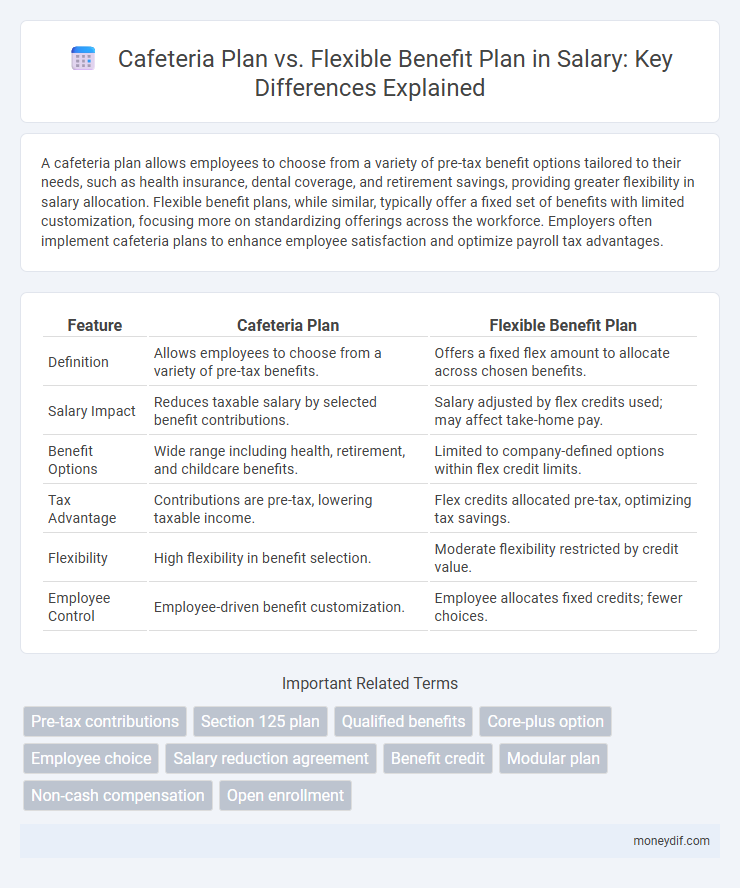

A cafeteria plan allows employees to choose from a variety of pre-tax benefit options tailored to their needs, such as health insurance, dental coverage, and retirement savings, providing greater flexibility in salary allocation. Flexible benefit plans, while similar, typically offer a fixed set of benefits with limited customization, focusing more on standardizing offerings across the workforce. Employers often implement cafeteria plans to enhance employee satisfaction and optimize payroll tax advantages.

Table of Comparison

| Feature | Cafeteria Plan | Flexible Benefit Plan |

|---|---|---|

| Definition | Allows employees to choose from a variety of pre-tax benefits. | Offers a fixed flex amount to allocate across chosen benefits. |

| Salary Impact | Reduces taxable salary by selected benefit contributions. | Salary adjusted by flex credits used; may affect take-home pay. |

| Benefit Options | Wide range including health, retirement, and childcare benefits. | Limited to company-defined options within flex credit limits. |

| Tax Advantage | Contributions are pre-tax, lowering taxable income. | Flex credits allocated pre-tax, optimizing tax savings. |

| Flexibility | High flexibility in benefit selection. | Moderate flexibility restricted by credit value. |

| Employee Control | Employee-driven benefit customization. | Employee allocates fixed credits; fewer choices. |

Understanding Cafeteria Plans and Flexible Benefit Plans

Cafeteria plans, also known as flexible benefit plans, enable employees to choose from a variety of pre-tax benefits such as health insurance, retirement contributions, and dependent care assistance, tailoring compensation packages to individual needs. These plans enhance employee satisfaction by offering customizable benefit options that can reduce taxable income and increase overall take-home pay. Employers benefit from cafeteria plans by attracting and retaining talent while optimizing payroll tax expenses.

Key Differences Between Cafeteria and Flexible Benefits

Cafeteria plans allow employees to choose from a variety of pre-tax benefits tailored to their individual needs, enhancing tax savings and personalization. Flexible benefit plans offer a set amount of benefits where employees have limited customization, focusing more on standardizing employee perks. Key differences include the level of choice, tax advantages, and administrative complexity, with cafeteria plans providing greater flexibility and potential cost-efficiency.

Eligibility and Participation Requirements

Cafeteria plans require employees to be eligible based on specific criteria such as full-time status and employment duration, often needing a waiting period before participation is allowed. Flexible benefit plans typically offer broader eligibility, allowing part-time and temporary employees to participate depending on employer policy. Enrollment in cafeteria plans usually involves annual open enrollment periods, while flexible benefit plans may allow more frequent changes in selections to accommodate varying employee needs.

Tax Implications for Employees and Employers

Cafeteria plans allow employees to choose from taxable and nontaxable benefits, reducing taxable income and lowering payroll taxes for employers under IRS Section 125. Flexible benefit plans provide set benefit options but may not optimize tax savings as effectively as cafeteria plans, potentially leading to higher taxable wages for employees and increased tax obligations for employers. Both plans impact tax withholding and reporting requirements, influencing overall cost-effectiveness and compliance for organizations.

