Double time means employees earn twice their regular hourly wage, typically for working holidays or excessive overtime hours, while time and a half provides 1.5 times the standard pay rate, usually applied to overtime beyond the normal workweek. Understanding these pay structures helps employees accurately calculate extra earnings for extended work hours. Employers often use these rates to incentivize productivity and comply with labor laws regarding fair compensation.

Table of Comparison

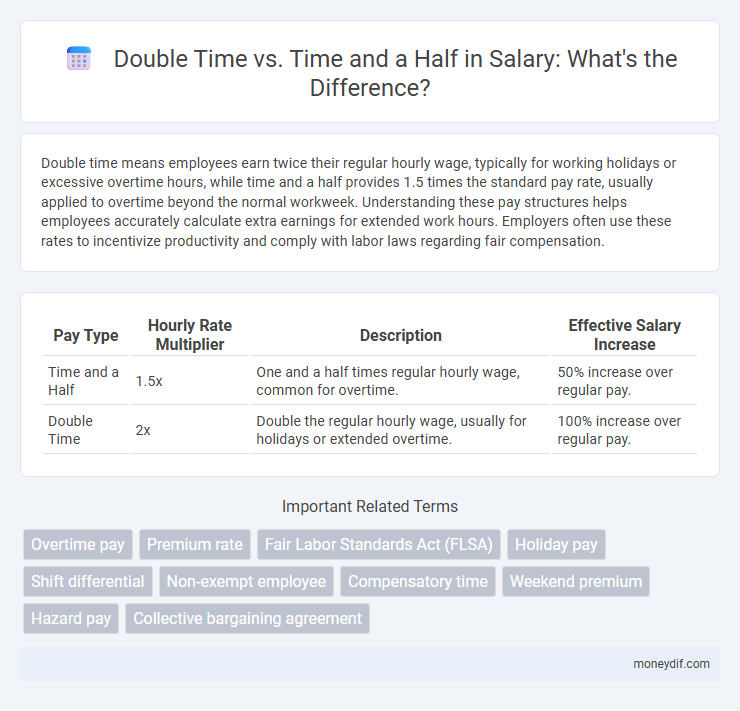

| Pay Type | Hourly Rate Multiplier | Description | Effective Salary Increase |

|---|---|---|---|

| Time and a Half | 1.5x | One and a half times regular hourly wage, common for overtime. | 50% increase over regular pay. |

| Double Time | 2x | Double the regular hourly wage, usually for holidays or extended overtime. | 100% increase over regular pay. |

Understanding Double Time vs Time and a Half

Double time pay is calculated at twice the regular hourly wage, typically applied during holidays or excessive overtime, offering a higher compensation rate than time and a half. Time and a half means earning 1.5 times the standard hourly rate, commonly used for overtime after 40 hours per week as mandated by the Fair Labor Standards Act (FLSA). Understanding the distinction between double time and time and a half is essential for employees and employers to ensure accurate payroll and compliance with labor laws.

Key Differences Between Double Time and Time and a Half

Double time pays employees twice their regular hourly rate, typically applied on holidays or extensive overtime, while time and a half offers 1.5 times the normal pay, often used for overtime exceeding standard work hours. Double time results in significantly higher compensation, directly impacting payroll costs and employee earnings. Understanding these distinctions helps employers allocate labor budgets effectively and ensures compliance with labor laws.

Eligibility Criteria for Double Time and Time and a Half

Eligibility criteria for time and a half typically include working beyond 40 hours per week or on designated holidays, as mandated by the Fair Labor Standards Act (FLSA) for non-exempt employees. Double time pay often applies to hours worked beyond 12 in a single day or during special occasions such as major holidays, depending on state labor laws and company policies. Employers must clearly define eligibility in employment contracts or labor agreements to ensure compliance and proper compensation.

Common Industries Paying Double Time and Time and a Half

Common industries paying double time include manufacturing, emergency services, and healthcare for overtime work on holidays or weekends, reflecting compensation for high-demand hours. Time and a half is prevalent in retail, hospitality, and customer service sectors for overtime beyond standard 40-hour workweeks, incentivizing extended shifts. Understanding these pay structures helps employees maximize earnings and employers comply with labor regulations.

How to Calculate Double Time and Time and a Half Pay

Double time pay is calculated by multiplying the employee's regular hourly wage by two, reflecting twice the standard rate, whereas time and a half pay is computed by multiplying the regular hourly wage by 1.5, representing 150% of the standard rate. For example, if an employee earns $20 per hour, double time equals $40 per hour and time and a half equals $30 per hour. Accurately applying these multipliers ensures correct compensation for overtime hours worked beyond standard shifts or during holidays.

