Drawing a salary provides consistent monthly income based on agreed compensation, whereas a recoverable advance is an upfront payment that must be repaid or offset against future earnings. While salary ensures financial stability, recoverable advances offer immediate cash flow but create a liability until recovered. Understanding the difference helps in managing personal finances and contractual obligations effectively.

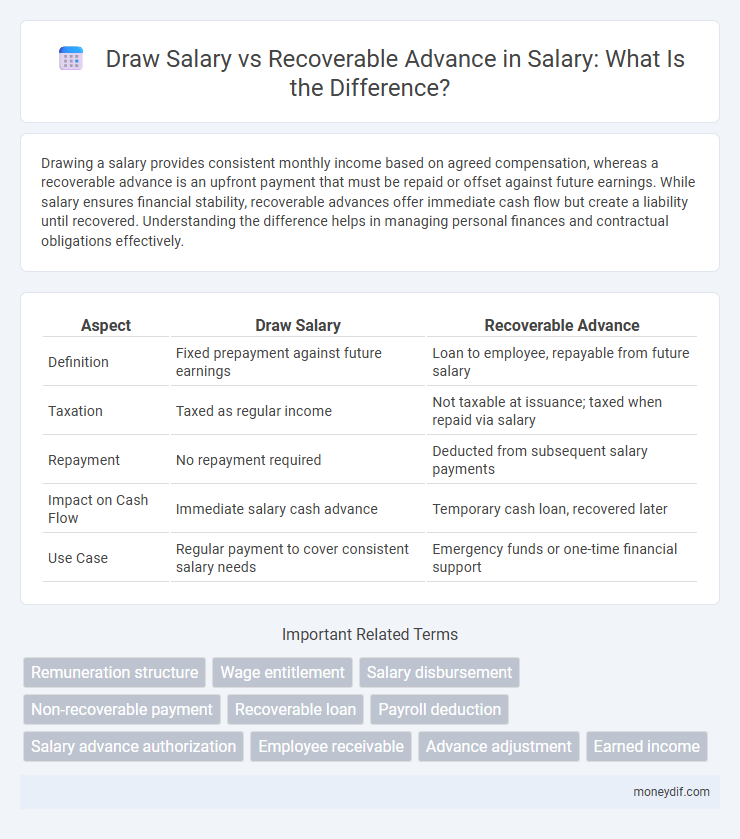

Table of Comparison

| Aspect | Draw Salary | Recoverable Advance |

|---|---|---|

| Definition | Fixed prepayment against future earnings | Loan to employee, repayable from future salary |

| Taxation | Taxed as regular income | Not taxable at issuance; taxed when repaid via salary |

| Repayment | No repayment required | Deducted from subsequent salary payments |

| Impact on Cash Flow | Immediate salary cash advance | Temporary cash loan, recovered later |

| Use Case | Regular payment to cover consistent salary needs | Emergency funds or one-time financial support |

Understanding Draw Salary vs Recoverable Advance

Draw salary represents an employee's earned wages paid in advance against future commissions or bonuses, effectively a salary prepayment. Recoverable advance refers to funds provided to an employee or contractor that must be repaid or deducted from future earnings, often treated as a loan rather than salary. Distinguishing between draw salary and recoverable advance is critical for correct payroll processing and tax compliance, as draws affect wage reporting while advances influence liability accounting.

Key Differences Between Draw Salary and Recoverable Advance

Draw salary refers to a fixed amount paid regularly to employees as part of their compensation package, often aligned with their contractual salary. Recoverable advance is an advance payment given to employees or contractors, which must be repaid or adjusted against future salaries or earnings. Key differences include the nature of draw salary as a standard, ongoing payment versus the recoverable advance as a temporary, repayable loan impacting cash flow and accounting practices.

How Draw Salary Works in Employment

Draw salary functions as a prepayment system where employees receive a fixed amount against future commissions or earnings, ensuring consistent income during variable sales periods. Employers deduct advance draw payments from future commissions, balancing cash flow while maintaining employee motivation. This mechanism contrasts with recoverable advances, which strictly require repayment irrespective of future earnings, making draw salary a flexible compensation strategy in commission-based employment.

What Constitutes a Recoverable Advance?

A recoverable advance is a financial arrangement where an employee receives funds upfront, which must be repaid through future salary deductions or other agreed methods. Unlike a standard draw salary, which is an early payment against expected earnings without repayment obligations, recoverable advances are considered loans and require reconciliation against actual wages earned. This mechanism helps employers manage cash flow while providing employees with immediate access to funds, typically outlined clearly in employment contracts or company policies.

