Cost of Living Allowance (COLA) adjusts salaries to keep up with inflation and rising expenses, ensuring employees maintain their purchasing power. Merit increases reward individual performance and contributions, reflecting an employee's value and achievements within the company. Organizations often balance COLA and merit increases to address economic shifts while incentivizing excellence.

Table of Comparison

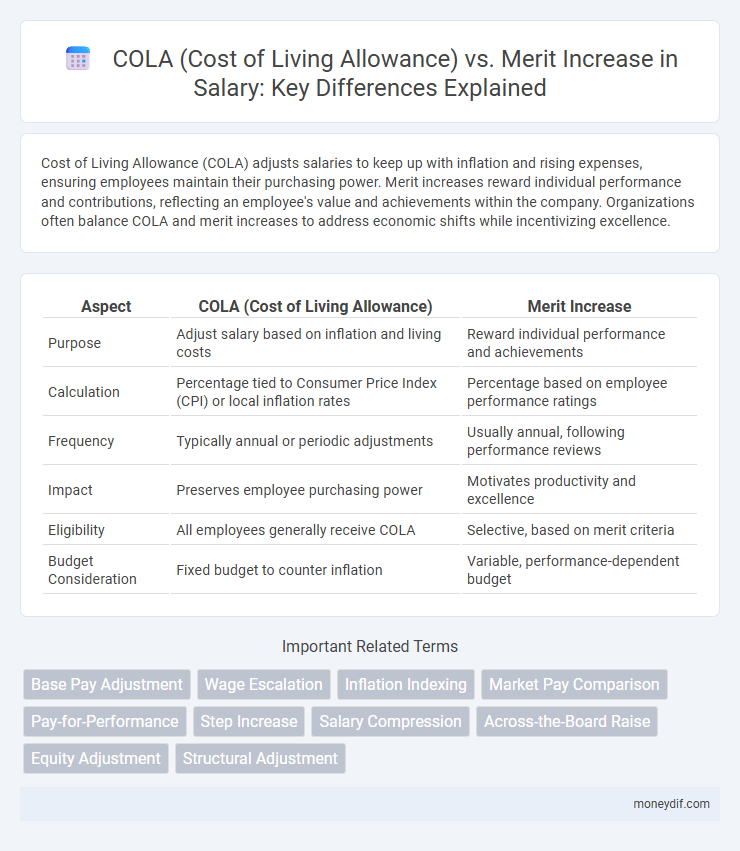

| Aspect | COLA (Cost of Living Allowance) | Merit Increase |

|---|---|---|

| Purpose | Adjust salary based on inflation and living costs | Reward individual performance and achievements |

| Calculation | Percentage tied to Consumer Price Index (CPI) or local inflation rates | Percentage based on employee performance ratings |

| Frequency | Typically annual or periodic adjustments | Usually annual, following performance reviews |

| Impact | Preserves employee purchasing power | Motivates productivity and excellence |

| Eligibility | All employees generally receive COLA | Selective, based on merit criteria |

| Budget Consideration | Fixed budget to counter inflation | Variable, performance-dependent budget |

Understanding COLA: Definition and Purpose

Cost of Living Allowance (COLA) is a salary adjustment designed to offset inflation and rising living expenses, ensuring employees maintain their purchasing power over time. Unlike merit increases, which reward individual performance, COLA is standardized and based on economic indicators such as consumer price index (CPI) changes. Understanding COLA helps organizations balance fair compensation with economic realities, supporting employee financial stability without linking it directly to job performance.

What Is a Merit Increase?

A merit increase is a salary adjustment awarded based on an employee's performance and contributions rather than external economic factors. Unlike Cost of Living Allowance (COLA), which compensates for inflation and rising living expenses, merit increases reward individual achievements and productivity improvements. Companies use merit-based pay to motivate and retain top talent by directly linking compensation to work quality and results.

Key Differences Between COLA and Merit Increases

COLA (Cost of Living Allowance) adjusts salaries based on inflation rates to maintain an employee's purchasing power, reflecting changes in the cost of living without addressing individual performance. Merit increases, however, are performance-based salary adjustments awarded for employee achievements, productivity, or contribution to company goals. While COLA is typically standardized and applied broadly, merit increases are discretionary, varying significantly between employees depending on appraisal outcomes.

Factors Influencing COLA Adjustments

COLA adjustments primarily depend on inflation rates, regional cost of living variations, and changes in consumer price indices, ensuring employees maintain purchasing power despite rising living expenses. Economic conditions such as housing, transportation, and food costs significantly influence COLA calculations to reflect local market realities. Unlike merit increases tied to individual performance and organizational goals, COLA adjustments focus on maintaining employee income value relative to living cost fluctuations.

Criteria for Awarding Merit Increases

Merit increases are awarded based on employee performance metrics such as productivity, quality of work, and achievement of specific goals, reflecting individual contributions to organizational success. Unlike COLA, which adjusts compensation to offset inflation and maintain purchasing power, merit increases reward exceptional effort and skill development. This performance-based evaluation ensures salary growth aligns with employee value rather than external economic factors.

