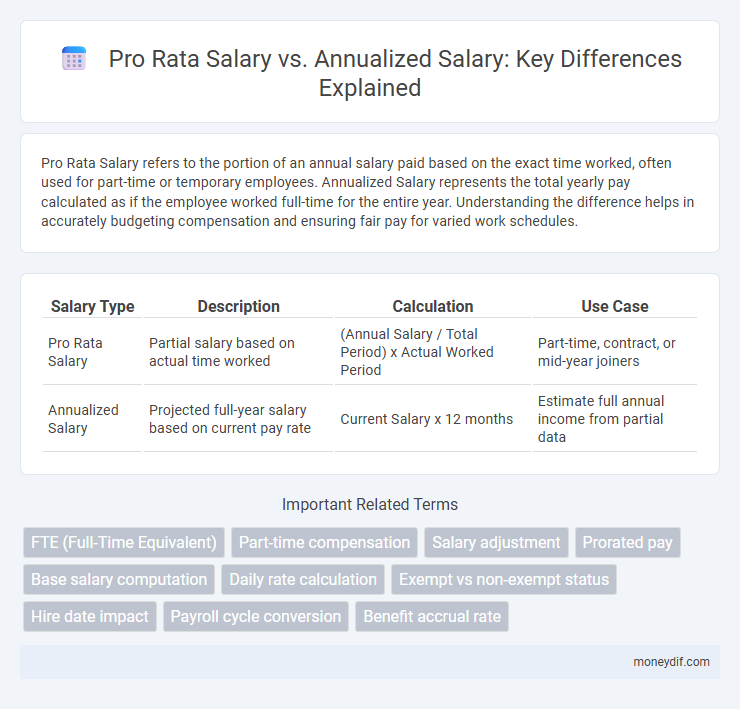

Pro Rata Salary refers to the portion of an annual salary paid based on the exact time worked, often used for part-time or temporary employees. Annualized Salary represents the total yearly pay calculated as if the employee worked full-time for the entire year. Understanding the difference helps in accurately budgeting compensation and ensuring fair pay for varied work schedules.

Table of Comparison

| Salary Type | Description | Calculation | Use Case |

|---|---|---|---|

| Pro Rata Salary | Partial salary based on actual time worked | (Annual Salary / Total Period) x Actual Worked Period | Part-time, contract, or mid-year joiners |

| Annualized Salary | Projected full-year salary based on current pay rate | Current Salary x 12 months | Estimate full annual income from partial data |

Understanding Pro Rata Salary: Key Concepts

Pro Rata Salary refers to the proportionate amount of an annual salary paid based on the actual time worked, commonly used for part-time or temporary employees. It is calculated by multiplying the full annual salary by the fraction of the year or hours worked, ensuring fair compensation aligned with employment duration. Understanding the distinction from Annualized Salary, which represents the total projected salary over a full year regardless of actual time worked, is critical for accurate payroll management and employee agreements.

What Is Annualized Salary? A Clear Definition

Annualized salary represents the total amount of money an employee earns over a full year, calculated by multiplying the regular pay period amount by the number of pay periods in a year. This method standardizes compensation for employees who may work irregular hours or shorter terms, allowing for accurate salary comparisons and financial planning. Understanding annualized salary helps both employers and employees evaluate earnings consistently, regardless of actual time worked during the year.

Main Differences Between Pro Rata and Annualized Salary

Pro Rata Salary represents the portion of an annual salary paid based on the actual time worked, typically calculated when employment is part-time or starts mid-year, ensuring employees receive fair compensation relative to their working period. Annualized Salary refers to the total amount an employee would earn if working full-time for an entire year, providing a standardized figure for budgeting and comparison. The main difference lies in Pro Rata Salary's adjustment for actual work duration versus Annualized Salary's projection of full-year earnings regardless of time worked.

Calculating Pro Rata Salary: Step-by-Step Guide

Calculating pro rata salary involves determining the employee's earnings based on the proportion of the full-time equivalent worked during a specific period. To calculate, multiply the annual salary by the fraction of time worked relative to the full year, such as months or weeks employed divided by 12 months or 52 weeks. This approach ensures accurate compensation for part-time workers or those who join or leave mid-year.

How to Determine Annualized Salary

To determine annualized salary, multiply the regular pay rate by the total number of pay periods within a year, reflecting the full-year equivalent income regardless of actual working duration. This calculation standardizes income comparison by converting partial or pro rata salaries into a consistent yearly figure. Employers use annualized salary to ensure fair compensation assessment and budget planning across different employment terms.

