W-2 employees receive a regular paycheck with taxes withheld by their employer, including Social Security and Medicare, providing consistent tax reporting and benefits eligibility. In contrast, 1099 contractors are considered self-employed, responsible for managing their own tax payments, including quarterly estimated taxes and self-employment tax. Understanding these distinctions is crucial for optimizing salary structure, tax obligations, and financial planning.

Table of Comparison

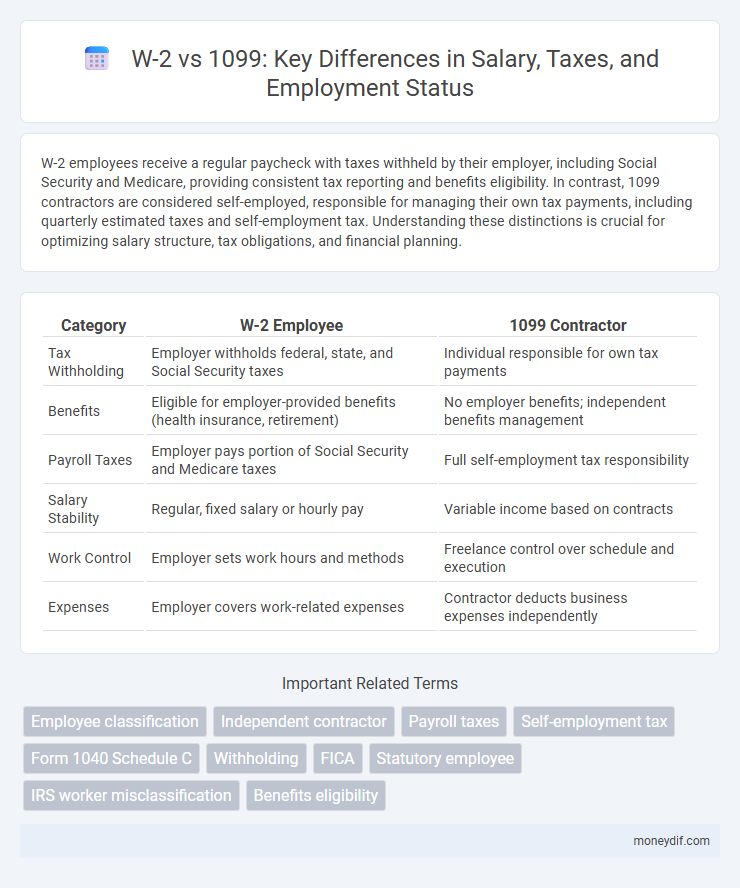

| Category | W-2 Employee | 1099 Contractor |

|---|---|---|

| Tax Withholding | Employer withholds federal, state, and Social Security taxes | Individual responsible for own tax payments |

| Benefits | Eligible for employer-provided benefits (health insurance, retirement) | No employer benefits; independent benefits management |

| Payroll Taxes | Employer pays portion of Social Security and Medicare taxes | Full self-employment tax responsibility |

| Salary Stability | Regular, fixed salary or hourly pay | Variable income based on contracts |

| Work Control | Employer sets work hours and methods | Freelance control over schedule and execution |

| Expenses | Employer covers work-related expenses | Contractor deducts business expenses independently |

Understanding W-2 and 1099 Employment Status

W-2 employment status designates employees whose employers withhold taxes, provide benefits, and adhere to labor laws, ensuring regular paycheck deductions for Social Security and Medicare. In contrast, 1099 status applies to independent contractors responsible for self-employment taxes, handling their own benefits, and receiving payment without tax withholding. Understanding the distinction between W-2 and 1099 affects tax obligations, eligibility for unemployment benefits, and legal protections in salary management.

Key Differences Between W-2 and 1099 Workers

W-2 workers are employees who receive regular wages with tax withholding, employer-paid benefits, and eligibility for workers' compensation and unemployment insurance. In contrast, 1099 workers are independent contractors responsible for their own tax payments, including self-employment taxes, and typically do not receive employee benefits. The classification impacts payroll taxes, legal protections, and the nature of control employers have over work performed.

Salary Structure: W-2 vs 1099 Compensation

W-2 salary structures typically include regular wages subject to federal and state tax withholdings, employer-paid Social Security and Medicare contributions, and benefits such as health insurance and retirement plans. In contrast, 1099 compensation is paid as gross income without tax withholdings, requiring independent contractors to manage their own tax payments including self-employment tax. Understanding these differences is crucial for accurate salary planning, tax compliance, and financial benefits management.

Tax Implications for W-2 and 1099 Employees

W-2 employees have taxes withheld directly from their paychecks, including federal income tax, Social Security, and Medicare, simplifying their tax filing process. In contrast, 1099 contractors receive gross income without withholding, requiring them to manage quarterly estimated tax payments and self-employment taxes. Understanding these tax obligations is crucial for accurate financial planning and compliance with IRS regulations.

