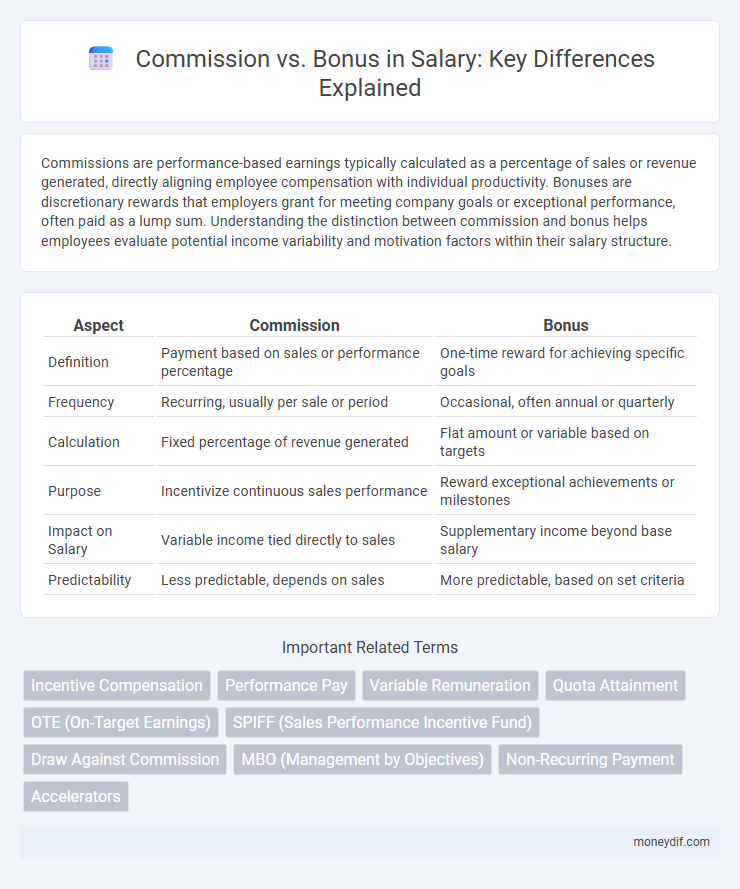

Commissions are performance-based earnings typically calculated as a percentage of sales or revenue generated, directly aligning employee compensation with individual productivity. Bonuses are discretionary rewards that employers grant for meeting company goals or exceptional performance, often paid as a lump sum. Understanding the distinction between commission and bonus helps employees evaluate potential income variability and motivation factors within their salary structure.

Table of Comparison

| Aspect | Commission | Bonus |

|---|---|---|

| Definition | Payment based on sales or performance percentage | One-time reward for achieving specific goals |

| Frequency | Recurring, usually per sale or period | Occasional, often annual or quarterly |

| Calculation | Fixed percentage of revenue generated | Flat amount or variable based on targets |

| Purpose | Incentivize continuous sales performance | Reward exceptional achievements or milestones |

| Impact on Salary | Variable income tied directly to sales | Supplementary income beyond base salary |

| Predictability | Less predictable, depends on sales | More predictable, based on set criteria |

Understanding Commission vs Bonus: Key Differences

Commission is compensation directly tied to sales performance, calculated as a percentage of revenue generated by an employee. Bonus, in contrast, is a discretionary reward given based on individual or company-wide achievement, often unrelated to specific sales figures. Understanding these key differences clarifies how incentives drive employee motivation and impact overall salary structure.

How Commission Structures Impact Salary

Commission structures directly influence overall salary by linking earnings to individual or team sales performance, creating variable income potential. Employees with high commission rates often experience significant fluctuations in monthly pay, tied to sales volume and achievement of targets. This alignment incentivizes productivity but can introduce income instability compared to fixed bonuses.

The Role of Bonuses in Employee Compensation

Bonuses serve as a variable component of employee compensation, directly tied to individual, team, or company performance metrics, enhancing motivation and productivity. Unlike commissions, which are often limited to sales roles and calculated as a percentage of sales, bonuses can be awarded across various job functions as a reward for meeting or exceeding key performance indicators (KPIs). This flexibility allows employers to align employee incentives with broader organizational goals beyond revenue generation.

Pros and Cons of Commission-Based Salaries

Commission-based salaries motivate employees by directly linking earnings to performance, driving higher sales and productivity. However, this pay structure can create income instability and may encourage aggressive selling tactics, potentially harming customer relationships. Companies should weigh the benefits of increased motivation against the risks of fluctuating employee income and possible ethical concerns.

Advantages and Disadvantages of Bonus Payments

Bonus payments offer employees financial rewards tied to individual or company performance, enhancing motivation and job satisfaction. They provide flexibility for employers to incentivize productivity without increasing fixed salary costs but may lead to inconsistent income and potential overemphasis on short-term goals. Unlike commissions, bonuses are not typically based on direct sales, making them suitable for a broader range of roles but sometimes less transparent in their calculation.