When is Pro Rata Salary Used?

Pro Rata Salary is used when an employee works less than the full standard annual hours, such as part-time roles or mid-year hires, ensuring pay aligns with actual time worked. It calculates earnings based on the proportion of the full-time equivalent salary corresponding to the employee's working hours or contract length. This method provides a fair compensation structure reflecting partial employment periods or hours.

Common Scenarios for Annualized Salary

Annualized salary is commonly used in scenarios where employees work irregular hours, such as seasonal roles or part-time contracts, ensuring consistent pay calculated on a yearly basis regardless of actual hours worked each period. It provides a standardized income figure for roles with fluctuating schedules or temporary appointments, facilitating budget planning and payroll management. Employers often apply annualized salary to salaried employees with varying work hours or those transitioning between part-time and full-time status to maintain equitable compensation.

Advantages and Disadvantages of Pro Rata Salary

Pro rata salary offers the advantage of equitable pay based on the actual hours or portion of the year worked, making it ideal for part-time or contract employees by ensuring precise compensation aligned with work contribution. However, the disadvantage lies in potential income instability for workers with fluctuating hours, and the complexity it introduces in payroll calculations compared to fixed annualized salaries. Employers benefit from cost control and fairness, while employees may face challenges in budgeting due to variable monthly earnings.

Pros and Cons of Annualized Salary

Annualized salary provides a consistent, predictable income by spreading total yearly earnings evenly across pay periods, enhancing budget planning for employees. However, it may not reflect actual hours worked during fluctuating workloads, potentially disadvantaging those with seasonal or variable schedules. Employers benefit from simplified payroll management, but employees might face challenges tracking overtime or additional compensation accurately.

Which Salary Structure Is Best For You?

Choosing between pro rata salary and annualized salary depends on your employment type and work hours. Pro rata salary is ideal for part-time or temporary roles, paying based on actual hours worked, ensuring fair compensation aligned with time invested. Annualized salary suits full-time employees offering a fixed yearly income, providing stability and predictability regardless of fluctuations in workload or hours.

Important Terms

FTE (Full-Time Equivalent)

Full-Time Equivalent (FTE) measures employee workload relative to a full-time schedule, crucial for calculating pro rata salary, which adjusts pay based on actual hours worked versus full-time hours. Annualized salary represents the total yearly compensation based on the full-time equivalent, enabling consistent comparison between part-time and full-time earnings.

Part-time compensation

Part-time compensation is often calculated using a pro rata salary based on actual hours worked, whereas annualized salary represents a full-time equivalent annual income adjusted proportionally for part-time employment.

Salary adjustment

Pro Rata Salary reflects the earnings based on actual working time or portion of the year worked, while Annualized Salary represents the total expected yearly income if the employee worked full-time for the entire year.

Prorated pay

Prorated pay calculates an employee's earnings based on the actual time worked within a salary period, differing from pro rata salary which adjusts pay according to worked hours relative to full-time employment, while annualized salary represents the total projected earnings over a full year regardless of actual work duration.

Base salary computation

Base salary computation involves calculating the employee's fixed earnings before deductions, with Pro Rata Salary representing the proportional pay based on the actual time worked during a pay period, often used for part-time or mid-year joiners. Annualized Salary refers to the total projected earnings for a full year, standardized to reflect yearly compensation regardless of actual days worked, enabling consistent salary comparisons and budgeting.

Daily rate calculation

Daily rate calculation accurately reflects employee compensation by dividing the pro rata salary or annualized salary by the total number of working days in the year.

Exempt vs non-exempt status

Exempt employees typically receive an annualized salary unaffected by hourly work, while non-exempt employees may have pro rata salaries reflecting actual hours worked under overtime regulations.

Hire date impact

Hire date directly impacts Pro Rata Salary calculation by determining the exact portion of the Annualized Salary an employee earns based on their start date within the fiscal year.

Payroll cycle conversion

Payroll cycle conversion requires accurately calculating pro rata salary for partial periods and annualized salary for full fiscal years to ensure precise employee compensation.

Benefit accrual rate

Benefit accrual rate varies based on whether Pro Rata Salary or Annualized Salary is used, directly impacting the calculation of earned benefits over a specific service period.

Pro Rata Salary vs Annualized Salary Infographic

moneydif.com

moneydif.com