Guaranteed pay offers a fixed and predictable income that provides financial stability regardless of company performance or individual achievements. At-risk pay, such as bonuses or commissions, fluctuates based on meeting specific targets or company profitability, motivating employees to exceed performance goals. Balancing guaranteed and at-risk pay can align employee incentives with organizational success while ensuring a reliable baseline income.

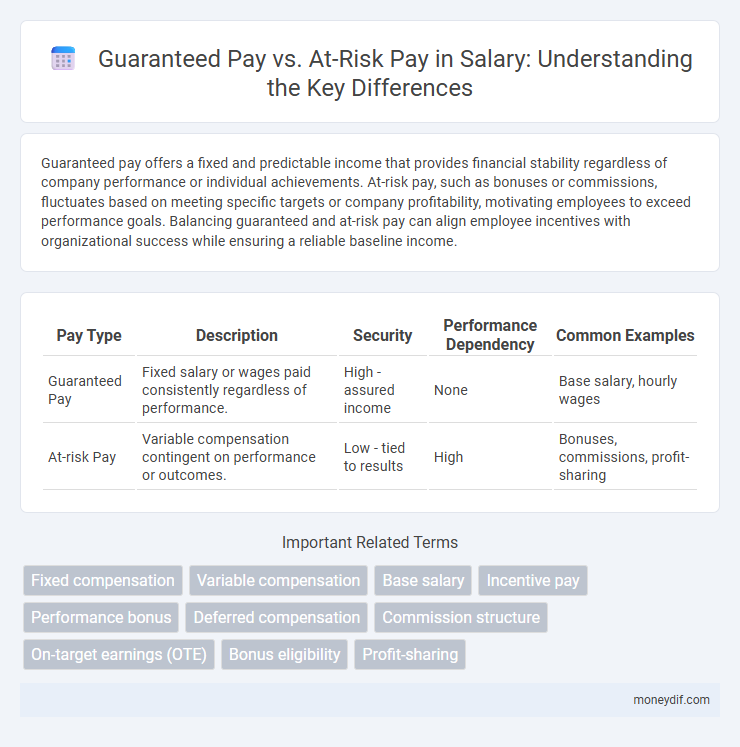

Table of Comparison

| Pay Type | Description | Security | Performance Dependency | Common Examples |

|---|---|---|---|---|

| Guaranteed Pay | Fixed salary or wages paid consistently regardless of performance. | High - assured income | None | Base salary, hourly wages |

| At-risk Pay | Variable compensation contingent on performance or outcomes. | Low - tied to results | High | Bonuses, commissions, profit-sharing |

Understanding Guaranteed Pay and At-Risk Pay

Guaranteed pay ensures a fixed income regardless of company performance, providing financial stability and predictability to employees. At-risk pay varies based on individual, team, or company performance, often including bonuses, commissions, or profit-sharing that incentivize productivity and goal achievement. Understanding the balance between guaranteed pay and at-risk pay helps employees evaluate total compensation and align their earnings with organizational success.

Key Differences Between Guaranteed Pay and At-Risk Pay

Guaranteed pay provides employees with a fixed salary or hourly wage that remains consistent regardless of performance, offering financial stability and predictability. At-risk pay depends on achieving specific targets or performance metrics, often including bonuses, commissions, or profit-sharing incentives that align employee rewards with company success. The key difference lies in the certainty of income, where guaranteed pay ensures a steady paycheck while at-risk pay introduces variability tied to individual or organizational outcomes.

Advantages of Guaranteed Pay for Employees

Guaranteed pay offers employees financial stability by ensuring a consistent income regardless of performance or company profits, which reduces stress and enhances job security. It enables better financial planning, as employees can predict their earnings with certainty, supporting long-term commitments such as housing or education. Reliable guaranteed pay also fosters employee loyalty and motivation, as individuals feel valued and supported by their employer.

Benefits of At-Risk Pay in Modern Compensation

At-risk pay incentivizes employee performance by directly linking compensation to individual or company achievements, fostering a results-driven culture. This pay structure enhances motivation, aligning employee goals with organizational success and potentially increasing overall productivity. Companies benefit from cost flexibility, as at-risk pay adjusts with performance outcomes, reducing fixed salary expenses during lower revenue periods.