Which Is Better for Motivation: Commission or Bonus?

Commission provides direct financial rewards tied to individual sales performance, creating a clear incentive for employees to increase productivity and achieve measurable results. Bonuses, often based on overall company performance or achieving specific targets, can foster a sense of team collaboration and long-term commitment. Choosing between commission and bonus depends on the desired motivational outcome: commissions drive immediate action and personal achievement, while bonuses encourage collective goals and sustained effort.

Industry Trends: Commission vs Bonus Practices

Industry trends reveal a growing preference for performance-based pay structures, with commissions gaining traction in sales-driven sectors while bonuses remain prevalent in corporate and tech industries. Data indicates that commissions often provide direct incentives aligned with individual revenue generation, whereas bonuses are typically tied to overall company performance or project milestones. Employers increasingly blend both strategies to balance motivation with financial stability, adapting to market demands and employee expectations.

Legal Considerations: Commission and Bonus Payments

Commission payments are typically considered guaranteed compensation tied directly to sales performance, subject to clear contractual terms to avoid disputes and ensure compliance with wage laws. Bonus payments, often discretionary, must still adhere to employment agreements and anti-discrimination regulations to prevent unfair treatment or claims of withheld compensation. Employers must document commission and bonus structures precisely, aligning with local labor laws and tax regulations to mitigate legal risks and protect both parties' interests.

Managing Employee Expectations: Commission vs Bonus

Managing employee expectations requires clear communication about the differences between commission and bonus structures. Commissions provide direct financial rewards based on sales performance, incentivizing productivity and motivating consistent effort. Bonuses are typically discretionary, reflecting company profitability or individual achievements, and may vary in frequency and amount.

Choosing the Right Compensation Model for Your Business

Selecting the most effective compensation model depends on your business goals and sales strategy; commissions incentivize direct sales performance by rewarding a percentage of revenue generated, while bonuses offer fixed rewards based on achieving specific targets or milestones. Commission structures drive consistent motivation for sales roles but may lead to unpredictable expenses, whereas bonuses provide cost control and reward broader employee contributions. Evaluating your financial stability, sales cycle length, and team dynamics helps determine whether a commission, bonus, or hybrid model best aligns with your company's objectives.

Important Terms

Incentive Compensation

Incentive compensation structures often differentiate commissions as performance-based payments directly tied to sales results, while bonuses are typically discretionary rewards based on overall performance or company profitability.

Performance Pay

Performance pay structures primarily vary by commission, which directly rewards individual sales results, versus bonuses, which are discretionary payments based on overall company or team performance metrics.

Variable Remuneration

Variable remuneration consists of commissions directly tied to sales performance and bonuses awarded based on overall company or individual achievements.

Quota Attainment

Quota attainment measures the percentage of sales targets achieved by a salesperson, directly impacting commission calculations based on predefined rates. Bonuses often supplement commissions by rewarding sales performance that exceeds quota thresholds or exceptional achievements beyond standard commission structures.

OTE (On-Target Earnings)

On-Target Earnings (OTE) represent the total expected compensation combining base salary with variable components, typically commission or bonus, contingent on achieving specific sales or performance targets. Commissions are usually directly tied to sales revenue generated, fostering a performance-driven pay structure, while bonuses may reward broader achievements or milestones beyond direct sales metrics.

SPIFF (Sales Performance Incentive Fund)

SPIFFs are short-term sales incentives focusing on immediate performance rewards, differing from commissions which are percentage-based earnings on sales, and bonuses which are broader, often periodic, extra compensation beyond standard pay.

Draw Against Commission

A Draw Against Commission is an advance payment on future commissions where the employee must repay the draw if commissions earned exceed the advance, unlike a bonus which is an additional, unconditional reward beyond regular commission payments.

MBO (Management by Objectives)

Management by Objectives (MBO) aligns employee goals with company targets, often linking compensation strategies such as commissions and bonuses to measurable performance outcomes. Commissions typically reward specific sales achievements, while bonuses incentivize overall objective fulfillment, driving both individual and organizational success.

Non-Recurring Payment

Non-recurring payments, such as one-time commissions, are typically tied to specific sales or performance targets, distinguishing them from bonuses which are often discretionary rewards based on overall company performance or employee evaluation. Commissions directly incentivize transactional achievements, while bonuses serve as broader motivational tools reflecting cumulative success or milestones.

Accelerators

Accelerators increase sales commissions by applying higher payout rates once sales surpass predefined targets, incentivizing superior performance beyond standard bonuses.

commission vs bonus Infographic

moneydif.com

moneydif.com