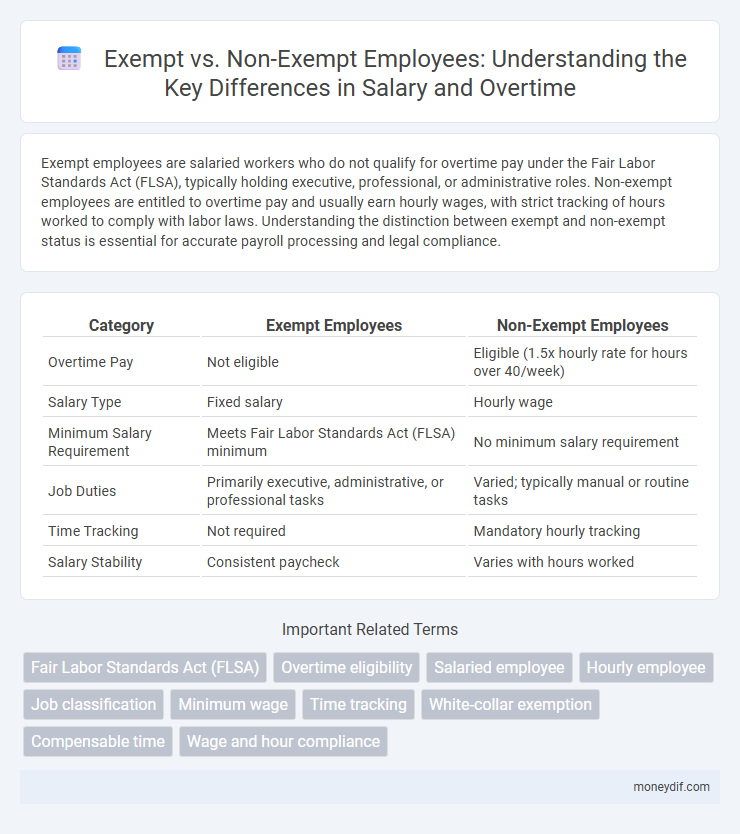

Exempt employees are salaried workers who do not qualify for overtime pay under the Fair Labor Standards Act (FLSA), typically holding executive, professional, or administrative roles. Non-exempt employees are entitled to overtime pay and usually earn hourly wages, with strict tracking of hours worked to comply with labor laws. Understanding the distinction between exempt and non-exempt status is essential for accurate payroll processing and legal compliance.

Table of Comparison

| Category | Exempt Employees | Non-Exempt Employees |

|---|---|---|

| Overtime Pay | Not eligible | Eligible (1.5x hourly rate for hours over 40/week) |

| Salary Type | Fixed salary | Hourly wage |

| Minimum Salary Requirement | Meets Fair Labor Standards Act (FLSA) minimum | No minimum salary requirement |

| Job Duties | Primarily executive, administrative, or professional tasks | Varied; typically manual or routine tasks |

| Time Tracking | Not required | Mandatory hourly tracking |

| Salary Stability | Consistent paycheck | Varies with hours worked |

Understanding Exempt vs Non-Exempt Status

Exempt employees are salaried workers who are not entitled to overtime pay under the Fair Labor Standards Act (FLSA), typically including executive, professional, and administrative roles. Non-exempt employees must be paid hourly and are eligible for overtime compensation at one and a half times their regular pay rate for hours worked beyond 40 in a workweek. Accurate classification between exempt and non-exempt status is crucial for compliance with wage and hour laws and avoiding costly legal disputes.

Key Differences Between Exempt and Non-Exempt Employees

Exempt employees are salaried workers who are not eligible for overtime pay under the Fair Labor Standards Act (FLSA), typically holding executive, professional, or administrative roles. Non-exempt employees are usually paid hourly and must receive overtime pay at one and a half times their regular rate for hours worked beyond 40 per week. The classification depends on specific job duties, salary thresholds, and how the employee's work aligns with FLSA criteria.

Salary Basis: What Qualifies as Exempt?

Exempt employees must be paid on a salary basis, receiving a predetermined amount each pay period regardless of hours worked, ensuring compliance with the Fair Labor Standards Act (FLSA). To qualify as exempt, the salary must meet the minimum threshold set by the Department of Labor, currently $684 per week or $35,568 annually, and the employee's job duties must primarily involve executive, professional, or administrative tasks. Non-exempt employees, in contrast, are paid hourly and eligible for overtime pay under FLSA regulations.

Overtime Eligibility for Non-Exempt Workers

Non-exempt workers are entitled to overtime pay at a rate of one and a half times their regular hourly wage for hours worked beyond 40 per week, as mandated by the Fair Labor Standards Act (FLSA). This classification ensures protection for employees performing hourly tasks or earning below a specified salary threshold, guaranteeing additional compensation for extended work hours. Employers must accurately categorize employees to comply with federal and state labor laws and avoid legal liabilities related to unpaid overtime wages.