Legal Requirements for Overtime Compensation

Legal requirements for overtime compensation mandate that qualifying employees receive pay rates exceeding their standard hourly wage for hours worked beyond regular schedules. Double time requires employers to pay twice the employee's normal hourly rate, typically applied during holidays or extensive overtime, while time and a half mandates 1.5 times the regular rate for hours worked beyond the standard 40-hour workweek as specified by the Fair Labor Standards Act (FLSA). Compliance with these regulations ensures workers receive fair remuneration for extended labor while protecting employer liabilities.

Pros and Cons of Double Time and Time and a Half

Time and a half pay, typically 1.5 times the regular hourly wage, boosts employee earnings during overtime while being more cost-effective for employers compared to double time. Double time, paying twice the regular rate, incentivizes employees to work extra hours during high-demand periods, improving staffing but significantly increasing labor expenses. Choosing between time and a half and double time depends on factors like budget constraints, workload demands, and employee motivation strategies.

Impact on Payroll and Business Budgets

Double time pay rates result in significantly higher payroll expenses compared to time and a half, directly increasing labor costs by 200% of the standard hourly wage rather than 150%. Businesses with frequent overtime at double time may face tighter profit margins and require adjustments to budget forecasts to accommodate elevated wage liabilities. Strategic scheduling and payroll management are essential to mitigate the financial impact of double time on overall business budgets.

Employee Rights Regarding Overtime Pay

Employees are entitled to specific overtime pay rates depending on labor laws and company policies, typically receiving time and a half for hours worked beyond 40 per week. Double time compensation applies in certain circumstances like holidays or excessive overtime, offering twice the regular hourly wage. Understanding these distinctions ensures workers receive fair pay and protects their rights under the Fair Labor Standards Act (FLSA) and relevant state regulations.

Frequently Asked Questions About Overtime Pay Rates

Overtime pay rates commonly vary between time and a half and double time, with time and a half meaning employees earn 1.5 times their regular hourly rate and double time paying twice the standard rate. Frequently asked questions about overtime focus on eligibility criteria, calculation methods, and which hours qualify for double time versus time and a half. Understanding state and federal labor laws is crucial, as some jurisdictions mandate double time pay for hours worked beyond a certain daily or weekly threshold.

Important Terms

Overtime pay

Overtime pay typically awards employees time and a half (1.5x) for hours over 40 per week, while double time (2x) applies for extended hours such as holidays or exceeding double the standard workday.

Premium rate

Premium rates for double time are typically 200% of the base pay, whereas time and a half rates are 150% of the base pay.

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) mandates time and a half pay for overtime hours exceeding 40 in a workweek but does not require double time, which is often determined by state laws or employer policies.

Holiday pay

Holiday pay rates typically offer double time compensation for hours worked on holidays, exceeding the standard time and a half rate applied to overtime hours on regular days.

Shift differential

Shift differentials for double time typically pay employees twice their base hourly rate, whereas time and a half compensates at 1.5 times the regular hourly wage, significantly impacting overtime and holiday shift premiums.

Non-exempt employee

Non-exempt employees typically receive time and a half pay for overtime hours up to 12 hours per day, but they may qualify for double time pay for hours worked beyond 12 hours or on designated holidays according to state labor laws.

Compensatory time

Compensatory time allows employees to earn time off instead of immediate overtime pay, often calculated at time and a half for hours beyond the standard workweek; however, double time pay applies to hours worked on holidays or after extended shifts, reflecting higher compensation rates. Employers must comply with labor laws by accurately tracking compensatory time accrual and differentiating it from double time and time-and-a-half pay to ensure fair employee remuneration.

Weekend premium

Weekend premium pay rates typically offer double time instead of time and a half to incentivize work during non-standard hours.

Hazard pay

Hazard pay often includes a premium rate such as double time or time and a half, with double time typically paid at twice the employee's regular hourly wage and time and a half at 1.5 times the regular wage. Employers choose between these rates based on industry standards, labor contracts, and the level of risk involved in hazardous working conditions.

Collective bargaining agreement

A collective bargaining agreement typically specifies whether employees receive double time or time and a half pay for overtime hours, with double time usually applied for holidays or extended overtime beyond standard thresholds.

double time vs time and a half Infographic

moneydif.com

moneydif.com