Financial Implications for Employees

Draw salary provides employees with regular income security, ensuring consistent cash flow without immediate tax liabilities or repayment obligations. Recoverable advances offer short-term financial relief but require repayment, potentially impacting future earnings and creating obligations that can affect personal budgeting. Understanding these differences helps employees manage liquidity while mitigating risks associated with debt accumulation and cash flow variability.

Tax Considerations: Draw Salary vs Recoverable Advance

Draw salary is subject to standard income tax withholding and social security contributions, impacting the employee's taxable income directly. In contrast, recoverable advances are typically not treated as taxable income at the time of payment since they are expected to be repaid, reducing immediate tax liabilities. Misclassification of recoverable advances as salary can lead to unintended tax consequences, including penalties and interest from tax authorities.

Legal Aspects and Employer Obligations

Employers must ensure that draw salaries, which are advance payments against expected commissions, comply with labor laws and employment contracts to avoid wage disputes. Recoverable advances should be clearly documented, specifying repayment terms without infringing on minimum wage guarantees or employee rights under the Fair Labor Standards Act (FLSA). Legal precautions require transparent communication and adherence to jurisdictional regulations to protect both employer and employee interests in managing draw salaries and recoverable advances.

Pros and Cons of Draw Salary

Draw salary provides employees with a regular, predictable income that supports financial stability and simplifies budgeting, but it can reduce immediate cash flow flexibility compared to recoverable advances. Unlike recoverable advances, which are treated as temporary loans to be repaid, draw salary commits the employer to consistent payroll expenses regardless of business fluctuations. This fixed obligation may increase financial risk for employers during low-revenue periods, while employees benefit from guaranteed compensation without the need for reimbursement.

When Should You Opt for a Recoverable Advance?

Opt for a recoverable advance when facing temporary cash flow constraints that prevent you from drawing a full salary without jeopardizing business operations. This financial tool allows you to access funds in advance, which can later be deducted from future salaries or profits, preserving immediate liquidity. Recoverable advances are ideal for startups or small businesses experiencing fluctuating incomes but needing steady personal cash flow.

Best Practices for Managing Salary Advances and Draws

Proper management of draw salaries versus recoverable advances involves clear documentation and transparent communication between employers and employees to avoid financial discrepancies. Establishing well-defined repayment schedules and regularly tracking advances ensures timely recovery and maintains trust in payroll processes. Utilizing automated payroll systems can enhance accuracy and streamline reconciliation of salary advances against future earnings.

Important Terms

Remuneration structure

Remuneration structure in companies often distinguishes between draw salary and recoverable advance, where a draw salary acts as a fixed prepayment against future commissions or bonuses, ensuring regular income for employees. Recoverable advances are temporary funds provided to employees that must be repaid or deducted from future earnings, maintaining cash flow stability while accounting for variable compensation components.

Wage entitlement

Wage entitlement ensures employees receive their full salary after deducting any recoverable advances authorized by the employer.

Salary disbursement

Salary disbursement policies distinguish between net salary draw amounts and recoverable advances, ensuring accurate payroll processing and financial accountability.

Non-recoverable payment

Non-recoverable payments in salary disbursement differ from recoverable advances as they are final deductions that cannot be reclaimed or offset against future earnings.

Recoverable loan

A recoverable loan refers to funds advanced to employees, such as salary draws or recoverable advances, which must be repaid or deducted from future earnings according to company policy.

Payroll deduction

Payroll deduction methods manage employee compensation by directly subtracting amounts from draw salaries, which are pre-paid wages against future earnings. Recoverable advances differ as they represent funds lent to employees, recouped through structured payroll deductions over a specified period, ensuring financial accountability and cash flow stability for the employer.

Salary advance authorization

Salary advance authorization permits employees to access partial wages before the scheduled payday, categorized as draw salary if it affects ongoing payroll calculations, whereas a recoverable advance is typically documented and deducted systematically from future earnings to ensure repayment without altering regular salary disbursement. Clear policies distinguishing draw salary from recoverable advance processes enhance financial control and employee transparency.

Employee receivable

Employee receivables related to draw salary represent funds owed to the company due to salary advances, whereas recoverable advances are prepayments made to employees expecting future reimbursement.

Advance adjustment

Advance adjustment involves deducting the recoverable advance amount from the employee's draw salary to balance outstanding advances.

Earned income

Earned income refers to the salary or wages received by an individual for services rendered, which is subject to payroll taxes and reported as taxable income. A draw salary is an advance payment against expected earned income, while a recoverable advance represents funds lent to an employee that must be reimbursed, impacting cash flow but not immediately recognized as earned income.

draw salary vs recoverable advance Infographic

moneydif.com

moneydif.com