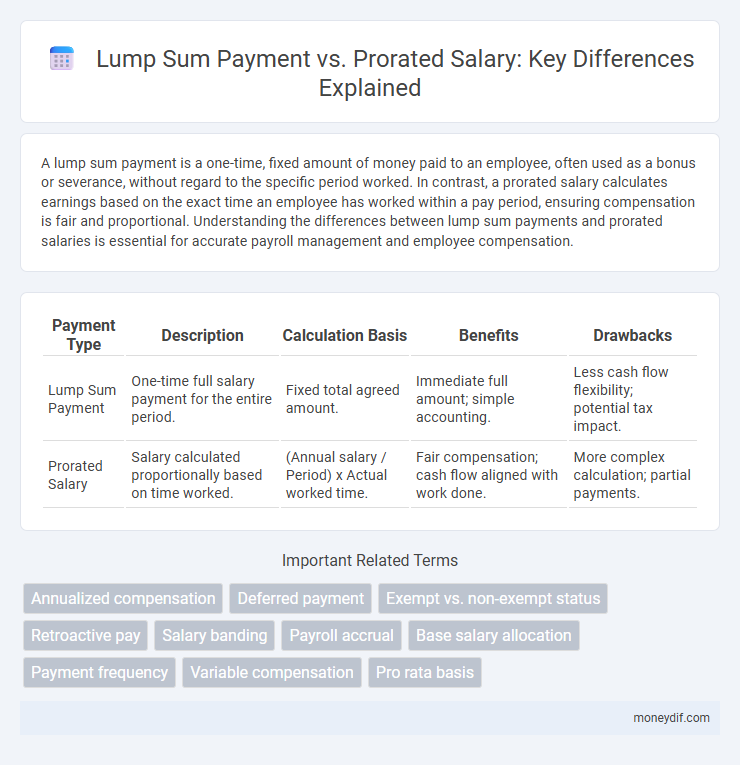

A lump sum payment is a one-time, fixed amount of money paid to an employee, often used as a bonus or severance, without regard to the specific period worked. In contrast, a prorated salary calculates earnings based on the exact time an employee has worked within a pay period, ensuring compensation is fair and proportional. Understanding the differences between lump sum payments and prorated salaries is essential for accurate payroll management and employee compensation.

Table of Comparison

| Payment Type | Description | Calculation Basis | Benefits | Drawbacks |

|---|---|---|---|---|

| Lump Sum Payment | One-time full salary payment for the entire period. | Fixed total agreed amount. | Immediate full amount; simple accounting. | Less cash flow flexibility; potential tax impact. |

| Prorated Salary | Salary calculated proportionally based on time worked. | (Annual salary / Period) x Actual worked time. | Fair compensation; cash flow aligned with work done. | More complex calculation; partial payments. |

Lump Sum Payment vs Prorated Salary: Key Differences

Lump sum payment is a fixed amount paid at once, typically used for bonuses or severance, whereas prorated salary adjusts the payment proportionally based on the working period within a pay cycle. Lump sum payments offer upfront financial benefit without impacting regular payroll, while prorated salary ensures fair compensation aligned with actual work duration. Understanding the distinction helps employers manage cash flow and employees anticipate accurate earnings during partial employment terms.

Understanding Lump Sum Payments in Salary Structures

Lump sum payments in salary structures refer to a one-time, fixed amount of money paid to employees, often as bonuses, severance, or special incentives, distinct from regular periodic wages. Unlike prorated salary, which calculates pay proportionally based on the actual time worked within a pay period, lump sum payments do not depend on hours or months worked and are paid regardless of ongoing employment status. Understanding lump sum payments helps employers and employees accurately manage compensation expectations, tax implications, and financial planning within total remuneration packages.

What Is a Prorated Salary?

A prorated salary refers to the portion of an employee's full salary that corresponds to the actual time worked during a pay period, often used when an employee starts or leaves a job mid-cycle. Unlike a lump sum payment, which is a one-time full payment, prorated salaries adjust compensation based on days or hours worked to ensure accurate and fair pay. This method provides precise salary calculation aligned with employment duration and contractual terms.

Benefits of Lump Sum Payments for Employers and Employees

Lump sum payments provide employers with simplified payroll management and improved cash flow predictability by consolidating compensation into a single transaction, reducing administrative overhead. Employees benefit from receiving a significant amount upfront, allowing for immediate financial flexibility, easier debt repayment, or investment opportunities. This payment method also minimizes the complexity of partial salary calculations, ensuring clarity and transparency for both parties.

When Is Prorated Salary Typically Used?

