Exempt employees are paid a fixed salary and do not receive overtime pay, as their roles typically involve executive, professional, or administrative duties. Nonexempt employees earn hourly wages and are entitled to overtime pay for hours worked beyond 40 per week under the Fair Labor Standards Act (FLSA). Understanding the distinction between exempt and nonexempt status ensures compliance with labor laws and accurate payroll management.

Table of Comparison

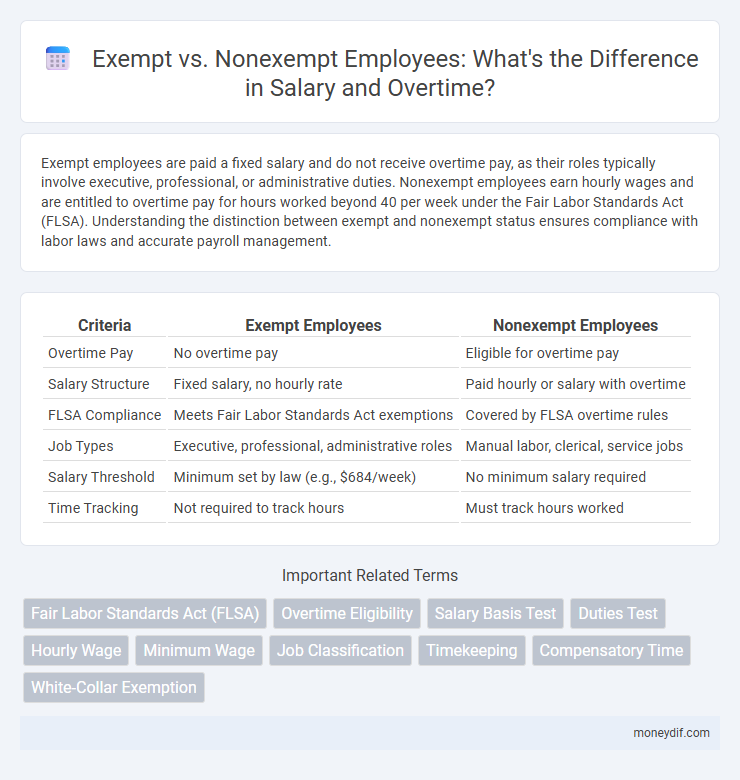

| Criteria | Exempt Employees | Nonexempt Employees |

|---|---|---|

| Overtime Pay | No overtime pay | Eligible for overtime pay |

| Salary Structure | Fixed salary, no hourly rate | Paid hourly or salary with overtime |

| FLSA Compliance | Meets Fair Labor Standards Act exemptions | Covered by FLSA overtime rules |

| Job Types | Executive, professional, administrative roles | Manual labor, clerical, service jobs |

| Salary Threshold | Minimum set by law (e.g., $684/week) | No minimum salary required |

| Time Tracking | Not required to track hours | Must track hours worked |

Understanding Exempt vs Nonexempt Employee Status

Exempt employees are typically salaried workers who are not eligible for overtime pay under the Fair Labor Standards Act (FLSA), while nonexempt employees must be paid overtime for hours worked beyond 40 in a workweek. The classification depends on job duties, salary level, and payment basis, ensuring compliance with labor laws and proper payroll management. Employers must accurately determine employee status to avoid legal penalties and ensure fair compensation practices.

Key Differences Between Exempt and Nonexempt Salaries

Exempt salaries are paid on a fixed basis regardless of hours worked and typically include roles classified under the Fair Labor Standards Act (FLSA) exempt categories such as executive, professional, and administrative positions, whereas nonexempt salaries require overtime pay for hours worked beyond 40 per week. Key differences include eligibility for overtime compensation, with nonexempt employees entitled to time-and-a-half pay, while exempt employees receive no additional pay regardless of extra hours worked. Salary classification impacts payroll management, labor law compliance, and employee benefits, making accurate designation critical for businesses to avoid legal penalties.

Overtime Pay: Who Qualifies?

Exempt employees are typically salaried workers who do not qualify for overtime pay under the Fair Labor Standards Act (FLSA) due to their job duties and salary level, whereas nonexempt employees are entitled to receive overtime pay at one and a half times their regular rate for hours worked beyond 40 in a workweek. Key criteria determining exemption status include job responsibilities such as executive, administrative, or professional roles, and meeting the minimum salary threshold of $684 per week as of 2024. Employers must carefully classify employees to ensure compliance with overtime pay regulations and avoid potential wage and hour disputes.

Salary Thresholds for Exempt Employees

Salary thresholds for exempt employees determine eligibility under the Fair Labor Standards Act (FLSA), requiring a minimum weekly salary of $684 as of 2024 to qualify for exempt status. Employees earning below this threshold must be classified as nonexempt and are entitled to overtime pay. Employers must carefully evaluate salary levels alongside job duties to ensure compliance with federal and state wage laws.

