Deferred compensation allows employees to receive a portion of their earnings at a later date, often providing tax advantages and retirement benefits. Immediate compensation delivers wages or bonuses instantly, enhancing short-term cash flow and financial flexibility. Choosing between deferred and immediate compensation depends on individual financial goals, tax considerations, and liquidity needs.

Table of Comparison

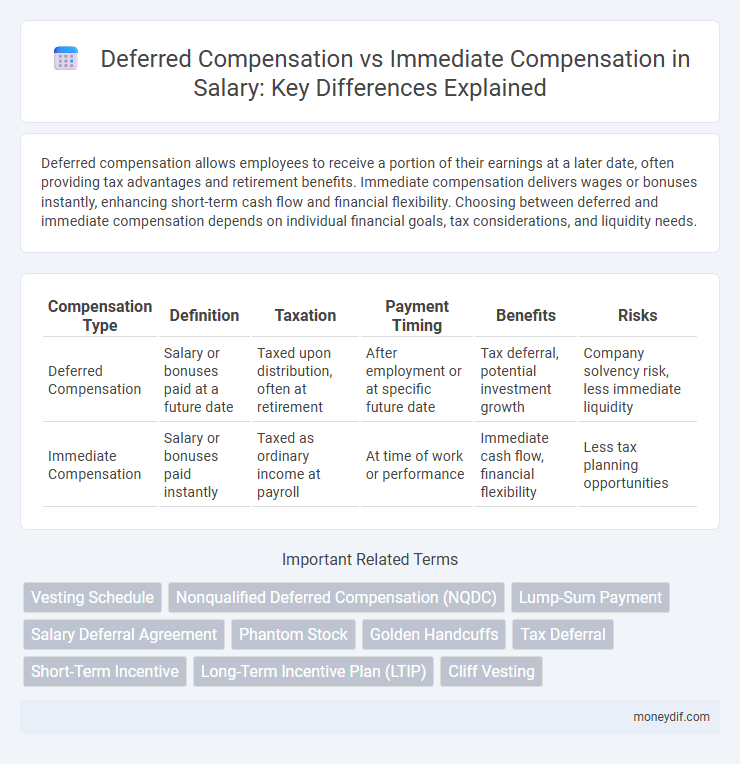

| Compensation Type | Definition | Taxation | Payment Timing | Benefits | Risks |

|---|---|---|---|---|---|

| Deferred Compensation | Salary or bonuses paid at a future date | Taxed upon distribution, often at retirement | After employment or at specific future date | Tax deferral, potential investment growth | Company solvency risk, less immediate liquidity |

| Immediate Compensation | Salary or bonuses paid instantly | Taxed as ordinary income at payroll | At time of work or performance | Immediate cash flow, financial flexibility | Less tax planning opportunities |

Understanding Deferred Compensation

Deferred compensation is a portion of an employee's earnings set aside to be paid at a later date, often upon retirement or termination, providing tax advantages and long-term financial security. Unlike immediate compensation, which is received as regular wages or bonuses, deferred compensation allows employees to benefit from potential investment growth and reduced current taxable income. Common types include non-qualified plans, 401(k) contributions, and stock options, each designed to enhance retirement savings and incentivize employee retention.

What Is Immediate Compensation?

Immediate compensation refers to the total wages or salary paid to employees at the time services are rendered, including base pay, hourly wages, bonuses, and commissions. This form of compensation is subject to standard payroll taxes and is typically reflected in each paycheck, providing instant financial benefit to employees. Immediate compensation directly impacts cash flow for recipients and is often contrasted with deferred compensation, which delays income to a future date for tax or investment purposes.

Key Differences Between Deferred and Immediate Compensation

Deferred compensation involves earning income that is paid out at a later date, typically used for retirement planning or tax advantages, while immediate compensation is earned and received in real-time such as regular salary or wages. Deferred plans often include pensions, 401(k)s, or stock options, providing potential tax deferral and long-term financial growth, whereas immediate compensation offers immediate liquidity and regular cash flow for daily expenses. The key difference lies in timing and tax treatment, with deferred compensation postponing income tax until distribution, contrasting with immediate compensation taxed as earned.

Pros and Cons of Deferred Compensation

Deferred compensation offers the advantage of tax deferral, allowing employees to reduce their current taxable income and potentially benefit from lower tax rates upon withdrawal. Its drawbacks include limited liquidity and reliance on the employer's financial stability, which could risk forfeiture if the company faces insolvency. This form of compensation is ideal for long-term financial planning but may not suit those needing immediate access to earnings.

Advantages of Immediate Compensation

Immediate compensation provides employees with instant access to their earnings, enhancing financial flexibility and liquidity for daily expenses and investments. It eliminates the uncertainty associated with future payments, ensuring predictable cash flow and supporting short-term financial goals. Employers also benefit from increased employee motivation and retention by offering tangible, timely rewards.

