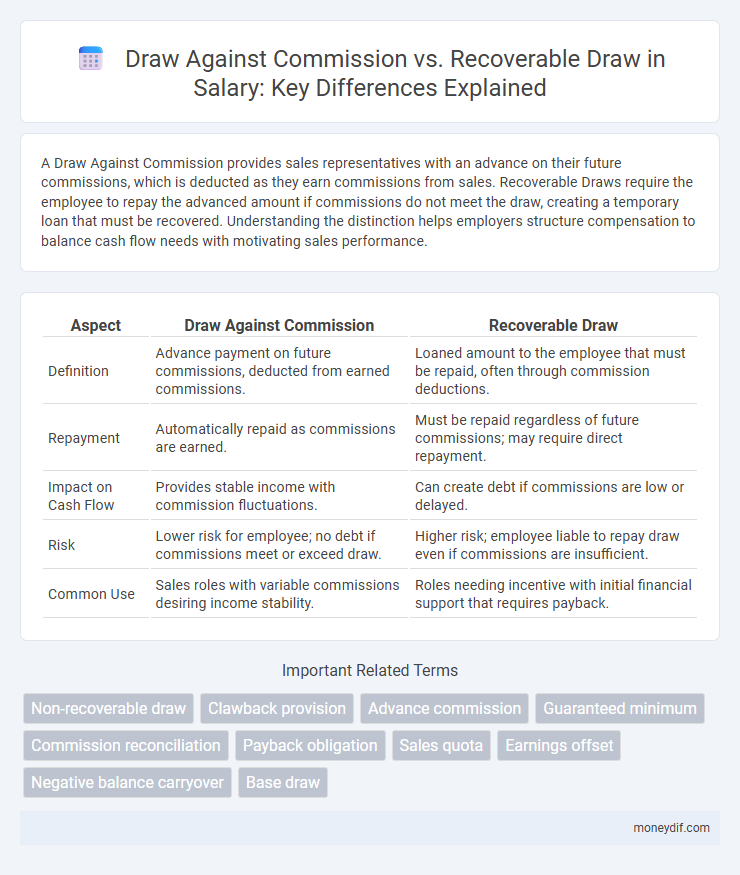

A Draw Against Commission provides sales representatives with an advance on their future commissions, which is deducted as they earn commissions from sales. Recoverable Draws require the employee to repay the advanced amount if commissions do not meet the draw, creating a temporary loan that must be recovered. Understanding the distinction helps employers structure compensation to balance cash flow needs with motivating sales performance.

Table of Comparison

| Aspect | Draw Against Commission | Recoverable Draw |

|---|---|---|

| Definition | Advance payment on future commissions, deducted from earned commissions. | Loaned amount to the employee that must be repaid, often through commission deductions. |

| Repayment | Automatically repaid as commissions are earned. | Must be repaid regardless of future commissions; may require direct repayment. |

| Impact on Cash Flow | Provides stable income with commission fluctuations. | Can create debt if commissions are low or delayed. |

| Risk | Lower risk for employee; no debt if commissions meet or exceed draw. | Higher risk; employee liable to repay draw even if commissions are insufficient. |

| Common Use | Sales roles with variable commissions desiring income stability. | Roles needing incentive with initial financial support that requires payback. |

Understanding Draw Against Commission: An Overview

Draw Against Commission is a payment method where sales representatives receive an advance on their expected commissions, providing steady income before actual sales close. This advance is deducted from future earned commissions, ensuring that the draw amount is recoverable by the employer once commissions accumulate. Understanding this mechanism helps clarify how income is balanced between immediate cash flow and commission-based earnings.

What is a Recoverable Draw in Salary?

A recoverable draw in salary is an advance payment against future commissions that employees receive to stabilize income during sales cycles. This draw must be repaid through earned commissions, meaning any shortfall in sales requires employees to reimburse the company. It creates a financial safety net while ensuring compensation aligns with actual sales performance.

Key Differences: Draw Against Commission vs Recoverable Draw

Draw Against Commission requires sales representatives to repay any amount advanced that exceeds their earned commissions, creating an obligation to recover the draw through future sales commissions. Recoverable Draw also provides an advance but often includes more flexible terms for repayment, sometimes allowing the draw to be recovered over a longer period or with less stringent immediate repayment requirements. The key difference lies in the repayment structure and financial liability: Draw Against Commission demands prompt recovery from commissions, while Recoverable Draw may offer more lenient repayment options to support sales staff cash flow.

How Draw Against Commission Works

Draw against commission is an advance payment method where sales representatives receive a fixed draw amount that is deducted from future earned commissions. This approach ensures consistent cash flow while allowing employees to earn beyond the draw if commissions exceed the advanced amount. If commissions fall short, the difference typically becomes a recoverable draw, which can be recouped through subsequent sales.

