Gross salary represents the total earnings before any deductions such as taxes, social security, and retirement contributions are subtracted. Net salary is the actual amount received by an employee after all mandatory withholdings have been deducted from the gross salary. Understanding the difference between gross and net salary is crucial for accurate financial planning and budgeting.

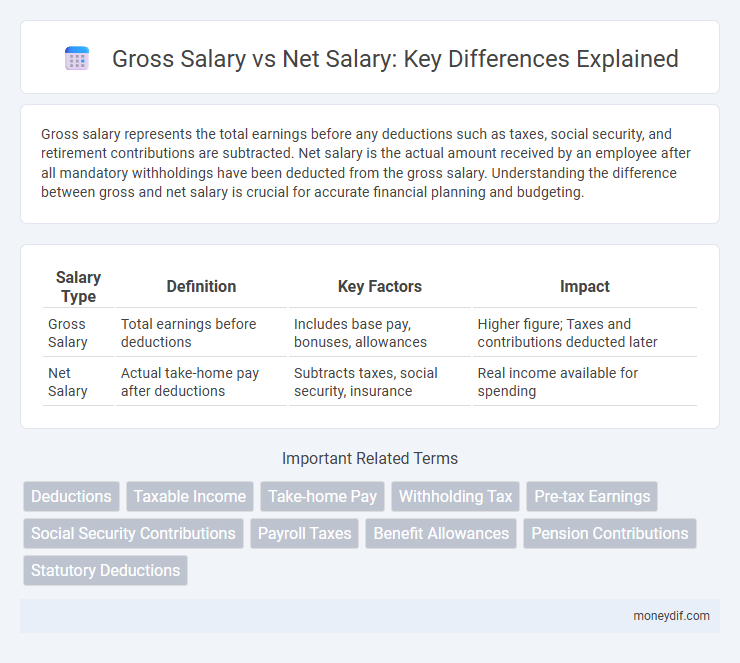

Table of Comparison

| Salary Type | Definition | Key Factors | Impact |

|---|---|---|---|

| Gross Salary | Total earnings before deductions | Includes base pay, bonuses, allowances | Higher figure; Taxes and contributions deducted later |

| Net Salary | Actual take-home pay after deductions | Subtracts taxes, social security, insurance | Real income available for spending |

Understanding Gross Salary

Gross salary refers to the total amount earned by an employee before any deductions such as taxes, social security, or retirement contributions are subtracted. It includes base pay, bonuses, overtime, and other compensation forms, representing the full salary package agreed upon. Understanding gross salary is crucial for accurate financial planning, as it determines the baseline before mandatory and voluntary withholdings reduce take-home pay.

What Is Net Salary?

Net salary refers to the amount of money an employee takes home after all deductions, including taxes, social security contributions, and other withholdings, are subtracted from the gross salary. It represents the actual disposable income available for spending or saving, reflecting the true earnings from employment. Understanding net salary is crucial for budgeting and financial planning, as it determines the funds accessible for living expenses and investments.

Key Differences Between Gross and Net Salary

Gross salary represents the total earnings before any deductions, including basic pay, allowances, bonuses, and overtime, while net salary is the amount received after tax deductions, social security contributions, and other withholdings. Key differences include tax liability, as gross salary forms the basis for calculating income tax, whereas net salary reflects actual take-home pay. Understanding these distinctions helps employees accurately assess financial benefits and plan budgeting effectively.

Components Included in Gross Salary

Gross salary includes the total earnings of an employee before deductions, encompassing basic salary, allowances, bonuses, and overtime pay. It also incorporates statutory benefits like employer contributions to provident fund, gratuity, and bonuses mandated by law. Understanding these components is essential to calculate net salary accurately, which is the amount received after taxes and other deductions.

Common Deductions Affecting Net Salary

Common deductions affecting net salary include income tax, social security contributions, and health insurance premiums, which reduce the gross salary to arrive at the take-home pay. Other frequent deductions may involve retirement fund contributions, union fees, and wage garnishments. Understanding these deductions is crucial for accurately calculating net salary from the gross amount received.