Prorated salary is typically used when an employee joins or leaves a company partway through a pay period or fiscal year, ensuring compensation matches actual time worked. It applies in scenarios such as mid-month hires, contract terminations, or extended unpaid leaves, providing precise, proportional payment. This method contrasts with lump sum payments, which deliver a fixed amount regardless of days worked.

Tax Implications: Lump Sum vs Prorated Salary

Lump sum payments can result in higher tax withholding rates because the total amount is taxed in a single fiscal period, potentially pushing the recipient into a higher tax bracket. Prorated salaries distribute income evenly over multiple pay periods, which often smooths tax liability and reduces the risk of excessive withholding in any one period. Understanding these tax implications helps employees and employers optimize cash flow and tax efficiency when choosing between lump sum and prorated salary structures.

Impact on Employee Benefits and Entitlements

Lump sum payments can affect employee benefits by altering the calculation of entitlements such as bonuses, pensions, and leave accruals, potentially leading to higher tax liabilities or reduced future benefits. Prorated salaries ensure benefits and entitlements are proportional to actual time worked, maintaining consistency in accruals and tax treatment. Understanding these impacts is crucial for optimizing total compensation and long-term financial planning.

Choosing Between Lump Sum and Prorated Salary: Factors to Consider

Choosing between a lump sum payment and a prorated salary depends on factors such as cash flow needs, tax implications, and employment duration. A lump sum payment provides immediate access to the full amount, beneficial for one-time bonuses or severance, while prorated salaries allocate pay based on actual work periods, ensuring consistent income over time. Employers and employees must evaluate financial stability, budgeting preferences, and legal requirements to select the most suitable compensation method.

Common Scenarios for Lump Sum Payments

Common scenarios for lump sum payments include severance packages, bonuses, and retirement payouts where employees receive a fixed total amount instead of periodic payments. Lump sum payments often occur during contract terminations, incentive rewards, or as compensation for accrued benefits such as unused vacation days. This payment structure contrasts with prorated salaries, which calculate wages based on the actual time worked within a pay period.

Best Practices for Employers: Lump Sum vs Prorated Salary

Employers should clearly define salary structures in employment contracts to avoid confusion between lump sum payments and prorated salaries, ensuring compliance with labor laws. Implementing transparent communication about payment schedules and calculation methods enhances employee trust and reduces disputes. Utilizing payroll software that accurately handles prorated calculations and lump sum disbursements supports efficient and error-free salary management.

Important Terms

Annualized compensation

Annualized compensation calculates total yearly earnings by converting lump sum payments or prorated salaries into equivalent full-year amounts for accurate financial comparison.

Deferred payment

Deferred payment allows employees to receive a portion of their earnings after a specified period, contrasting with a lump sum payment that provides the entire amount upfront. Unlike prorated salary, which adjusts pay based on actual time worked within a pay period, deferred payments delay compensation while providing potential tax or cash flow advantages for both employers and employees.

Exempt vs. non-exempt status

Exempt employees typically receive lump sum payments without overtime eligibility, while non-exempt employees are paid prorated salaries based on hours worked and qualify for overtime compensation.

Retroactive pay

Retroactive pay compensates employees for previous underpayments, often delivered as a lump sum payment rather than a prorated salary to address the full amount owed from past periods.

Salary banding

Salary banding determines the fixed payment ranges while lump sum payments provide one-time amounts and prorated salary adjusts earnings based on the actual service period within the band.

Payroll accrual

Payroll accrual ensures expenses for lump sum payments and prorated salaries are accurately recorded in the financial period they relate to, reflecting true employee compensation costs. Correct accrual of lump sum payments like bonuses or severance differs from prorated salary accrual, which adjusts monthly wages based on the actual days worked within a pay period.

Base salary allocation

Base salary allocation can be structured as a lump sum payment or a prorated salary, with lump sum offering a one-time full payment regardless of employment duration, while prorated salary adjusts compensation based on the actual time worked within the pay period. Companies often choose prorated salary for partial periods like mid-month hires or terminations to ensure accurate employee compensation reflecting their exact service time.

Payment frequency

Lump sum payments provide a one-time full amount, whereas prorated salaries adjust regular payment frequency based on actual time worked or service duration.

Variable compensation

Variable compensation structures often weigh lump sum payments against prorated salary to balance incentive flexibility with fair, time-adjusted employee rewards.

Pro rata basis

Pro rata basis allocates a lump sum payment or prorated salary according to the exact portion of time worked relative to the full payment period.

Lump sum payment vs Prorated salary Infographic

moneydif.com

moneydif.com