The Mechanics of Recoverable Draws

Recoverable draws function as an advance on future commissions, where employees receive a predetermined amount regularly that must be reimbursed through earned commissions. If commissions exceed the draw, the surplus is paid out to the employee; if commissions fall short, the difference is carried forward as a debt to be recovered from upcoming earnings. This mechanism creates a balance between guaranteed income and incentive-based pay, ensuring sales representatives maintain cash flow while aligning compensation with performance.

Benefits of Draw Against Commission for Employers

Draw Against Commission offers employers a predictable cash flow as it advances a fixed amount against future commissions, ensuring sales staff remain motivated while managing payroll costs effectively. This method reduces financial uncertainty by aligning payouts with actual sales performance, incentivizing higher productivity without increasing fixed salary expenses. Employers benefit from improved budget control and enhanced sales force accountability, driving overall revenue growth.

Pros and Cons of Recoverable Draws for Employees

Recoverable draws provide employees with a guaranteed income advance against future commissions, reducing financial uncertainty during low sales periods and helping with budgeting. However, employees must repay the draw if commissions exceed the draw amount, which can lead to paycheck reductions and financial stress. This repayment structure incentivizes consistent performance but may create cash flow challenges if sales targets are not met promptly.

Common Industries Using Draw Against Commission

Common industries using draw against commission include real estate, automotive sales, and insurance, where sales professionals receive an advance on commissions to ensure income stability. This structure helps manage cash flow fluctuations, as the draw is deducted from future earned commissions. Employers in these sectors prefer draw against commission to incentivize high performance while mitigating risk during slower sales periods.

Legal Considerations of Recoverable Draw Agreements

Recoverable draw agreements in salary structures require careful legal consideration to ensure compliance with wage and hour laws, avoiding unlawful wage deductions. Employers must clearly define repayment terms and conditions in the contract to prevent disputes related to the recovery of advances against future commissions. Proper documentation and adherence to state-specific labor regulations are essential to maintain enforceability and protect both parties' rights.

Choosing the Right Draw Structure for Your Sales Team

Choosing the right draw structure for your sales team hinges on balancing cash flow stability and motivation. A Draw Against Commission provides salespeople with upfront earnings against future commissions, ensuring steady income but requiring careful recovery if sales targets are unmet. Conversely, a Recoverable Draw is more flexible, recovering advances only when commissions exceed the draw, thus aligning incentives with performance while safeguarding company finances.

Important Terms

Non-recoverable draw

A non-recoverable draw is a fixed advance given to sales representatives that does not require reimbursement, unlike a recoverable draw which must be repaid through commissions earned, distinguishing it from a draw against commission where future commissions offset the advanced amount.

Clawback provision

The Clawback provision ensures that Recoverable Draw advances, unlike non-recoverable Draw Against Commission, are deducted from future commissions if sales targets are not met.

Advance commission

Advance commission involves an upfront payment to sales representatives that is offset by future commissions earned, distinguishing Draw Against Commission as recoverable advances deducted from future earnings while Recoverable Draws specifically require repayment if commissions fail to cover the draw amount.

Guaranteed minimum

A Guaranteed Minimum in a commission structure ensures a baseline income for sales representatives, protecting earnings in low-performance periods compared to a Recoverable Draw, which requires repayments against future commissions when advances exceed commissions earned. In the context of Draw Against Commission, recoverable draws are recouped through future sales, whereas Guaranteed Minimums provide a non-recoverable safety net, ensuring consistent minimum compensation.

Commission reconciliation

Commission reconciliation involves comparing and adjusting the Draw Against Commission (DAC), an advance payment against future commissions, with the Recoverable Draw, the portion of the DAC that must be recovered from earned commissions. Accurate tracking of DAC ensures that recoverable amounts are properly deducted from commissions, preventing overpayment and maintaining correct financial records.

Payback obligation

Payback obligation arises when sales representatives must return excess funds from Draw Against Commission, distinguishing it from Recoverable Draw where advances are offset by earned commissions without mandatory repayment.

Sales quota

Sales quota performance improves when distinguishing Draw Against Commission as an advance on earnings versus Recoverable Draw, which requires repayment from future commissions.

Earnings offset

Earnings offset in commission structures occurs when a Draw Against Commission is recovered by deducting future earned commissions to balance advances paid.

Negative balance carryover

Negative balance carryover occurs when a salesperson's commissions, reduced by draw advances, fall below zero, creating a deficit that must be recovered in future periods. In the context of Draw Against Commission, recoverable draws are advances that generate negative balances to be offset by future earnings, while non-recoverable draws do not require repayment and do not result in carryover deficits.

Base draw

A Base Draw is a guaranteed upfront payment to a sales representative that is offset against earned commissions, distinguishing it from a Recoverable Draw which must be repaid if commissions fall short.

Draw Against Commission vs Recoverable Draw Infographic

moneydif.com

moneydif.com