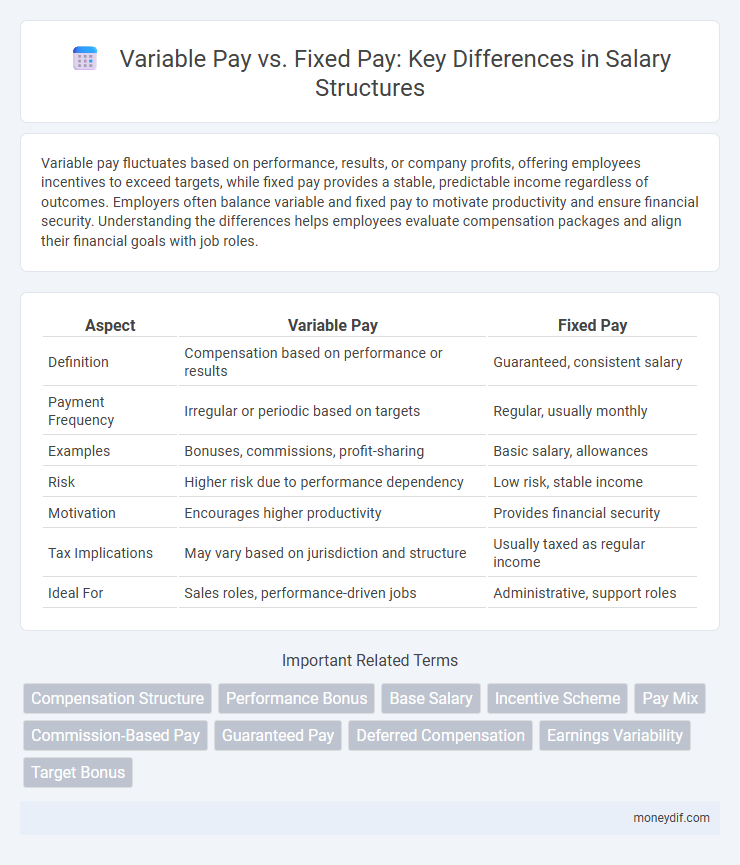

Variable pay fluctuates based on performance, results, or company profits, offering employees incentives to exceed targets, while fixed pay provides a stable, predictable income regardless of outcomes. Employers often balance variable and fixed pay to motivate productivity and ensure financial security. Understanding the differences helps employees evaluate compensation packages and align their financial goals with job roles.

Table of Comparison

| Aspect | Variable Pay | Fixed Pay |

|---|---|---|

| Definition | Compensation based on performance or results | Guaranteed, consistent salary |

| Payment Frequency | Irregular or periodic based on targets | Regular, usually monthly |

| Examples | Bonuses, commissions, profit-sharing | Basic salary, allowances |

| Risk | Higher risk due to performance dependency | Low risk, stable income |

| Motivation | Encourages higher productivity | Provides financial security |

| Tax Implications | May vary based on jurisdiction and structure | Usually taxed as regular income |

| Ideal For | Sales roles, performance-driven jobs | Administrative, support roles |

Understanding Variable Pay and Fixed Pay

Variable pay refers to compensation tied to individual, team, or company performance, fluctuating based on sales targets, bonuses, or incentives, while fixed pay is a predetermined salary amount consistently paid regardless of performance. Understanding the balance between fixed and variable pay helps organizations motivate employees effectively and manage compensation costs. Employees benefit from fixed pay's stability and variable pay's potential for higher earnings linked directly to their contributions or company success.

Key Differences Between Variable and Fixed Pay

Fixed pay refers to a predetermined salary amount that employees receive regularly, ensuring financial stability and predictability. Variable pay fluctuates based on performance metrics, company profits, or individual achievements, providing incentives and alignment with business goals. Key differences include the consistency of income in fixed pay versus the performance-linked, contingent nature of variable pay, impacting motivation and compensation flexibility.

Pros and Cons of Fixed Pay Structures

Fixed pay structures provide employees with a stable and predictable income, which enhances financial security and simplifies personal budgeting. However, fixed pay lacks flexibility and may not motivate employees to exceed performance expectations, potentially limiting productivity and growth incentives. Employers benefit from easier payroll management but may struggle to align compensation with individual or company performance.

Advantages of Variable Pay Systems

Variable pay systems offer enhanced motivation by directly linking employee performance to rewards, boosting productivity and engagement. These systems provide cost flexibility for employers, allowing compensation to adjust according to business results and financial health. They also encourage goal alignment by incentivizing employees to focus on key organizational objectives, driving overall company success.

Impact on Employee Motivation: Variable vs Fixed Pay

Variable pay directly influences employee motivation by aligning rewards with individual or team performance, boosting productivity and engagement. Fixed pay provides financial stability and reduces stress but may not incentivize extra effort or innovation effectively. Companies often blend both to balance consistent income with performance-driven motivation, optimizing overall employee satisfaction and retention.

