Overtime pay compensates employees with extra wages for hours worked beyond the standard workweek, typically at a rate of one and a half times their regular pay. Comp time offers paid time off in lieu of overtime wages, allowing employees to take additional leave instead of immediate cash compensation. Employers must adhere to federal and state regulations when offering comp time, as it is not always permitted in the private sector.

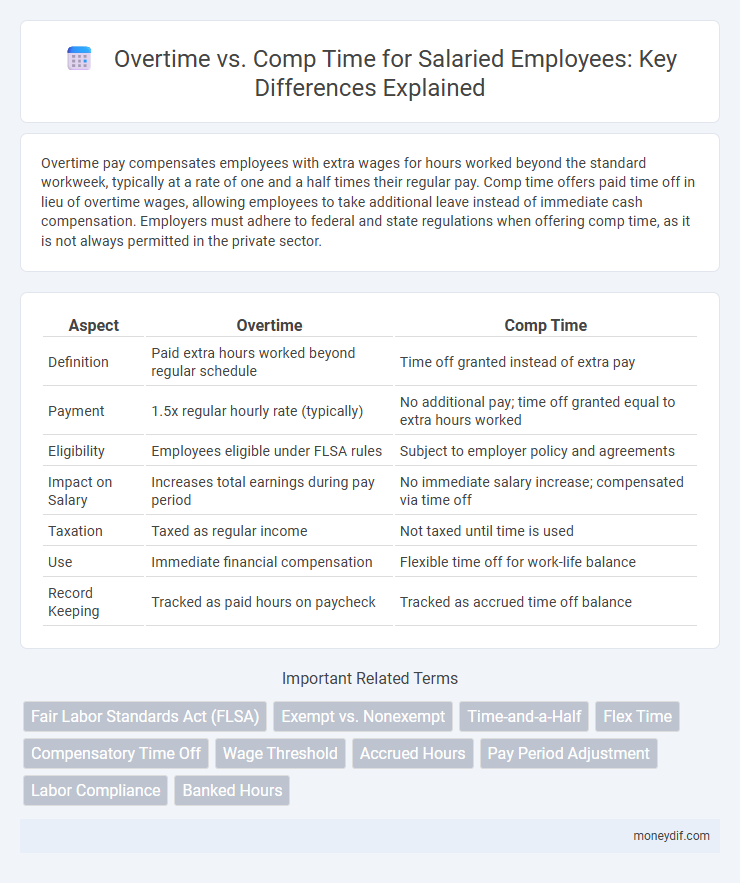

Table of Comparison

| Aspect | Overtime | Comp Time |

|---|---|---|

| Definition | Paid extra hours worked beyond regular schedule | Time off granted instead of extra pay |

| Payment | 1.5x regular hourly rate (typically) | No additional pay; time off granted equal to extra hours worked |

| Eligibility | Employees eligible under FLSA rules | Subject to employer policy and agreements |

| Impact on Salary | Increases total earnings during pay period | No immediate salary increase; compensated via time off |

| Taxation | Taxed as regular income | Not taxed until time is used |

| Use | Immediate financial compensation | Flexible time off for work-life balance |

| Record Keeping | Tracked as paid hours on paycheck | Tracked as accrued time off balance |

Understanding Overtime and Comp Time

Overtime refers to the additional hours worked beyond the standard 40-hour workweek, typically compensated at 1.5 times the regular pay rate according to the Fair Labor Standards Act (FLSA). Comp time, or compensatory time off, allows employees to earn paid time off instead of immediate overtime pay, commonly used in public sector jobs but restricted under federal law for private employers. Understanding the legal frameworks and company policies governing overtime and comp time ensures employees receive appropriate compensation for extra hours worked.

Key Differences Between Overtime and Comp Time

Overtime refers to the additional wages employees receive for hours worked beyond their standard schedule, typically paid at a rate of 1.5 times the regular pay under the Fair Labor Standards Act (FLSA). Comp time, or compensatory time, allows employees to earn paid time off instead of overtime pay, mainly offered in public sector jobs but generally restricted for private-sector employees. The key differences lie in payment structure, eligibility, and regulation compliance, with overtime guaranteeing extra pay while comp time provides flexible time off.

Legal Framework: Overtime and Comp Time Laws

The legal framework governing overtime and comp time primarily stems from the Fair Labor Standards Act (FLSA), which mandates that non-exempt employees receive overtime pay at one and a half times their regular rate for hours worked beyond 40 in a workweek. Compensatory time, or comp time, is typically allowed for public sector employees as an alternative to overtime pay but is subject to strict government regulations and agreement between employer and employee. Violations of overtime laws can result in penalties enforced by the Department of Labor, emphasizing the importance of compliance with federal and state wage and hour laws.

Eligibility Criteria for Overtime and Comp Time

Eligibility for overtime pay typically applies to non-exempt employees under the Fair Labor Standards Act (FLSA) who work more than 40 hours per week, entitling them to 1.5 times their regular hourly rate. Compensatory time, or comp time, is generally offered to public sector employees as an alternative to overtime pay, allowing eligible employees to accrue paid time off instead of immediate overtime compensation. Private sector employers may offer comp time only under specific collective bargaining agreements, with strict eligibility criteria to ensure compliance with labor laws.