Impact on Employee Retention and Motivation

Cost of Living Allowance (COLA) directly addresses inflation by adjusting salaries to maintain employees' purchasing power, which helps reduce financial stress and supports retention during economic volatility. Merit increases reward individual performance, driving motivation and incentivizing productivity, fostering a high-performance culture essential for employee engagement. Employers balancing COLA with merit-based pay demonstrate commitment to both fairness and excellence, enhancing long-term retention and workforce stability.

Budgeting for COLA vs Merit-Based Raises

Budgeting for COLA (Cost of Living Allowance) ensures employees maintain purchasing power despite inflation, requiring consistent annual adjustments linked to inflation rates or consumer price indexes. Merit-based raises depend on individual performance and contribute to employee motivation and retention, often resulting in variable increases tied to evaluation outcomes and company profitability. Organizations must balance these components in compensation budgets to sustain workforce stability while rewarding excellence.

COLA and Merit Increases in Different Industries

Cost of Living Allowance (COLA) is designed to offset inflation and maintain employee purchasing power, with significant variations across industries such as manufacturing, healthcare, and education, where inflation rates impact wages differently. Merit increases reward individual performance and are highly prevalent in competitive sectors like technology and finance, driving employee motivation and retention through performance-based pay raises. Understanding industry-specific salary structures helps employers balance COLA adjustments with merit increases to ensure equitable and motivating compensation packages.

Legal and Regulatory Considerations

Legal and regulatory considerations for Cost of Living Allowance (COLA) versus merit increases involve compliance with labor laws and wage regulations, such as the Fair Labor Standards Act (FLSA) and Equal Employment Opportunity (EEO) guidelines. COLA adjustments are typically tied to inflation indices and must align with minimum wage requirements, while merit increases require documented performance evaluations to justify pay differentials and avoid claims of discrimination. Employers must maintain transparent and consistent policies to ensure adherence to regulatory standards and mitigate legal risks linked to pay equity and wage-related disputes.

Best Practices for Implementing Salary Adjustments

Employers should implement Cost of Living Allowance (COLA) adjustments based on inflation indices such as the Consumer Price Index (CPI) to maintain employees' purchasing power, ensuring salary adjustments reflect genuine economic changes. Merit increases must be tied to comprehensive performance evaluations, aligning rewards with individual contributions and organizational goals for motivation and retention. Combining transparent COLA policies with merit-based raises optimizes compensation strategies, promoting fairness and sustaining workforce engagement.

Important Terms

Base Pay Adjustment

Base pay adjustment reflects the changes in employee salaries driven by market factors or organizational budget, often incorporating Cost of Living Allowance (COLA) to offset inflation's impact on purchasing power. Merit increases, in contrast, reward individual performance and contributions, making them distinct from COLA, which focuses solely on maintaining salary value amidst rising living costs.

Wage Escalation

Wage escalation driven by Cost of Living Allowance (COLA) adjusts salaries based on inflation rates, whereas merit increases reward individual performance improvements.

Inflation Indexing

Inflation indexing adjusts wages based on the Consumer Price Index (CPI) to maintain purchasing power, while Cost of Living Allowance (COLA) specifically targets inflation-driven expense changes, ensuring employees' salaries keep pace with rising living costs. Merit increases, in contrast, are performance-based pay adjustments that reward employee achievements and skills advancement rather than inflation or cost-of-living fluctuations.

Market Pay Comparison

Market pay comparison reveals that COLA adjustments address inflation-driven cost increases, while merit increases reward individual performance improvements.

Pay-for-Performance

Pay-for-Performance systems link Merit Increases directly to employee performance, while COLA adjustments are standardized raises based on inflation and cost of living changes.

Step Increase

Step increases provide automatic salary progression based on tenure, while COLA adjusts employee pay to offset inflation, and merit increases reward individual performance improvements.

Salary Compression

Salary compression occurs when Cost of Living Allowance (COLA) increases narrow the pay gap between employees, reducing the impact of merit-based salary increases on differentiating performance.

Across-the-Board Raise

An across-the-board raise equally boosts employee salaries based on a percentage increase aligned with the Cost of Living Allowance (COLA), ensuring wage adjustments keep pace with inflation. Merit increases, in contrast, reward individual performance with varied increments reflecting employee contributions rather than economic indicators.

Equity Adjustment

Equity adjustment addresses salary disparities to ensure internal pay fairness, often implemented when Cost of Living Allowance (COLA) and merit increases fail to align employee compensation with market standards or performance levels. COLA adjusts wages based on inflation rates while merit increases reward individual performance, but equity adjustments correct structural pay gaps that neither COLA nor merit raises adequately resolve.

Structural Adjustment

Structural adjustment policies often influence government decisions to prioritize Cost of Living Allowance (COLA) over merit increases, impacting wage structures and employee motivation.

COLA (Cost of Living Allowance) vs Merit increase Infographic

moneydif.com

moneydif.com