Employee Benefits: W-2 Compared to 1099

W-2 employees receive comprehensive benefits such as health insurance, retirement plans, and paid time off provided by their employer, contributing to greater financial security and job stability. In contrast, 1099 contractors are responsible for securing their own benefits, often resulting in higher out-of-pocket costs and lack of employer-sponsored coverage. This distinction significantly impacts overall compensation and long-term financial planning for workers in each category.

Payroll Deductions and Withholdings Explained

W-2 employees have payroll deductions automatically withheld from their salary, including federal and state income taxes, Social Security, and Medicare contributions, ensuring compliance with tax obligations. In contrast, 1099 contractors receive payments without automatic withholdings, requiring them to manage and pay estimated taxes quarterly, including self-employment tax covering Social Security and Medicare. Understanding these distinctions in payroll deductions and withholdings is essential for accurate tax reporting and financial planning for both employees and independent contractors.

Legal Rights and Protections: W-2 vs 1099

W-2 employees receive legal rights and protections such as minimum wage, overtime pay, unemployment insurance, and workers' compensation, which are not guaranteed for 1099 independent contractors. Labor laws and employer obligations like tax withholding and benefits apply strictly to W-2 workers, whereas 1099 contractors are classified as self-employed and must manage their own taxes and benefits. Understanding these distinctions is crucial for ensuring compliance and safeguarding worker rights in salary agreements.

Choosing Between W-2 and 1099 for Maximum Earnings

Choosing between W-2 and 1099 significantly impacts maximum earnings due to tax obligations and benefits. W-2 employees receive consistent paycheck with employer-covered taxes, retirement contributions, and benefits, reducing personal tax liabilities but limiting deductions. Independent contractors with 1099 forms can deduct business expenses, potentially lowering taxable income and increasing net earnings, but must manage self-employment taxes and quarterly payments carefully.

Recordkeeping and Documentation Requirements

W-2 employees receive detailed annual wage and tax statements from employers, simplifying recordkeeping with standardized documentation of earnings and withheld taxes. Independent contractors paid via 1099 must diligently maintain their own records of income and expenses for accurate tax filing and potential audits. Proper documentation for 1099 workers includes invoices, receipts, and bank statements to substantiate deductions and income reported to the IRS.

Which Employment Type is Right for Your Career?

Choosing between W-2 and 1099 employment depends on your work preferences and financial goals. W-2 employees receive consistent paychecks with taxes withheld, benefits like health insurance, and employer protections, whereas 1099 contractors enjoy flexibility, control over projects, and responsibility for self-employment taxes. Evaluating the stability of income, tax obligations, and desired autonomy helps determine the employment type best suited for your career growth and lifestyle.

Important Terms

Employee classification

Employee classification determines tax obligations, with W-2 employees subject to payroll tax withholding and benefits, while 1099 contractors handle their own taxes and lack employer-provided benefits.

Independent contractor

Independent contractors receive Form 1099 for tax reporting, reflecting non-employee income without employer tax withholdings, unlike W-2 employees whose earnings include withholding for Social Security, Medicare, and income tax. The classification affects eligibility for benefits, tax deductions, and legal protections under IRS guidelines distinguishing employee status.

Payroll taxes

Payroll taxes for W-2 employees are withheld and matched by employers, while independent contractors receiving 1099 forms are responsible for paying their full self-employment taxes.

Self-employment tax

Self-employment tax applies to income reported on Form 1099, requiring self-employed individuals to pay both the employer and employee portions of Social Security and Medicare taxes, unlike W-2 employees whose employers share these tax responsibilities.

Form 1040 Schedule C

Form 1040 Schedule C is used by sole proprietors to report income and expenses from their business, typically associated with 1099 income rather than W-2 wages. Unlike W-2 employees whose taxes are withheld by employers, independent contractors report earnings on Schedule C and pay self-employment taxes on 1099 income.

Withholding

Withholding on a W-2 involves employer-deducted taxes from wages, while 1099 income requires recipients to manage and pay their own estimated taxes without automatic withholding.

FICA

FICA taxes are automatically withheld from employees' wages on Form W-2, while independent contractors reporting income on Form 1099 are responsible for paying the full self-employment tax, including both the employer and employee portions of FICA.

Statutory employee

A statutory employee receives a W-2 form for tax reporting, allowing them to deduct work-related expenses on Schedule C, unlike independent contractors who receive a 1099 and must handle self-employment taxes.

IRS worker misclassification

The IRS worker misclassification audit focuses on ensuring employees classified under W-2 receive correct tax withholdings, distinguishing them from independent contractors who receive 1099 forms.

Benefits eligibility

Benefits eligibility often depends on employment classification; W-2 employees typically qualify for employer-sponsored benefits like health insurance and retirement plans, while 1099 contractors generally do not have access to these perks and must secure their own benefits independently. Employers must correctly classify workers to ensure compliance with IRS regulations and avoid penalties related to misclassification affecting benefits eligibility.

W-2 vs 1099 Infographic

moneydif.com

moneydif.com