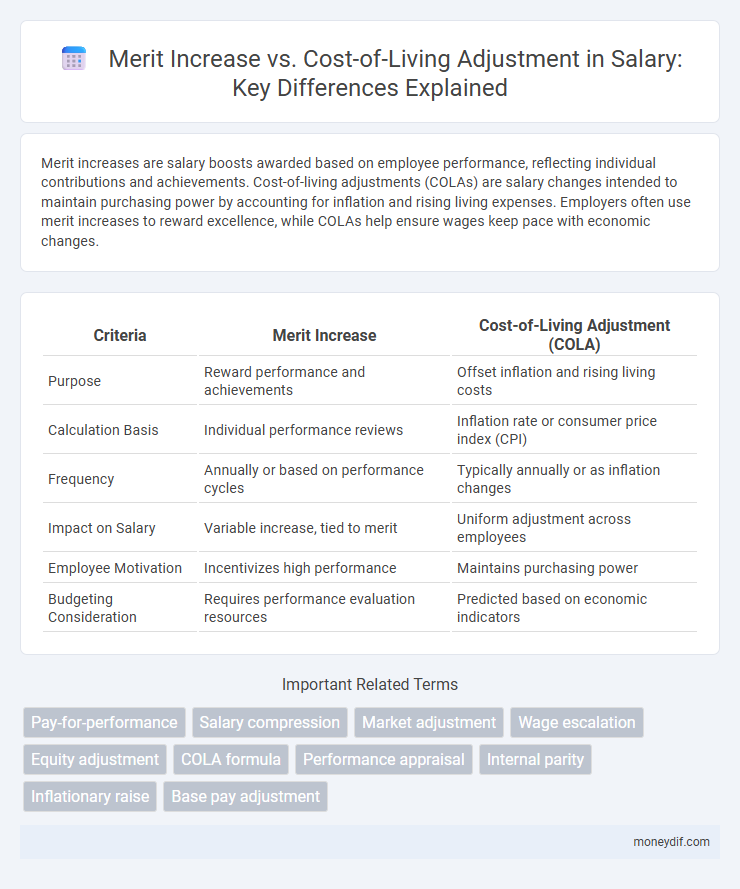

Merit increases are salary boosts awarded based on employee performance, reflecting individual contributions and achievements. Cost-of-living adjustments (COLAs) are salary changes intended to maintain purchasing power by accounting for inflation and rising living expenses. Employers often use merit increases to reward excellence, while COLAs help ensure wages keep pace with economic changes.

Table of Comparison

| Criteria | Merit Increase | Cost-of-Living Adjustment (COLA) |

|---|---|---|

| Purpose | Reward performance and achievements | Offset inflation and rising living costs |

| Calculation Basis | Individual performance reviews | Inflation rate or consumer price index (CPI) |

| Frequency | Annually or based on performance cycles | Typically annually or as inflation changes |

| Impact on Salary | Variable increase, tied to merit | Uniform adjustment across employees |

| Employee Motivation | Incentivizes high performance | Maintains purchasing power |

| Budgeting Consideration | Requires performance evaluation resources | Predicted based on economic indicators |

Understanding Merit Increases

Merit increases reward employees based on performance, distinguishing individual contributions and encouraging productivity through salary growth tied to achievement. Unlike cost-of-living adjustments (COLAs), which offset inflation by maintaining purchasing power, merit increases serve as incentives reflecting meritocratic recognition within compensation strategies. Employers typically allocate merit budgets around 3-5%, focusing on performance evaluations to align salaries with organizational goals and employee value.

Defining Cost-of-Living Adjustments (COLA)

Cost-of-Living Adjustments (COLA) are periodic salary increases designed to offset the impact of inflation and rising living expenses, ensuring employees maintain their purchasing power. Unlike merit increases, which reward individual performance, COLA is typically applied uniformly to all employees based on changes in consumer price indices such as the CPI-U. Organizations use COLA to preserve real wages amid fluctuating economic conditions without linking raises to job performance metrics.

Key Differences Between Merit Increase and COLA

Merit increases are performance-based salary raises awarded to employees demonstrating exceptional work, directly linked to individual achievements and company goals. Cost-of-living adjustments (COLA) are raises designed to offset inflation and rising living expenses, applied across the board regardless of performance. The key difference lies in merit increases rewarding merit and productivity, while COLA ensures wages keep pace with economic changes to maintain purchasing power.

Impact on Employee Motivation

Merit increases directly enhance employee motivation by recognizing individual performance and rewarding achievements, leading to higher productivity and engagement. Cost-of-living adjustments maintain purchasing power but have a neutral effect on motivation since they are not tied to performance. Companies leveraging merit increases see more significant improvements in employee morale and retention compared to those relying solely on cost-of-living adjustments.

