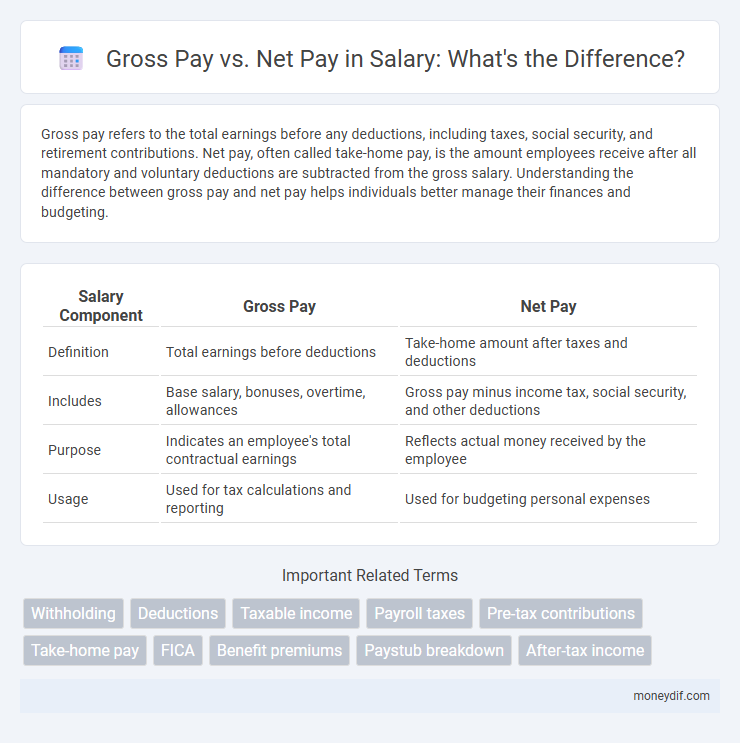

Gross pay refers to the total earnings before any deductions, including taxes, social security, and retirement contributions. Net pay, often called take-home pay, is the amount employees receive after all mandatory and voluntary deductions are subtracted from the gross salary. Understanding the difference between gross pay and net pay helps individuals better manage their finances and budgeting.

Table of Comparison

| Salary Component | Gross Pay | Net Pay |

|---|---|---|

| Definition | Total earnings before deductions | Take-home amount after taxes and deductions |

| Includes | Base salary, bonuses, overtime, allowances | Gross pay minus income tax, social security, and other deductions |

| Purpose | Indicates an employee's total contractual earnings | Reflects actual money received by the employee |

| Usage | Used for tax calculations and reporting | Used for budgeting personal expenses |

Understanding Gross Pay: Definition and Components

Gross pay represents the total earnings an employee receives before any deductions such as taxes, social security, or retirement contributions are applied. It includes base salary, overtime, bonuses, commissions, and other forms of compensation. Understanding gross pay is essential for accurately calculating taxes, benefits, and net pay, which reflects the actual amount an employee takes home.

What Is Net Pay? Key Elements Explained

Net pay refers to the amount of salary an employee receives after all mandatory deductions such as federal and state taxes, Social Security, Medicare, and other withholdings like retirement contributions or health insurance premiums. It represents the actual take-home pay available for personal use or savings. Understanding net pay is crucial for effective budgeting and financial planning, as it reflects the real income from which expenses must be covered.

Gross Pay vs Net Pay: Core Differences

Gross pay represents the total earnings before deductions such as taxes, social security, and retirement contributions, reflecting an employee's full compensation package. Net pay, also known as take-home pay, is the amount an employee receives after all mandatory and voluntary deductions are subtracted from the gross pay. Understanding the core differences between gross pay and net pay is essential for accurate budgeting, tax planning, and financial decision-making.

How to Calculate Gross Pay

Calculating gross pay involves multiplying the total number of hours worked by the hourly wage or using the fixed salary amount for salaried employees. Include overtime pay, bonuses, and commissions to ensure the total earnings before deductions are accurately accounted for. Gross pay represents the full earnings before taxes, Social Security, and other withholdings are subtracted.