Potential Drawbacks of Each Pay Structure

Guaranteed pay provides financial security but may reduce motivation for high performance due to its fixed nature. At-risk pay can incentivize employees to exceed targets, yet it introduces income uncertainty and stress, potentially impacting job satisfaction. Balancing these structures is crucial for optimizing workforce productivity and stability.

Industries Commonly Using At-Risk Pay Models

Industries commonly using at-risk pay models include finance, sales, and technology, where performance-based incentives align employee output with company goals. In these sectors, guaranteed pay covers basic compensation, while at-risk pay, such as bonuses or commissions, fluctuates based on individual or company performance metrics. This structure motivates higher productivity and directly ties compensation to results, driving competitive advantage.

Factors Influencing Pay Structure Selection

Companies often select their pay structure based on industry risk, employee performance variability, and organizational financial stability. Guaranteed pay is favored in stable sectors with predictable revenue streams, ensuring consistent employee income and retention. At-risk pay schemes are preferred in sales-driven or startup environments where incentives align employee output with company profitability and growth objectives.

Impact on Employee Motivation and Performance

Guaranteed pay provides employees with financial stability, fostering consistent motivation and reducing stress, which enhances overall performance. In contrast, at-risk pay links compensation directly to performance outcomes, driving higher effort and productivity through clear incentives. Balancing guaranteed and at-risk pay optimizes motivation by combining security with performance-based rewards, aligning employee goals with organizational success.

Employer Considerations: Managing Compensation Risk

Employers manage compensation risk by balancing guaranteed pay, which provides financial stability and predictability, against at-risk pay that motivates performance and aligns employee goals with company success. Guaranteed pay involves fixed salaries and benefits, ensuring employee retention and satisfaction while maintaining budget control. At-risk pay, including bonuses and commissions, requires careful performance measurement and risk assessment to prevent overpayment during downturns and incentivize high achievement.

Future Trends in Salary Structures and Compensation

Future salary structures emphasize a shift from traditional guaranteed pay toward increased at-risk pay components, reflecting performance-based incentives and company profitability. Organizations are leveraging data analytics and AI to customize compensation packages that align employee rewards with business outcomes and market competitiveness. This trend aims to enhance motivation and retention by closely tying total remuneration to individual and organizational success.

Important Terms

Fixed compensation

Fixed compensation refers to the guaranteed pay employees receive regardless of performance, providing financial stability and predictability. In contrast, at-risk pay varies based on individual, team, or company performance and includes bonuses, commissions, or incentives tied to achieving specific targets.

Variable compensation

Variable compensation balances guaranteed pay with at-risk pay to motivate performance while ensuring financial stability.

Base salary

Base salary represents the fixed guaranteed pay an employee receives regardless of performance, forming the foundation of total compensation. In contrast, at-risk pay includes variable components like bonuses or commissions that depend on individual or company performance, incentivizing achievement beyond the base salary.

Incentive pay

Incentive pay consists of guaranteed pay, offering fixed earnings, and at-risk pay, which depends on performance outcomes to motivate and reward employees.

Performance bonus

Performance bonuses affect total compensation by increasing at-risk pay, which contrasts with guaranteed pay that remains fixed regardless of performance outcomes.

Deferred compensation

Deferred compensation structures balance guaranteed pay, providing financial stability, with at-risk pay components that incentivize performance-based outcomes.

Commission structure

Commission structures balance guaranteed pay, offering financial stability through fixed salaries, with at-risk pay tied to performance metrics, incentivizing higher sales and productivity. Effective commission plans strategically combine a baseline salary with variable commissions to motivate employees while minimizing financial uncertainty for the employer.

On-target earnings (OTE)

On-target earnings (OTE) combine guaranteed pay and at-risk pay to reflect total compensation when sales or performance targets are met.

Bonus eligibility

Bonus eligibility often depends on the balance between guaranteed pay and at-risk pay, where employees receiving a higher proportion of at-risk pay typically have greater bonus potential tied to performance metrics. Companies structure bonus programs to incentivize employees with variable pay components, aligning rewards with individual, team, or organizational goals to drive business outcomes.

Profit-sharing

Profit-sharing aligns employee incentives with company performance by supplementing guaranteed pay with at-risk pay components tied directly to profitability metrics.

Guaranteed pay vs At-risk pay Infographic

moneydif.com

moneydif.com