Severance pay refers to compensation provided to employees upon involuntary termination, often based on length of service and company policy, aimed at financial support during job transition. Settlement pay typically arises from negotiated agreements between employer and employee to resolve disputes or claims, encompassing more than just termination compensation. Understanding the distinct purposes and conditions of severance and settlement pay is crucial for navigating post-employment financial arrangements.

Table of Comparison

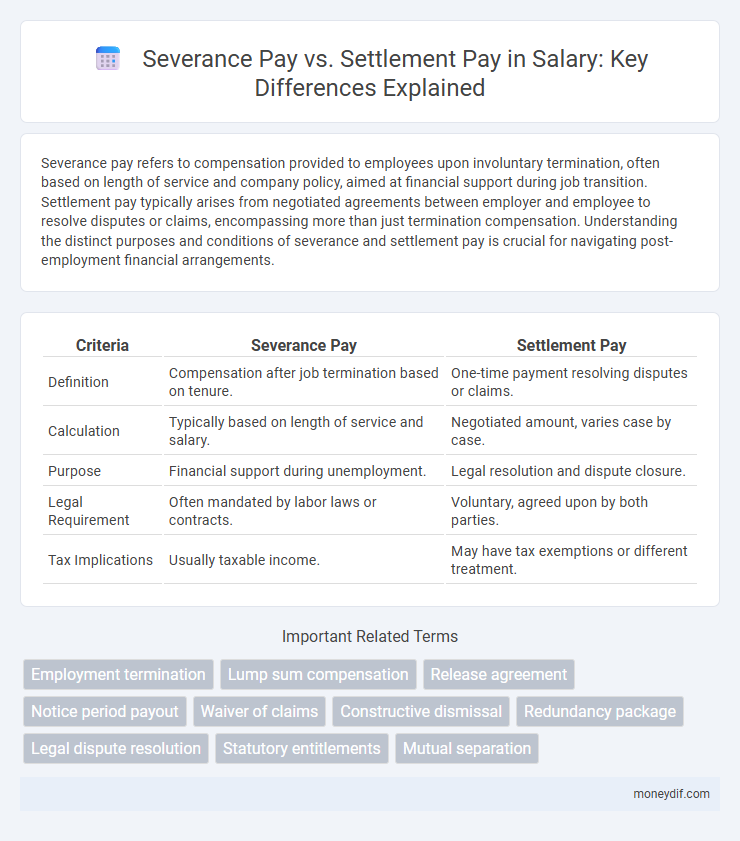

| Criteria | Severance Pay | Settlement Pay |

|---|---|---|

| Definition | Compensation after job termination based on tenure. | One-time payment resolving disputes or claims. |

| Calculation | Typically based on length of service and salary. | Negotiated amount, varies case by case. |

| Purpose | Financial support during unemployment. | Legal resolution and dispute closure. |

| Legal Requirement | Often mandated by labor laws or contracts. | Voluntary, agreed upon by both parties. |

| Tax Implications | Usually taxable income. | May have tax exemptions or different treatment. |

Understanding Severance Pay

Severance pay is a financial compensation provided by employers to employees upon termination, often based on the length of service and company policy. It serves as a safety net, helping employees manage the transition while seeking new employment. Understanding severance pay involves knowing eligibility criteria, calculation methods, and how it differs from settlement pay, which typically resolves legal disputes.

Defining Settlement Pay

Settlement pay refers to a mutually agreed-upon compensation between an employer and employee, often provided to resolve potential disputes or terminate employment without litigation. Unlike severance pay, which is typically calculated based on tenure or contractual terms, settlement pay amounts are negotiated and can cover various claims, including unpaid wages or discrimination. This agreement usually includes a release of claims, ensuring both parties avoid future legal action.

Key Differences Between Severance and Settlement Pay

Severance pay is typically a predetermined amount offered to employees upon involuntary termination to ease financial transition, often based on tenure and salary. Settlement pay, in contrast, arises from legal agreements resolving disputes, encompassing compensation beyond standard severance, such as damages or penalties. Understanding these distinctions helps employers and employees navigate contractual obligations and legal rights regarding post-employment compensation.

Legal Framework for Severance Pay

Severance pay is governed by strict labor laws and employment contracts that define eligibility criteria, calculation methods, and payment timelines, ensuring employees receive compensation for job termination without cause. Legal frameworks mandate employers to provide severance pay based on factors such as length of service, salary level, and local labor regulations, protecting workers' financial security. Settlement pay, by contrast, often arises from negotiated agreements resolving disputes and may not have the same statutory protections as severance pay under employment law.

Legal Aspects of Settlement Pay

Severance pay is typically mandated by labor laws or employment contracts to compensate employees upon termination, while settlement pay arises from negotiated agreements resolving disputes. Settlement pay often involves legally binding contracts that waive further claims against the employer, requiring careful drafting to ensure enforceability and compliance with jurisdictional regulations. Employers and employees must understand the legal implications of settlement agreements, as improper handling can lead to litigation or invalidation of the settlement terms.

