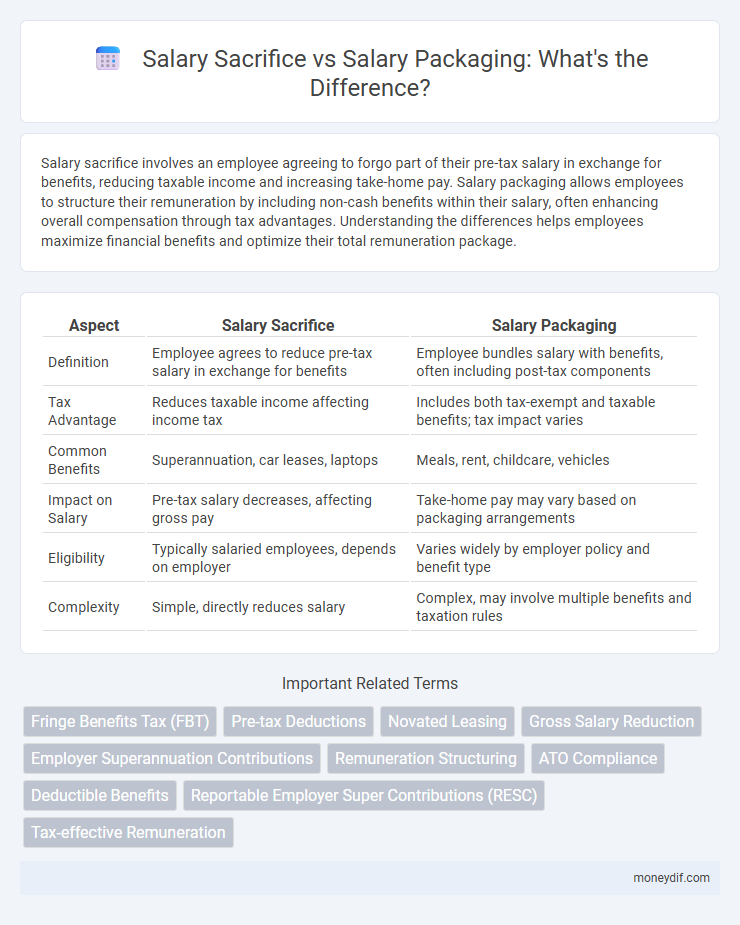

Salary sacrifice involves an employee agreeing to forgo part of their pre-tax salary in exchange for benefits, reducing taxable income and increasing take-home pay. Salary packaging allows employees to structure their remuneration by including non-cash benefits within their salary, often enhancing overall compensation through tax advantages. Understanding the differences helps employees maximize financial benefits and optimize their total remuneration package.

Table of Comparison

| Aspect | Salary Sacrifice | Salary Packaging |

|---|---|---|

| Definition | Employee agrees to reduce pre-tax salary in exchange for benefits | Employee bundles salary with benefits, often including post-tax components |

| Tax Advantage | Reduces taxable income affecting income tax | Includes both tax-exempt and taxable benefits; tax impact varies |

| Common Benefits | Superannuation, car leases, laptops | Meals, rent, childcare, vehicles |

| Impact on Salary | Pre-tax salary decreases, affecting gross pay | Take-home pay may vary based on packaging arrangements |

| Eligibility | Typically salaried employees, depends on employer | Varies widely by employer policy and benefit type |

| Complexity | Simple, directly reduces salary | Complex, may involve multiple benefits and taxation rules |

Understanding Salary Sacrifice: An Overview

Salary sacrifice involves an employee agreeing to reduce their pre-tax salary in exchange for non-cash benefits such as additional superannuation contributions or a company car. This arrangement can lower taxable income, potentially resulting in tax savings while increasing overall compensation value. Understanding salary sacrifice options requires assessing personal financial goals, employer policies, and applicable tax regulations to maximize benefits.

What Is Salary Packaging?

Salary packaging is a pre-tax arrangement where employees agree to receive part of their salary as non-cash benefits, reducing taxable income and increasing take-home pay. Common benefits include cars, laptops, and superannuation contributions, tailored to meet employees' financial goals. This strategy leverages tax advantages to maximize overall compensation without increasing gross salary.

Key Differences Between Salary Sacrifice and Salary Packaging

Salary sacrifice involves an employee agreeing to reduce their pre-tax salary in exchange for benefits, lowering taxable income and potentially increasing take-home pay. Salary packaging, commonly used in Australia, allows employees to receive part of their salary in the form of non-cash benefits, which can include items like cars or laptops, often with fringe benefits tax (FBT) implications. The key difference lies in salary sacrifice requiring a formal agreement to reduce pay, while salary packaging offers a flexible mix of cash and benefits tailored to tax-effective arrangements.

Pros and Cons of Salary Sacrifice

Salary sacrifice allows employees to reduce their taxable income by agreeing to forgo part of their salary in exchange for benefits, often leading to significant tax savings on items like superannuation contributions or car leases. However, this arrangement can reduce take-home pay and impact government benefits or loan eligibility due to the lowered reported income. While salary sacrifice offers tax efficiency and potential savings on large purchases, it requires careful consideration of personal financial circumstances and long-term goals.

Advantages and Disadvantages of Salary Packaging

Salary packaging offers employees the advantage of increasing their take-home pay by reducing taxable income through pre-tax benefits such as vehicles, laptops, or superannuation contributions. However, disadvantages include potential complexities in administration, limited benefit options depending on employer policies, and possible impacts on government entitlements like childcare benefits or loans. It requires careful consideration of individual financial situations and consultation with tax professionals to maximize advantages effectively.