How to Calculate Gross Salary

Gross salary calculation involves summing an employee's base salary, allowances, bonuses, and other taxable benefits before deductions. Employers must include components like basic pay, housing allowance, transport allowance, and overtime payments to determine the total gross earnings. This figure serves as the foundation for calculating tax liabilities and net salary after mandatory deductions such as taxes and social security contributions.

Steps to Calculate Net Salary

To calculate net salary, begin with the gross salary, which is the total income before any deductions. Subtract mandatory taxes such as income tax, social security contributions, and health insurance premiums. Deduct any additional items like retirement plan contributions or loan repayments to arrive at the final net salary amount.

Impact of Taxes on Salary

Gross salary represents the total earnings before any deductions, while net salary is the amount received after taxes and other withholdings. Taxes significantly reduce gross salary, with income tax, social security, and Medicare contributions collectively impacting the employee's take-home pay. Understanding the tax brackets and applicable deductions helps employees better estimate their net salary and plan their finances effectively.

Tips for Negotiating Your Salary Package

When negotiating your salary package, clearly differentiate between gross salary and net salary to understand the actual take-home pay after taxes and deductions. Research industry standards and use reliable salary calculators to estimate your net income, enabling informed discussions with employers. Highlight your skills and experience while requesting a transparent breakdown of all components, including bonuses and benefits, to ensure a fair and comprehensive compensation deal.

Why Knowing the Difference Matters for Employees

Understanding the difference between gross salary and net salary is essential for employees to accurately plan their finances and assess their true take-home pay. Gross salary represents the total earnings before deductions, while net salary reflects the amount received after taxes, social security, and other withholdings. This knowledge enables better budgeting, tax planning, and financial decision-making throughout the year.

Important Terms

Deductions

Deductions such as taxes, social security, and benefits reduce the gross salary to determine the net salary an employee takes home.

Taxable Income

Taxable income is calculated by deducting allowable expenses and exemptions from the gross salary, which represents the total earnings before any deductions. Net salary reflects the actual take-home pay after subtracting taxes, social security contributions, and other withholdings from the gross salary.

Take-home Pay

Take-home pay refers to the net salary received by an employee after deducting taxes, social security contributions, and other withholdings from the gross salary.

Withholding Tax

Withholding tax is deducted from an employee's gross salary, directly impacting their net salary by reducing the amount received after taxes.

Pre-tax Earnings

Pre-tax earnings represent an employee's gross salary before deductions, whereas net salary is the amount received after taxes and other withholdings are subtracted.

Social Security Contributions

Social Security contributions are typically calculated based on the gross salary, which represents the total earnings before any deductions, ensuring that the contributions reflect the full income base. Net salary, the amount received after taxes and Social Security contributions, does not influence the calculation of Social Security payments but indicates the worker's disposable income post-deductions.

Payroll Taxes

Payroll taxes significantly impact the difference between gross salary and net salary, as they are deducted from the gross income before the employee receives their net pay. Understanding payroll tax rates and mandatory contributions, such as Social Security, Medicare, and federal withholding, is essential for accurately calculating net salary from the gross amount.

Benefit Allowances

Benefit allowances contribute to the overall compensation package by supplementing the gross salary, thereby increasing the total income before tax deductions. These allowances impact the calculation of net salary by either being taxable or non-taxable, influencing the final take-home pay employees receive.

Pension Contributions

Pension contributions are typically calculated based on the gross salary, which is the total earnings before any deductions such as taxes or social security contributions. Understanding the difference between gross salary and net salary is crucial because pension contributions affect the net salary, reducing the take-home pay while increasing future retirement benefits.

Statutory Deductions

Statutory deductions such as income tax, social security contributions, and health insurance premiums are subtracted from the gross salary to determine the net salary, which represents the actual take-home pay. Understanding the impact of these mandatory deductions is crucial for accurate salary calculations and financial planning.

Gross Salary vs Net Salary Infographic

moneydif.com

moneydif.com