Federal and State Labor Laws Impacting Classification

Federal labor laws, including the Fair Labor Standards Act (FLSA), establish criteria for exempt versus non-exempt employee classification based on job duties and salary thresholds, ensuring eligibility for overtime pay protections. State labor laws may impose stricter standards or higher salary minimums, affecting the classification and compliance requirements within those jurisdictions. Employers must navigate both federal and state regulations carefully to determine proper classification, minimize legal risks, and ensure fair compensation.

Common Job Roles: Exempt vs Non-Exempt Examples

Common exempt job roles include executive, professional, and administrative positions such as managers, teachers, and software developers who receive a fixed salary and are not eligible for overtime pay. Non-exempt roles typically involve hourly-wage jobs like retail associates, customer service representatives, and maintenance workers, who must be paid overtime for hours worked beyond 40 per week. Understanding the classification is crucial for compliance with wage and hour laws and effective payroll management.

The Impact of Misclassification on Employers and Employees

Misclassification of employees as exempt instead of non-exempt can lead to significant financial penalties for employers, including back pay for overtime wages and legal fees. Employees misclassified as exempt may lose entitlement to overtime pay and protections under the Fair Labor Standards Act (FLSA), resulting in decreased income and increased work hours. Proper classification is crucial to ensure compliance with labor laws and protect both employer liabilities and employee rights.

Exempt and Non-Exempt: Pros and Cons for Workers

Exempt employees receive a fixed salary regardless of hours worked, offering income stability and eligibility for managerial or specialized roles, but they often face unpaid overtime and less flexibility in work hours. Non-exempt workers are paid hourly with overtime compensation, providing fair pay for extra time but less predictable income and generally fewer benefits. Understanding these distinctions helps workers choose roles aligning with their financial needs, work-life balance, and career goals.

Frequently Asked Questions About Employee Classification

Exempt employees typically receive a fixed salary and are excluded from overtime pay regulations under the Fair Labor Standards Act (FLSA), while non-exempt employees qualify for overtime pay based on hours worked beyond 40 per week. Classification hinges on job duties, salary level, and payment method, with the Department of Labor providing detailed guidelines to prevent misclassification. Accurate employee classification ensures compliance with wage and hour laws, minimizing legal risks and safeguarding employee rights.

Compliance Tips for Employers on Exempt vs Non-Exempt Status

Employers must accurately classify employees as exempt or non-exempt under the Fair Labor Standards Act (FLSA) to ensure compliance with minimum wage and overtime pay requirements. Regularly reviewing job duties and salary thresholds prevents misclassification and potential legal penalties. Implementing clear documentation and training for HR teams on exemption criteria enhances adherence to labor laws and mitigates risk.

Important Terms

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) classifies employees as exempt or non-exempt based on job duties, salary level, and payment method, determining their eligibility for overtime pay.

Overtime eligibility

Overtime eligibility is determined by the Fair Labor Standards Act (FLSA), which classifies employees as exempt or non-exempt based on job duties, salary thresholds, and industry regulations. Non-exempt employees qualify for overtime pay at 1.5 times their regular rate for hours worked beyond 40 in a workweek, while exempt employees are excluded from overtime compensation regardless of hours worked.

Salaried employee

Salaried employees classified as exempt are not eligible for overtime pay under the Fair Labor Standards Act, while non-exempt salaried employees must receive overtime compensation for hours worked beyond 40 per week.

Hourly employee

Hourl y employees classified as non-exempt are entitled to overtime pay under the Fair Labor Standards Act, while exempt employees receive a fixed salary without overtime eligibility.

Job classification

Job classification determines employee eligibility for overtime pay under the Fair Labor Standards Act (FLSA), categorizing positions as exempt or non-exempt based on salary level, job duties, and responsibilities. Exempt employees, typically salaried and in executive, professional, or administrative roles, are excluded from overtime pay requirements, whereas non-exempt employees receive overtime pay for hours worked beyond 40 in a workweek.

Minimum wage

Minimum wage laws apply differently to exempt employees, who are salaried and not eligible for overtime, and non-exempt employees, who must be paid at least the minimum wage plus overtime for hours worked beyond 40 per week.

Time tracking

Time tracking is essential for non-exempt employees to accurately record hours worked and ensure compliance with wage and hour laws, while exempt employees are generally not required to track time as they receive a fixed salary regardless of hours. Employers must differentiate exemptions based on criteria such as job duties and salary thresholds defined by the Fair Labor Standards Act (FLSA) to determine proper time-tracking protocols and overtime eligibility.

White-collar exemption

The White-collar exemption classifies employees as exempt from overtime pay under the Fair Labor Standards Act based on specific job duties and salary thresholds, distinguishing them from non-exempt employees who are entitled to overtime compensation.

Compensable time

Compensable time determines whether non-exempt employees qualify for overtime pay under the Fair Labor Standards Act, while exempt employees are excluded from such compensation requirements.

Wage and hour compliance

Understanding wage and hour compliance requires distinguishing between exempt employees, who are not eligible for overtime pay under the Fair Labor Standards Act (FLSA), and non-exempt employees, who must be compensated for overtime hours worked beyond 40 per week.

Exempt vs Non-exempt Infographic

moneydif.com

moneydif.com