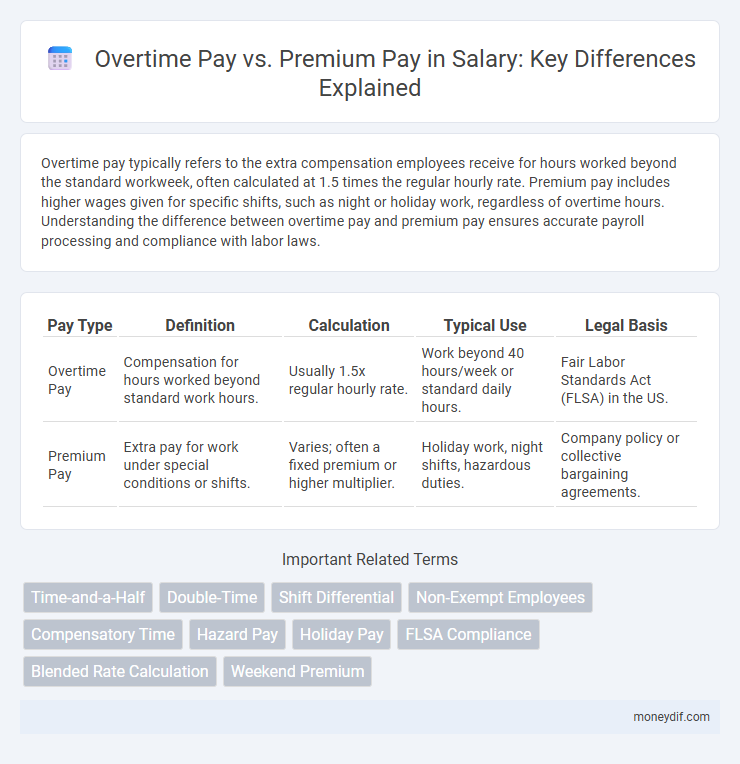

Overtime pay typically refers to the extra compensation employees receive for hours worked beyond the standard workweek, often calculated at 1.5 times the regular hourly rate. Premium pay includes higher wages given for specific shifts, such as night or holiday work, regardless of overtime hours. Understanding the difference between overtime pay and premium pay ensures accurate payroll processing and compliance with labor laws.

Table of Comparison

| Pay Type | Definition | Calculation | Typical Use | Legal Basis |

|---|---|---|---|---|

| Overtime Pay | Compensation for hours worked beyond standard work hours. | Usually 1.5x regular hourly rate. | Work beyond 40 hours/week or standard daily hours. | Fair Labor Standards Act (FLSA) in the US. |

| Premium Pay | Extra pay for work under special conditions or shifts. | Varies; often a fixed premium or higher multiplier. | Holiday work, night shifts, hazardous duties. | Company policy or collective bargaining agreements. |

Understanding Overtime Pay: Definition and Basics

Overtime pay refers to the additional compensation employees receive for working beyond their standard hours, typically over 40 hours per week, as mandated by the Fair Labor Standards Act (FLSA) in the United States. It is usually calculated at 1.5 times the employee's regular hourly rate, also known as "time and a half." Understanding the distinction between overtime pay and premium pay is crucial as premium pay can include various forms of increased wages for specific conditions, such as holiday pay or weekend work, not necessarily tied to hours worked beyond the regular schedule.

What is Premium Pay? Key Differences Explained

Premium pay refers to additional compensation awarded to employees for work performed beyond their standard hours, often at a higher rate than regular wages. Unlike overtime pay, which is mandated by labor laws and typically applies after exceeding a specific hourly threshold, premium pay can include bonuses, hazard pay, or shift differentials based on company policies or union agreements. Understanding these distinctions helps clarify employee rights and employer obligations regarding extra earnings beyond base salary.

Legal Requirements for Overtime Pay

Overtime pay is legally required under the Fair Labor Standards Act (FLSA) for non-exempt employees working over 40 hours in a workweek, typically at 1.5 times their regular hourly rate. Premium pay, while often used to incentivize work during holidays or weekends, is not mandated by federal law but may be required by state laws or employment contracts. Employers must comply with specific legal standards for overtime pay to avoid penalties and ensure fair compensation.

Common Types of Premium Pay

Common types of premium pay include overtime pay, holiday pay, and shift differentials, each designed to compensate employees beyond their regular wages. Overtime pay typically applies when employees work more than 40 hours per week, calculated at one and a half times the regular hourly rate. Shift differentials reward employees working less desirable hours, such as nights or weekends, often paid as a percentage increase over base pay.

Calculating Overtime Pay: Methods and Examples

Calculating overtime pay typically involves multiplying the employee's regular hourly wage by 1.5 for hours worked beyond the standard 40-hour workweek, as mandated by the Fair Labor Standards Act (FLSA). For example, an employee earning $20 per hour would receive $30 for each overtime hour worked. Alternative methods include using a fixed premium rate or averaging pay over different periods, but the most common approach remains the "time and a half" calculation.