Industry Trends: Variable Pay Adoption Rates

Variable pay adoption rates have significantly increased across industries such as technology, finance, and healthcare, driven by the need for performance-based incentives and flexibility in compensation structures. According to recent surveys, over 70% of companies in the tech sector now allocate a portion of employee compensation to variable pay, reflecting a shift toward merit-based rewards. This trend aligns with growing demands for agility in salary designs to attract and retain top talent while linking pay more directly to business outcomes.

How Fixed and Variable Pay Affect Company Budgets

Fixed pay provides predictable expenses that simplify budgeting and financial planning by establishing consistent salary costs. Variable pay introduces flexibility, enabling companies to adjust compensation based on performance outcomes and business results, which helps manage cash flow during fluctuating economic conditions. Balancing fixed and variable pay structures allows organizations to optimize labor costs while aligning employee incentives with company goals.

Best Practices for Implementing Variable Pay Plans

Implementing variable pay plans requires clearly defined performance metrics aligned with organizational goals to ensure fairness and motivation. Regular communication and transparency about how variable pay is calculated increase employee trust and engagement. Combining variable pay with a competitive fixed salary base helps balance risk and reward, enhancing overall compensation effectiveness.

Legal Considerations in Compensation Structures

Legal considerations in compensation structures require clear distinctions between variable pay and fixed pay to ensure compliance with labor laws and tax regulations. Fixed pay constitutes guaranteed salary components subject to minimum wage laws, whereas variable pay, such as bonuses or commissions, must be structured transparently to avoid misclassification and disputes. Employment contracts and compensation policies should explicitly outline variable pay criteria to protect both employer and employee rights under applicable legal frameworks.

Which Pay Structure Suits Your Business Model?

Fixed pay provides consistent, predictable expenses that help stabilize budgeting for businesses with steady workflows, while variable pay aligns compensation with performance and can motivate employees in sales-driven or project-based models. Companies with fluctuating revenues or goal-oriented cultures often benefit from variable pay to drive productivity and manage costs effectively. Evaluating your business's financial stability, employee roles, and strategic objectives is crucial to choosing a pay structure that maximizes both motivation and fiscal responsibility.

Important Terms

Compensation Structure

Variable pay supplements fixed pay by rewarding employees based on performance metrics, enhancing motivation and aligning individual goals with company targets. Fixed pay provides financial stability through consistent salaries, while variable components introduce flexibility, incentivizing productivity and driving overall business performance.

Performance Bonus

Performance bonuses are a key component of variable pay, designed to reward employees based on achievement of specific goals, unlike fixed pay which remains constant regardless of performance. This variable compensation strategy enhances motivation and aligns employee efforts with organizational objectives, creating a direct link between performance outcomes and financial rewards.

Base Salary

Base salary constitutes the guaranteed fixed pay component, while variable pay fluctuates based on performance metrics and organizational results.

Incentive Scheme

Incentive schemes enhance employee performance by prioritizing variable pay, which adjusts compensation based on individual or company achievements, compared to fixed pay that remains constant regardless of performance.

Pay Mix

Pay mix refers to the proportion of fixed pay, such as base salary, versus variable pay components like bonuses, commissions, and incentives that together shape an employee's total compensation. Optimizing pay mix aligns reward structures with performance goals, enhances motivation, and balances risk-taking behaviors across roles and industries.

Commission-Based Pay

Commission-based pay is a variable pay structure that directly ties employee earnings to sales performance, unlike fixed pay which provides a consistent salary regardless of outcomes.

Guaranteed Pay

Guaranteed pay refers to the fixed portion of an employee's total compensation, providing consistent income regardless of performance metrics or company profits. In contrast, variable pay fluctuates based on individual, team, or organizational results, aligning incentives with performance outcomes.

Deferred Compensation

Deferred compensation allows employees to receive a portion of their variable pay at a later date, enhancing long-term incentives compared to fixed pay, which remains constant and immediate. This strategy aligns employee interests with company performance by linking future rewards to variable pay components such as bonuses or stock options, increasing retention and motivation.

Earnings Variability

Earnings variability significantly impacts employee motivation, with variable pay structures--such as bonuses and commissions--introducing fluctuations based on performance outcomes, while fixed pay offers consistent income stability. Organizations leverage variable pay to align employee incentives with company goals, enhancing productivity but also increasing income risk compared to the predictable nature of fixed salaries.

Target Bonus

Target bonus represents the expected component of variable pay that supplements fixed pay, aligning employee performance with organizational goals.

Variable Pay vs Fixed Pay Infographic

moneydif.com

moneydif.com