Eligibility Criteria for Severance and Settlement

Severance pay eligibility typically requires termination without cause, a minimum period of employment, and adherence to company policy or legal standards such as the WARN Act in the U.S. Settlement pay eligibility often arises in dispute resolution scenarios, requiring mutual agreement between employer and employee or as part of a legal settlement to resolve claims related to employment termination. Understanding specific contractual terms and regional labor laws is essential for determining eligibility for both severance and settlement payments.

Tax Implications: Severance vs Settlement

Severance pay is typically subject to standard income tax withholding, similar to regular wages, impacting the net amount received by employees. Settlement pay may have varied tax implications depending on the nature of the settlement, with portions potentially classified as compensation for lost wages and others as damages, which may be tax-exempt. Understanding the differential tax treatment of severance versus settlement pay is crucial for accurate financial planning and compliance with IRS regulations.

Negotiating Your Exit: Severance or Settlement?

Negotiating your exit requires understanding the key differences between severance pay and settlement pay to maximize financial benefits. Severance pay is typically a predetermined amount based on your tenure and salary, while settlement pay often involves negotiated compensation to resolve disputes or claims. Evaluating your employment contract and leveraging legal advice can help secure the most favorable terms during this critical negotiation phase.

Employee Rights During Termination

Severance pay is a legally mandated compensation provided to employees upon involuntary termination, ensuring financial support during job transition. Settlement pay often arises from negotiated agreements, addressing disputes or claims related to employment termination while potentially including non-disclosure clauses. Understanding employee rights during termination involves recognizing eligibility criteria, legal entitlements under labor laws, and the distinction between statutory severance and privately negotiated settlements.

Choosing the Best Option: Severance or Settlement Pay

Choosing between severance pay and settlement pay depends on factors such as tax implications, financial needs, and legal protections. Severance pay typically offers structured payments over time with continued benefits, while settlement pay provides a lump sum that may be negotiated to include confidentiality and dispute resolution clauses. Evaluating long-term financial stability and legal considerations ensures the optimal choice between severance and settlement compensation.

Important Terms

Employment termination

Severance pay is a predetermined compensation granted by employers upon employment termination based on contract terms, while settlement pay is a negotiated financial agreement resolving disputes related to the termination.

Lump sum compensation

Lump sum compensation refers to a one-time payment that can be structured as either severance pay, which compensates employees for length of service and wrongful termination, or settlement pay, often negotiated to resolve disputes without litigation. Severance pay is typically calculated based on tenure and salary, while settlement pay may include additional damages for claims such as discrimination or breach of contract.

Release agreement

A release agreement in the context of severance pay or settlement pay legally bars an employee from pursuing further claims against the employer in exchange for agreed compensation. Severance pay typically follows employment termination under contract terms, while settlement pay often results from negotiated dispute resolutions, each requiring precise documentation within the release agreement to ensure enforceability and limit liability.

Notice period payout

Notice period payout is often included in severance pay but differs from settlement pay, which typically covers broader negotiated claims beyond standard termination benefits.

Waiver of claims

Waiver of claims in the context of severance pay versus settlement pay involves an employee relinquishing the right to pursue future legal claims against the employer in exchange for agreed compensation. Severance pay typically follows statutory or contractual obligations, while settlement pay is often negotiated to resolve specific disputes, with the waiver serving as a binding release of claims tied to the payment received.

Constructive dismissal

Constructive dismissal occurs when an employee resigns due to employer misconduct, entitling them to severance pay, which differs from settlement pay as the latter typically involves negotiated compensation resolving disputes without admission of fault.

Redundancy package

The Redundancy package often includes Severance Pay, which is a statutory payment based on length of service and salary, while Settlement Pay is a negotiated amount that may cover additional claims or compensation beyond legal requirements. Employers typically calculate Severance Pay using a formula reflecting weekly wages and years worked, whereas Settlement Pay aims to resolve disputes or avoid litigation through mutually agreed terms.

Legal dispute resolution

Legal dispute resolution involving severance pay versus settlement pay often hinges on the terms of employment contracts and applicable labor laws, determining eligibility, payment amounts, and tax implications. Severance pay is typically mandated by statute or contract for termination without cause, while settlement pay arises from negotiated agreements to resolve disputes and may include broader compensation elements.

Statutory entitlements

Statutory entitlements guarantee minimum severance pay based on employment duration, while settlement pay often involves negotiated agreements exceeding legal severance requirements.

Mutual separation

Mutual separation agreements often involve negotiated severance pay based on employment tenure and company policy, whereas settlement pay typically resolves specific legal disputes or claims.

Severance Pay vs Settlement Pay Infographic

moneydif.com

moneydif.com