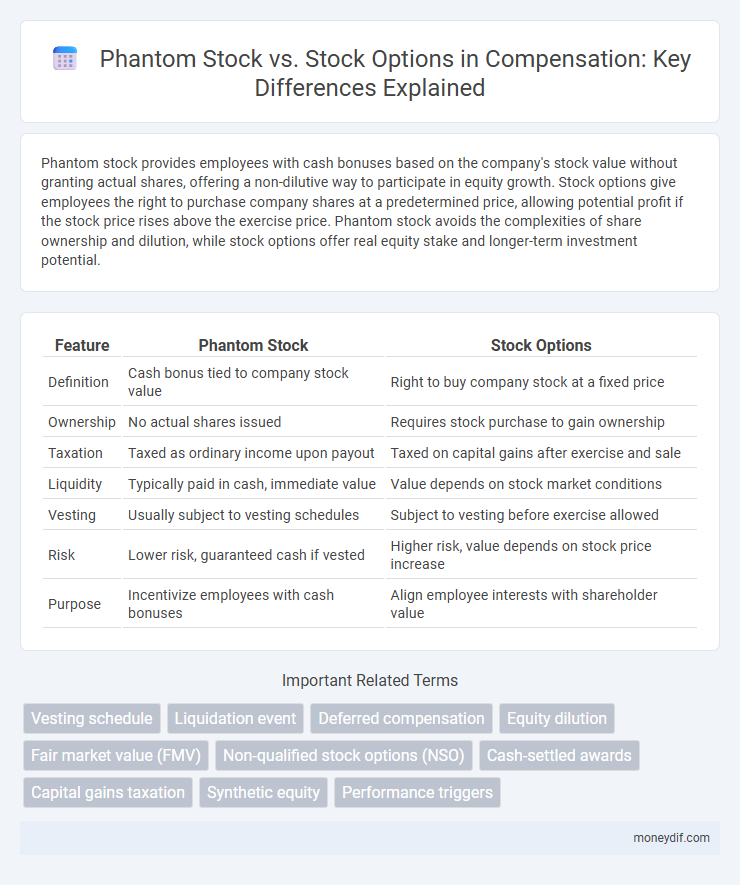

Phantom stock provides employees with cash bonuses based on the company's stock value without granting actual shares, offering a non-dilutive way to participate in equity growth. Stock options give employees the right to purchase company shares at a predetermined price, allowing potential profit if the stock price rises above the exercise price. Phantom stock avoids the complexities of share ownership and dilution, while stock options offer real equity stake and longer-term investment potential.

Table of Comparison

| Feature | Phantom Stock | Stock Options |

|---|---|---|

| Definition | Cash bonus tied to company stock value | Right to buy company stock at a fixed price |

| Ownership | No actual shares issued | Requires stock purchase to gain ownership |

| Taxation | Taxed as ordinary income upon payout | Taxed on capital gains after exercise and sale |

| Liquidity | Typically paid in cash, immediate value | Value depends on stock market conditions |

| Vesting | Usually subject to vesting schedules | Subject to vesting before exercise allowed |

| Risk | Lower risk, guaranteed cash if vested | Higher risk, value depends on stock price increase |

| Purpose | Incentivize employees with cash bonuses | Align employee interests with shareholder value |

Understanding Phantom Stock and Stock Options

Phantom stock grants employees the right to receive cash or stock payouts based on the company's stock value without actual equity transfer, offering a non-dilutive incentive aligned with company performance. Stock options provide the right to purchase shares at a predetermined price, enabling potential profit if the stock price increases, but require exercising and can lead to dilution of shares. Understanding the differences between phantom stock and stock options is crucial for structuring compensation packages that balance risk, reward, and employee motivation.

Key Differences Between Phantom Stock and Stock Options

Phantom stock represents a cash bonus equivalent to the value of company shares without actual equity transfer, while stock options grant the right to purchase shares at a fixed price. Phantom stock carries no purchase price or risk of losing money, unlike stock options which require exercising and can become worthless if the stock price falls below the exercise price. Phantom stock dividends are often paid in cash reflecting real stock appreciation, whereas stock options benefit primarily from capital gains through share ownership.

How Phantom Stock Plans Work

Phantom stock plans grant employees the right to receive a cash payment or stock equivalent based on the company's stock value without actual equity ownership, aligning compensation with company performance. These plans typically vest over time, mirroring stock options, and payout occurs upon a triggering event such as a sale, IPO, or retirement. Phantom stock is taxed as ordinary income at payout, offering a cash-based reward that avoids dilution of company shares.

How Stock Options Operate

Stock options grant employees the right to purchase company shares at a predetermined price, known as the exercise or strike price, after a vesting period. These options typically expire within a set time frame, and employees benefit if the market price exceeds the strike price, allowing them to buy low and potentially sell high. The value of stock options depends on factors such as the company's stock performance, option terms, and vesting schedule.