Budgeting for Merit vs. COLA in Organizations

Budgeting for merit increases requires allocating funds based on individual performance metrics, often leading to differentiated salary adjustments that reward high achievers. In contrast, cost-of-living adjustments (COLA) are uniform percentage increases applied across the organization to maintain employees' purchasing power amidst inflation. Organizations must balance both by forecasting economic conditions and performance outcomes to optimize salary expenditures while sustaining employee motivation and retention.

Aligning Salary Adjustments with Business Strategy

Aligning salary adjustments with business strategy requires differentiating merit increases from cost-of-living adjustments to optimize budget allocation and employee motivation. Merit increases are performance-based rewards that promote productivity and retention, directly supporting strategic goals, while cost-of-living adjustments address inflation-driven expenses to maintain employee purchasing power. Prioritizing merit increases in high-performing roles ensures alignment with organizational objectives, while equitable cost-of-living adjustments sustain overall workforce stability.

Pros and Cons of Merit Increases

Merit increases reward individual performance by motivating employees and aligning compensation with productivity but can create internal pay disparities and may lead to perceived unfairness if not implemented transparently. These increases often boost employee retention and encourage skill development yet require ongoing performance evaluation, which can be time-consuming and subjective. Unlike cost-of-living adjustments, merit increases directly tie pay growth to achievement, offering targeted incentives but potentially overlooking broader economic factors like inflation.

Advantages and Disadvantages of COLA

Cost-of-living adjustments (COLA) provide employees with automatic salary increases that directly address inflation, ensuring that purchasing power remains consistent over time. While COLA offers predictable and standardized compensation growth, it may not reward individual performance or motivation, potentially leading to complacency. Organizations must consider that although COLA helps maintain employee satisfaction during inflationary periods, it can increase overall payroll expenses without linking pay to merit or productivity.

Best Practices for Implementing Salary Adjustments

Merit increases should be based on comprehensive performance evaluations to reward employee contributions effectively and motivate continued excellence. Cost-of-living adjustments require accurate market data and inflation tracking to maintain competitive and fair compensation that supports employee financial well-being. Implementing clear communication plans and consistent review cycles ensures transparency and alignment with organizational goals in salary adjustments.

Future Trends in Salary Adjustment Methods

Future trends in salary adjustment methods indicate a shift towards performance-driven merit increases that align pay with individual contributions and organizational goals. Cost-of-living adjustments (COLAs) continue to be relevant but are increasingly complemented by dynamic compensation strategies leveraging real-time economic data and employee productivity metrics. Employers are adopting hybrid models combining merit increases with inflation-based adjustments to maintain competitiveness and employee satisfaction in fluctuating markets.

Important Terms

Pay-for-performance

Pay-for-performance systems allocate merit increases based on individual employee achievements and contributions, directly linking compensation with productivity and results. In contrast, cost-of-living adjustments (COLAs) provide uniform raises to counteract inflation and maintain the purchasing power of wages, regardless of performance levels.

Salary compression

Salary compression occurs when merit increases fail to outpace cost-of-living adjustments, reducing wage differentiation among employees with varying performance levels.

Market adjustment

Market adjustments align employee salaries with current industry standards, while merit increases reward individual performance and cost-of-living adjustments compensate for inflation-driven expenses.

Wage escalation

Wage escalation driven by merit increases rewards employee performance with higher pay increases, while cost-of-living adjustments (COLAs) maintain purchasing power by aligning wages with inflation rates.

Equity adjustment

Equity adjustments ensure fair compensation by correcting disparities between merit increases, which reward performance, and cost-of-living adjustments that address inflation-based salary changes.

COLA formula

The COLA formula adjusts salaries based on inflation rates to maintain purchasing power, while merit increases reward individual performance and do not necessarily align with cost-of-living changes.

Performance appraisal

Performance appraisals directly influence merit increases by evaluating employee performance, whereas cost-of-living adjustments are standardized salary adjustments based on inflation rates, independent of individual performance.

Internal parity

Internal parity ensures equitable compensation among employees with similar roles and performance, balancing merit increases that reward individual contributions against cost-of-living adjustments designed to maintain purchasing power amid inflation. Employers maintaining internal parity strategically align merit increases to recognize performance differentiation while applying cost-of-living adjustments uniformly to uphold fairness and employee satisfaction.

Inflationary raise

Inflationary raises, often distinguished from merit increases by their focus on maintaining purchasing power, are typically implemented as cost-of-living adjustments (COLAs) to offset rising consumer prices without reflecting individual job performance.

Base pay adjustment

Base pay adjustments balance merit increases based on employee performance with cost-of-living adjustments that address inflation and maintain purchasing power.

merit increase vs cost-of-living adjustment Infographic

moneydif.com

moneydif.com