formal borrowing arrangement that involves repaying the borrowed amount over a set period, often with interest and requires credit evaluation. Understanding these differences helps employees make informed decisions based on their financial needs and repayment capabilities.

Key Differences Between Salary Advance and Salary Loan

Salary advance provides employees with early access to a portion of their upcoming paycheck, typically without interest but has lower borrowing limits and shorter repayment periods. Salary loans are formal loans with higher borrowing limits, interest rates, and structured repayment plans extending over weeks or months. Key differences include approval processes, cost implications, repayment flexibility, and impact on cash flow, where salary advances offer quick, interest-free funds and salary loans require credit evaluations and incur financing charges.

Eligibility Criteria for Salary Advance vs Salary Loan

Eligibility criteria for salary advance typically require employees to have a minimum tenure of three months with a stable income and active employment status, as this ensures the borrower can repay the advance before the next paycheck. Salary loans often have more stringent requirements, including a longer employment period of six months or more, proof of consistent salary deposits, and sometimes a good credit history to mitigate lending risks. Both financial options prioritize regular income verification but differ in the depth of eligibility assessments based on the loan amount and repayment terms.

Interest Rates and Fees Comparison

Salary advances typically involve lower or no interest rates but may include small processing fees, making them a cost-effective short-term cash solution. Salary loans often carry higher interest rates and additional fees, reflecting their longer repayment terms and higher risk for lenders. Comparing the two, salary advances are more affordable for immediate needs, while salary loans might be suitable for larger amounts despite incurring greater overall costs.

Application Process and Documentation Required

Salary advances typically involve a simpler application process requiring minimal documentation, such as proof of employment and recent pay slips, enabling quicker access to funds. Salary loans demand a more thorough application process, often including credit checks, detailed income verification, and sometimes collateral documentation to assess borrower reliability. Both options serve different financial needs, with salary advances suited for urgent, small fund requirements, while salary loans cater to larger, structured repayments.

Repayment Terms and Flexibility

Salary advances typically require repayment through automatic deductions from the employee's next paycheck, offering limited flexibility and short-term borrowing. Salary loans provide structured repayment terms over several pay periods, allowing borrowers to manage installments more effectively and negotiate terms based on their financial situation. The extended repayment schedule of salary loans reduces pressure on immediate funds, contrasting with the immediate deduction characteristic of salary advances.

Advantages of Salary Advance

Salary advance offers immediate access to funds by allowing employees to withdraw a portion of their upcoming paycheck without interest, providing a quick financial solution for urgent expenses. Unlike salary loans, salary advances typically require minimal paperwork and no credit checks, making them accessible to a wider range of employees. This option helps improve cash flow management without the burden of accumulating debt or high interest rates.

Benefits of Opting for a Salary Loan

Salary loans provide higher borrowing limits compared to salary advances, enabling employees to access larger funds for urgent needs or significant expenses. These loans generally offer flexible repayment terms spread over several months, reducing financial strain and improving cash flow management. Opting for a salary loan often includes lower interest rates and structured payment plans, enhancing affordability and long-term financial planning.

Potential Risks and Drawbacks

Salary advances often come with shorter repayment periods that can strain immediate cash flow, while salary loans typically have higher interest rates and extended debt obligations posing continuous financial pressure. Both salary advances and loans may lead to a cycle of dependency, increasing the risk of missed payments, credit score damage, and additional fees or penalties. Borrowers should carefully evaluate terms, potential hidden costs, and their ability to repay on time to avoid long-term financial setbacks.

Choosing the Best Option for Your Financial Needs

Salary advance provides quick access to a portion of your upcoming paycheck without interest but usually requires repayment by your next payday, making it ideal for urgent short-term cash needs. Salary loans involve borrowing a larger sum with fixed repayment terms and interest rates, offering more flexibility and time to manage larger expenses. Consider your financial situation, repayment ability, and urgency to determine whether a salary advance or salary loan better supports your cash flow and budget management.

Important Terms

Payroll Advance

Payroll advance offers immediate access to earned wages, while salary advances are short-term withdrawals against upcoming paychecks and salary loans provide longer repayment terms with interest.

Wage Advance

Wage advance provides immediate access to earned wages without interest, unlike salary loans which involve formal borrowing and repayment with interest over time.

Payday Loan

A Payday Loan offers quick cash but high interest, whereas a Salary Advance provides a portion of your upcoming paycheck interest-free, and a Salary Loan is a formal installment loan repaid through payroll deductions.

Earned Wage Access

Earned Wage Access provides employees instant access to earned wages without interest, unlike salary advances requiring repayment and salary loans involving formal credit checks and interest rates.

Salary Overdraft

Salary overdraft allows employees to access funds beyond their current salary balance, differing from salary advances which are early payments of earned wages, and salary loans which are formal borrowings repaid over time with interest.

Employer-Funded Advance

Employer-funded advances provide immediate access to earned wages without interest fees, distinguishing them from salary loans which typically involve borrowing costs and longer repayment terms.

Salary Deduction Loan

A Salary Deduction Loan differs from a Salary Advance and a Salary Loan by automatically deducting installments from the employee's paycheck, ensuring consistent repayment without requiring upfront cash like a Salary Advance or flexible terms typical of a Salary Loan.

Short-term Employee Loan

Short-term employee loans, such as salary advances and salary loans, offer immediate financial relief by allowing workers to access a portion of their earned wages before payday. Salary advances typically involve smaller amounts deducted from the next paycheck, whereas salary loans may have structured repayment terms and higher borrowing limits based on the employee's salary history and creditworthiness.

Instant Pay Disbursement

Instant Pay Disbursement enables employees to access salary advances immediately, offering faster liquidity compared to traditional salary loans that involve longer approval processes and repayment schedules.

On-demand Pay

On-demand pay offers immediate access to earned wages, distinguishing it from salary advances which are typically employer-driven and salary loans that involve borrowing with repayment terms and interest.

Salary Advance vs Salary Loan Infographic

moneydif.com

moneydif.com