Steps to Determine Net Pay

Calculate net pay by first identifying the gross pay, which includes total earnings before deductions. Subtract mandatory deductions such as federal and state taxes, Social Security, and Medicare from the gross pay. Then deduct voluntary contributions like health insurance premiums and retirement plan payments to arrive at the final net pay amount.

Common Deductions Impacting Net Pay

Gross pay represents the total earnings before any deductions, while net pay is the actual amount received after subtracting taxes, Social Security, Medicare, and retirement contributions. Common deductions impacting net pay include federal and state income taxes, health insurance premiums, and voluntary retirement savings such as 401(k) plans. Understanding these deductions helps employees estimate take-home pay accurately and plan their finances effectively.

Gross Pay in Employment Contracts

Gross pay in employment contracts represents the total earnings before any deductions such as taxes, social security, or retirement contributions are applied. It serves as the baseline figure for calculating an employee's salary, bonuses, and overtime compensation. Understanding gross pay is crucial for accurate financial planning and assessing the overall value of a job offer.

The Importance of Net Pay on Take-Home Salary

Net pay represents the actual amount employees receive after all deductions such as taxes, social security, and retirement contributions are subtracted from gross pay. Understanding net pay is crucial for accurate budgeting and financial planning since it reflects the usable income available for daily expenses and savings. Prioritizing net pay over gross pay helps workers make informed decisions about job offers, benefits, and financial commitments, ensuring a realistic view of take-home salary.

Employer Obligations: Withholding Taxes and Deductions

Employers are legally obligated to withhold taxes such as federal income tax, Social Security, and Medicare from an employee's gross pay before disbursing net pay. These mandatory deductions ensure compliance with tax laws and contribute to government programs. Proper calculation and timely withholding prevent penalties and maintain accurate payroll records.

Gross Pay vs Net Pay: Employee Financial Planning Tips

Gross pay represents an employee's total earnings before deductions, including taxes, retirement contributions, and insurance premiums, while net pay is the actual take-home amount after all withholdings. Understanding the difference between gross and net pay is crucial for effective financial planning, enabling employees to budget accurately and manage expenses. Tracking both figures helps optimize savings strategies and anticipate tax liabilities throughout the year.

Important Terms

Withholding

Withholding is the portion of an employee's gross pay deducted for taxes and other obligations, resulting in the net pay received after all deductions.

Deductions

Deductions such as taxes, Social Security, and retirement contributions reduce gross pay to determine an employee's net pay.

Taxable income

Taxable income is calculated by subtracting allowable deductions from gross pay, whereas net pay is the amount remaining after all taxes and deductions are withheld.

Payroll taxes

Payroll taxes are calculated based on an employee's gross pay and directly reduce the net pay by withheld amounts such as Social Security and Medicare taxes.

Pre-tax contributions

Pre-tax contributions reduce gross pay by deducting amounts before taxes are calculated, lowering taxable income and increasing take-home pay; net pay reflects earnings after all taxes and deductions, including pre-tax contributions, are subtracted. Understanding pre-tax contributions is essential for maximizing tax benefits and accurately calculating disposable income.

Take-home pay

Take-home pay is the net pay amount an employee receives after all taxes and deductions are subtracted from their gross pay.

FICA

FICA taxes are deducted from gross pay, reducing it to net pay by funding Social Security and Medicare contributions.

Benefit premiums

Benefit premiums are typically calculated based on gross pay rather than net pay to ensure consistent coverage and accurate payroll deductions.

Paystub breakdown

A paystub breakdown details gross pay, including total earnings before deductions, and net pay, the actual amount received after taxes and withholdings.

After-tax income

After-tax income represents the portion of gross pay remaining after all federal, state, and local taxes, as well as other deductions like Social Security and Medicare, are subtracted, reflecting true take-home pay. Understanding the difference between gross pay and net pay is essential for accurate budgeting and financial planning, as gross pay is the total earnings before deductions while net pay, or after-tax income, indicates available funds.

gross pay vs net pay Infographic

moneydif.com

moneydif.com