Calculation Methods for Overtime Pay vs. Comp Time

Overtime pay is typically calculated at one and a half times the employee's regular hourly wage for hours worked beyond the standard 40-hour workweek, ensuring immediate monetary compensation. Comp time, or compensatory time off, grants employees equivalent paid leave instead of overtime pay, often calculated on an hour-for-hour basis but can vary depending on company policy or collective bargaining agreements. Employers must adhere to federal and state labor laws, such as the Fair Labor Standards Act (FLSA), which regulate eligibility and calculation methods for both overtime pay and comp time to avoid legal penalties.

Pros and Cons of Overtime vs. Comp Time

Overtime pay offers immediate financial compensation, boosting employee earnings and motivating extra work hours, while comp time allows flexible time off, reducing burnout and supporting work-life balance without increasing payroll expenses. However, overtime can lead to higher labor costs and potential fatigue, whereas comp time may complicate scheduling and delay employee compensation for extra work. Employers must balance budget constraints and employee preferences to determine the optimal approach for managing extended work hours.

Impact on Employee Work-Life Balance

Overtime pay provides immediate financial compensation, allowing employees to benefit directly from extra hours worked, which can improve job satisfaction through increased earnings. Comp time, on the other hand, offers employees additional time off instead of pay, supporting better work-life balance by enabling rest and personal activities after busy periods. The choice between overtime pay and comp time significantly impacts employee well-being and productivity, depending on individual preferences for income versus time flexibility.

Overtime and Comp Time Policies by Industry

Overtime and comp time policies vary significantly across industries, with the manufacturing and healthcare sectors often mandating overtime pay due to labor-intensive demands, while government and nonprofit organizations commonly utilize comp time arrangements to manage employee hours flexibly. The Fair Labor Standards Act (FLSA) requires that non-exempt employees receive overtime pay at 1.5 times their regular rate for hours worked beyond 40 per week in most industries, but comp time can be offered as an alternative primarily in public sector jobs. Industry-specific regulations and union contracts heavily influence whether overtime pay or compensatory time off is implemented, affecting overall employee compensation and work-life balance strategies.

Employer Considerations for Overtime and Comp Time

Employers must balance legal compliance with the Fair Labor Standards Act (FLSA) when managing overtime and comp time, ensuring non-exempt employees receive appropriate compensation for hours worked beyond 40 per week. Offering comp time requires careful tracking and may lead to challenges in employee morale and administrative complexity compared to straightforward overtime pay. Strategic policies addressing overtime vs. comp time impact labor costs, workforce productivity, and regulatory risk management.

Best Practices for Managing Overtime and Comp Time

Effective management of overtime and comp time enhances workforce productivity and controls labor costs. Clear policies that define eligibility, approval processes, and compensation rates ensure compliance with labor laws and improve employee satisfaction. Regular tracking and transparent communication regarding accrued hours prevent disputes and promote fair usage of overtime and compensatory time benefits.

Important Terms

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) mandates that non-exempt employees receive overtime pay at 1.5 times their regular rate for hours worked beyond 40 in a workweek, whereas compensatory time (comp time) is generally permitted only for public sector employees under specific conditions and is not a substitute for overtime pay in the private sector.

Exempt vs. Nonexempt

Exempt employees, typically salaried and classified under the Fair Labor Standards Act (FLSA), do not qualify for overtime pay or comp time, while nonexempt employees, usually hourly workers, are entitled to overtime pay at 1.5 times their regular rate for hours worked beyond 40 in a workweek or comp time if offered by the employer under certain conditions. Understanding the distinctions between exempt and nonexempt status is crucial for compliance with labor laws and proper management of employee work hours and compensation.

Time-and-a-Half

Time-and-a-half pay applies to overtime hours worked beyond 40 per week under the Fair Labor Standards Act, whereas comp time offers equivalent paid time off instead of immediate overtime wages.

Flex Time

Flex Time allows employees to adjust their work hours to reduce overtime by earning comp time that can be used later for paid time off.

Compensatory Time Off

Compensatory Time Off allows employees to exchange overtime hours worked for paid time off, reducing the need for immediate overtime payment while maintaining fair labor compensation.

Wage Threshold

The wage threshold determines eligibility for overtime pay versus compensatory time off based on employee earnings under the Fair Labor Standards Act.

Accrued Hours

Accrued hours represent the total time an employee has worked beyond their standard schedule, which can be compensated either through overtime pay or comp time, depending on company policy and labor laws. Overtime hours typically require additional monetary compensation at a higher pay rate, while comp time allows employees to redeem accrued hours as paid time off instead of immediate extra wages.

Pay Period Adjustment

Pay period adjustment ensures accurate tracking and compensation of overtime hours versus comp time based on company policy and labor regulations.

Labor Compliance

Labor compliance requires strict adherence to federal and state regulations ensuring overtime is properly compensated either through mandated overtime pay rates or legally approved compensatory time off arrangements.

Banked Hours

Banked hours refer to overtime hours worked by employees that are saved and accumulated for later use as paid time off, rather than being compensated immediately with overtime pay. This system allows employees to convert extra work hours into compensatory time (comp time), providing flexibility in managing work-life balance without immediate financial compensation.

overtime vs comp time Infographic

moneydif.com

moneydif.com