Calculating Wages: Hourly vs Salaried Pay

Exempt employees receive a fixed salary regardless of hours worked, while nonexempt employees are paid hourly with overtime compensation for exceeding 40 hours per week. Calculating wages for nonexempt workers involves multiplying hourly rates by hours worked and applying time-and-a-half for overtime. Salaried pay simplifies budgeting but requires understanding job classifications to ensure compliance with the Fair Labor Standards Act (FLSA).

Legal Compliance: FLSA Guidelines Explained

Exempt and nonexempt classifications under the Fair Labor Standards Act (FLSA) determine eligibility for overtime pay, with exempt employees typically holding executive, administrative, or professional roles and meeting specific salary thresholds. Employers must ensure compliance by accurately categorizing workers according to job duties and salary basis to avoid legal penalties and wage disputes. Understanding FLSA guidelines helps businesses maintain fair labor standards and safeguard against costly litigation.

Pros and Cons of Exempt and Nonexempt Roles

Exempt roles offer salaried employees predictable income and exemption from overtime, ideal for stable workloads but potentially leading to unpaid extra hours and burnout. Nonexempt positions provide overtime pay, ensuring fair compensation for extra work, yet often involve variable schedules and less income predictability. Employers must balance cost efficiency and employee satisfaction when choosing between exempt and nonexempt classifications.

Impact on Benefits and Compensation Packages

Exempt employees typically receive a fixed salary regardless of hours worked and often qualify for broader benefit packages, including paid leave and retirement plans. Nonexempt employees are generally paid hourly with overtime eligibility, which can affect total earnings but may limit access to certain benefits. Employers design compensation packages based on exemption status to balance legal compliance with attracting and retaining talent.

Common Misconceptions About Exempt Status

Many employees mistakenly believe that all salaried workers are exempt from overtime pay, but exempt status depends on specific criteria set by the Fair Labor Standards Act (FLSA), including duties performed and salary thresholds. Another common misconception is that job titles alone determine exemption, whereas the actual job duties and responsibilities are the key factors. Employers and employees should carefully review the Department of Labor guidelines to accurately classify exempt versus nonexempt status and avoid potential wage violations.

Making the Right Salary Classification for Your Business

Properly distinguishing between exempt and nonexempt employees ensures compliance with the Fair Labor Standards Act (FLSA), preventing costly wage and overtime disputes. Misclassification risks legal penalties and employee dissatisfaction, impacting overall business productivity and financial health. Implementing a clear salary classification strategy tailored to job duties, salary thresholds, and state regulations optimizes workforce management and safeguards company resources.

Important Terms

Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) classifies employees as exempt or nonexempt based on job duties and salary thresholds to determine eligibility for overtime pay and minimum wage protections.

Overtime Eligibility

Overtime eligibility is determined by the Fair Labor Standards Act (FLSA) classification of employees as exempt or nonexempt, with nonexempt employees entitled to overtime pay at 1.5 times their regular hourly rate for hours worked beyond 40 in a workweek. Exempt employees, typically salaried and holding executive, administrative, or professional roles, are not eligible for overtime compensation under federal law.

Salary Basis Test

The Salary Basis Test determines whether employees qualify as exempt from overtime pay based on receiving a predetermined fixed salary regardless of hours worked. Nonexempt employees fail this test and are entitled to overtime compensation under the Fair Labor Standards Act (FLSA).

Duties Test

The Duties Test classifies employees as exempt or nonexempt based on their specific job responsibilities and tasks to determine eligibility for overtime pay under the Fair Labor Standards Act.

Hourly Wage

Hourly wage determination hinges on the employee's classification as exempt or nonexempt under the Fair Labor Standards Act (FLSA), with nonexempt employees entitled to overtime pay for hours worked beyond 40 per week. Exempt employees typically receive a fixed salary without overtime eligibility, whereas nonexempt workers earn a specified hourly wage subject to mandated overtime compensation.

Minimum Wage

Nonexempt employees are entitled to minimum wage and overtime pay under the Fair Labor Standards Act, while exempt employees are excluded from these minimum wage protections based on their job duties and salary level.

Job Classification

Job classification into exempt and nonexempt categories determines eligibility for overtime pay under the Fair Labor Standards Act based on job duties and salary thresholds.

Timekeeping

Nonexempt employees must track their hours worked for overtime pay eligibility, while exempt employees are typically salaried and not subject to hourly timekeeping requirements.

Compensatory Time

Compensatory time is typically not provided to exempt employees under the Fair Labor Standards Act (FLSA), while nonexempt employees are eligible for compensatory time off or overtime pay for hours worked beyond their standard workweek.

White-Collar Exemption

White-Collar Exemption classifies employees as exempt from overtime pay under the Fair Labor Standards Act based on job duties and salary thresholds, distinguishing them from nonexempt employees who are entitled to overtime compensation.

Exempt vs Nonexempt Infographic

moneydif.com

moneydif.com