Tax Implications: Salary Sacrifice vs Salary Packaging

Salary sacrifice reduces taxable income by redirecting part of an employee's pre-tax salary towards benefits, lowering overall tax liability and increasing take-home pay. Salary packaging involves structuring remuneration packages through non-cash benefits, which can be taxed differently depending on the benefit and tax laws, potentially optimizing tax efficiency for both employer and employee. Understanding the specific tax implications of each strategy is crucial for maximizing after-tax income and complying with regulations.

Impact on Take-Home Pay

Salary sacrifice reduces your taxable income by redirecting a portion of your pre-tax salary towards benefits, increasing your take-home pay by lowering income tax and Medicare levy liabilities. Salary packaging involves arranging specific benefits within your salary structure, often including fringe benefits tax concessions, which can further enhance net earnings by maximizing tax-effective remuneration. Both strategies optimize take-home pay by legally minimizing taxable income, with the choice depending on individual financial circumstances and employer offerings.

Eligible Benefits and Inclusions

Salary sacrifice and salary packaging both offer tax-effective ways to allocate portions of pre-tax income towards eligible benefits, yet their inclusions vary based on employer policies and tax regulations. Salary sacrifice commonly includes benefits like superannuation contributions, novated leases, and work-related expenses, while salary packaging may extend to additional items such as laptops, mobile phones, and meal entertainment within specified limits. Eligibility often depends on the employee's contract and employer agreements, with strict adherence to Australian Taxation Office (ATO) guidelines ensuring compliance and optimal tax advantages.

Employer and Employee Considerations

Salary sacrifice allows employees to reduce taxable income by redirecting pre-tax earnings towards benefits like superannuation, improving tax efficiency for both parties. Employers may benefit from reduced payroll taxes and enhanced employee satisfaction, while employees gain potential tax savings and increased take-home pay. Salary packaging involves bundling various benefits into a salary package, requiring employers to balance administrative complexity with attractive compensation to retain talent and comply with taxation laws.

Choosing the Right Option for Your Financial Goals

Selecting between salary sacrifice and salary packaging hinges on your financial goals and tax situation. Salary sacrifice directly reduces your taxable income by redirecting pre-tax salary to benefits like superannuation or a car, enhancing retirement savings or lowering tax liability. Salary packaging offers flexibility by allowing employees to receive specific benefits tax-free or at a reduced cost, making it ideal for those seeking immediate everyday savings on items such as laptops, phones, or meal allowances.

Important Terms

Fringe Benefits Tax (FBT)

Fringe Benefits Tax (FBT) applies to salary sacrifice arrangements where employees forego salary for benefits, while salary packaging encompasses various pre-tax benefit options that can influence FBT liabilities depending on the benefit types and limits.

Pre-tax Deductions

Pre-tax deductions in salary sacrifice reduce taxable income by redirecting part of an employee's salary into benefits, while salary packaging involves an agreement with the employer to allocate a portion of salary towards specified expenses before tax calculation, both enhancing tax efficiency.

Novated Leasing

Novated leasing allows employees to finance a vehicle through salary sacrifice, reducing taxable income and improving cash flow by paying lease payments from pre-tax salary. Salary packaging offers a broader range of benefits including novated leases, enabling greater flexibility in managing remuneration by allocating pre-tax earnings towards various expenses.

Gross Salary Reduction

Gross salary reduction occurs when an employee agrees to receive a lower pre-tax salary in exchange for non-cash benefits through salary sacrifice arrangements, effectively lowering taxable income and potentially increasing take-home pay. Salary packaging differs as it involves structuring total remuneration to include fringe benefits, optimizing tax efficiency but not necessarily reducing gross salary directly.

Employer Superannuation Contributions

Salary sacrifice Employer Superannuation Contributions increase retirement savings by redirecting pre-tax salary, while salary packaging offers broader benefits by allowing employees to exchange salary for non-cash benefits, potentially optimizing tax efficiency.

Remuneration Structuring

Remuneration structuring through salary sacrifice involves employees agreeing to forgo part of their pre-tax salary in exchange for specific benefits, optimizing tax efficiency and increasing take-home pay. Salary packaging, often tailored to include items like superannuation, vehicles, or electronic devices, combines both pre-tax and post-tax components to maximize employer and employee financial advantages within legislative frameworks.

ATO Compliance

Salary packaging offers broader benefits beyond salary sacrifice by including tax-efficient methods like novated leases and fringe benefit allowances to optimize ATO compliance for employees.

Deductible Benefits

Deductible benefits in salary sacrifice arrangements allow employees to reduce their taxable income by redirecting pre-tax salary towards eligible expenses, enhancing overall tax efficiency compared to salary packaging where non-cash benefits are provided but may not always qualify for tax deductions. Understanding the specific allowable expenses and limits under income tax regulations is crucial for maximizing the financial advantages of deductible benefits within these remuneration strategies.

Reportable Employer Super Contributions (RESC)

Reportable Employer Super Contributions (RESC) include both salary sacrifice and salary packaging contributions, which are reported on the employee's annual payment summary to the Australian Taxation Office (ATO) for superannuation purposes. Salary sacrifice contributions are pre-tax amounts redirected from an employee's income into superannuation, reducing taxable income, while salary packaging may include post-tax benefits and does not always impact RESC reporting in the same manner.

Tax-effective Remuneration

Tax-effective remuneration strategies such as salary sacrifice and salary packaging enable employees to allocate a portion of their pre-tax salary towards approved benefits, reducing taxable income and increasing take-home pay. Salary sacrifice typically involves diverting salary into superannuation or other fringe benefits, while salary packaging extends to a broader range of expenses including vehicles, laptops, and mortgage payments, optimizing tax savings based on specific government regulations.

Salary Sacrifice vs Salary Packaging Infographic

moneydif.com

moneydif.com