Plan Design and Customization Options

Cafeteria plans offer employees a selection of pre-tax benefit options, allowing customization based on individual needs such as health insurance, retirement contributions, and dependent care. Flexible benefit plans provide a broader spectrum of choices, enabling employers to tailor benefits packages with more diverse options including wellness programs, commuter benefits, and supplemental insurance. Design-wise, cafeteria plans standardize core benefits with limited elective options, while flexible benefit plans emphasize extensive plan design flexibility to accommodate varying employee preferences and organizational goals.

Covered Benefits and Allowable Expenses

A cafeteria plan allows employees to choose from a variety of pre-tax benefits, including health insurance, retirement plans, and dependent care, offering flexibility in covered benefits tailored to individual needs. Flexible benefit plans encompass a broader range of allowable expenses, such as medical, dental, vision care, and even transportation or education costs, maximizing tax savings by reimbursing eligible out-of-pocket expenses. Both plans enhance employee compensation by providing customizable benefits and tax advantages, with covered benefits and allowable expenses varying based on plan design and employer offerings.

Impact on Employee Take-Home Salary

Cafeteria plans allow employees to customize their benefits by selecting pre-tax options, reducing taxable income and increasing take-home salary. Flexible benefit plans offer a set benefit package with some elective options but generally provide less tax advantage flexibility compared to cafeteria plans. Employees participating in cafeteria plans typically experience a more significant increase in net pay due to the tax savings on selected benefits.

Compliance and Legal Considerations

Cafeteria plans and flexible benefit plans must adhere to IRS Section 125 regulations to maintain tax-advantaged status, ensuring employee contributions are made on a pre-tax basis. Employers must comply with nondiscrimination testing requirements to prevent favoring highly compensated employees, mitigating legal risks. Proper documentation and regular plan audits are essential to remain compliant with ERISA and DOL guidelines, avoiding penalties and potential employee disputes.

Pros and Cons of Cafeteria Plans vs Flexible Benefits

Cafeteria plans allow employees to choose from a variety of pre-tax benefits, offering personalized flexibility and potential tax savings, but can be complex to administer and may lead to decision fatigue. Flexible benefit plans bundle options into predefined packages, simplifying administration and ensuring compliance, yet they lack the customization that cafeteria plans provide, potentially reducing employee satisfaction. Both plans impact overall compensation strategy, with cafeteria plans favoring employee choice and flexible benefits emphasizing streamlined management.

Choosing the Right Plan for Your Organization

Cafeteria plans offer employees the flexibility to select from a variety of pre-tax benefits such as health insurance, retirement savings, and dependent care, optimizing tax savings for both employers and employees. Flexible benefit plans provide customizable options tailored to diverse workforce needs, enhancing employee satisfaction and retention while managing organizational costs. Evaluating factors like workforce demographics, administrative complexity, and potential tax advantages is crucial for organizations when choosing the most effective salary benefit plan.

Important Terms

Pre-tax contributions

Pre-tax contributions in a cafeteria plan allow employees to allocate a portion of their salary to qualified benefits like health insurance, reducing taxable income and increasing take-home pay. Flexible benefit plans offer similar pre-tax options but provide more customization, enabling employees to tailor benefits such as medical, dental, and dependent care accounts to their specific needs while maximizing tax advantages.

Section 125 plan

Section 125 plans, also known as cafeteria plans, allow employees to choose from a variety of pre-tax benefit options, including health insurance, flexible spending accounts, and dependent care assistance. Flexible benefit plans are a broader category under which cafeteria plans fall, offering customizable employee benefits that maximize tax advantages and improve overall compensation packages.

Qualified benefits

Qualified benefits under cafeteria plans allow employees to choose tax-advantaged options like health insurance and flexible spending accounts, while flexible benefit plans provide a fixed allowance for selecting a broader range of personalized benefits.

Core-plus option

The Core-plus option in cafeteria plans offers a standardized set of benefits with additional employee-choice flexibility compared to traditional flexible benefit plans.

Employee choice

Employee choice in cafeteria plans allows workers to select from a range of pre-tax benefits such as health insurance, retirement contributions, and dependent care, optimizing personal financial and coverage preferences. Flexible benefit plans similarly enable customization but may offer broader options, including wellness programs and commuter benefits, enhancing overall employee satisfaction and cost-efficiency for employers.

Salary reduction agreement

A salary reduction agreement allows employees to contribute pre-tax earnings to a cafeteria plan, offering flexible benefit options such as health insurance and retirement savings.

Benefit credit

Benefit credit in cafeteria plans refers to the predetermined dollar amount employers allocate for employees to spend on various benefits, promoting personalized healthcare and insurance choices, while flexible benefit plans offer a broader selection of options that can include non-health-related perks, allowing employees to tailor their benefits package according to individual preferences and needs. Both plans aim to enhance employee satisfaction and cost control but differ primarily in structure and flexibility regarding benefit selection and credit utilization.

Modular plan

A modular plan structures employee benefits into distinct modules allowing customized choices, differing from cafeteria plans that offer a fixed set of options and from flexible benefit plans that provide a broader range of personalized benefit selections.

Non-cash compensation

Non-cash compensation under cafeteria plans allows employees to customize benefits within a flexible benefit plan framework, optimizing tax advantages and personal preferences.

Open enrollment

Open enrollment allows employees to select or modify their cafeteria plans, which offer a menu of pre-tax benefits, or flexible benefit plans that provide customizable options tailored to individual needs.

cafeteria plan vs flexible benefit plan Infographic

moneydif.com

moneydif.com