Tax Implications: Phantom Stock vs Stock Options

Phantom stock is typically taxed as ordinary income upon vesting or payout, reflecting the value of the stock without requiring an actual share transfer, whereas stock options can trigger tax events at grant, exercise, or sale depending on whether they are incentive stock options (ISOs) or non-qualified stock options (NSOs). ISOs generally receive favorable tax treatment with potential capital gains taxation if holding requirements are met, while NSOs are taxed as ordinary income on the spread at exercise. Understanding these distinctions impacts overall compensation planning and tax liability for employees receiving equity-based incentives.

Advantages of Phantom Stock for Employees

Phantom stock offers employees the advantage of receiving financial benefits similar to actual stock ownership without the need to purchase shares, eliminating upfront costs and reducing financial risk. It provides a straightforward cash payout tied to company performance, ensuring liquidity and avoiding tax complexities associated with exercising stock options. Employees also benefit from simpler administration and no dilution of equity, making phantom stock a flexible and attractive component of total compensation packages.

Benefits of Stock Options for Employees

Stock options offer employees the opportunity to purchase company shares at a predetermined price, often below market value, creating potential for significant financial gain if the company's stock appreciates. These options align employee interests with shareholder value, motivating higher performance and retention through long-term wealth building. Tax advantages, such as deferral until exercise and capital gains treatment on profits, further enhance the appeal of stock options as part of employee compensation packages.

Risks and Drawbacks: Phantom Stock vs Stock Options

Phantom stock carries less risk of dilution for the company but poses significant tax complexities and potential cash flow challenges when payouts are due, unlike stock options which require employees to invest upfront and risk losing their options if stock prices decline. Stock options may lead to significant financial loss if the market value falls below the strike price, and their value can be highly volatile. Phantom stock lacks ownership rights, which can limit upside potential and employee engagement compared to stock options that offer potential equity gains and voting rights.

Choosing the Right Equity Compensation for Your Company

Phantom stock and stock options offer distinct advantages when selecting equity compensation for your company. Phantom stock grants cash bonuses tied to the company's stock value without diluting ownership, making it ideal for private firms seeking retention incentives. Stock options provide employees the right to buy shares at a set price, fostering long-term commitment and aligning employee interests with company growth.

Real-World Examples: Phantom Stock and Stock Options in Practice

Phantom stock plans provide employees with cash bonuses tied to company stock value without actual equity transfer, as seen in companies like IBM, enhancing retention without diluting ownership. Stock options, popularized by tech giants such as Google and Microsoft, grant employees the right to purchase shares at a fixed price, aligning incentives with company growth and offering potentially substantial financial rewards. Real-world application shows phantom stock suits closely-held firms avoiding equity dilution, while stock options are prevalent in startups and public companies incentivizing long-term employee performance.

Important Terms

Vesting schedule

Phantom stock typically features a simpler vesting schedule tied to company performance or time, whereas stock options often use graded vesting schedules based on employment duration and specific milestones.

Liquidation event

A liquidation event triggers different outcomes for phantom stock and stock options holders; phantom stock entitles employees to a cash payout equivalent to stock value without actual equity transfer, while stock options provide the right to purchase shares at a predetermined price before or during liquidation, potentially offering direct equity ownership. Understanding the specific terms and vesting schedules of each instrument is crucial, as phantom stock typically guarantees cash compensation upon liquidation, whereas stock options require exercising the option to realize gains.

Deferred compensation

Deferred compensation plans using phantom stock provide employees with cash-based benefits tied to company stock value without actual equity dilution, whereas stock options grant the right to purchase shares at a predetermined price, potentially offering higher long-term capital gains but involving ownership risk.

Equity dilution

Phantom stock avoids equity dilution by providing cash or stock value appreciation without issuing new shares, unlike stock options which increase outstanding shares and dilute ownership.

Fair market value (FMV)

Fair market value (FMV) determines the exercise price for stock options while phantom stock awards are valued based on FMV fluctuations without requiring purchase or exercising.

Non-qualified stock options (NSO)

Non-qualified stock options (NSOs) provide employees the right to purchase company stock at a set price, whereas phantom stock grants a cash or stock equivalent based on the company's stock value without actual share issuance, offering distinct tax and liquidity benefits.

Cash-settled awards

Cash-settled awards allow employees to receive the monetary equivalent of stock value without actual equity transfer, often used in phantom stock plans to mimic stock ownership benefits without issuing shares. Unlike stock options that grant the right to purchase company stock at a predetermined price, phantom stock awards provide cash payouts based on the company's share price appreciation, reducing dilution risk for existing shareholders.

Capital gains taxation

Capital gains taxation on phantom stock typically occurs upon payout as ordinary income, while stock options may qualify for favorable capital gains treatment if exercised and held according to IRS holding periods.

Synthetic equity

Phantom stock provides synthetic equity by granting cash or stock value based on company performance without actual ownership, unlike stock options which offer the right to purchase shares at a set price, creating potential equity dilution.

Performance triggers

Performance triggers for phantom stock typically tie simulated equity rewards to specific company milestones or financial targets, whereas stock options activate based on predetermined vesting periods or individual performance criteria.

Phantom stock vs Stock options Infographic

moneydif.com

moneydif.com