Eligibility Criteria: Who Qualifies for Overtime and Premium Pay?

Employees who work beyond the standard 40-hour workweek are typically eligible for overtime pay, which is calculated at 1.5 times their regular hourly rate under the Fair Labor Standards Act (FLSA). Premium pay eligibility often depends on specific job roles, shift differentials, or holiday work mandates, with criteria set by employer policies or collective bargaining agreements. Both pay types require clear documentation of hours worked and adherence to federal, state, and local labor laws to determine qualification accurately.

Industry Practices: Overtime Pay vs Premium Pay Standards

Industry practices distinguish overtime pay as compensation for hours worked beyond the standard 40-hour workweek, usually at 1.5 times the regular hourly rate, whereas premium pay refers to higher wages for specific shifts or conditions, such as night shifts or holidays. Overtime pay is mandated by federal and state labor laws like the Fair Labor Standards Act (FLSA), ensuring employees receive fair compensation for extra hours worked. Premium pay standards vary by industry and employer policies, often used to incentivize work during less desirable hours or hazardous conditions.

Impact on Employee Compensation

Overtime pay directly increases employee compensation by providing additional wages for hours worked beyond the standard workweek, typically calculated at 1.5 times the regular hourly rate. Premium pay enhances earnings through incentives like night shift differentials or holiday bonuses, rewarding non-standard work hours or conditions. Both types of pay significantly impact overall employee income, improving financial motivation and job satisfaction.

Employer Obligations and Compliance

Employers must comply with labor laws by accurately distinguishing between overtime pay, which compensates employees for hours worked beyond the standard workweek at a regulated rate, and premium pay, which applies to work under special conditions such as holidays or night shifts. Failure to adhere to federal and state overtime regulations, including the Fair Labor Standards Act (FLSA), can result in penalties and legal disputes for non-compliance. Proper payroll systems and documentation ensure employers fulfill their obligations, avoiding wage violations related to both overtime and premium compensation requirements.

Overtime and Premium Pay: Best Practices for Payroll Management

Overtime pay and premium pay represent crucial components of effective payroll management, ensuring compliance with labor laws and fair employee compensation. Employers optimize payroll processes by accurately tracking hours, applying correct overtime rates typically 1.5 times the regular hourly wage, and implementing transparent policies for premium pay such as holiday or weekend bonuses. Leveraging automated payroll systems enhances accuracy, reduces errors in overtime calculations, and supports timely payments, fostering employee satisfaction and minimizing legal risks.

Important Terms

Time-and-a-Half

Time-and-a-Half refers to an overtime pay rate where employees earn 1.5 times their regular hourly wage for hours worked beyond standard full-time schedules, differing from premium pay which may include fixed bonuses or different multipliers for special shifts or holidays.

Double-Time

Double-time pay refers to compensation at twice the employee's regular hourly rate, often applied during overtime hours exceeding standard overtime thresholds, whereas premium pay generally includes any higher-than-regular hourly wages such as overtime premiums or holiday pay.

Shift Differential

Shift differential increases hourly wages for non-standard work hours, affecting overtime pay calculations when combined with premium pay rates.

Non-Exempt Employees

Non-exempt employees qualify for overtime pay at 1.5 times their regular hourly rate for hours worked beyond 40 per week, whereas premium pay may include additional compensation rates mandated by state or local laws for specific hours or shifts.

Compensatory Time

Compensatory time allows employees to receive paid time off instead of overtime pay, offering an alternative to premium pay for hours worked beyond regular schedules.

Hazard Pay

Hazard pay is additional compensation awarded to employees working under dangerous conditions, distinct from overtime pay, which is compensation for hours worked beyond the standard workweek, typically paid at a higher rate. Premium pay encompasses both hazard pay and overtime pay, reflecting any extra wage rates paid to compensate employees for special circumstances or working conditions.

Holiday Pay

Holiday pay often includes premium pay rates that differ from overtime pay calculations, ensuring employees receive legally mandated compensation for work performed on holidays.

FLSA Compliance

FLSA compliance mandates that overtime pay must be at least 1.5 times the regular pay rate for hours worked beyond 40 per workweek, while premium pay can vary based on employer policies and is not required by law.

Blended Rate Calculation

Blended rate calculation combines regular pay and various overtime or premium pay rates into a single hourly wage, simplifying payroll processing and cost analysis for hours worked beyond standard schedules. This method ensures accurate compensation by proportionally integrating overtime pay rates, such as time-and-a-half, with premium pay rates like weekend or holiday differentials.

Weekend Premium

Weekend Premium pay typically refers to higher wages earned for work performed on weekends, distinct from overtime pay which compensates hours worked beyond standard shifts, while premium pay can encompass both weekend and overtime rates based on company policies and labor laws.

Overtime Pay vs Premium Pay Infographic

moneydif.com

moneydif.com