Tax Implications: Deferred vs Immediate Compensation

Deferred compensation allows employees to postpone income taxes by receiving earnings in future periods, potentially reducing their current taxable income and placing them in a lower tax bracket during the deferral period. Immediate compensation is taxed as ordinary income in the year it is received, which may result in a higher current tax liability but provides liquidity for present expenses. Employers and employees must evaluate tax rates, timing of income recognition, and potential changes in tax laws when choosing between deferred and immediate compensation structures.

Impact on Employee Retention and Satisfaction

Deferred compensation plans, such as stock options or retirement benefits, enhance long-term employee retention by aligning worker interests with company success and providing future financial security. Immediate compensation, including salaries and bonuses, delivers instant gratification that boosts short-term job satisfaction and motivation but may not encourage prolonged tenure. Balancing both compensation types strategically improves employee loyalty and overall workplace morale, reducing turnover rates and fostering sustained productivity.

Which Industries Prefer Deferred Compensation?

Industries with long-term project cycles and high executive turnover, such as finance, technology, and pharmaceuticals, tend to prefer deferred compensation to align employee incentives with company performance over time. Deferred compensation plans are common in sectors like investment banking and private equity, where bonus structures often include stock options or performance shares payable in the future. This approach reduces immediate tax liabilities and promotes retention among key employees in competitive, high-growth fields.

Legal Considerations in Deferred and Immediate Compensation

Deferred compensation plans must comply with the Employee Retirement Income Security Act (ERISA) to ensure proper tax treatment and protection for employees, while immediate compensation is subject to standard income tax withholding and employment laws. Employers must adhere to Internal Revenue Code Section 409A regulations to avoid penalties on nonqualified deferred compensation arrangements. Legal considerations also mandate clear documentation and employee consent for deferred plans, contrasting with the straightforward legal obligations of immediate wage payments under the Fair Labor Standards Act (FLSA).

Choosing the Right Compensation Structure for Your Business

Evaluating deferred compensation versus immediate compensation requires analyzing cash flow, tax implications, and employee retention strategies aligned with your business goals. Deferred compensation can enhance long-term employee loyalty and offer tax deferral benefits, while immediate compensation improves current employee satisfaction and financial flexibility. Selecting the right pay structure depends on balancing operational budget constraints with the competitive advantage of incentivizing talent sustainably.

Important Terms

Vesting Schedule

A vesting schedule for deferred compensation typically requires employees to meet specific service or performance criteria before fully owning the benefits, contrasting with immediate compensation which is fully owned and accessible upon earning.

Nonqualified Deferred Compensation (NQDC)

Nonqualified Deferred Compensation (NQDC) plans allow employees to defer a portion of their income to a future date, providing tax deferral benefits compared to immediate compensation, which is taxed in the year it is earned. Unlike qualified plans, NQDC offers greater flexibility in deferral amounts and distribution timing but carries higher risk due to lack of federal protection and reliance on the employer's financial stability.

Lump-Sum Payment

Lump-sum payments in deferred compensation plans allow employees to receive accumulated earnings at a future date, contrasting immediate compensation which provides taxable earnings at the time of payment.

Salary Deferral Agreement

A Salary Deferral Agreement allows employees to postpone receiving a portion of their immediate compensation into deferred compensation plans, optimizing tax benefits and retirement savings.

Phantom Stock

Phantom stock offers deferred compensation by mimicking equity value growth without immediate payout, differentiating from immediate compensation which provides instant monetary benefits.

Golden Handcuffs

Golden Handcuffs in deferred compensation plans incentivize employees to remain with a company by offering future financial rewards that vest over time, contrasting with immediate compensation, which provides instant salary or bonuses without long-term retention benefits. Deferred compensation strategies align employee interests with company performance and promote long-term loyalty by delaying income taxation and encouraging sustained employment.

Tax Deferral

Tax deferral allows income from deferred compensation to be taxed at a later date, typically during retirement when lower tax rates may apply, enhancing cash flow and investment growth. Immediate compensation is taxed as ordinary income in the year earned, reducing current take-home pay but providing immediate access to funds.

Short-Term Incentive

Short-term incentives offer immediate compensation to motivate performance, while deferred compensation allocates rewards over time to encourage long-term retention and alignment with company goals.

Long-Term Incentive Plan (LTIP)

Long-Term Incentive Plans (LTIPs) provide deferred compensation that aligns employee rewards with company performance over multiple years, contrasting with immediate compensation that offers instant financial benefits without performance-based deferral.

Cliff Vesting

Cliff vesting in deferred compensation plans means employees gain full ownership of benefits after a specific period, enhancing retention compared to immediate compensation, which provides earnings upfront without future ownership conditions. This structure incentivizes long-term commitment by delaying access to deferred payments until the vesting cliff is reached, unlike immediate compensation that offers no such deferral or vesting schedule.

Deferred Compensation vs Immediate Compensation Infographic

moneydif.com

moneydif.com